-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI US MARKETS ANALYSIS - Fed-Implied Rates Drift Further Ahead of Weds CPI

Highlights:

- Fed-implied rates drift further ahead of Weds CPI

- Treasury curve sits bull flatter ahead of quiet data/speaker docket

- AUD/JPY extends losing streak, shedding 4% from June high

US TSYS: Bull Flattening Sees TYU3 Climb But Still In Bearish Technical Conditions

- Cash Tsys have bull flattened through Asia and Europe sessions, with the rally extending yesterday’s second half moves that had been helped by a large fall in Manheim used vehicle prices. Fresh China property market support nor a second increase in US NFIB pricing intentions have had much cheapening bias on the space.

- The day's rally is aided by block buying flow in FV through UXY futures, after Monday's activity saw longs added/shorts trimmed in the TU through US segment of the curve (per OI data), while WN futures saw a reduction in existing longs.

- It leaves cash benchmarks trading 2-3bps richer on the day, with 2s10s 1bp lower at -87bps.

- TYU3 trades 8 ticks higher at 111-12+ off best levels of 111-16 with elevated cumulative volumes of 320k. If bulls manage to cement the break above initial resistance it will allow them to switch their focus to the June 14 low (112-12+). A break there is needed to start turning the technical tide more in the favour of bulls, with a downtrend in play and moving average studies in bear mode.

- Note/bond issuance: US Tsy $40B 3Y Note auctions (91282CHM6) – 1300ET

- Bill issuance: 1130 US Tsy $38B 52W Bill, $50B 42D CMB auctions – 1130ET

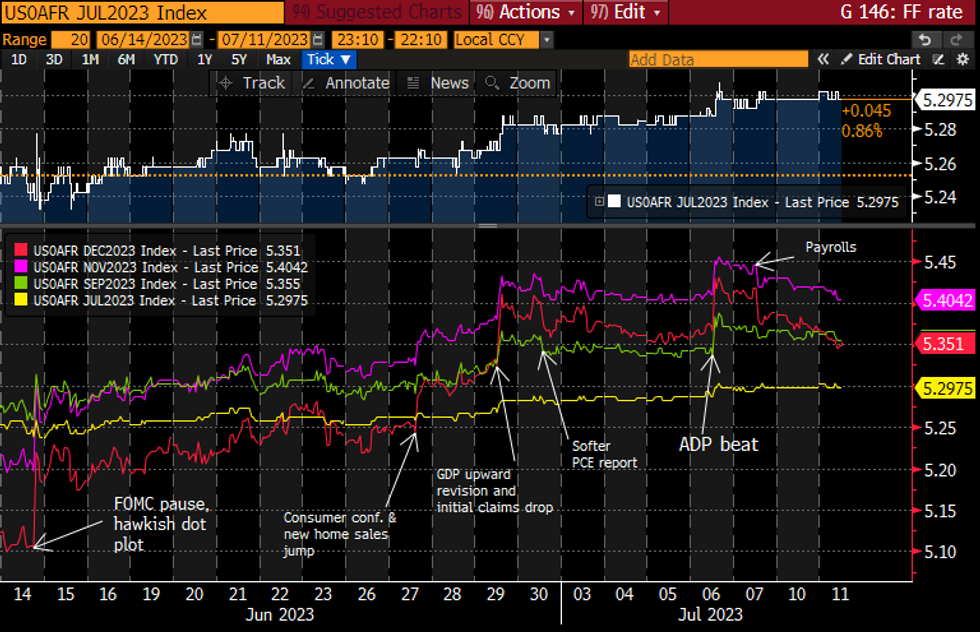

STIR FUTURES: Fed Implied Rates Drift Lower With CPI Eyed Tomorrow

- Fed Funds implied rates are unchanged for the Jul 26 FOMC but otherwise have drifted lower overnight. It is seemingly building on yesterday’s second half softer trading in response to a sizeable drop for Manheim used vehicle prices rather than any new drivers, with US CPI landing tomorrow.

- NY Fed Williams (voter) told the FT overnight he has pretty slow growth rather than a recession in his forecast, with little impact on current pricing.

- Cumulative moves from 5.08% effective: +22bp Jul (unch), +27.5bp Sep (-1bp), +32.5bp Nov (-1.5bp), +27bp Dec (-1.5bp). Rates are first seen lower than they are today with the May'24 meeting (cumulative -11.5bps, -3bp on the day).

- Cuts from Nov terminal: 6bp Dec’23, 64bp Jun’24 and 137bp Dec’24.

Source: Bloomberg

Source: Bloomberg

Early SOFR/Treasury Option Roundup

Better put volumes on net overnight, fading the carry-over support in underlying futures ahead of tomorrow's key CPI data. Salient trade is Dec'23 SOFR put condor hedging two 25bp rate hikes by year end. On the flipside, Green Dec'23 call spd looking for rate cuts to price into late 2025 futures.

- SOFR Options:

- 32,700 SFRZ3 93.50/93.75/94.00/94.50 broken put condors ref 94.665 to -.65, checking premium

- 1,000 SFRQ3 94.37/94.43/94.50 put flys ref 94.59

- 3,000 SFRN3 94.37/94.50/94.62 put flys ref 94.585

- 8,000 2QZ3 98.00/98.50 call spds, 2.0 ref 96.44 to -.425

- 2,000 SFRH4 95.37/95.62/95.87/96.12 call condors ref 94.915

- Treasury Options:

- over 6,100 TYQ3 110.5/111.25 put spds vs. TYQ3 112.25 calls ref 111-15

- 3,000 TYQ3 109 puts, 4 ref 111-15

- 2,000 TYU3 108.5/109.5 put spds, 14 ref 111-13.5

- 2,000 TYU3 109.5/110.5 put spds, 20 ref 111-12

- 2,300 TYQ3 112 calls, 23 ref 111-10

- 1,000 TYU3 108.5 puts ref 111-09.5

- 1,000TYQ3 113 calls ref 111-08

US DATA: Small Business Survey Sends Mixed Inflation Signals

The June NFIB survey pointed to an improvement in small business optimism to the highest since November 2022 (the index rose 1.6 points to 91.0, above the 89.9 expected).

- The underlying improvement was more mixed than the headline number suggests. On the positive side, expectations of a better economy rose 10 points to net -40% (in June 2022 it was -61%), with expectations of higher real sales volumes improving 7 points to net -14%. Credit conditions have changed little this year despite the recent bank crisis, and the capital spending plans category printed a solid net 25% (joint highest since May 2022).

- But of course several of those are merely improvements from deeply negative levels, while other key categories were little changed (earnings trends -24%, inventory rebuild plans -3%). Hiring plans fell 4 points to 15%, and the Uncertainty Index was up 5 points to 76, joint-highest of the year.

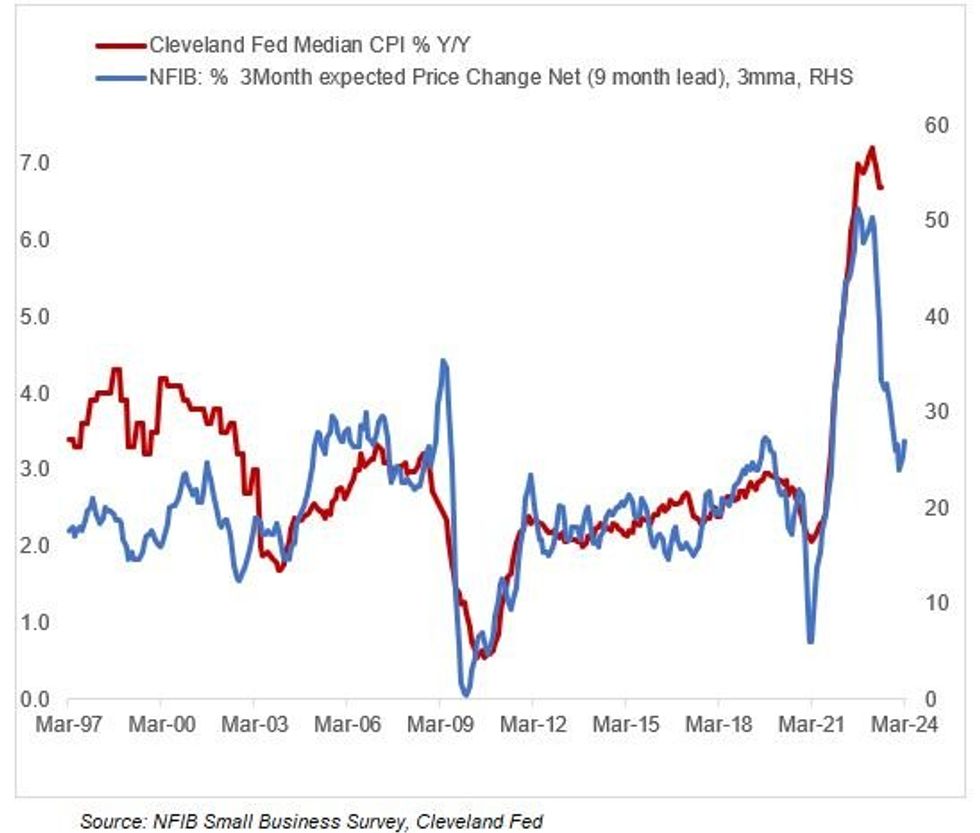

- A standout headline from the survey was the 3 point drop in the net percent reporting raising average selling prices: at 29% that's the lowest since March 2021 and while still "a very inflationary level" per the NFIB, it's trending down. On the wage side, those reporting higher compensation fell 5 points from May to 36% on net.

- That said though, 22% plan to raise comp in the next 3 months (hasn't changed from that level all year), and plans to set higher prices increased, by 2 points to 31% - the highest since November 2022.

- The latter is a key forward-looking CPI metric and a smoothed leading series has already begun to round out higher, suggesting that inflationary pressures will persist well into next year above the Fed's 2% target (see chart).

MNI US CPI Preview: Core Softer On Used Cars Drag

- We have published and e-mailed to subscribers the MNI US CPI Preview for tomorrow's June report. It includes MNI analysis plus summaries from 16 sell side analysts.

- You can find the full report here: https://marketnews.com/mni-us-cpi-preview-core-seen-softer-on-used-cars-drag

MNI BoC Preview, Jul'23: A Second Hike Before Assessing

- We have published and e-mailed to subscribers the MNI BoC Preview for Wednesday's decision.

- Please find the full report including MNI analysis and detailed views from twelve sell side analysts here: https://marketnews.com/mni-boc-preview-jul-23-a-second-hike-before-assessing

MNI Employment Insight, Jul'23: Hotter Wages Partly Offset Rare Payrolls Miss

- We have published and e-mailed to subscribers the MNI Employment Insight covering Friday's payrolls report and other important labor market indicators. It includes MNI analysis plus summaries from sixteen sell side analysts.

- Please find the full report here: https://marketnews.com/mni-employment-insight-jul-23-hotter-wages-partly-offset-rare-payrolls-miss

EUROZONE ISSUANCE UPDATE

EU-bond syndication update

- E4bln WNG 2.50% Oct-52 tap. Spread set at MS+66bp. Books above E70bln.

Greece GGB syndication update

- New Jul-38 GGB. Spread set at MS+125bp. Books above E13bln.

Dutch auction result

- E2.225bln of the 2.50% Jan-30 DSL. Avg yield 2.95%.

German auction result

- Today's 2.40% Oct-28 Bobl saw a higher bid-to-cover than last month with a tight tail and the lowest accepted price comfortably above the pre-auction mid-price. Post-auction the Bobl traded in line with the low price of the auction but we remained off the highs of the day.

- E5bln (E3.823bln allotted) of the 2.40% Oct-28 Bobl. Avg yield 2.71% (bid-to-cover 1.45x).

AUD/JPY Off 4% From Cycle High Amid Signs of Life in the VIX

- AUDJPY remains under considerable pressure, extending the current losing streak to five consecutive sessions - the longest losing streak since September last year. This puts the pullback from the June cycle high (itself a bearish harami candle pattern) at over 4%.

- The pullback is now within range of key support at the 50-dma at 93.44 - last crossed in early May and looks partially corrective - unwinding the overbought condition that set in after the early June rally. Weakness through the 50-dma exposes 93.24 retracement support initially, ahead of 91.87, the 50% retracement of the recovery off the March low.

- Over the past few years, the cross has been closely tied to risk/equity volatility and market turns (early March SVB crisis, Sept BoJ intervention) via the VIX Index, which has ticked higher from the post-COVID lows printed in late June. Further equity volatility gains could spell further weakness in AUD/JPY. This brings tomorrow's US CPI report and the late July BoJ decision into the spotlight ahead.

FOREX: AUD/JPY Extends Losing Streak to Five Sessions

- The softer USD backdrop is persisting into a fourth session, with the USD Index edging to the lowest levels since mid-may. The pullback after nonfarm payrolls has extended, compounded by the softer Manheim user car report released on Monday. The USD Index touched 101.676 at the low, narrowing the gap with the next major support of 101.027.

- USD/JPY typifies the soft USD theme, with the pair lower for a fourth consecutive session and narrowing in on 50-dma support of 139.92 - last crossed in early May. The level could come in particular focus tomorrow if the US CPI report misses forecast and prompts a broader pullback in Fed pricing.

- AUD, NZD are among the poorest performers in G10, with AUD/JPY a stand out cross at these levels: AUD/JPY is now on a five session losing streak, with the 50-dma the next level to watch at 93.439.

- Perhaps surprisingly, GBP is mid-table despite another stronger-than-expected wage growth release. The data did little to stir a further GBP rally, as markets pointed to other elements of the report that signaled a looser labour market.

- Scheduled datapoints and risk events due later today are few and far between, with no tier one releases set for Tuesday. The central bank speaker slate is similarly light.

FX OPTIONS: Expiries for Jul11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0780-00(E1.9bln), $1.0890-00(E1.1bln)

- USD/CNY: Cny7.2500($525mln)

BONDS: Close to the Intraday Highs

- Core fixed income has moved higher this morning and at the time of writing USTs and Bunds are both close to their highs of the day (with gilts also higher but 10-year yields around 1.5bp off their intraday lows).

- UK labour market data has been the biggest release of the morning. Markets initially reacted to the higher-than-expected wage numbers, but by the time gilts opened the focus had switched to the softening of the employment level and the rise in the unemployment rate. Gilts hit their highs of the day on the open.

- The moves in USTs seem to be following on from richness seen through the Asian session (and were also helped by the moves higher in gilts in early European trading). Bunds have generally followed USTs today, with Italian IP stronger than expected but the ZEW survey mixed.

- There is not much on the docket today with markets already having one eye on tomorrow's US CPI data.

EQUITIES: Eurostoxx 50 Futures Remain Vulnerable Despite Recent Bounce

- Eurostoxx 50 futures remain vulnerable despite the latest bounce. The contract traded sharply lower last week, clearing a number of key support levels in the process. 4241.00, the May 31 low, has been breached highlighting a potential reversal. This has opened 4208.50, a Fibonacci retracement point. Key short-term resistance is seen at 4330.20, the 50-day EMA. A break of this average would ease bearish pressure.

- A bull theme in S&P E-minis remains intact and the pullback last week appears to be a correction - for now. Attention is on the first support 4415.05, the 20-day EMA. Clearance of this level would strengthen a bearish threat and expose 4368.50, the Jun 26 low and a key support. The bull trigger is at 4498.00, the Jun 16 high. A clear breach of this level would confirm a resumption of the uptrend and open 4532.08, a Fibonacci projection.

COMMODITIES: WTI Futures Short-Term Conditions Bullish

- WTI futures remain in a medium-term bear mode condition, however, a corrective cycle remains in play and the contract has breached resistance at $72.72, the Jun 21 high, This strengthens a short-term bullish condition and a continuation would expose key resistance at $75.70, the Jun 5 high. A break of this level would highlight an important bullish break. On the downside, key short-term support is at $66.96, the Jun 12 low.

- Gold is consolidating. The trend condition is unchanged and remains bearish. Recent fresh lows reinforce bearish conditions, confirming a resumption of the downtrend and extending the price sequence of lower lows and lower highs. Moving average studies are in a bear mode position highlighting current sentiment. The focus is on $1885.8, the Mar 15 low. Key resistance is $1985.3, the May 24 high. Initial resistance is $1944.3, the 50-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/07/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 11/07/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 11/07/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 11/07/2023 | 1500/1100 |  | US | New York Fed's John Williams | |

| 11/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 11/07/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 11/07/2023 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.