-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI US MARKETS ANALYSIS - Bank Stocks Slip on Both Sides of the Pond

Highlights:

- Bank stocks slip on both sides of the pond on Moody's downgrade, Italy's surprise tax raid

- CNH offered on disappointing China trade data

- Fed's Harker, Barkin latest to add to views of FOMC

US TSYS: Bull Flattening Sees TY Test Resistance

- Cash Tsys trade firmly bull flatter today against a risk-off backdrop stemming from Moody's cutting ratings on the US banking sector, some soft Chinese data, an Italian windfall tax on banking sector profits and most recently UPS missing EPS expectations and cutting its full-year revenue outlook. Still stubborn price pressures amid an improving activity outlook for NFIB small businesses helped steady gains but no more than that.

- 2YY -3.1bp at 4.730%, 5YY -7.4bp at 4.092%, 10YY -9.3bp at 3.996% and 30YY -10.2bp at 4.168%.

- TYU3 trades 14 ticks higher at 111-18, where it finds resistance at the 20-day EMA of 111-18+ in a continued push off support at yesterday’s low of 110-23. A more concerted climb could signal scope for a stronger recovery to the 50-day EMA at 112-15+. Volumes are strong at 390k after a large increase in European hours.

- Fedspeak: Harker (0815ET), Barkin (0830ET)

- Data: Trade Balance Jun (0830ET), Wholesale trade sales/inventories Jun/Jun final (1000ET)

- Note/bond issuance: US Tsy $42B 3Y Note auction (91282CHU8) – 1300ET

- Bill issuance: US Tsy $55B 42D CMB, $40B 52W bill auctions – 1130ET

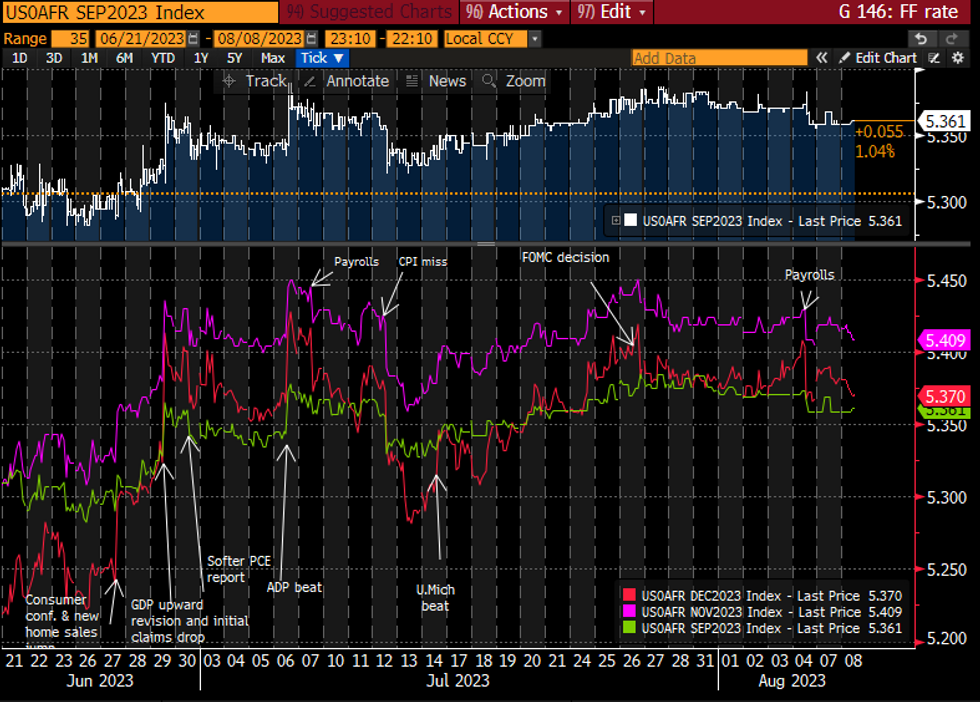

STIR FUTURES: 2024 Fed Implied Rates Push Further Below Post-Payrolls Levels

- Fed Funds implied rates have pushed lower overnight on souring risk sentiment on drivers including Moody's cutting ratings on the US banking sector, some soft Chinese data and most recently UPS missing EPS expectations and cutting its full-year revenue outlook.

- The move sees near-term meetings back at the lower end of recent ranges (+3bp for Sep, cumulative +8bp for Nov) whilst 2024 rates push further below Friday’s post-payrolls close having drawn back level in the second-half of yesterday’s session.

- Cuts from Nov terminal: 4bp to Dec’23 (from 3bp yesterday), 69bp to Jun’24 (from 66bp) and 145bp to Dec’24 (from 142bp).

- Harker (’23 voter) speaks with text at 0815ET and Barkin (’24) at 0830ET, both for the first time since last month’s FOMC in an otherwise relatively light session. However, the nature of enhanced data dependency sees Thursday’s CPI report more heavily in focus.

Source: Bloomberg

Source: Bloomberg

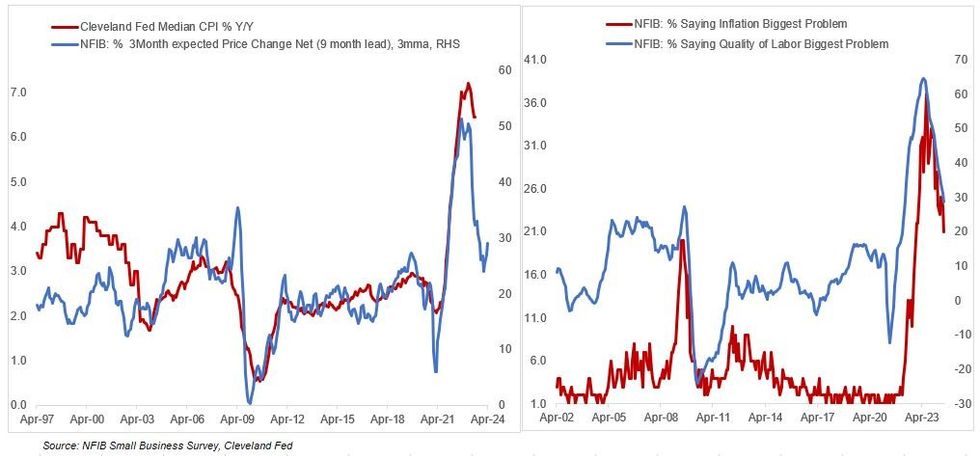

NFIB Shows Stubborn Price Pressures Amid Improving Activity Outlook

The NFIB Optimism Index rose 0.9 points to 91.9 in July, representing a bigger improvement than the 91.3 expected and the highest readings since Nov 2022. As usual though the subcomponents were more interesting and suggested that the outlook for small business activity was stable-to-improved, while inflation pressures were abating slightly but at a still-high level.

- Of the index's 10 components, 5 saw improvement (employment, capital outlays, inventory plans, economic expectations, real sales expectations), 1 fell (earnings), and 4 were unchanged (current inventories, job openings, expected credit conditions, "good time to expand").

- A net 21% plan to raise compensation in the next 3 months (-1pp), while 10% cited labor costs as their biggest problem (up 2 points).

- A net -13% reported higehr nominal sales the past 3 months, lowest since Aug 2020, though the net % expecting higher real sales volumes was up 2 points to -12%.

- From an inflation perspective, the the net % of businesses reporting higher selling prices fell 4 points to net 25%, lowest since Jan 2021 (on a seas adj basis), with 21% saying inflation was their biggest problem, a 3 point drop. So there is some progress here but overall stabilization of net price expectations (a net 27% plan price hikes, albeit down 4 points) continues to suggest some difficulty in getting CPI back toward the Fed's 2% target (see chart).

- Credit availability didn't seem to be a problem despite this year's high profile bank turmoil, with most related indicators basically unchanged vs June (only 3% said their borrowing needs were not satisfied, with 6% reporting their last loan was harder to get than in previous attempts).

Bank Tax Highlights Social Not Fiscal Conservative Nature Of Gov't

The decision by Italy's right-wing coalition to implement a 40% windfall tax on excess bank profits in 2023 has come as a shock to markets, with Italian bank stocks hit hard in early trading (see here). The rightward lean of the Italian gov't, led by PM Giorgia Meloni's Brothers of Italy (FdI) had led many to assume that it would be a more pro-business, free-market gov't than the 5-Star/Democratic Party administration that proceeded it.

- However, the two major forces in the gov't, the FdI and Deputy PM Matteo Salvini's League, exist as national conservatives and populist nationalists respectively. As such, their policies (domestically at least) will be more focused on socially conservative legislation in the areas of immigration and families than in fiscally conservative areas such as spending cuts or promoting an improved Italian business environment.

- The type of action taken by the Italian gov't could prove a harbinger of other national conservative parties in Europe that are seeking to gain power (e.g. Vox in Spain, Marine Le Pen's National Rally in France, the Alternative for Germany), with a focus on social rather than fiscal conservatism and as such a greater prospect of populist measures such as windfall taxes or increased taxation on businesses/high earners.

USD/CNH Nearing Key Resistance After Poor Trade Data

- Underlying dollar strength working in favour of USD/CNH and putting the pair just below the mid-July highs of 7.2368 - the first upside level ahead of 7.2457 - the 76.4% retracement for the July downleg.

- A softer local equity close in China and the disappointing trade data overnight are working against the currency - with weakness across both exports and imports suggesting weaker local demand as well as poorer total trade.

- Exports slipped 14.5%, making for the fastest pace of decline since the onset of the COVID pandemic in Feb'20 and the third consecutive month of declines.

- The data turns focus to July inflation due Wednesday, with CPI seen dropping 0.4% and PPI at -4.0%. A miss on forecast is sure to reignite speculation of further stimulus.

FOREX: USD Boosted as Global Bank Shares Hit Retreat

- The USD trades on the front foot in early Tuesday trade, with markets taking note of a series of negative sector news for global banks. Firstly, Moody's cutting their rating on the US Banking sector, with the ratings agency flagging the weaker outlook for banks stemming from both higher funding costs as well as office and commercial real estate exposure.

- Compounding the pullback in banking stocks, a fresh windfall tax on banking sector profits has hurt the EuroStoxx50 Bank Index and sent the likes of UniCredit lower by over 5% - making for a risk-off feel ahead of the NY crossover.

- Equities are lower, alongside global yields, hindering progress among AUD and NZD, which again are circling key support and recent lows. AUD/USD trades heavy and is through to new weekly lows this morning, and now sits within range of 0.6514, the early August low and bear trigger.

- Weakness through here puts the pair at the lowest level since June 1st and within range of a series of key levels: firstly the YTD low and assumed sizeable support at 0.6458 - the May 31st low - as well as one of the largest option strikes for today's NY cut: A$1.4bln set to roll off at $0.6450.

- Focus turns to the US trade balance release for June, followed by wholesale trade sales and inventories stats. Speeches are set from Fed's Harker and Barkin.

FX OPTIONS: Expiries for Aug08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0790-00(E571mln), $1.0870(E1.3bln), $1.0895-10(E880mln), $1.0970-80(E679mln), $1.1300(E602mln)

- GBP/USD: $1.2980-00(Gbp554mln)

- EUR/GBP: Gbp0.8700-25(E1.1bln)

- AUD/USD: $0.6450(A$1.4bln)

- NZD/USD: $0.6235(N$553mln)

- USD/CAD: C$1.3335($580mln)

BONDS: Bull Flattening as Sentiment Sours

- Core fixed income is higher across the board this morning. Drivers include Moody's cutting ratings on the US banking sector and some soft Chinese data overnight which have both led to a generally risk-off tone across markets. Although it didn't see any real market reaction the ECB Consumer Expectations Survey also showed a continued decline, helping add to the dovish sentiment in the market this morning.

- Curves have bull flattened across the board in core FI.

- EGBs have seen the biggest rally with 10-year Bund yields almost 10bp lower on the day at the time of writing, back to 2.5%, but decent moves for both gilts and Treasuries too (with TY1 hitting its highest level of the month so far).

- Today we will hear from Fed's Harker and Barkin but markets already have one eye on tomorrow's US CPI print.

EQUITIES: Bearish Threat in Eurostoxx 50 Futures Remains Present

- A bearish threat in Eurostoxx 50 futures remains present following last week’s sharp sell-off from 4513.00, the Jul 31 high. Price has cleared both the 20- and 50-day EMAs, highlighting a stronger bearish theme. Note too, that key support at 4331.00, the Jul 26 low, has been cleared. This strengthens current conditions and opens 4220.00, the Jul 7 low and a reversal trigger. Initial firm resistance is at 4424.00, the Aug 2 high.

- Bearish conditions in the E-mini S&P contract remain intact. Last week’s sell-off reinforced a bearish threat and resulted in a break of support at the 20-day EMA. The recent failure at the top of the bull channel also highlights a bearish development and the risk of an extension lower near-term. Further downside would open 4457.21, the 50-day EMA. First key resistance is at 4634.50, the Jul 27 high.

COMMODITIES: WTI Futures Uptrend Intact Despite Recent Move Lower

- The uptrend in WTI futures remains intact and last Friday’s gains confirmed a resumption of the bull cycle. The move higher maintains the bullish price sequence of higher highs and higher lows. Note that moving average studies are in a bull mode position and this reinforces current positive conditions. The focus is on $83.59, the Nov 7 2022 high. On the downside, initial firm support has been defined at $78.69, the Aug 3 low.

- Gold remains bearish. The yellow metal traded lower last week, confirming an extension of the bear cycle that started Jul 20. This signals scope for a move towards $1924.5, the Jul 11 low. Clearance of this level would suggest potential for an extension towards the key support at $1893.1, the Jun 29 low. Key resistance is at $1987.5, the Jul 20 high. A break would reinstate a bullish theme.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/08/2023 | 1215/0815 |  | US | Philadelphia Fed's Pat Harker | |

| 08/08/2023 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 08/08/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 08/08/2023 | 1230/0830 |  | US | Richmond Fed's Tom Barkin | |

| 08/08/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 08/08/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 08/08/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/08/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 08/08/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 08/08/2023 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 09/08/2023 | 0130/0930 | *** |  | CN | CPI |

| 09/08/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 09/08/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/08/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 09/08/2023 | 1230/0830 | * |  | CA | Building Permits |

| 09/08/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 09/08/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.