-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Markets Watch for Powell Policy Clues

HIGHLIGHTS:

- Markets watch for March meeting clues in Powell speech

- Oil offered as Saudi Arabia, Russia reportedly discuss output hike plans

- Stocks softer after heavy Asia-Pac session

US TSYS SUMMARY: Edging Higher Pre-Powell

A bit of respite for Tsys early Thursday after the previous session's sell-off, with most attention on Fed Chair Powell's appearance later.

- Bull flattening in the curve: 2-Yr yield is up 0.2bps at 0.1427%, 5-Yr is down 1bps at 0.7221%, 10-Yr is down 1.6bps at 1.4653%, and 30-Yr is down 3.6bps at 2.2402%.

- Jun 10-Yr futures (TY) steady at at 133-01.5 (L: 132-27.5 / H: 133-06)

- Risk-off in the Asia-Pac session as equities fell, though S&P futures are now off overnight lows. Dollar trading mixed. Fairly quiet European morning.

- Little question that the day's main event is Powell speaking in a moderated Q&A at 1205ET. Attention is on his comments (if any) regarding the run-up in yields after since his congressional testimony last week.

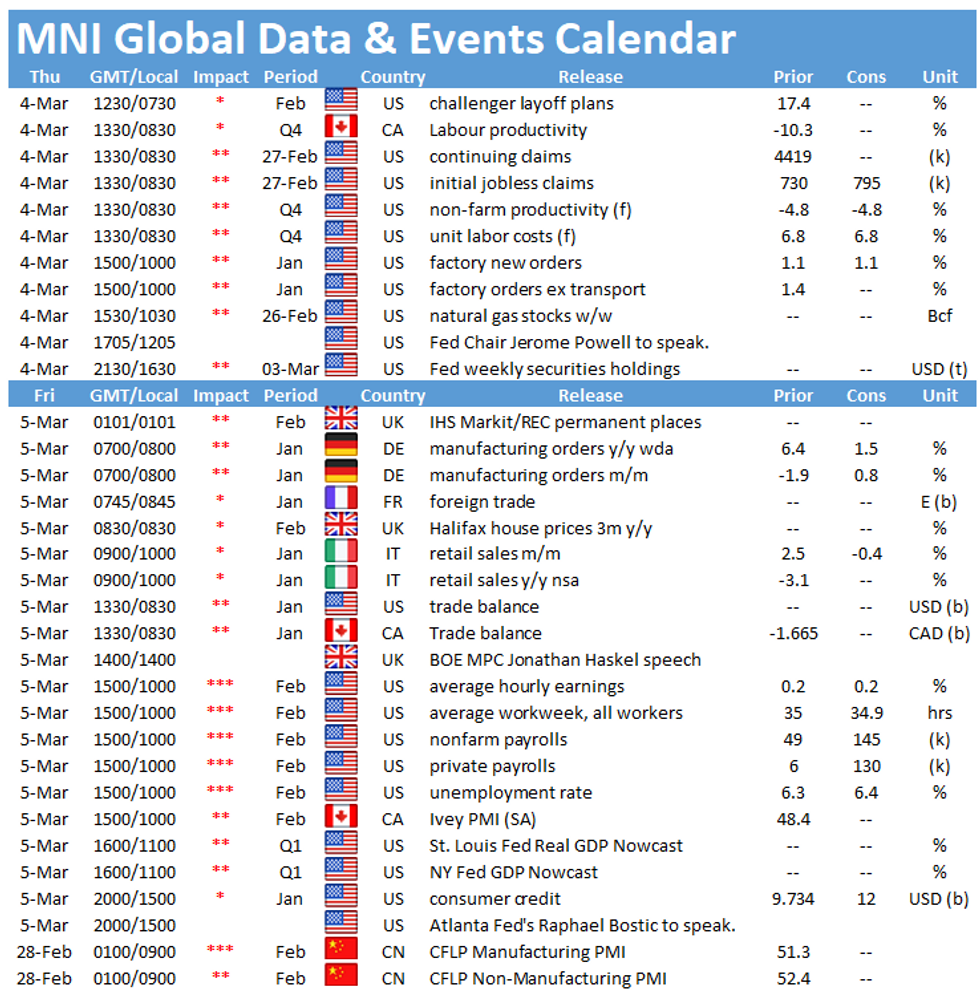

- In data, jobless claims and Q4 nonfarm productivity out at 0830ET, with Jan factory / durable goods orders at 1000ET.

- On the fiscal stimulus front, the Senate vote on the $1.9trn bill has been pushed back to the weekend pending CBO cost estimates on the most recent version of the bill.

- In supply, $65B of 4-/8-week bill sales at 1130ET. NY Fed buys ~$1.750B of 20-30Y Tsys.

EGB/GILT SUMMARY: Budget Hangover

Markets have shifted to a risk-off posture this morning with core EGBs rallying, equities pushing lower, commodities weak and the US dollar gaining against G10 FX.

- Gilts opened stronger and have gradually inched higher through the morning with the curve 2bp flatter.

- The bund curve has similarly bull flattened with the 2s30s spread 2bp narrower.

- OAT yields are up to 2bp lower on the day, with the very short end marginally outperforming.

- BTPs have similarly traded firmer, albeit broadly within 1bp of yesterday's closing level

- Following yesterday's UK budget, Chancellor of the Exhequer Rishi Sunak is today defending his decision to raise corporation tax to 25% from 19% in 2023. The decision to freeze income tax thresholds could similarly attract further criticism from Conservative backbenchers in the coming days.

- The UK construction PMI print for February came in better than expected (53.3 vs 51.0 survey). Elsewhere, Eurozone unemployment edged down to 8.1% in January vs 8.3% the previous month, while euro area retail sales for January missed by a wide margin (-5.9% Y/Y vs -1.4% survey).

- Supply this morning came from the UK (Gilts, GBP2.75bn), France (OATs, EUR 10.999bn) and Spain (Bonos/Oblis/Linkers, EUR5.449bn),

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXJ1 170p, sold at 34 in 5k

RXK1 170/166.50ps vs 174c, bought for 26.5 in 5k

UK:

0LH1 99.87/99.75 RR, sold the call at 0.25 in 7.5k (ref 99.825)

EUROPE ISSUANCE: UK, Spain, France Auctions

UK DMO sells GBP2.75bln nominal of 0.25% Jul-31 gilt

- Avg yld 0.868% (0.441%), bid-to-cover 2.75x (2.95x), tail 0.2bps (0.1bps)

France sells E10.999bln of LT OATs sold vs E10-11bln target

- E6.272bln of 0% Nov-30 OAT.

- Ave yld -0.07% (-0.25%), bid-to-cover 2.04x (2.19x)

- E2.344bln of 0.50% May-40 OAT.

- Ave yld 0.43% (0.10%), bid-to-cover 2.30x (2.01x)

- E2.383bln of 0.75% May-52 OAT.

- Ave yld 0.72% (0.50%), bid-to-cover 2.10x (2.21x)

Spain sells E5.449bln of Bono/Obli and E0.731bln of ObliEi sold: Target issuance volumes: nominals E5-6bln, ObliEi E0.5-1.0bln.

- E1.120bln of 0% Jan-26 Bono

- Ave yld -0.250% (-0.360%), bid-to-cover 2.40x (2.39x)

- E1.16857bln of 1.40% Jul-28 Obli

- Ave yld 0.024%, bid-to-cover 20x

- E1.87452bln of 0.10% Apr-31 Obli

- Ave yld 0.351% (0.271%), bid-to-cover 1.59x (2.12x)

- E1.28632bln of 1.85% Jul-35 Obli

- Ave yld 0.663% (0.366%), bid-to-cover 1.38x

- E0.731bln of 1.00% Nov-30 Obli-Ei

- Ave yld -0.889% (-0.361%), bid-to-cover 1.39x

FOREX: Greenback Slightly Firmer Pre-Powell

Growth and commodity-tied FX is holding water so far Thursday, with AUD and NZD outperforming all others in G10. There are few signs of a bullish breakout just yet, however, with both pairs still well below the week's best levels and recent cycle highs. Australian trade balance data out overnight helped the AUD cause, with exports rising faster than forecast.

- Equities market are soft so far Thursday, with mainland indices lower by 0.2-0.7%. Nonetheless, the JPY remains soft to keep the recent bullish sequence of higher highs in tact for USD/JPY.

- Scandi currencies are among the worst performers of the day, with NOK and SEK both lower.

- Focus turns to a speech from the Fed Chair Powell, speaking later today at 1705GMT/1205ET. This marks the penultimate Fed speech ahead of the pre-March meeting media blackout period, so markets will be carefully watching for any policy signals - with speculation the Chair could lean dovish given recent volatility in yields. Data due today also includes weekly US jobless claims and Factory Orders.

FX OPTIONS: Expiries for Mar04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1890-10(E1.2bln), $1.2000-10(E819mln), $1.2075(E518mln), $1.2085-00(E1.35bln), $1.2150(E554mln), $1.2250(E558mln), $1.2300-05(E900mln)

- USD/JPY: Y105.45-50($582mln), Y105.60-75($1.6bln), Y106.30-50($1.0bln), Y106.90-107.00($535mln)

- GBP/USD: $1.3700-10(Gbp406mln), $1.3900(Gbp550mln), $1.4090-00(Gbp708mln)

- AUD/USD: $0.7700(A$614mln), $0.7750(A$779mln), $0.7775(A$579mln), $0.7800(A$1.0bln), $0.7820-25(A$1.5bln-AUD puts), $0.7900(A$885mln)

- USD/CNY: Cny6.45($745mln)

EQUITIES: Europe, US Indices Lower as Asia-Pac Sets a Heavy Tone

Both US and European markets are in the red, with futures uniformly lower after the poor performance in the Asia-Pac region. The Hang Seng and Shanghai Comp both closed lower by over 2%, which has fed through to a heavy feel pre-NY.

- On the continent, UK and Italian stocks are underperforming, with both the FTSE-100 and the FTSE-MIB lower by over 1% apiece, while losses are stemmed in Spain and France.

- The e-mini S&P touched a new monthly low in early Asia-Pac at 3777.50 but remains off key support at the February lows of 3656.60.

COMMODITIES: WTI, Brent Lower Ahead of Key OPEC Meeting

OPEC+ meet later today to confirm the latest output targets, with reports swirling to suggest that Saudi Arabia and Russia are in discussions over a proposed joint production hike - raising the focus on any announcement later today. Sourced reports in the WSJ suggest the two nations are eyeing a production hike of as much as 1mln bpd. The committee is scheduled to be meeting from 1300GMT/0800ET before a decision is made.

- This has kept most crude benchmarks on the backfoot, with WTI and Brent lower to the tune of 0.5% ahead of the Thursday NYMEX open.

- Metals are more mixed, with gold slightly firmer while silver remains in retreat. This has helped the gold/silver ratio rise further off recent lows, but the 2021 highs remain well out of reach for now.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.