-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Curve Steepening, Stocks Lower

HIGHLIGHTS:

- Treasuries under pressure, yield curve steepening

- USD benefiting from higher yields, stocks under pressure

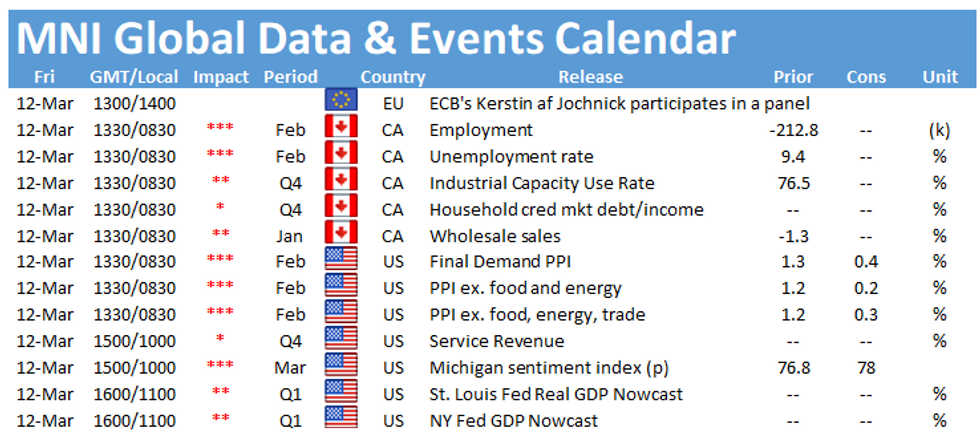

- Focus turns to US PPI, Uni of Mich and Canadian jobs data

US TSYS SUMMARY: Yields March Higher

The Tsy sell-off from Thursday's lows picked up pace again a little after 0100ET overnight Friday, with the curve bear steepening sharply.

- While that initial steepening has reversed for the most part (5s30s hit 154.8bps but have fallen back to 151.2bps), we are at some notable levels for bears.

- 10s are underperforming on the curve and back above 1.60%, a whisker from the Mar 5 highs (1.6238%). The 2-Yr yield is up 1.6bps at 0.155%, 5-Yr is up 5.7bps at 0.8433%, 10-Yr is up 7.5bps at 1.6124%, and 30-Yr is up 6.4bps at 2.3588%.

- Jun 10-Yr futures (TY) down 23.5/32 at 131-28 (H: 132-18), heavy volumes (~640k traded). Around 55k traded just after 0100ET, vs avg volumes of <5k for that 20 min period.

- Though at the time we reported that there was no clear catalyst, there is no shortage of broader factors to point to, adding to the broader reflationary theme ahead of next week's FOMC: some citing Aussie bond sell-off (which was also seen involved in the Feb 25 move); post-ECB disappointment on asset purchase rhetoric; retrospectively dour analysis of this week's Tsy auction results.

- A light schedule today, with 0830ET seeing PPI data, and 1000ET UMich consumer sentiment.

- No supply, with NY Fed buying ~$12.825B of 0-2.25Y Tsys.

EGB/GILT SUMMARY: Digesting UK Data & ECB Reaction Function

European sovereign bonds have sold off this morning, with gilts leading the charge. Equities are broadly lower following a mixed Asia session, while the dollar is gaining against G10 FX.

- Gilts have sold off sharply with yields 1-7bp higher on the day and the curve bear steepening.

- UK monthly GDP for January came in better than expected at -2.9% M/M vs -4.9% survey. While industrial production fared a little worse, the index of services data was not as bad as expected. The 40% drop in exports to the EU in January is arguably at the most eye-catching data point from this morning's releases.

- Bunds have traded weaker and have unwound yesterday's ECB-driven rally following the commitment to increasing weekly PEPP purchases. Bund yields are now broadly 1-3bp higher.

- OATs have similarly pushed lower, with the curve 3bp steeper

- BTP yields are 2-3bp higher and trade broadly in line with core EGBs

- Supply this morning came from the UK (Bills, GBP3.5bn).

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXJ1 171.50p, bought for 59 in 2.5k

RXJ1 171.50^, sold at 118 in 2.5k

OEJ1 134.50/134.25ps, bought for 2.5 in 1k

OEJ1 135/25/50c ladder, bought for 8 in 1k

OEM1 134.5/134/133.75p fly, bought for 7.5 in 1k

DUM1 112.20/30cs vs 112.00/111.90ps, bought the cs for flat in 2.5k

3RM1100.25/100.37/100.50c ladder, was sold at 5 in 3k

UK:

2LM1 99.37/99.12ps, bought for 4.5 in 15k3LM1 99.00/98.75ps 1x2, bought for 3 in 5k

FOREX: Dollar Bouncing as Yields Roll Higher

- The greenback is erasing late Thursday weakness in relatively one-directional trade in G10 this morning. The USD is comfortably the best performer so far Friday, heading into the open higher by 0.5-0.7% against most others.

- The USD is following the US yield curve's march higher that began in late US trade and persisted throughout both Asia-Pacific and European hours. The Treasury curve is steeper, with 10y yields higher by close to 7bps and well above 1.60%. Moves follow the passage of Biden's $1.9trl stimulus bill late yesterday, with the fiscal expansion pressuring Treasuries and raising speculation that a swifter return to growth will bring sharper inflation pressure into the economic mix.

- USD strength has pressured EUR/USD back below the $1.19 level, with GBP/USD on track to test $1.39 in the near-term.

- Focus turns to US PPI & Uni of Michigan data as well as the Canadian jobs report for February.

FX OPTIONS: Expiries for Mar12 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1900(E574mln), $1.1925-30(E1.3bln), $1.1940-50(E475mln), $1.1995-1.2000(E2.56bln, E2.3bln EUR puts), $1.2100-15(E1.2bln), $1.2125-30(E717mln)

USD/JPY: Y105.95-106.00($2.7bln), Y108.30-35($2.26bln-USD puts), Y108.50($507mln, $497mln-USD puts), Y108.90-109.00($702mln-USD puts)

EUR/JPY: Y130.00(E431mln-EUR puts)

USD/NOK: Nok8.45($518mln)

AUD/USD: $0.7690(A$521mln), $0.7720-25(A$1.1bln-AUD puts), $0.7745-60(A$1.2bln-AUD puts), $0.7925-30(A$616mln)

AUD/NZD: N$1.0730(A$1.3bln-AUD puts)

USD/CAD: C$1.2600($510mln)

USD/MXN: Mxn20.30($1.1bln), Mxn20.55($617mln-USD puts), Mxn20.70($875mln-USD puts), Mxn21.00($630mln)

TECHS: Price Signal Summary - Equity Bulls Still In Charge

- In the FX space:

- EURUSD, has this week found support at 1.1836, Tuesday's low. Gains are considered corrective however, the move above 1.1952, Feb 5 low does signal scope for a stronger short-term recovery with attention on 1.2024, the 20-day EMA. Today's move lower though also highlights support at 1.1836, a break would resume the downtrend.

- USDJPY remains in an uptrend. The focus is on 109.56, 61.8% of the Mar 2020 - Jan downleg and an important pivot resistance. Support is seen at 107.82 Mar 5 low.

- The trend is overbought and this is being monitored. Price has yet to display a reversal though and signal a top.

- On the commodity front, a bullish engulfing candle in Gold Tuesday suggests a potential short-term base at $1676.9, Monday's low. The focus is on the 20-day EMA at $1750.4. The yellow metal is softer today. A break of $1676.9 is needed to resume the downtrend instead. Oil contracts remain below Monday's high and appear to have entered a corrective phase. Brent (K1) weakness would open $65.04, the 20-day EMA. The bull trigger is at $71.38, Mar 8 high. In WTI (J1) a deeper pullback would open $61.92, the 20-day EMA. Key resistance is at $67.98, Mar 8 high.

- In the FI space, BTP futures (M1) rallied yesterday. A break of 150.69, 76.4% retracement of the Feb 12 - 26 sell-off is needed to further strengthen a bullish argument. In Bunds (M1), the resistance to watch today is 172.30, yesterday's high and in Gilts (M1), 129.27, Mar 2 high remains the key near-term resistance. A breach of these hurdles would signal scope for a stronger short-term recovery.

- In the equity space, bulls managed to deliver fresh trend highs in the E-mini S&P futures yesterday. The bull trigger is at yesterday's high of 3949.00. A break would open the psychological 4000.00 level.

EQUITIES: Stocks Lower as Bond Weakness Unsettles Recent Rally

- Despite the passage of Biden's flagship $1.9trl COVID stimulus package late yesterday, stock markets globally have come well off the overnight highs, with futures pointing to a lower open on Wall Street later today.

- The e-mini S&P stalled ahead of a test on the all time highs posted in mid February, leaving 3959.25 as first resistance. Support undercuts at Thursday's 3893.00.

- The pullback from overnight highs has coincided with a rally in Treasury yields, with the curve steepening across the European morning. Markets appear to be mulling the reflationary theme, with a swifter return to growth possibly adding sharper inflationary pressures to the economic mix.

- The moves are similar in Europe, with Germany's DAX leading declines as the index drops 0.8%. Spain's IBEX-35 is modestly outperforming and is the only major index in the green - higher by around 0.1%.

COMMODITIES: Precious Metals Underwater as Dollar, Yields Rally

- The USD's Friday strength has kept a lid on the commodity complex, keeping precious metals under pressure and preventing energy products from any meaningful show above the Thursday highs.

- Both gold and silver underperform early Friday, with silver the real laggard with losses of 2%. This has stabilised the gold/silver ratio, which had traded heavy since the beginning of the week, but remains in a 2021 downtrend.

- WTI and Brent are broadly unchanged, but made an early effort to progress through Thursday's highs and resume the overriding uptrend. This soon faltered on persistent greenback strength, leaving the technical outlook unchanged for oil.

- Focus turns to US data later today, with US PPI and prelim Uni. of Michigan numbers due.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.