-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI US MARKETS ANALYSIS - Curve Sits Bull Steeper Pre-Minutes, Fedspeak

Highlights:

- EUR shrugs off soft PMIs, softening inflation expectations to trade firmer

- US curve sits bull steeper with Fed minutes and Fedspeak incoming

- FOMC minutes eyed for degree of division over pause in rate hikes

US TSYS: Bull Steeper With FOMC Minutes & Late Fedspeak In Focus

- Cash Tsys have bull steepened after yesterday’s Independence Day closure, albeit with some gyrations with a strong open, intraday cheapening early in the European hours and subsequent paring on softer European data. Accordingly, the modest rally in 10s underperforms core EU FI.

- The FOMC minutes (preview here) headline the session with typical Wednesday data releases ahead of payrolls shunted to tomorrow in the holiday-shortened week.

- 2YY -4.6bp at 4.890%, 5YY -3.2bp at 4.156%, 10YY -1.6bp at 3.839%, 30YY +0.0bp at 3.863%

- TYU3 trades 3+ ticks richer at 112-01+ on soft but in line with recent average volumes of 230k. The trend needle pointing south with support at 111-25+ (both yesterday and Jun 30 low) after which lies 111-14+ (Mar 9 low) and the key 110-27+ (Mar 2 low). Resistance meanwhile sits at 112-21 (Jun 22 low).

- Fed: FOMC minutes (1400ET), NY Fed’s Williams with no text (1600ET)

- Data: Factory orders/final durable goods May (1000ET)

- Bills issuance: US Tsy 17W bill auction (1130ET)

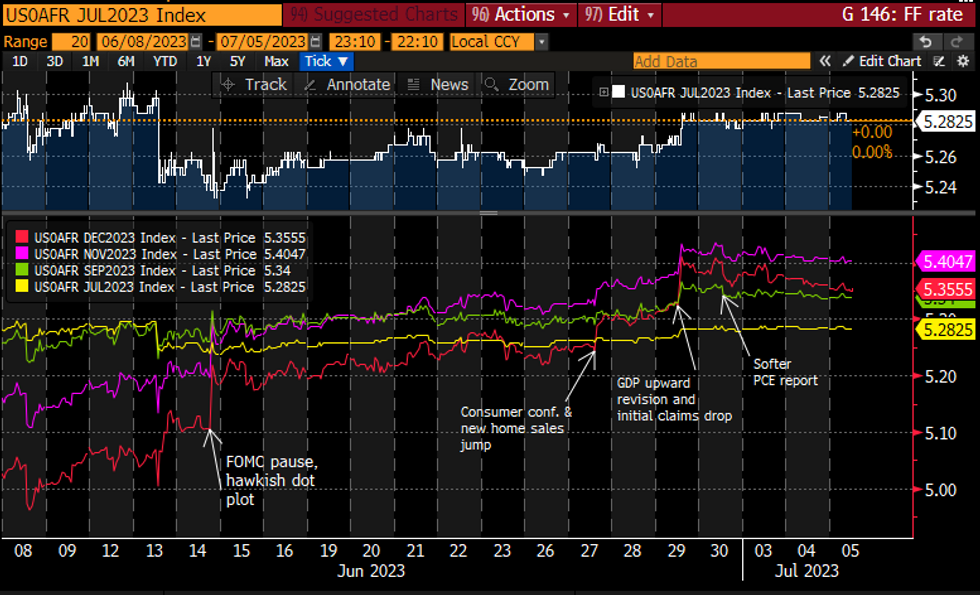

STIR FUTURES: Extending Modest Decline For Later Meetings With FOMC Minutes Eyed

- Fed Funds implied rates have cooled a touch further after yesterday’s holiday-thinned softening, supported at the margin by softer European data. There’s a similar story out to the implied terminal rate with the Nov meeting before some modestly larger cuts priced thereafter.

- Cumulative changes from 5.07% effective: +21bp Jul (-0.5bp from Mon close), +27bp Sep (-1bp), +33.5bp Nov (-1bp), +28bp Dec (-2.5bp), +20bp Jan (-4bp).

- The 5bp of cuts from the Nov terminal to year-end builds to a cumulative 57bp of cuts by Jun’24 vs 52bps at the Mon close.

- The FOMC minutes are in focus today at 1400ET before the next Fedspeak from NY Fed’s Williams (voter) at 1600ET with no text nor media Q&A afterwards.

Source: Bloomberg

Source: Bloomberg

MNI FOMC Minutes Preview

MNI FOMC MINUTES PREVIEW - July 2023

The June Summary of Economic projections brought an unexpectedly hawkish dot plot which included a median of two further 25bp rate hikes implied by the end of 2023. Most market participants interpreted this to mean a hike at the July meeting (and Powell effectively endorsed this by calling the next FOMC “live”), but have remained less convinced of a second increase beyond that. The main question for the June meeting minutes (out Jul 5 at 1400ET/1900UK) is the degree to which the FOMC was divided over the decision to deliver a “hawkish pause/skip”, and to what degree the communications were crafted in a hawkish direction to appease those who would have preferred to hike at that meeting.

STIR FUTURES: Data Biases ECB Pricing A Touch Lower

As noted elsewhere, local data has been a more meaningful driver of the light downtick in ECB-dated OIS than already delivered ECB speak (Nagel remaining hawkish and Visco relatively dovish).- Softer than expected final services PMI & PPI data out of the Eurozone, alongside a mark lower in the short-term inflation expectations in the latest ECB consumer survey, leave terminal rate pricing just below 4.00% in deposit rate terms, while the majority of the liquid contracts are little changed to ~3bp softer.

- Looking ahead, comments from ECB's Villeroy and de Cos fill out the ECB speaker slate on Wednesday.

ECB: Longer-Term Consumer Inflation Expectations Remain Elevated

The main highlight of the inflation expectations section of the ECB's May CES survey is that near-term inflation expectations measured by the 12-month ahead series (5.1% vs 5.3% prior on mean, 3.9% vs 4.1% prior on median) continue to make progress alongside falling observed headline inflation. Both were the lowest since Feb 2022 (Russian invasion of Ukraine).- But longer-term inflation expectations (3 years out) have flattened out at elevated levels, with 3Y median at 2.5% for the 2nd consecutive month and basically where it's been since the start of the year, absent a one-off spike to 2.9% in March. 3Y mean has likewise steadied out but in the high 3% area (3.8-4% each month this year apart from 4.3% in March).

- Both remain above the ECB's target and thus will be seen by hawks as a piece of evidence that there is more work to do to bring longer-term expectations back to the 2% (median) and 3% (mean) at which they were firmly anchored as recently as mid-2021.

EUROPE ISSUANCE UPDATE:

Gilt auction result- A strong short-dated gilt auction with the LAP for the 3.50% Oct-25 Gilt of 95.382 in line with the pre-auction highs of the day. The tail of 0.3bp was the tightest it has been for this gilt (this is the fifth auction).

- The price continued to move higher post-auction, comfortably higher than the average price of 95.389. Gilts across the curve have also moved higher, partly helped by the slightly lower Eurozone PPI data released at the same time as the gilt auction.

- GBP4bln of the 3.50% Oct-25 Gilt. Avg yield 5.668% (bid-to-cover 2.77x, tail 0.3bp).

- There was decent demand at the 10-year Green Bund auction (with the 2.30% Feb-33 Bund on offer). This was the first 10-year Green auction this year (the current issue was launched via syndication in April).

- Bids exceeded the past two 10-year Green Bund auctions and saw the highest volume since May 2022. However, bids remain lower than see for the three Green Bobl auctions held in 2023. The price moved higher post-auction but we have generally reversed that bounce now, and at 99.160 we trade below the average (and low) price seen at auction today.

- E1bln (E979mln allotted) of the 2.30% Feb-33 Green Bund. Avg yield 2.39% (bid-to-cover 2.17x).

- Revised guidance: MS+90bp +/5bp WPIR, size: EUR benchmark (MNI expects E0.5-1.0bln with E750mln likely), books in excess of E2.3bln

FOREX: EUR Shrugs Off Slip in Inflation Expectations, Soft PMIs

- The EUR trades well, shrugging off early weakness on the back of a shaky set of final PMI numbers from across the EU: Italian, Spanish, German and the Eurozone composite PMIs came in short of expectations. Added weight went through on the Eurozone consumer survey, showing a further retreat for short-term inflation expectations in the Euroarea - a release that tipped EUR/USD to a daily low of 1.0866.

- Traders were clearly content to buy the dip in the single currency, helping put the likes of EUR/GBP, EUR/USD back in minor positive territory ahead of the NY crossover.

- CNY trades poorly, with USD/CNH back above 7.25 despite a continued push from Chinese authorities for more stability across the yuan. Many large Chinese banks are to cut their USD deposit rates on corporate accounts for the second time in as many weeks, however a lower-than-expected Caixin services PMI has weighed, keeping the pair within striking distance of the 7.2857 cycle highs.

- US Factory Orders for May are the data highlight ahead, with markets expecting orders to have risen by 0.8% on the month. The data precedes the FOMC minutes for the last rate-setting meeting at which the Fed paused the pace of tightening for the first time this cycle.

- The speaker slate sees ECB's Villeroy and de Cos as well as Fed's Williams at the US market close.

FX OPTIONS: Expiries for Jul05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0900(E2.2bln), $1.1000(E1.4bln)

- USD/JPY: Y145.25($680mln)

- GBP/USD: $1.2530(Gbp736mln), $1.2565-75(Gbp1.2bln)

- USD/CNY: Cny7.2000($1.6bln)

EQUITIES: E-Mini S&Ps Trade Close to Recent Highs

- The Eurostoxx 50 futures uptrend remains intact and the latest pullback is considered corrective. Price has traded through resistance at 4438.00, the Jun 16 high and a bull trigger. The break confirms a resumption of the primary uptrend and paves the way for gains towards 4472.40, a Fibonacci projection. Initial key support is seen at 4368.30, the 20-day EMA. A pullback would be considered corrective.

- A bull theme in S&P E-minis remains intact and last Friday’s gains reinforce this condition. The contract has pierced key resistance and the bull trigger at 4493.75, the Jun 16 high. A clear break of this level would confirm a resumption of the uptrend and pave the way for a climb towards 4532.08, a Fibonacci projection. On the downside, key trend support has been defined at 4368.50, the Jun 26 low.

COMMODITIES: Recent Gains in WTI Futures Considered Technically Corrective

- WTI futures remain in a bear mode condition and recent gains appear to be a correction. The contract is trading below resistance at $75.70, the Jun 5 high. Clearance of this level would signal a reversal. Initial resistance is $72.72, the Jun 21 high. Support at $67.21, the May 31 low, was pierced last week, a clear break of this level would open $64.41, the May 4 low. Moving average studies are in a bear mode position highlighting a downtrend.

- Trend conditions in Gold remain bearish and gains are considered corrective. Fresh trend lows last week reinforce bearish conditions, confirming a resumption of the downtrend and extending the price sequence of lower lows and lower highs. MA studies are in a bear mode position highlighting current sentiment. The focus is on $1885.8, Mar 15 low. Key resistance is $1985.3, May 24 high. Initial resistance is $1933.9, the 20-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/07/2023 | 0900/1100 | ** |  | EU | PPI |

| 05/07/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/07/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 05/07/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 05/07/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 05/07/2023 | 1800/1400 | * |  | US | FOMC Statement |

| 05/07/2023 | 2000/1600 |  | US | New York Fed's John Williams | |

| 06/07/2023 | 0130/1130 | ** |  | AU | Trade Balance |

| 06/07/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/07/2023 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/07/2023 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/07/2023 | 0830/0930 |  | UK | BOE DMP Survey | |

| 06/07/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 06/07/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/07/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 06/07/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 06/07/2023 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/07/2023 | 1230/0830 | ** |  | US | Wholesale Trade |

| 06/07/2023 | 1245/0845 |  | US | Dallas Fed's Lorie Logan | |

| 06/07/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 06/07/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 06/07/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 06/07/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 06/07/2023 | 1500/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 06/07/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 06/07/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.