-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - CNH Hits New Multi-Year High

HIGHLIGHTS:

- USD/CNH hits fresh multi-year low on signing of RCEP deal

- UST yields bounce as Pfizer upgrade vaccine efficacy rate

- USD/JPY extends losing streak to five consecutive sessions

US TSYS SUMMARY: Intraday Reversal From Post-Pfizer Highs

Treasuries have reversed after setting post-Nov 9 (Pfizer COVID vaccine announcement) highs, and are now on session lows - mirroring S&P futures which have bounced sharply.

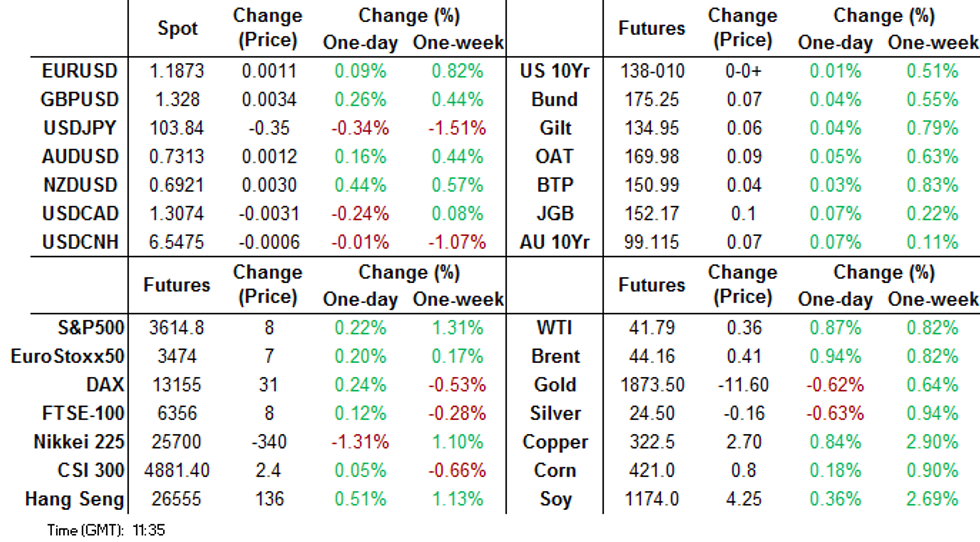

- Curve a bit flatter (though off session's flattest levels): 2-Yr yield is up 0.4bps at 0.1732%, 5-Yr is up 0.6bps at 0.3856%, 10-Yr is up 0.5bps at 0.8619%, and 30-Yr is down 0.3bps at 1.6033%.

- Dec 10-Yr futures (TY) steady at at 138-09.5 (L: 138-09.5 / H: 138-16.5) on ~300k volume.

- Dollar's bounced a little but looks to be testing those Nov 9 lows.

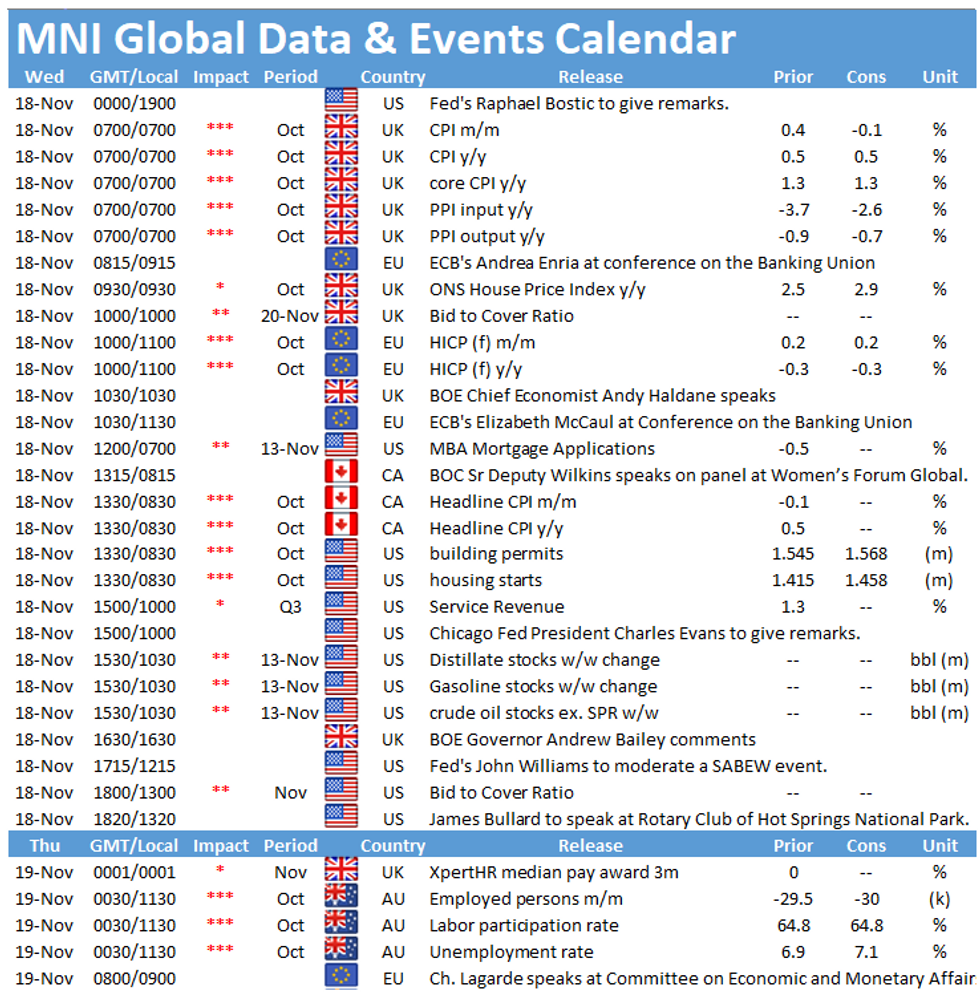

- Fed speakers today include Chicago's Evans (0955ET), NY's Williams (1215ET), StL's Bullard (1320ET), Dallas' Kaplan (1800ET) and Atlanta's Bostic (1900ET).

- Tuesday's failed procedural vote leaves Judy Shelton's appointment to the Fed in the balance. No word on Republican leadership bringing another vote but the arithmetic and politics suggest that it will have to be this week (ahead of the Thanksgiving recess) if she is to have a chance.

- In data, 0830ET sees October housing starts/permits.

- In supply, we get $55B in 105-/154-day bills at 1130ET, with highlight being $27B in 20-Yr Bonds at 1300ET. NY Fed buys ~1.225B of TIPS (7.5-30Y).

EGB/GILT SUMMARY: EGBs Slightly Higher

European govies have traded slightly firmer this morning alongside incremental equity gains, fresh upside for oil and broad G10 FX strength against the US dollar.

- Gilts trade close to unch on the day. Last yields: 2-year -0.0392%, 5-year 0.0045%, 10-year 0.3190%, 30-year 0.9057%.

- The bund curve has flattened with the 2s30s spread 2bp narrower on the day.

- OATs are marginally firmer with cash yields within 1bp of yesterday's closing levels.

- BTPs trade broadly in line with core EGBs.

- Supply this morning came from Germany (bund, EUR2.4285bn allotted) and the UK (Gilts, GBP2.25bn).

- UK CPI data for October came in above expectations (0.7% Y/Y vs 0.5% survey). The final Eurozone CPI print for October matched the initial estimate (-0.3% Y/Y).

- The BoE's Andy Haldane earlier warned of the lasting economic scars from Covid. BoE Governor Andrew Bailey is due to speak at an event organised by the Carnegie Institute for World Peace at 1630GMT.

OPTION FLOW SUMMARY

UK:

0LM1 99.87/100^^, bought for 12 in 5k

LU1 100.125/100.00/99.875p fly 1x3x2, bought for -0.75 (receive) in 5k

Eurozone:

RXF1 175/174/173.5p ladder, bought for 2 in 2k

RXH1 177/176/172p ladder, bought for 7.5 in 2k

US:

TYZ0 138.00p, bought for 2 in 20k (-14 delta, Friday expiry)

Near 15,500 FVF 126/127 call spds, 7.5

Block -40,000 FVF 126 calls early overnight at 8.5 vs. 138-14 to -14.5/0.25%, total volume 55,900, 8/64 last

Elsewhere:

24,800 TYZ 138 puts, 2/64

4,780 USF 184 calls, 5/64

GERMAN AUCTION RESULTS: Germany Allots E2.4285bn of the 0% Aug-30 Bund

- Average yield -0.57% (0.51%), Buba cover 2.0x (2.12x), bid-to-cover 1.65x (1.75x), pre-auction mid-price: 105.68

UK AUCTION RESULTS: DMO sells GBP2.25bln nominal of the 0.625% Jul-35 gilt

- Avg yield 0.676% (0.618%), bid-to-cover 2.44x (2.41x), tail 0.1bp (0.2bp), price 99.283 (100.099)

- Pre-auction mid-price 99.241

- An additional GBP562.5mln nominal will be available through the PAOF to successful bidders until 13:00GMT.

FOREX: USD Offered as Treasury Yields Narrow Gap With Pre-Vaccine Levels

The greenback is solidly the poorest performer in G10 early Wednesday, with the USD index slipping to its lowest level since November 9th - the session in which Pfizer/BioNTech released the interim analysis of their COVID vaccine candidate. The USD index is closely tracking US Treasury yields - the 10y yield is has narrowed the gap with last Monday's low of 0.7964.

Overriding USD weakness pressuring USD/CNH to a new multi-year low, with most pinning the move on the signing of the Regional Comprehensive Economic Partnership between China and 14 other Asia-Pacific countries. USD/CNH touched 6.5321, the lowest level since mid-2018.

USD, EUR are weakest in G10, NZD, NOK the strongest.

US housing starts & building permits and Canadian CPI are the data highlights going forward. BoE's Bailey & Haldane, BoC's Wilkins and Fed's Williams, Bullard & Kaplan are the speaker highlights.

FX OPTIONS: Expiries for Nov18 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1600(E939mln), $1.1770-90(E1.3bln), $1.1850(E564mln), $1.1995-1.2000(E996mln-EUR calls)

USD/JPY: Y104.95-00($580mln)

USD/CAD: C$1.3000($1.1bln), C$1.3195-00($645mln)

TECHS: Key Price Signal Summary

- E-Mini S&P futures resistance at 3668.00, Nov 9 high remains intact. A break higher would resume the uptrend to open 3699.03, a Fibonacci projection. Price action on Nov 9 is a shooting star candle and a reversal threat. Watch 3506.50, Oct 11 low.

- EURUSD directional triggers at 1.1920, Nov 9 high and 1.1746, Nov 11 low remain intact. A break of 1.1920 resumes the uptrend. On the downside, 1.1603, Nov 4 low is exposed if 1.1746 gives way.

- USDJPY is softer. Initial support is at 103.77, a Fibonacci retracement. Key support lies at 103.18, Nov 11 low.

- FI resistance levels to watch:

- Bund fut: 175.62 61.8% retracement of the Nov 4 - 11 sell-off

- Gilts: Have stalled ahead of 135.19, the 20-day EMA.

- Trendline resistance in Treasuries drawn off the Oct 2 high is at 138.16+, today's high so far

- Support in Gold remains at $1848.8, Sep 28 low and in Brent (F1) at $42.63 and WTI (Z0) at $40.06, the Nov 13 lows.

EQUITIES: European Stocks Mixed in Early Trade, Italy Leads, UK Lags

Continental equity markets are mixed-to-flat, with Italy's FTSE-MIB outperforming (up 0.75%) while the UK's FTSE-100 lags, edging lower by 0.4% ahead of NY hours.

Energy and consumer staples are at the bottom of the pile in Europe, with consumer discretionary and tech names modestly outperforming.

In futures space, E-mini S&P volumes are running at about 80% of the recent average for this time of day and sit in very minor positive territory. The overnight high of 3,612 is still some way off the Monday/Tuesday highs at 3,637/3,630.

E-mini S&P rallies to touch new session highs as Pfizer/BioNTech release new estimates for the efficacy of their COVID vaccine candidate. Efficacy now seen at 95%, up from 90% in prior analysis.

They outline their intention to file for US emergency use authorization of their vaccine within days, and announce no safety concerns of their treatment.

Their production estimates are unchanged, seeing 50mln doses produced this year, 1.3bln in 2021.

COMMODITIES: USD Weakness Buoys Oil, WTI Erases Tuesday Weakness

WTI and Brent crude futures both sit slightly higher, by around 1% or so, with WTI narrowing the gap with the Monday high at 42.09.

- The weakness in crude prices that followed OPEC+'s failure to reach an agreement on an extension to supply curbs unsettled markets yesterday, but this has largely been shrugged off ahead of NY hours today. Going forward, the weekly DoE crude oil inventories numbers are a focus, with the a build of around 1.2mln bbls expected in the week ending Nov13.

- Gold is softer, failing to find any support in the USD weakness. Markets ruminated over the blocking of Judy Shelton's nomination to the Fed late yesterday, with some speculating that late Tuesday weakness could be due to her much-vaunted preference for a return to the Gold Standard. Monday's lows provide first support at 1865.30.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.