-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Equities Recovering From Lows

HIGHLIGHTS:

- Equities softer, but off lows at NY crossover

- USD Index rises back through 50-dma resistance

- Fed's Williams, Kaplan and Beige Book on the docket

US TSYS SUMMARY: Ticking Higher On Weaker Equities, And Ahead Of 10Y Supply

The Treasury curve has bull flattened overnight Wednesday as equities have retraced. Session's focus is on 10Y supply and Fed communications. The 2-Yr yield is down 0.6bps at 0.2142%, 5-Yr is down 1.4bps at 0.8078%, 10-Yr is down 2.2bps at 1.3512%, and 30-Yr is down 2.8bps at 1.9591%. Dec 10-Yr futures (TY) up 4/32 at 133-04 (L: 132-30.5 / H: 133-06.5).

- A fairly quiet Asia-Pac session, with most overnight headlines focused on St Louis Fed's Bullard in an FT interview reiterating hawkish stance despite weak August jobs report. Treasuries gained in European trade, as equities sagged (S&P futures fell to September lows just after 0200ET).

- The primary focus will once again be supply: today is $38B 10Y note auction at 1300ET (also a $30B auction of 119-day bills at 1130ET).

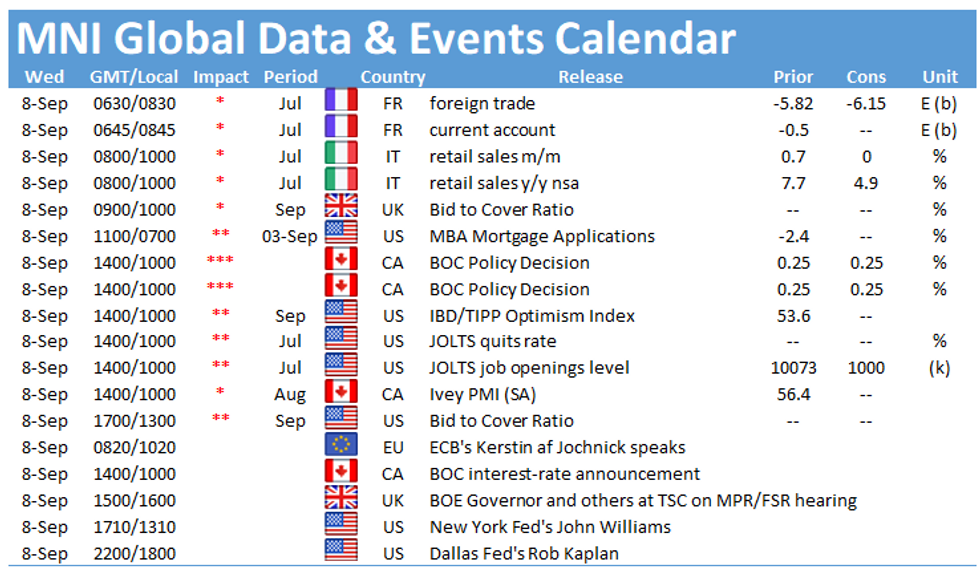

- A fairly light data schedule, with weekly MBA mortgage applications at 0700ET, July JOLTS at 1000ET, and July consumer credit at1500ET.

- FOMC speakers scheduled today include NY's Williams at 1310ET and Dallas' Kaplan at 1800ET, and we also get the latest Beige Book at 1400ET.

- NY Fed buys ~$2.025B of 1-7.5Y TIPS.

EGB/GILT SUMMARY: Slight Bull Flattening Ahead of Tomorrow's GC Meeting

European sovereign bonds have firmed this morning alongside a broad sell off in stocks.

- Gilts have firmed and the curve has bull flattened with the 2s30s spread 2bp narrower.

- Bund yields are 1-2bp lower across much of the curve.

- The long end of the OAT curve has also marginally outperformed with very long-end yields down 2bp on the day.

- Comments from the the ECB's Holzman and Vasle - possibly recorded a few weeks ago and published today in a EUROFI magazine interview - indicate the divergence in opinion ahead of tomorrow's GC meeting. While Vasle argued that highly accommodative monetary policy was still required, Holzman contended that the ECB may need to normalise policy sooner than thought.

- Supply this morning came from the UK (Gilt Linker, GBP1bn), Germany (Green Bund, EUR3.198bn allotted) and Greece (GTBs, EUR812.5mn). Slovenia is also tapping the 0% Feb-31 bond via syndication with Dow Jones reporting book size of around EUR1bn.

EUROPE ISSUANCE UPDATE:

Germany Allots E3.198bn of the 0% Aug-31 Green Bund, Average yield -0.38%, Buba cover 1.1x, bid-to-cover 1.05x

UK sells GBP1.00bln 0.125% Aug-31 linker, Avg yield -3.009% (Prev. -2.687%), Bid-to-cover 2.33x (Prev. 2.77x)

EGB SYNDICATION: Slovenia 10-year tap update:

Books for the 0% Feb-31 E250mln WNG tap are now at E1.0bln with guidance revised to MS+6bps area (from initial MS+8bps area)

FOREX: USD Following Risk Sentiment Cues, Tops 50-dma

- Markets have worked in favour of the USD so far Wednesday, with the USD Index making progress north of the 50-dma to extend the bounce off last week's lows. In contrast to the price action earlier in the week, the USD looks to be following equities and global risk sentiment more closely this morning, with the greenback gaining as the e-mini S&P ebbs. This differs from Tuesday price action which saw the dollar gain as the US yield curve steepened and the 10y yield rose to multi-year highs.

- Despite moderately hawkish comments from ECB's Holzmann earlier Wednesday, the EUR trades lower ahead of the NY crossover, with sagging continental equities a focus. Weakness across the industrials and financials sectors has pressured the DAX, CAC-40 and others, with losses of over 1% across the board.

- The data slate is relatively light, keeping focus on the slightly busier central bank speaker slate. NY Fed's Williams is due to speak directly on the economic outlook, marking the first major Fed comms since last week's disappointing Nonfarm Payrolls print. He speaks at 1810BST/1310ET. A number of BoE members appear in front of the Treasury Select Committee to discuss the August monetary policy report also.

FX OPTIONS: Expiries for Sep08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1785-00(E910mln)

- USD/JPY: Y109.55($620mln), Y110.00($781mln)

- AUD/USD: $0.7070(A$1.0bln), $0.7220(A$1.0bln), $0.7425(A$673mln)

- USD/CAD: C$1.2560-75($721mln), C$1.2600($547mln), C$1.2640($750mln)

- USD/CNY: Cny6.5540($500mln)

Price Signal Summary - USD Support Levels Hold

- On the equity front, S&P E-minis are lower and extending this week's corrective pullback. Support to watch is 4479.62, the 20-day EMA. The underlying trend condition is bullish and a resumption of strength would open 4580.21, 1.382 projection of the Jun 21 - Jul 14 - 19 price swing. EUROSTOXX 50 futures are also trading lower this morning. Trend conditions remain bullish but watch support at 4138.50, Aug 26 low.

- In the FX space, EURUSD remains below Friday's high of 1.1909 and is trading lower this morning. The next support lies at 1.1807, the 20-day EMA. Key resistance is unchanged at 1.1909, the Jul 30 high and Sep 3 high. GBPUSD maintains a short-term bullish tone but is pulling away from recent highs. Watch support at 1.3731, Sep 1 low. A break would undermine recent bullish signals. USDCAD rallied yesterday and is firmer today. The pair has defined a key short-term support at 1.2494, Sep 3 low. Immediate resistance is at 1.2708, Aug 27 high. DXY has recovered back above its 50-day EMA and short-term conditions appear to be improving for bulls. Key support at 91.78, Jul 30 low remains intact and a stronger reversal would highlight a potential base. A break of 91.78 is required to strengthen the case for bears.

- On the commodity front, Gold has pulled back from recent highs. The near-term outlook remains bullish with the key trigger for an extension higher at $1834.1, Jul 15 high. Support to watch is $1774.5, Aug 19 low. WTI futures remain in a bull mode. The focus is on $70.74, 76.4.% retracement of the Jul 30 - Aug 23 sell-off.

- In FI, Bund futures remain vulnerable following yesterday's sharp sell-off. The focus is on 171.30, 2.382 projection of the Aug 5 - 11 - 17 price swing. Gilt futures are weaker following yesterday's breach of support at 128.03, the Jul 6 low (cont). This opens 127.65, 61.8% of the Jun 3 - Aug rally (cont).

EQUITIES: Off Lows But Futures Still Point to Negative Open

- European equity markets opened markedly lower, with mainland indices off as much as 1.4% as risk sentiment took a hit at the Asia close. Markets have recovered somewhat at the NY crossover, but US futures continue to point to a lower open, with the e-mini S&P off around 5 points at pixel time.

- Financials and industrials were the main contributors to the weakness across Europe, although losses were more broad-based into the halfway point of the session.

- German carmakers remain a particular point of weakness, with the likes of Volkswagen, Daimler and BMW among the poorest performers in the EuroStoxx50.

COMMODITIES: WTI, Brent Off Lows Despite Firming Greenback

- The oil market traded lower Tuesday, with both WTI and Brent crude futures settling in negative territory. Futures have risen off yesterday's lows ahead of the NYMEX open, but remain comfortably below the week's best levels.

- The bounce in oil comes despite souring equity markets across Europe as well as the still-firming greenback. Production issues came back onto focus, with markets clearly remaining cognizant of the Ida-impacted supply out of the Gulf of Mexico, which continues to interrupt as much as 80% of output.

- Gold is holding the bulk of the Tuesday losses and continues to circle yesterday's lows of $1792.45. A break south of here opens Aug 13 lows of $1751.70.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.