-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessKey Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI US MARKETS ANALYSIS - BoC Eyed for '24 Rate Path Clues

Highlights:

- US curve sees mixed trade, cheapening led by the belly

- USD Index holding bulk of week's rally

- Bank of Canada eyed for dovish clues on '24 rate outlook in likely unchanged decision

US TSYS: Belly-Led Cheapening, Watching Productivity and Any BoC Spillover

- Cash Tsys have seen mixed trade overnight but ultimately pare yesterday’s rally, sitting 2.5-4.5bp cheaper and with the belly leading the sell-off despite oil prices falling further.

- ADP offers potential for volatility at 0815ET and we think there should be greater focus on the final Q3 productivity/ULC data at 0830ET. Also watch for any spillover from the BoC decision at 1000ET in case of any dovish surprises (in guidance rather than actual rate setting).

- TYH4 trades at session lows of 110-20+ (-08+) but remains in the upper half of yesterday’s range. Yesterday’s high at 110-31+ marks initial resistance just before the round 111-00 with the bull cycle in play, whilst support is seen at 109-11 (20-day EMA). Volumes are solid at 350k.

- Data: Weekly MBA mortgage data (0700ET), ADP employment Nov (0815ET), Productivity/ULCs Q3 final (0830ET), International trade Oct (0830ET)

- Bill issuance: US Tsy $56B 17W Bill auction (1130ET)

STIR: Latest Rally Retraced But Still Five Fed Cuts In 2024

- Fed Funds implied rates have reversed yesterday’s rally that began early on before it continued with lower-than-expected JOLTS job openings.

- It still implies sizeable probability of a March cut (17bp cumulative), fully prices two cuts by June and just about five cuts for 2024 as a whole – see table.

- The ADP employment report at 0815ET could generate some noise but finalized nonfarm productivity/ULCs should have greater impact from a trend perspective, with analysts expecting an even stronger than first thought productivity increase of 4.9% annualized in Q3 after last week’s GDP revision.

SOFR: OI Points to Mix Of Long Setting & short cover For SOFR On Tuesday

The combination of yesterday’s richening on the SOFR strip and preliminary open interest data point to the following positioning swings on Tuesday:

- Whites: Long setting apparent on a net pack basis, with only SFRH4 seeing apparent short cover.

- Reds: Short cover appeared to dominate, although that was largely a product of a sizable OI swing in SFRU4, with little net change through the rest of the pack as apparent rounds of short cover and long setting virtually offset.

- Greens & Blues: Small rounds of apparent net short cover were seen on a pack basis, although some apparent pockets of long setting were also noted.

- A reminder that a firmer-than-expected ISM services survey (save the employment sub-index) and softer-than-expected JOLTS job openings print factored into price action on the day, as did dovish communique from the ECB. The two latter inputs outweighed the former in net terms.

- Still, pricing re: cumulative Fed cuts through ’24 failed to revisit Friday’s dovish extreme.

| 05-Dec-23 | 04-Dec-23 | Daily OI Change | Daily OI Change In Packs | ||

| SFRU3 | 1,109,362 | 1,085,809 | +23,553 | Whites | +61,750 |

| SFRZ3 | 1,511,147 | 1,466,584 | +44,563 | Reds | -95,239 |

| SFRH4 | 1,076,616 | 1,084,354 | -7,738 | Greens | -3,498 |

| SFRM4 | 1,003,129 | 1,001,757 | +1,372 | Blues | -6,530 |

| SFRU4 | 884,026 | 977,848 | -93,822 | ||

| SFRZ4 | 926,340 | 924,492 | +1,848 | ||

| SFRH5 | 544,175 | 539,599 | +4,576 | ||

| SFRM5 | 593,460 | 601,301 | -7,841 | ||

| SFRU5 | 617,972 | 626,916 | -8,944 | ||

| SFRZ5 | 560,445 | 564,011 | -3,566 | ||

| SFRH6 | 414,864 | 410,905 | +3,959 | ||

| SFRM6 | 358,858 | 353,805 | +5,053 | ||

| SFRU6 | 319,950 | 323,893 | -3,943 | ||

| SFRZ6 | 252,506 | 258,340 | -5,834 | ||

| SFRH7 | 151,092 | 150,962 | +130 | ||

| SFRM7 | 140,469 | 137,352 | +3,117 |

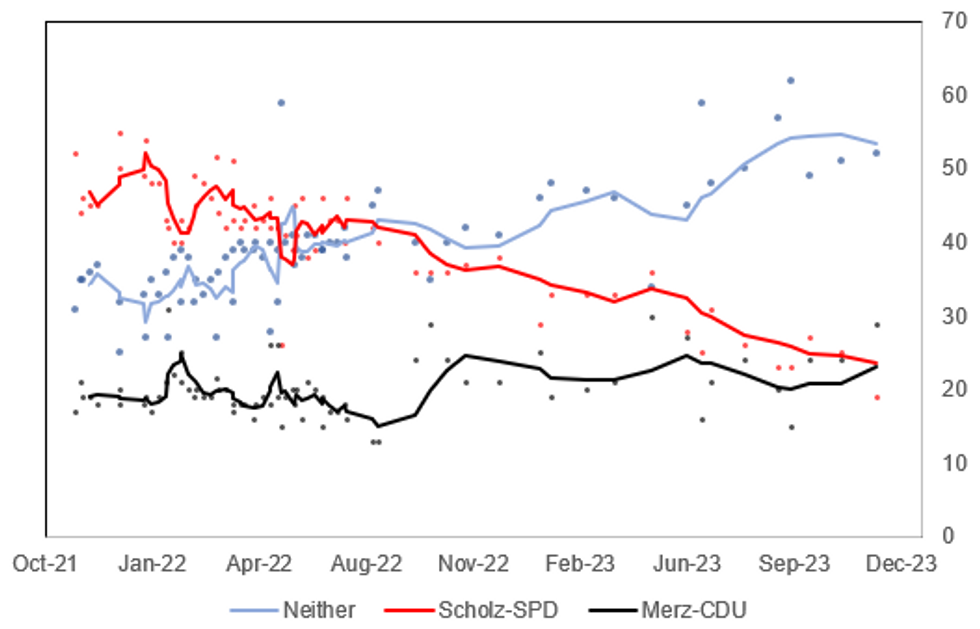

Merz Overtakes Scholz As Pref. Chancellor; Both Still Unpopular Choices

Chancellor Olaf Scholz is grappling with declining opinion polling ratings amid the continued inability of the federal gov't to reach an agreement on the 2024 budget. Opinion polling by Wahlkreisprognose in late Nov showed 19% of respondents preferred Scholz as chancellor compared to 29% for leader of the centre-right Christian Democratic Union (CDU) Freidrich Merz. This is the first time since preferred chancellor polling for this parliament began that Merz has outperformed Scholz, albeit with 52% of respondents claiming they preferred neither man.

- Scholz's declining support comes as the federal coalitionstruggles to come to a consensus on the 2024 budget. Reuters: "The failure of crunch talks between coalition leaders before Wednesday means it is unlikely parliament will approve a 2024 budget by the end of the year, leaving in limbo spending plans from climate projects to benefits and for local authorities.... coalition sources have told Reuters that little progress was made overnight and the parties were still far apart."

- Finance Minister Christian Lindner from the pro-business liberal wants to plug the EUR60bn hole in the federal budget (created by a Constitutional Court ruling regarding off-budget climate funds) with spending cuts. The environmentalist Greens want the debt brake suspended for another year, with a commitment to investment in climate projects and green transition, while Scholz's centre-left Social Democrats (SPD) will be loathe to agree with Lindner's plans to cut welfare payments.

Source: Wahlkreisprognose, Forsa, INSA, MNI

Source: Wahlkreisprognose, Forsa, INSA, MNI

EUROPE ISSUANCE UPDATE:

Gilt auction results:

- GBP3bln of the 0.875% Jul-33 Green Gilt. Avg yield 4.091% (bid-to-cover 2.66x, tail 1.3bp).

- A relatively weak 10-year green gilt auction with a relatively wide tail of 1.3bp (in line with the September auction) and the LAP of 74.483 coming in below the intraday low on the secondary market of 74.529. However, the auction was not as weak as yesterday's linker auction, and although it was relatively weak overall it wasn't that much weaker than the last auction (in September) of this particular gilt (the 0.875% Jul-33 Green Gilt).

- Gilt futures fell around 9 ticks on the release of the results after moving around 15 ticks higher when the bidding window closed - and around 10 minutes post-auction were trading back around levels seen around 9:45GMT - before the concession started to be priced by the market.

- MEF sold: E1.662bln of the 4.75% Sep-28 BTP and E1.338bln of the 5.00% Aug-39 BTP.

- MEF bought back E524mln of the 0% Apr-24 BTP, E875mln of the 1.75% Jul-24 BTP, E1.323bln of the 3.75% Sep-24 BTP and E495mln of the Feb-24 CCTeu.

FOREX: AUD GDP Aides Recovery Off Weekly Low

- Antipodean currencies are outperforming, with AUD among the strongest performers in G10 following the Australian GDP print overnight, which topped expectations at 2.1% Y/Y vs. Exp. 1.9% across Q3 to help partially reverse the early weakness in AUD/USD and put the pair (briefly) back above the 200-dma of 0.6578. NZD/USD exhibited similar price action, with 0.6150 providing a magnet for prices across much of the European morning.

- The USD Index sits slightly lower on the session, but is still holding solid gains off the late November low. 104.092 marks the next upside level - the weekly high - for the USD Index, but resistance seen stronger into 104.468, the 100-dma for the gauge.

- The EUR came under light, modest pressure across the morning following missives from ECB's Kazaks who, in a presentation to MNI, stated that should the outlook change and the balance of risks for price stability shift lower, then the outlook on rates at the ECB could change ahead.

- This leaves AUD, NZD the firmest in G10, while JPY, NOK and USD are the weakest on the session.

- The Bank of Canada rate decision takes focus going forward, with markets left with little doubt of another hold. The focus for markets will instead be on the extent to which the BoC stress the downside risk to rates across 2024. Our full preview is found here: https://roar-assets-auto.rbl.ms/files/58310/BOCPre...

- ADP Employment Change data set for later today will also be eyed for clues ahead of Friday's payrolls release. Consensus currently looks for the US to have added 187k in the month of November - a figure that could be re-assessed if data comes out of line with today's ADP.

EQUITIES: Bullish Theme in E-mini S&P Intact

- A bullish theme in S&P e-minis remains intact and last Friday’s push higher was a positive development. The contract is trading closer to its recent highs and so far, corrections have been shallow - a bullish signal. Note too that MA studies are in a bull-mode position.

- A bullish theme in Eurostoxx 50 futures remains intact and the contract is trading higher this week. Last week, resistance at 4387.00, Nov 24 high, was breached. The break confirms a resumption of the uptrend and maintains the price sequence of higher highs and higher lows.

COMMODITIES: Gold Remains Bullish Despite Reversal Off Monday High

- Gold traded in a volatile manner Monday. The trend condition is bullish and Monday’s initial gains reinforce this theme. The precious metal touched a fresh all-time high of $2135.39 and this signals potential for a climb towards 2177.58 next.

- The trend outlook in WTI futures remains bearish and the move lower from last Thursday’s high, reinforces this set-up. Resistance to watch is $79.65, the Nov 14 high. A breach of this hurdle would strengthen any developing bullish threat.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/12/2023 | 1315/0815 | *** |  | US | ADP Employment Report |

| 06/12/2023 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/12/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 06/12/2023 | 1330/0830 | ** |  | US | Non-Farm Productivity (f) |

| 06/12/2023 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 06/12/2023 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/12/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 07/12/2023 | 0645/0745 | ** |  | CH | Unemployment |

| 07/12/2023 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/12/2023 | 0730/0830 |  | EU | ECB's Lagarde and Cipollone in Eurogroup meeting | |

| 07/12/2023 | 0745/0845 | * |  | FR | Foreign Trade |

| 07/12/2023 | 0900/1000 | * |  | IT | Industrial Production |

| 07/12/2023 | 1000/1100 | *** |  | EU | GDP (final) |

| 07/12/2023 | 1000/1100 | * |  | EU | Employment |

| 07/12/2023 | 1000/1100 | * |  | IT | Retail Sales |

| 07/12/2023 | - | *** |  | CN | Trade |

| 07/12/2023 | 1330/0830 | *** |  | US | Jobless Claims |

| 07/12/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 07/12/2023 | 1330/0830 | * |  | CA | Building Permits |

| 07/12/2023 | 1430/1530 |  | EU | ECB's Elderson at CEPS | |

| 07/12/2023 | 1500/1000 | ** |  | US | Wholesale Trade |

| 07/12/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 07/12/2023 | 1735/1235 |  | CA | BOC Deputy Gravelle speech/press conference in Windsor ON. | |

| 07/12/2023 | 2000/1500 | * |  | US | Consumer Credit |

| 08/12/2023 | 2350/0850 | *** |  | JP | GDP |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.