-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - GBP Spirals as No Deal Threat Swirls

HIGHLIGHTS:

- GBP sharply lower against all others as reports of Brexit progress rebuffed

- Equities poised for lower open, with focus on fiscal

- Data, speaker calendar light, with Fed in media blackout

US TSYS SUMMARY: Fiscal Focus

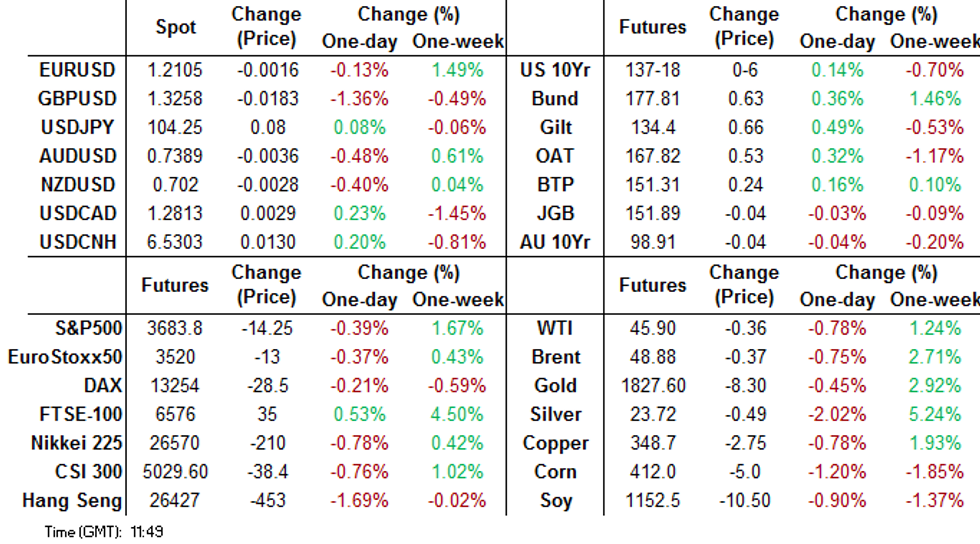

Pessimistic Brexit headlines and renewed Sino-U.S. diplomatic tensions over Hong Kong helped the Tsy curve bull flatten overnight, with equities softening and USD stronger. As we enter U.S. trading, focus is firmly on Washington fiscal developments.

- The 2-Yr yield is down 0.6bps at 0.1448%, 5-Yr is down 1.4bps at 0.402%, 10-Yr is down 2.5bps at 0.941%, and 30-Yr is down 3.5bps at 1.6991%.

- Mar 10-Yr futures (TY) up 6/32 at 137-18 (L: 137-09 / H: 137-20)

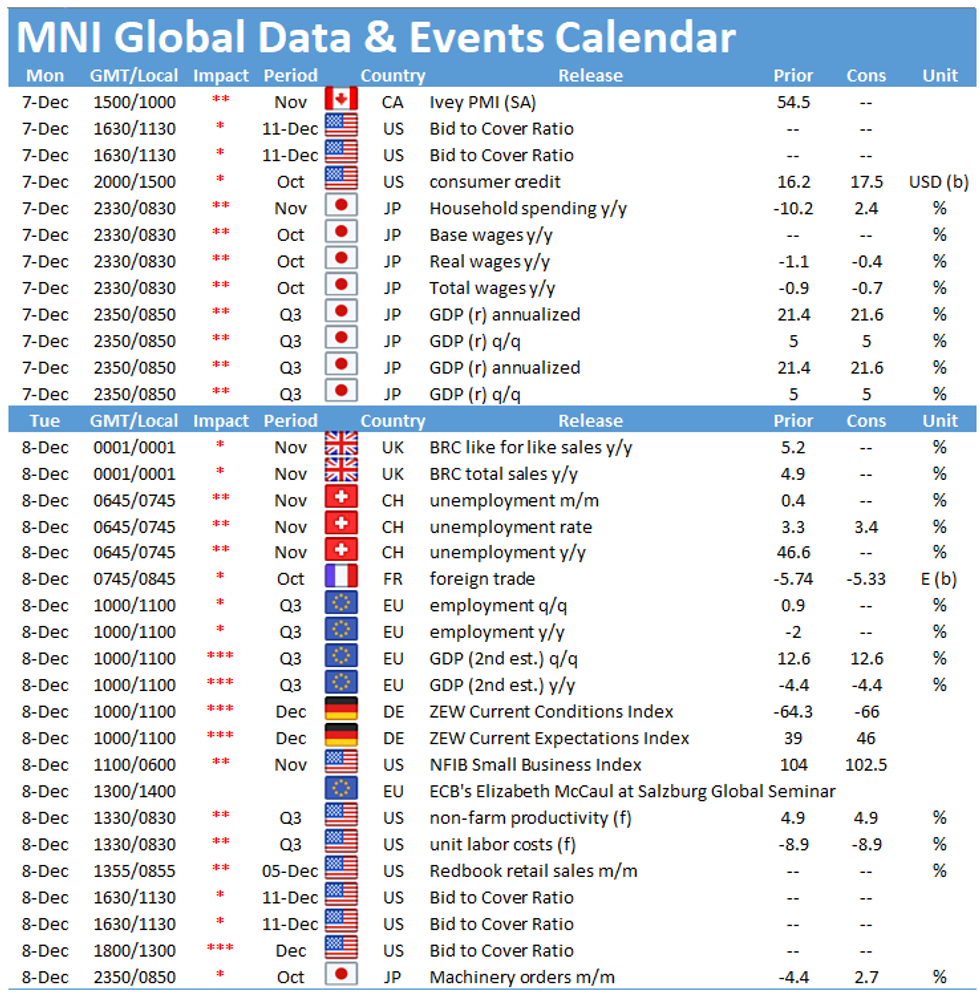

- A very thin calendar keeps the focus on fiscal negotiations ahead of the Dec 11 government funding deadline. Weekend headlines suggested key players (namely Trump+McConnell) could support a $908B package, for which we get more details today from bipartisan negotiators.

- Sounds from weekend reports like Congress will vote this week on a 1-week funding bill that extends the deadline to reach a full-year funding bill to Dec 18, while a longer-term bill and COVID relief legislation is hammered out.

- Little on the data docket (Oct consumer credit at 1500ET) in a very light start to the week until jobless claims and Nov inflation on Thursday.

- And the pre-FOMC blackout period has begun, so no monetary policy commentary until Powell on the 16th.

- In supply, $105B of 13-/26-wk bills at 1130ET. NY Fed buys ~$1.75B of 20-30Y Tsys.

EGB/GILT SUMMARY: Core EGBs Rally, Curves Bull Flatter

European sovereign bonds have rallied this morning and curves have bull flattened alongside weaker trading in equities.

- Brexit tension continues to mount as both sides continue to warn of the difficulty in getting a deal over the line in the coming days. The EU's chief Brexit negotiator Michel Barnier sressed that he 'cannot guarantee' a trade deal. Cable has been under pressure this morning, losing 1.4% on the day.

- Gilts have outperformed with EGBs, particularly at the longer end. Cash yields are 3-6bp lower on the day.

- The bund curve has bull flattened with the 2s30s spread 2np narrower.

- OATs have firmed with cash yields 1-3bp lower.

- BTPs have similarly edged higher with yields 1-2bp lower on the day.

- Supply this morning came from Germany (Bubills, EUR1.285bn allotted). France will sell 3-/6-/12-month BTFs for EUR5.2-6.4bn.

- The European data calendar was light this morning.

OPTION FLOW SUMMARY:

EUROZONE:

RXF1 176.5p, sold at 15 in ~1k

RXF1 176.00p, sold at 9 in ~1.3k

DUF1 112.50/60cs was sold at 0.5 in 2k. Desk also report, was bought for 1 in 1.25k

DUF1 112.30/112.20ps, bought for 1 in 4.5k

ERU1 100.25/100.125ps, bought for 2.5 in ~1.6k

UK:

LH1 99.87/100/100.12c fly 1x3x2, sold at 4.5 in 6k

0LH1 100.00/99.87ps, sold at 5 in 3k

0LJ1/0LK1/0LM1 99.87/99.75ps 1x2 strip, bought for 3 in 5k

FOREX: Swirling Sterling as News of Brexit Progress Rebuffed

Reports over the weekend tended to suggest that some furtive progress had been made between EU and UK negotiators, particularly on the topic of fisheries, which gave GBP a relatively solid start to the session Monday. This swiftly reversed in early European hours however, with GBP dropping sharply as all positive headlines were firmly denied by both parties. Negotiators meet again today, with UK PM Johnson & EU's von der Leyen also speaking in the evening. An EU Senior Diplomat summarises: "we are at a make it or break it moment".

GBP/USD weakness sees the pair trade well below the 1.33 handle, shedding close to 2 cents on the day. First support sits at 1.3197, the 50% retracement of the November - December rally.

Safe haven currencies outperform, with JPY, CHF as well as the USD all trading well.

There are no notable speakers or datapoints due for the rest of the session, with most CB members beginning their preparation work for upcoming central bank meetings. The Fed are now in their media blackout period.

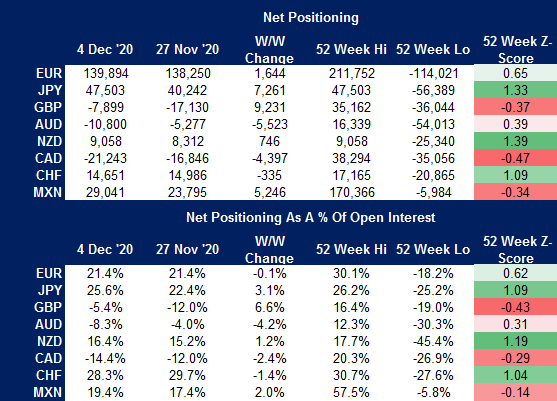

CFTC: Markets Built GBP Net Position Materially Last Week

Friday's CFTC CoT report showed markets built the GBP net position materially in the week ending Tuesday 2nd Dec, cutting the net short to just under 8k contracts - a swing of 6.6% as a % of open interest to -5.4%.

- The positioning shift more than likely a result a of Brexit newsflow, with hopes of a deal evident in GBP/USD's rise above 1.35 last week.

- Markets also bought JPY, MXN and NZD on a net basis.- The net short AUD position extended, with the short position as a % of open interest growing to -8.3% from -4.0% previously.

Full update here:

FX OPTIONS: Expiries for Dec7 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2000(E583mln), $1.2045-55(E794mln), $1.2100-15(E621mln)

USD/JPY: Y103.45-50($550mln), Y104.00-05($515mln), Y104.25-30(E517mln), Y104.50($700mln)

EUR/GBP: Gbp0.8970-90(E527mln)

AUD/USD: $0.7170-75(A$625mln), $0.7350(A$606mln)

AUD/NZD: N$1.0487(A$680mln-AUD puts)

USD/CAD: C$1.2800($410mln-USD puts), C$1.2900($670mln), C$1.3000($540mln-USD puts)

TECHS: Key Price Signal Summary - Sterling Is Offered.

- Cable is down sharply as Sterling is sold across the board. The pair has cleared support at 1.3288, Dec 2 low and is also through the 20-day EMA this morning. This exposes 1.3196, Nov 19 low and 1.3163 50-day EMA.

- EURGBP has rallied sharply higher. The cross has probed 61.8% of the Sep 11 - Nov 11 sell-off, at 0.9127. Stronger gains would open 0.9162, Oct 7 high. Last week's break of trendline resistance drawn off the Sep 11 high continues to highlight a bullish technical theme.

- The USD remains on the backfoot. USDCAD in particular accelerated lower late last week. Scope is for weakness towards 1.2712 1.00 projection of the Oct 29 - Nov 9 sell-off from Nov 13 high. EURUSD pullbacks are considered corrective. Support is at 1.2040, Dec 2 low.

- PM and Oil Still Bullish:

- Gold is trading ahead of firm resistance at $1848.8, Sep 18 and the recent breakout level. A break would reinforce bullish conditions.

- Brent (G1) last week resumed its uptrend. The focus is on $50.00 and $50.45, 61.8% of Jan - Apr sell-off (cont). WTI (F1) bulls eye $48.07, 0.764 projection of the Apr - Aug rally from the Nov 2 low.

- FI levels to watch:

- Bund (H1) resistance is at 178.10, Nov 30 high.

- Gilts (H1) key resistance is 134.70, Nov 20 high and support is at 133.52, Dec 2 low.

- Treasuries (H1) support and downside trigger is at 137-07+, Dec 4 low.

EQUITIES: Mixed Start, UK's FTSE-100 Outperforms on GBP Weakness

Continental equities are mixed, with most European indices lower (France's CAC-40 is weakest, lower by 0.9%) although the UK's FTSE-100 outperforms as the GBP currency takes a leg lower. Similarly, US futures are on the backfoot, resulting in a ~15 points decline in the e-mini S&P so far today.

Energy names and financials are leading declines, while defensive consumer staples and healthcare are the strongest sectors. Notable individual names include UK homebuilders, who are falling sharply on the negative Brexit newsflow. The likes of Persimmon, Berkeley Holdings and Barratt Development are lower by 5% or more.

COMMODITIES: Oil a Touch Lower as Risk Fades

Both WTI and Brent crude futures trade lower at the beginning of the week, with front-month contracts off around $0.40 apiece. Oil markets are following general risk appetite lower, with both US futures and European cash equity markets on the backfoot in early deals. Losses are minimal, however, with WTI bouncing off overnight lows at $45.36 and steering clear of last week's lowest levels.

Despite the softer equity picture, spot gold and silver are both lower, with spot gold showing below the Thursday low to touch $1822.51 in early European hours. The outlook has improved somewhat pre-NY open.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.