-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Equity Strength Persists, New ATH for Stoxx600

HIGHLIGHTS:

- Markets non-directional, but persistent equity strength puts Stoxx600 at new alltime high

- Analysts watch PPI for further signs of transitory inflation

- Gold/silver ratio hits new 2021 highs

US TSYS SUMMARY: Mostly Edging Higher Ahead Of Data And Supply

Treasuries are trading mixed, and within Wednesday's ranges (ie futures below yesterday's highs) as markets continue to digest a combination of a soft CPI print, and fairly hawkish Fed speakers' tones on tapering. Data and 30Y supply in focus.

- The 2-Yr yield is up 0.2bps at 0.2207%, 5-Yr is down 0.3bps at 0.8051%, 30-Yr is up 0.1bps at 1.9994%.

- Sep 10-Yr futures (TY) up 2/32 at 133-20.5 (L: 133-18.5 / H: 133-25), with 133-29 (Wed high) the near-term level to watch on the upside. Volumes light so far (~215k).

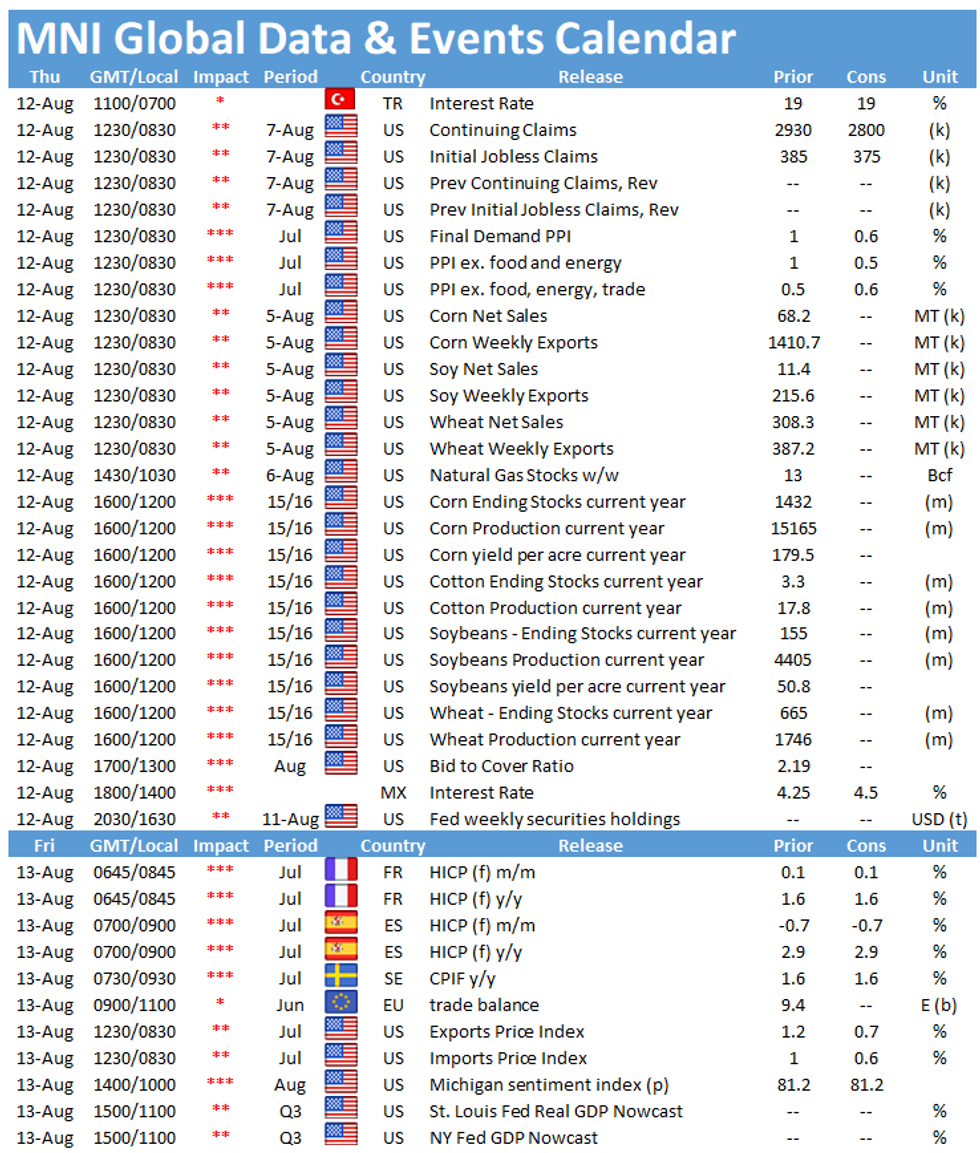

- The scheduled highlights are mostly in data: Jobless claims and PPI are released at 0830ET.

- No scheduled Fed speakers today, though we've heard plenty from hawkish-leaning FOMC participants this week (including KC's George yesterday).

- On the more dovish end of the spectrum, SF Fed Pres Daly told the FT in an interview published this morning that tapering could start as soon as this year (so not too dovish an outlook).

- In supply, 1130ET sees $75B of 4-/8-week bill auctions, while we get $27B 30Y Bond auction at 1300ET.

- NY Fed buys ~$2.025B of 1-7.5Y TIPS, and we get a new purchase schedule at 1500ET.

EGB/GILT SUMMARY: Core Weaker, Periphery Firming

Core European sovereign bonds have trade weaker this morning while the EGB periphery has firmed and equities broadly inching higher.

- Gilts have underperformed EGB majors with cash yields 2-3bp higher.

- Bunds are marginally weaker on the day with the curve close to flat.

- OAT yields are broadly 1bp higher across the curve.

- BTPs have firmed slightly with the curve 1bp flatter.

- UK GDP increased 4.8% Q/Q, in line with consensus and marking a sharp turnaround from the 1.6% contraction the previous quarter.

- Elsewhere, Eurozone industrial production in June dropped 0.3% M/M, slightly worse than expected.

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXU1 176/175ps, bought for 20 in 1k

ERV1 100.50/100.62cs vs 100.50/100.37, sold the call spread at 3.75 in 4.5k

0RH2 100.50/100.37/100.25p ladder, bought for 2 in 3k

SX7E 17/09 expiry, 96/100cs sold at 2.20 in 10,760

FOREX: USD Holding Post-CPI Losses

- The USD index is holding the majority of the post-CPI weakness, with the greenback broadly flat against most others in G10. Markets watch today's PPI release for any further evidence of a slowdown in price growth, with M/M expected to slow to 0.6% (Prev. 1.0%) and 0.5% (Prev. 1.0%) for core.

- AUD is the notable underperformer, putting AUD/USD toward first support at 0.7350, albeit well above the week's lows of 0.7316.

- EUR/USD remains toward the top end of the week's range, but well within striking distance of the key support at 1.1704. A break below here would be resolutely bearish.

- Weekly US jobless claims data takes focus going forward, with PPI numbers also crossing. Central bank decisions are also due from Mexico and Turkey, with former seen hiking 25bps, while the latter is seen unchanged.

FX OPTIONS: Expiries for Aug12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1650-60(E2.4bln), $1.1700-05(E1.7bln), $1.1785-00(E2.2bln), $1.1810-15(E1.6bln)

- USD/JPY: Y109.40-50($712mln), Y110.00-10($618mln), Y110.30-50($1.3bln), Y110.95-00($881mln)

- GBP/USD: $1.3840-60(Gbp906mln)

- EUR/GBP: Gbp0.8500(E570mln)

- AUD/USD: $0.7300(A$697mln), $0.7440(A$678mln)

- USD/CAD: C$1.2495-00($1.0bln), C$1.2540($585mln), C$1.2655($555mln)

- USD/CNY: Cny6.4620($960mln)

Price Signal Summary - EUR Fragile Above Key Support

- In FX, EURUSD printed a lower low Wednesday, narrowing the gap with key support at the 1.1704 2021 low printed back in March. Stiff support is expected here ahead of the 1.1685 mark, at which the 38.2% Fib crosses for the 2020 - 2021 rally. USDJPY added to recent gains in early Wednesday trade, topping out a new monthly high of 110.80 before fading. This keeps the outlook positive, with 110.82 the next upside level ahead of the 111.66 bull trigger.

- Brent futures traded inside the Tuesday range on Wednesday, flattening off the recovery off the Monday low. The move below the 50-day EMA last week looks convincing, with support now exposed at $66.91. To resume any incline, bulls need to again take out $74.47, the 76.4% retracement of the Jul 6 - 20 downleg. Silver followed gold sharply lower Monday, clearing through all nearby support to touch the lowest levels since late 2020. This has accelerated the formation of a death cross in DMA space, with the 50-dma likely to dip below the 200-dma in the coming sessions. A break and close below Monday's low would be resolutely bearish

- S&P E-minis outlook is bullish as evidence of dip buying remains solid on intraday pullbacks. Recent gains have confirmed a resumption of the uptrend and signal scope for a continuation near-term. EUROSTOXX 50 futures are extending gains, topping out at new cycle highs of 4215.00. This extends the winning streak to seven consecutive sessions of higher highs. This follows the break above previous resistance at 4101.50, Jul 1 high.

- The winning streak in Bund futures concluded Friday, with bond markets globally edging lower. This ends the winning streak of 8 consecutive sessions of higher highs, although the outlook holds bullish. Any return higher targets 177.69, a Fibonacci extension.

EQUITIES: Non-Directional Stock Markets Suggest a Flat US Open

- Cash equity markets are generally mixed, but the outlook remains positive, with the Stoxx600 index creeping to a new alltime high. Generally flat core European markets suggest a flat open on Wall Street later today, with focus on the upcoming weekly jobless claims data and PPI for July.

- Europe's communication services and real estate sectors are at the top of the pile, countering losses across materials and utilities.

- The e-mini S&P is trading just below yesterday's alltime high at 4443.25 and a break above opens 4481.75, the 1.00 projection of the Jun 21 - Jul 14 - 19 price swing.

COMMODITIES: Gold/Silver Ratio Hits 2021 Highs

- Oil benchmarks rallied into the Wednesday close and have traded horizontally since. Markets appear to have shrugged off reports of a plea from the White House yesterday to prompt OPEC+ to open the production taps.

- Recovery off the lows this week has improved the outlook slightly, but the picture is far from bullish while prices hold below the $71.50 50-dma for WTI.

- NatGas storage change data takes focus Thursday, with markets expecting a build of near 48BCF for the latest week.

- While gold has recovered well off the sharp decline seen earlier in the week, silver continues to lag, with the gold/silver ratio touching the best levels of the year. The imminent formation of a golden cross may suggest further gold outperformance over silver in the medium-term.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.