-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: BOJ Tankan To Show Slipping Sentiment

MNI: PBOC Net Drains CNY288.1 Bln via OMO Friday

MNI US MARKETS ANALYSIS - CNY At Best Levels Since Mid-Sept

Highlights:

- CNY rises to best level in months as speculation mounts that COVID restrictions could be eased as soon as January

- Fed inside media blackout period, keeping central bank speaker slate muted

- ISM Services Index, final durable goods on the docket

US TSYS: Holding Latest Post-Payrolls Cheapening, ISM Services Ahead

- Cash Tsys have traded in a particularly tight range since opening lower in a move that partly reversed the second half Friday unwinding of the initial post-payrolls report cheapening.

- In yield space, it sees the 2Y roughly in the middle of Friday’s wide range, almost 14bps above pre-payrolls lows but still 10bps below post-payrolls highs and more than 20bps below highs of 4.55% prior to Powell last week.

- 2YY +4.1bp at 4.313%, 5YY +4.8bps at 3.700%, 10YY +2.9bp at 3.515% and 30YY -0.3bp at 3.545%.

- TYH3 trades 5+ ticks lower at 114-15+ but remains near the high end of Friday’s range after a re-flattening in the curve. The trend needle points north, with resistance at 114-26 (Dec 2 high) and support at 113-21+ (Dec 2 low).

- Data: ISM services for Nov headlines at 1000ET but also see final readings for the Services/Composite PMI and durable goods.

- Bill issuance: US Tsy $54B 13W and $45B 26W bill auctions – 1130ET

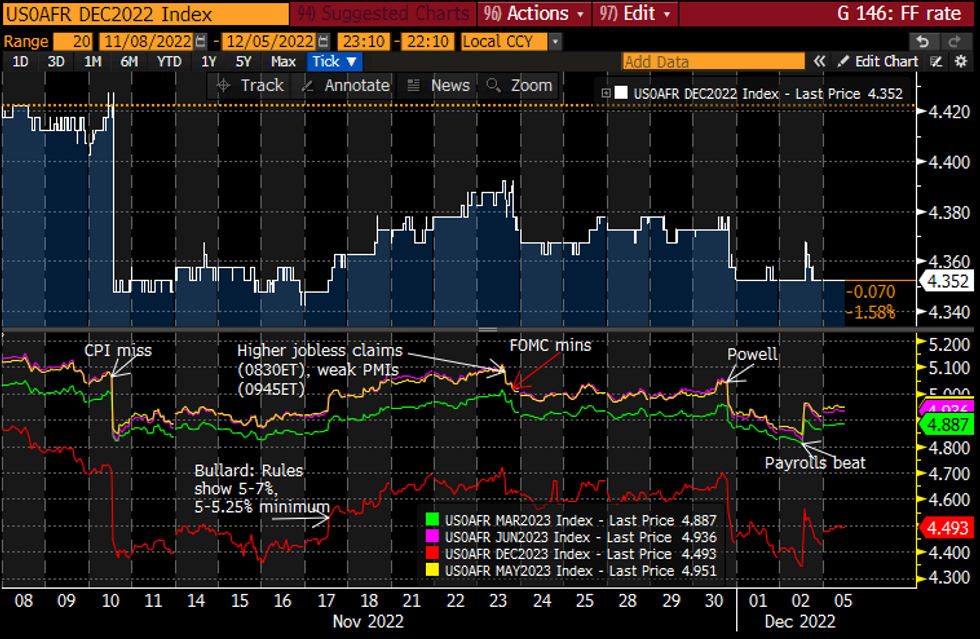

STIR FUTURES: Fed Terminal Closes Back In On Post-Payrolls High

- Fed Funds implied hikes have climbed overnight, unwinding a sizeable portion of Friday’s paring of the post-payrolls increase.

- 51bp for Dec (unch), 88bp to 4.72% for Feb’23 (+1bp), terminal 4.95% May’23 (+3.5bp) and 4.49% Dec’23 (+6.5bp).

- The terminal nears the post-payrolls high of 4.96% but is still some way off the pre-Powell high of 5.06%.

- No Fedspeak with media blackout leaves ISM services in focus.

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOREX: China Reports Help Underpin Risk Sentiment

- Currency markets have adopted a generally risk-on tone, with focus on the growing possibility that Chinese authorities could roll back COVID restrictions at a faster pace than previously expected.

- Reports suggest COVID-19 management in China could be downgraded to Category B as soon as January. This would mark a downgrade from the current level of management (Category A) which is infitting with measures surrounding highly infectious diseases such as bubonic plague and cholera. This isn't a new concept and had been floated by domestic press, but some more clarity on timing has helped support risk.

- JPY is comfortably the poorest performer in G10, with the greenback similarly weak. China remains the driver here, with further evidence emerging of a rollback in COVID restrictions and a possible pivot in policy in the near future.

- Price action has put USD/CNH comfortably below 7.00 to hit 6.9373 - the lowest since mid-Sept - with the likes of iron ore, local equities and AUD also higher to reinforce the risk-on.

- AUDJPY has bounced well off the Friday low, and now faces 92.242 as near-term resistance ahead of the 200-dma at 92.9118.

- Focus turns to the ISM Services Index for November, seen slipping to 53.3 from 54.4 previously. Final durable goods orders number also cross. ECB's Wunsch is the sole speaker on the docket. The Fed have now entered their pre-decision media blackout period.

FX OPTIONS: Expiries for Dec05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0450(E828mln), $1.0500(E727mln), $1.0570-75(E1.0bln)

- USD/JPY: Y134.00($980mln)

- EUR/GBP: Gbp0.8500(E1.6bln)

- USD/CNY: Cny6.9500($2.4bln), Cny7.0000($1.1bln)

EQUITIES: Futures Conditions Remain Bullish After Trading To Cycle Highs Last Week

EUROSTOXX 50 futures trend conditions remain bullish and the contract traded to a fresh cycle high last Thursday. This maintains the uptrend that started in early October and confirms an extension of the price sequence of higher highs and higher lows. The recent break of 3810.00, Aug 17 high, also strengthens the case for bulls. Initial firm support is 3840, Nov 17 low. S&P E-Minis remain in an uptrend. Gains last week resulted in a break of resistance at 4050.75, the Nov 15 high. This confirms a resumption of the uptrend and marks an extension of the price sequence of higher highs and higher lows. Sights are on 4146.63, a Fibonacci retracement. On the downside, key short-term support has been defined at 3912.50, the Nov 17 low.

- Japan's NIKKEI closed higher by 42.5 pts or +0.15% at 27820.4 and the TOPIX ended 6.08 pts lower or -0.31% at 1947.9.

- Elsewhere, in China the SHANGHAI closed higher by 55.67 pts or +1.76% at 3211.814 and the HANG SENG ended 842.94 pts higher or +4.51% at 19518.29.

- Across Europe, Germany's DAX trades lower by 52.16 pts or -0.36% at 14503.25, FTSE 100 higher by 15.05 pts or +0.2% at 7568.41, CAC 40 down 11.63 pts or -0.17% at 6735.52 and Euro Stoxx 50 down 6.11 pts or -0.15% at 3976.23.

- Dow Jones mini down 104 pts or -0.3% at 34371, S&P 500 mini down 14.25 pts or -0.35% at 4063.75, NASDAQ mini down 29.5 pts or -0.25% at 11989.

Price Signal Summary - Gold Trend Condition Remains Bullish

- On the commodity front, Gold remains in an uptrend and last week’s gains reinforce this condition. Last Thursday's rally resulted in a break of $1786.5, the Nov 15 high and a bull trigger, confirming a resumption of the uptrend. $1800.0 has also been cleared and sights are on resistance at $1807.9, the Aug 10 high. This level has been pierced, a clear break would be bullish. Key trend support has been defined at $1729.0, the Nov 23 low.

- In the Oil space, WTI futures are holding on to the bulk of last week’s gains. The latest recovery is considered corrective - for now. A resumption of weakness would refocus attention on $73.60, the Nov 28 low, where a break would strengthen the bearish condition. Key resistance is at $83.66, the 50-day EMA. A clear break of this average would alter the picture.

COMMODITIES: Clear Break of 1807.9 Aug 10 High to Affirm Bullish Gold Trend

Trend conditions in WTI futures remain bearish and last week’s gains are considered corrective. The move lower on Nov 28 resulted in a break of $74.96, Sep 28 low. This confirmed a resumption of the downtrend, opening $73.38, a Fibonacci projection and the $70.00 psychological handle. MA studies are in a bear mode condition, highlighting the current trend direction. Resistance is at $83.66, the 50-day EMA. Short-term trend conditions in Gold remain bullish and last week’s gains reinforce this condition. Last Thursday’s rally resulted in a break of $1786.5, the Nov 15 high and a bull trigger, confirming a resumption of the uptrend. $1800.0 has also been cleared and sights are on resistance at $1807.9, the Aug 10 high (pierced earlier today). A clear break would be bullish. On the downside, key trend support has been defined at $1729.0, the Nov 23 low.

- WTI Crude up $1.38 or +1.73% at $81.08

- Natural Gas down $0.29 or -4.57% at $6.016

- Gold spot down $1 or -0.06% at $1797.6

- Copper up $0.25 or +0.06% at $387.25

- Silver down $0.09 or -0.37% at $23.0127

- Platinum up $2.94 or +0.29% at $1021.8

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/12/2022 | - |  | EU | ECB Panetta at Eurogroup Meeting | |

| 05/12/2022 | 1330/0830 | * |  | CA | Building Permits |

| 05/12/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/12/2022 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/12/2022 | 1500/1000 | ** |  | US | factory new orders |

| 05/12/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 05/12/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 06/12/2022 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 06/12/2022 | 0330/1430 | *** |  | AU | RBA Rate Decision |

| 06/12/2022 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/12/2022 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/12/2022 | 0830/0930 |  | DE | S&P Global Germany Construction PMI | |

| 06/12/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/12/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 06/12/2022 | 1130/1130 | ** |  | UK | Gilt Outright Auction Result |

| 06/12/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 06/12/2022 | 1330/0830 | ** |  | US | Trade Balance |

| 06/12/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/12/2022 | 1400/1500 |  | EU | ECB Publication of Monthly APP/PEPP update | |

| 06/12/2022 | 1500/1000 | * |  | CA | Ivey PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.