-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - AUD On Top as China Could Ease Import Rules

Highlights:

- Soft French CPI spurs European bond rally

- AUD rebounds as China could relax coal import restrictions

- ISM Manufacturing marks first tier one US release of the year, ahead of Friday's NFP

US TSYS: Bull Flattening With EU FI Spillover, ISM & FOMC Mins To Come

- Cash Tsys trade solidly richer, with an overnight rally extended by European spillover from a sizeable downside miss for French CPI inflation before some retracement on a stronger than expected Eurozone service PMI. ISM and JOLTS come into attention first before the FOMC minutes later on.

- The front-end lags, with 2YY -2.9bps at 4.341%, 5YY -5.6bps at 3.838%, 10YY -5.6bps at 3.683% and 30YY -4.8bps at 3.791%.

- TYH3 trades 22+ ticks higher at 113-11 off session highs of 113-14, eyeing resistance at 113-15+ (Dec 23 high) after which sits 114-01+ (Dec 21 high). Volumes are above average for the second day running.

- Data: ISM mfg Dec (1000ET) and JOLTS Nov (1000ET) plus the usual weekly MBA mortgage data (0700ET)

- Fed: FOMC Dec meeting minutes (1400ET)

- Bill issuance: US Tsy $33B 17W bill auction (1130ET)

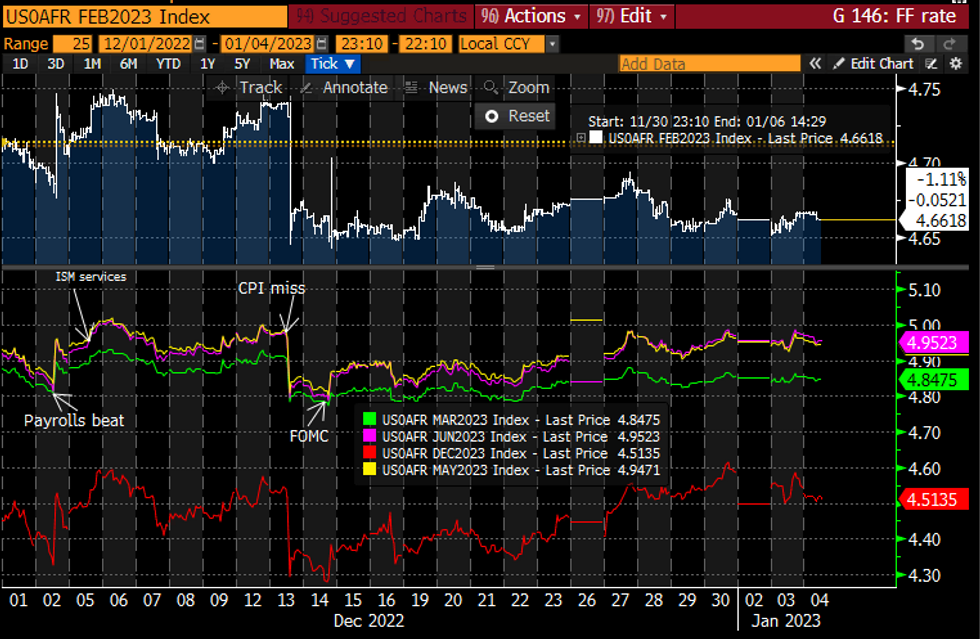

STIR FUTURES: Fed Terminal Keeping To Recent Range

- Fed Funds implied hikes continue yesterday’s second half retracement of earlier gains, with the terminal holding within the 4.9-5.0% range since Christmas at a level not far below that before the US CPI miss on Dec 13.

- Sitting at 33bps for Feb (unch), a cumulative 51.5bp to 4.85% for Mar (-1bp), a terminal 4.95% in Jun (-2bp) and 4.52% in Dec (-2.5bp).

- FOMC minutes at 1400ET (preview link) with next scheduled Fedspeak from Bostic (’24) tomorrow.

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOREX: AUD Motors Toward December High as China Relations Improve

- AUD tops the table in G10 ahead of the NY crossover, with AUD/USD nearing the next resistance at the December high of $0.6893 following overnight reports that China bureaucrats could roll back the ban on coal imports from Australia after a two-year freeze in trade. If confirmed, the move would mark a significant normalisation in relations between the two countries, reflected in the currency's material break back above the 200-dma for the first time since early 2022.

- The USD backtrack follows a strong rally in the currency on Tuesday, and may reflect a settling of markets after the volatile start to the year. French inflation was a material downside surprise at 6.7% for the EU-harmonized Y/Y figure vs. Exp. 7.3%. The release saw bond yields slide lower and EUR/GBP drop back below 0.8800.

- We see the first tier one US data of the year with today's ISM Manufacturing release. Markets will eye the release for any clues ahead of Friday's payrolls, which are expected to show jobs growth of 200k this month.

FX OPTIONS: Expiries for Jan04 NY cut 1000ET (Source DTCC)

- USD/JPY: Y129.30($595mln), Y130.00($640mln), Y134.30($1.4bln)

- AUD/USD: $0.6800-05(A$1.2bln)

BONDS: More Soft CPI Data Pulls Core FI Higher

- Core fixed income is higher this morning, with EGBs seeing the biggest moves in 10-year space. The moves were driven by a soft French inflation print with HICP falling 0.1% M/M and the Y/Y print falling 0.4ppt to 6.7% (instead of the 0.2ppt expected increase to 7.3% Y/Y that consensus had penciled in). This followed a soft German HICP print yesterday and a slightly weak Spanish HICP print last week.

- Bund futures hit a high of 136.46 around 8:30GMT/9:30CET - around 45 minutes after the release of the French data. They have since come off their highs a little but remain over 100 ticks higher on the day and over 300 ticks higher YTD.

- Gilts have been following Bunds higher but futures remain below yesterday's highs. 2-year gilt yields, however, have moved more than 10bp on the day.

- In contrast the moves seen in Treasuries are smaller, but futures have still hit their highs of the year.

- Looking ahead we have US ISM manufacturing data, JOLTS and the FOMC Minutes due later today.

- TY1 futures are up 0-21 today at 113-09+ with 10y UST yields down -4.9bp at 3.692% and 2y yields down -2.6bp at 4.346%.

- Bund futures are up 1.03 today at 136.11 with 10y Bund yields down -8.8bp at 2.296% and Schatz yields down -6.1bp at 2.609%.

- Gilt futures are up 0.89 today at 101.37 with 10y yields down -8.1bp at 3.567% and 2y yields down -10.1bp at 3.454%.

EQUITIES: Eurostoxx Futures Trade Higher Again, Though Gains Seen as Corrective For Now

EUROSTOXX 50 futures are again trading higher, with this week’s move resulting in a break of initial resistance at 3895.00, the Dec 22 high. Gains are considered corrective - for now - however, a continuation higher would expose key resistance and the bull trigger at 4043.00, the Dec 13 high. A reversal lower and a break of support at 3753.00, Dec 20 low, would resume the recent bear leg and open 3646.50, the 50% retracement of the Sep - Dec bull cycle. S&P E-Minis trend signals remain bearish and recent gains are considered corrective. Key resistance to watch is at 3926.25, the 50-day EMA. A clear break of this hurdle is required to suggest potential for a stronger recovery and possibly a reversal. On the downside, a break lower would confirm a resumption of the downtrend with the focus on 3778.45, a Fibonacci retracement.

- Japan's NIKKEI closed lower by 377.64 pts or -1.45% at 25716.86 and the TOPIX ended 23.56 pts lower or -1.25% at 1868.15.

- Elsewhere, in China the SHANGHAI closed higher by 7.004 pts or +0.22% at 3123.516 and the HANG SENG ended 647.82 pts higher or +3.22% at 20793.11.

- Across Europe, Germany's DAX trades higher by 194.94 pts or +1.37% at 14339.91, FTSE 100 higher by 29.89 pts or +0.4% at 7568.58, CAC 40 up 93.2 pts or +1.41% at 6705.19 and Euro Stoxx 50 up 55.36 pts or +1.43% at 3928.48.

- Dow Jones mini up 101 pts or +0.3% at 33381, S&P 500 mini up 16.5 pts or +0.43% at 3863.5, NASDAQ mini up 81.75 pts or +0.75% at 11036.5.

COMMODITIES: Gold Trades at Fresh Cycle High, Targets 1872.4 3.0% 10-DMA Envelope Next

Price action since the turn of year has worked against the bullish short-term WTI futures trend conditions. Key short-term support at $76.79, the Dec 29 low, has given way - which may signal a near-term top. Recent bullish price action resulted in the contract trading above both the 20- and 50-day EMAs, and any resumption of the recovery opens key resistance at $83.27, the Dec 1 high. Trend conditions in Gold remain bullish and the yellow metal has started the year on a firm note, clearing resistance and resuming its uptrend. The break higher signals scope for gains towards $1872.4 next, the 3.0% 10-dma envelope as well as $1896.5, the 61.8% retracement of the Mar - Sep bear leg. Moving average studies are in a bull mode position, highlighting current sentiment. Initial firm support is seen at $1795.00, the 20-day EMA.

- WTI Crude down $1.4 or -1.82% at $75.74

- Natural Gas down $0.01 or -0.18% at $3.988

- Gold spot up $19.56 or +1.06% at $1860.96

- Copper up $3.5 or +0.93% at $379.95

- Silver up $0.24 or +1.01% at $24.3237

- Platinum up $5.3 or +0.49% at $1097.32

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/01/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 04/01/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 04/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 04/01/2023 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 04/01/2023 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 04/01/2023 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 05/01/2023 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 05/01/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 05/01/2023 | 0700/0800 | ** |  | DE | Trade Balance |

| 05/01/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 05/01/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 05/01/2023 | 0930/0930 |  | UK | BOE Dec DMP Survey | |

| 05/01/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/01/2023 | 1000/1100 | *** |  | IT | HICP (p) |

| 05/01/2023 | 1000/1100 | ** |  | EU | PPI |

| 05/01/2023 | 1315/0815 | *** |  | US | ADP Employment Report |

| 05/01/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 05/01/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 05/01/2023 | 1420/0920 |  | US | Atlanta Fed President Raphael Bostic | |

| 05/01/2023 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/01/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 05/01/2023 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 05/01/2023 | 1820/1320 |  | US | St. Louis Fed's James Bullard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.