-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Dollar Pullback Hits Pause

- Dollar pullback hits pause, but not before fresh cycle lows vs. G10 FX

- Fed rate path sees modest lift on Waller headlines

- University of Michigan Sentiment provides last key risk event of the week

US TSYS: Off Cheaps, Still Bear Flattening On The Day

The early cheapening has moderated from extremes, with crude oil back from yesterday’s highs and little in the way of meaningful macro headline flow apparent since Fed Governor Waller’s hawkish musings in Asia-Pac hours. That leaves the major cash Tsy benchmarks running 1-2.5bp cheaper as the curve bear flattens, with the 2s10s curve ~5bp off recent highs at -87bps and ~23bp off inverted cycle extremes. TYU3 is -0-06+ at 112-27, 0-06 off the base of its 0-12+ session range. Support is seen at 112-07+ (Jul 13 low) and resistance at 113-03 (Jul 13 high).

- FOMC-dated OIS is little changed vs. early London levels, with a July hike priced with near certainty, a cumulative ~30bp of tightening showing through November before a little over 80bp of cuts is priced through June ’24.

- Prelim UoM sentiment data (particularly the inflation expectations components) and Fedspeak from Goolsbee (’23 voter) present the highlights of the NY slate, with the potential for impromptu Fedspeak before the pre-meeting blackout period goes into play over the weekend.

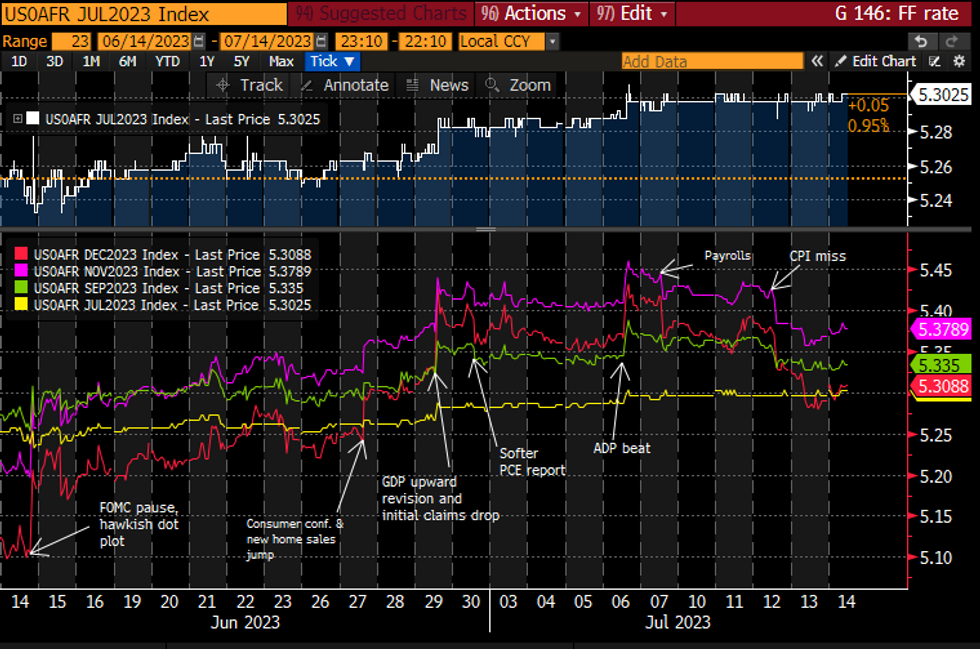

STIR FUTURES: Fed Rates Hold Modest Waller Lift, Goolsbee Last Before Blackout

- Fed Funds implied rates have seen a slight lift overnight, buoyed by Gov Waller (voter) hawkish remarks after the close but still only back to levels after Wednesday’s CPI.

- Pertinent moves: +22bp Jul (+0.5bp on the day) with cumulative +30bp terminal Nov (+1bp). Cumulative 7bp of cuts to Dec’23 (from 8bp), 82bp to Jun’24 (from 84bp) and 160bp to Dec’24 (from 164bp).

- Waller cited shorter mon pol lags owing to forward guidance and the magnitude of the tightening. Worth reading if missed: https://www.federalreserve.gov/newsevents/speech/waller20230713a.htm

- Goolsbee (’23 voter) is the last of the formally scheduled speakers ahead of the media blackout starting tonight, in a Fox News interview at 0910ET. Typically at the more dovish end of the spectrum, he was undecided on what the Fed should do this month but saw a decent chance of further tightening in the pipeline when speaking post-payrolls last week.

Source: Bloomberg

Source: Bloomberg

ECB Terminal Deposit Rate Pricing Back Above 4.00%

The liquid area of the ECB-dated OIS strip is little changed to 4.5bp firmer today as the move away from yesterday’s richest levels in core global FI markets biases price action in that direction, although a move away from session cheaps in bonds has capped the pay-side move, leaving pricing a touch off hawkish session extremes.

- That leaves ~24bp of tightening priced for this month’s decision, with ~41bp of tightening showing for September and a terminal deposit rate of just over 4.00% priced for December, after yesterday’s look below the round number.

- There isn’t much in the way of regional event risk slated for Friday, which will leave focus on headline flow, cross-market gyrations and any Fedspeak that crosses ahead of the U.S. central bank’s pre-meeting blackout period.

| ECB Meeting | €STR ECB-Dated OIS (%) | Difference Vs. Current Effective €STR Rate (bp) |

| Jul-23 | 3.639 | +23.8 |

| Sep-23 | 3.812 | +41.1 |

| Oct-23 | 3.880 | +47.9 |

| Dec-23 | 3.917 | +51.6 |

| Jan-24 | 3.905 | +50.4 |

| Mar-24 | 3.889 | +48.8 |

| Apr-24 | 3.822 | +42.1 |

CHF: SNB's Weekly Deposits Update Could Garner Extra Focus Next Week

- As has been the case across G10 FX more broadly, the USD printed new pullback lows against the EUR, JPY, GBP as well as CHF early Friday. USD/CHF's pullback from the recent high on Jun30 has now amounted to 5%, with the pair hitting the lowest levels since the breaking of the EUR/CHF peg in early 2015.

- The SNB remain a key factor in the recent strength of CHF, with the persistent drop in weekly sight deposits data showing the bank are likely active in buying CHF to tighten financial conditions inbetween quarterly policy meetings.

- This Monday's deposit update may garner extra focus given the run higher in spot (EUR/CHF is also lower) - and will provide markets with an insight into whether the bank are happy to continue adding to the stronger currency backdrop in light of the recent CHF rally. Data crosses at 0900 UK time Monday.

- SARON futures continue to underpin expectations of further SNB tightening - although implied rates have pulled back since Wednesday and the easing of global CB expectations. Pricing is consistent with expectations for a further 25bps hike in September to a peak rate of 2.00%

FOREX: Dollar Sell-Off Abates, But No Signs of Reversal Yet

- The week's greenback sell-off has abated modestly early Friday, but not before a number of major pairs managed to touch fresh highs during Asia-Pac hours. EUR/USD touched 1.1243, GBP/USD touched 1.3142, while USD/JPY slipped to 137.25.

- Despite the pause in the USD pullback, there are few signs of any form of reversal from these levels, with markets clearly content to maintain the weak USD backdrop a few weeks out from the July Fed rate decision.

- CHF remains one of the key beneficiaries of the weaker USD backdrop, with USD/CHF lower again Friday for a seventh consecutive session, pressing prices to 0.8566. Bearish USD/CHF momentum extended on the break below key support earlier this week at 0.8758 to once again print the lowest levels since early 2015 and the removal of the EUR/CHF peg.

- CHF continues to gain as sight deposits data suggests the SNB continue to favour FX sales/CHF purchases to tighten financial conditions despite the stronger FX backdrop. The 3.0% 10-dma envelope below undercuts at 0.8560, marking first support.

- The Friday docket is considerably quieter, with the prelim University of Michigan confidence release the last key data release of the week. Markets expecting the 1-yr inflation expectations metric to moderate lower, slowing to 3.1% from 3.3% prior. Fed's Goolsbee is the sole CB speaker Friday, appearing on Fox News at 1410BST/0910ET.

FX OPTIONS: USD/CAD Caught Between Two Sizeable Friday Strikes

The outsized move in the USD week has kept most major pairs clear of the larger strikes rolling off this week - and that remains the case headed into the final NY cut of the week. Larger options rolling off include:- EUR/USD: $1.1120(E767mln), $1.1200(E971mln)

- USD/JPY: Y140.00($745mln)

- AUD/USD: $0.6700(A$960mln)

- USD/CAD: C$1.3030-40($795mln), C$1.3210-25($697mln)

- USD/CNY: Cny7.1500($2.9bln)

BONDS: Moving Off the Highs of the Week

- After the big moves of the week so far, core fixed income sits below yesterday's highs but moves have been relatively limited in the context of the wider week. USTs, Bunds and gilts all sit comfortably above yesterday's opening price. Part of the move looks like a retracement ahead of the weekend, while part is continued reaction to Fed's Waller comments yesterday.

- The shorter-end has seen the biggest moves this morning with curves bear flattening.

- Looking ahead, the highlights of the rest of the day are likely to be the inflation expectations component of the Michigan survey, an appearance by Fed's Goolsbee on CNBC and US import / export price data.

- TY1 futures are down -0-10 today at 112-23+ with 10y UST yields up 3.0bp at 3.796% and 2y yields up 4.1bp at 4.676%.

- Bund futures are up 0.10 today at 132.93 with 10y Bund yields up 1.3bp at 2.460% and Schatz yields up 4.2bp at 3.183%.

- Gilt futures are up 0.20 today at 949.91 with 10y yields up 0.8bp at 4.425% and 2y yields up 1.9bp at 5.138%.

EQUITIES: E-Mini S&P Remain Close to Thursday Cycle High

- Eurostoxx 50 futures trading higher again this week. The rally has resulted in a move above the 50-day EMA at 4335.00 and price is through 4371.00, the Jul 6 high. Clearance of this latter level highlights a potentially stronger bull cycle and attention is on key resistance and the bull trigger at 4447.00, the Jul 3 high. Key support and the bear trigger has been defined at 4220.00, the Jul 7 low. Initial support is at the 50-day EMA.

- A bull theme in S&P E-minis remains intact. This week’s rally has resulted in a break of resistance at 4498.00, the Jun 30 high. The break confirms a resumption of the uptrend and maintains a bullish price sequence of higher highs and higher lows. The contract has also traded through 4500.00 and this opens 4556.71, a Fibonacci projection. First support lies at 4439.81, the 20-day EMA. Clearance of this level would highlight a S/T bearish threat.

COMMODITIES: Current Bull Theme in WTI Futures Intact Despite Trading Slightly Lower Friday

- The current bull cycle in WTI futures remains intact. The contract has recently breached $72.72, the Jun 21 high and Wednesday’s move higher resulted in a break of key resistance at $75.70, the Jun 5 high. This strengthens current bullish conditions and paves the way for a climb towards $78.03, a Fibonacci retracement point. Key short-term support has been defined at $66.96, the Jun 12 low. Initial support is at $72.31, the 20-day EMA.

- Gold is holding on to its latest gains. The yellow metal has breached resistance at the 50-day EMA. The average intersects at $1945.0 and the break signals scope for a continuation of the current corrective cycle. This opens $1968.00, the Jun 16 high. Key resistance has been defined at $1985.3, the May 24 high where a break would highlight a stronger reversal. Key support and the bear is at $1893.1, the Jun 29 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/07/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 14/07/2023 | - |  | EU | ECB de Guindos in Ecofin Meeting | |

| 14/07/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/07/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 14/07/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 14/07/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 16/07/2023 | - |  | EU | ECB Panetta at G20 Finance/Central Bank meeting | |

| 17/07/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 17/07/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 17/07/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate M/M |

| 17/07/2023 | 0200/1000 | *** |  | CN | GDP |

| 17/07/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 17/07/2023 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 17/07/2023 | 0815/1015 |  | EU | ECB Lagarde speaks at ECB CESEE conference | |

| 17/07/2023 | 0830/1030 |  | EU | ECB Lane chairs session at ECB CESEE conference | |

| 17/07/2023 | - |  | EU | ECB Panetta at G20 Finance/Central Bank meeting | |

| 17/07/2023 | 1215/1415 |  | EU | ECB Elderson chairs session at ECB CESEE conference | |

| 17/07/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/07/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 17/07/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 17/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 17/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.