-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS: PBoC Fills the Void Pre-ECB

- ECB-dated OIS shows a little under 17bp of tightening for today’s meeting. Tuesday’s (single-sourced) hawkish ECB sources piece from RTRS biased pricing higher yesterday, tipping the odds of a hike beyond 50/50 in the market’s view. The BBG survey narrowly favours no change in policy rates.

- PBoC enacts latest RRR cut.

- U.S. retail sales, weekly jobless claims and PPI data pad out the NY docket.

MNI ECB Preview - September 2023: A Hawkish Hold

- Conflicting data, limited insight from policymakers since the last meeting, and the very marginal nature of hiking by 25bp or holding following 425bp in policy hikes this cycle, make the September ECB rate decision a tough call.

- We assume that the ECB will leave policy rates unchanged at this meeting, while maintaining a tightening bias and stressing that rates could head higher at future meeting. However, this is a relatively low conviction call.

- For the full publication please see: ECB Preview September 2023 .pdf

US TSYS: Off Bests Alongside European Peers, ECB & NY Data Eyed

Travel away from best levels in Bunds and Gilts has resulted in a similar move for U.S. Tsys, with TYZ3 operating just off fresh session lows.

- Contract last -0-03, trading in a 0-08+ range thus far. A brief look above Wednesday high was seen in Asia.

- Cash Tsys sit 1-1.5bp cheaper across the curve.

- Asia-Pac flow was dominated by a block buyer of TY futures (DV01 $152K), which helped underpin ahead of the weakness in London hours.

- An FV/US steepener block (DV01 ~$340K) was seen more recently.

- Macro headline flow has been relatively limited since the Asia-London handover, with regional participants focused on the impending ECB decision. The decision is deemed to be a very close call (BBG survey narrowly favours no change in rates, while market pricing shows ~68bp of tightening, adjusting higher after Tuesday’s hawkish RTRS sources piece).

- Retail sales, PPI and weekly jobless claims headline the NY docket.

US DATA: Analyst One Line Takeaways From CPI Report

- The general consensus from the twenty analysts below appears to be for no further hikes from the Fed for the cycle, but some don’t rule out further action whilst BofA and Citi explicitly see a 25bp hike in November.

- Summarized views behind these one line takeaways will follow in the MNI Inflation Insight.

STIR: Fed Implied Rates Only Trim Post CPI Declines Ahead Of Important Session

- Fed Funds implied rates for the next two meetings stick to yesterday’s 1bp nudge lower on CPI, but otherwise have chipped away at larger declines for meetings later into 2024.

- Cumulative hikes from 5.33% effective: +1bp for next week (unch), +10bp for Nov (unch) and +12.5bp for Dec to a terminal 5.45% (+0.5bp from yesterday).

- Cuts from terminal: 35bp to Jun’24 (from 36bp) and 101bp to Dec’24 (from 103bp). As noted ahead of CPI, the pace of rate cuts is now aligned with the Fed’s June dot plot, albeit from a higher starting point with the median FOMC participant at the time seeing an additional hike in 2023 compared to the 50/50 odds currently priced.

- An important session ahead with potential spillover from a close ECB decision, with both retail sales and PPI landing in between the announcement and press conference. PPI has added weight after yesterday’s CPI upside surprise was driven by some categories that are more reliant on PPI for core PCE calculations.

STIR: OI Points To Long Setting On SOFR Strip After CPI

The mix of yesterday’s price action and preliminary open interest data suggests to us that the setting of fresh SOFR longs in the wake of the CPI data was the dominant theme from a net positioning perspective on Wednesday.

- The picture in the whites is a little cloudier, given the mixed moves in OI, while 3 of the contracts were unchanged on the day at settlement. SFRU3 is the only contract that we can flag conviction in re: net long setting dominating and that was the key driver of the net OI change in the pack.

- Beyond the whites, firmer prices and a general trend of increased OI give clearer signs of apparent net long setting from the reds through the blues (on a pack basis).

| 13-Sep-23 | 12-Sep-23 | Daily OI Change | Daily OI Change In Packs | ||

| SFRM3 | 1,107,720 | 1,113,810 | -6,090 | Whites | +18,387 |

| SFRU3 | 1,170,415 | 1,153,373 | +17,042 | Reds | +30,130 |

| SFRZ3 | 1,288,609 | 1,296,860 | -8,251 | Greens | +28,190 |

| SFRH4 | 992,512 | 976,826 | +15,686 | Blues | +6,859 |

| SFRM4 | 921,737 | 901,706 | +20,031 | ||

| SFRU4 | 828,235 | 820,359 | +7,876 | ||

| SFRZ4 | 889,569 | 882,237 | +7,332 | ||

| SFRH5 | 519,218 | 524,327 | -5,109 | ||

| SFRM5 | 584,679 | 577,335 | +7,344 | ||

| SFRU5 | 488,149 | 486,092 | +2,057 | ||

| SFRZ5 | 431,587 | 426,462 | +5,125 | ||

| SFRH6 | 304,470 | 290,806 | +13,664 | ||

| SFRM6 | 249,881 | 246,904 | +2,977 | ||

| SFRU6 | 173,824 | 167,116 | +6,708 | ||

| SFRZ6 | 169,461 | 171,408 | -1,947 | ||

| SFRH7 | 125,444 | 126,323 | -879 |

EGBS: Generally Flat To A Touch Firmer, ECB On Deck

Bund futures trade around mid-range, stabilising after the early pull away from best levels.

- That leaves the contract +20 or so, with the German cash benchmarks running 0.5-1.5bp richer, lightly steepening.

- Headline flow has been limited, with the usual comments surrounding pre-ECB positioning evident.

- ECB-dated OIS shows a little under 17bp of tightening for today’s meeting, with terminal deposit rate pricing sitting bang on 4.00%. A reminder that Tuesday’s (single-sourced) hawkish ECB sources piece from RTRS biased pricing higher yesterday, tipping the odds of a hike beyond 50/50 in the market’s view.

- Our full preview of the cliffhanger event can be found here.

- Core/semi-core EGB spreads to Bunds are little changed, while peripheral spreads to 10-Year German paper sit within 1bp of yesterday’s closing levels.

- A quick reminder that Italian PM Meloni ruled out scrapping the banking tax late on Wednesday, although she left the door open to amendments as long as the tax take surrounding the measure still contributes ~€3bn.

- Irish supply saw decent demand as the NTMA rounded off its scheduled issuance for calendar ’23.

BONDS: European Issuance Update

Ireland auction results

- E500mln of the 0.20% May-27 IGB. Avg yield 3.028% (bid-to-cover 2.70x).

- E500mln of the 2.00% Feb-45 IGB. Avg yield 3.460% (bid-to-cover 2.00x).

FOREX: Focus is on the ECB

- The Dollar leans in the red across the majors this morning, with the Kiwi and the Aussie the early best performer overnight with the Aussie helped by the employment data.

- Going into the US session, the Dollar is still down, but has pared some of its weakness, now closer to flat against the GBP, EUR, NZD, CHF, SEK, NOK and JPY.

- EURUSD stays in that 7 sessions range of 1.0686/1.0769, as market participants await the ECB.

- As previously noted, given the lack of risk events and data, large options expiry may have played a role in keeping the pair within ranges.

- Initial technical, resistance/support will be at that range.

- Best performer against the Greenback, over a 5 day period is the CAD, up 1.05% buoyed by the latest Employment data last week, and has overtaken the Kiwi and the Aussie as the best performer against the USD in G10 today, albeit by just 0.15%.

- Main focus is now on the ECB decision, with calls for a hike or Unchanged rate decision completely split.

- On the data front, sees US PPI/Retail sales.

FX OPTIONS: Expiries for Sep14 NY cut 1000ET (Source DTCC)

- EURUSD: 1.0700 (950mln), 1.0775 (646mln), 1.0785 (1.49bn), 1.0790 (687mln), 1.0800 (834mln), 1.0810 (825mln), 1.0815 (731mln)

- USDJPY: 146.90 (380mln), 147.00 (944mln), 147.30 (265mln), 147.40 (431mln), 147.50 (362mln), 147.90 (591mln), 148.00 (964mln)

- GBPUSD: 1.2475 (1.13bn)

- EURSEK: 12.00 (400mln)

- AUDUSD: 0.6450 (843mln), 0.6470 (1.08bn), 0.6485 (649mln), 0.6500 (302mln)

- NZDUSD: 0.5900 (521mln).{ch} USDCNY: 7.30 (1.88bn).

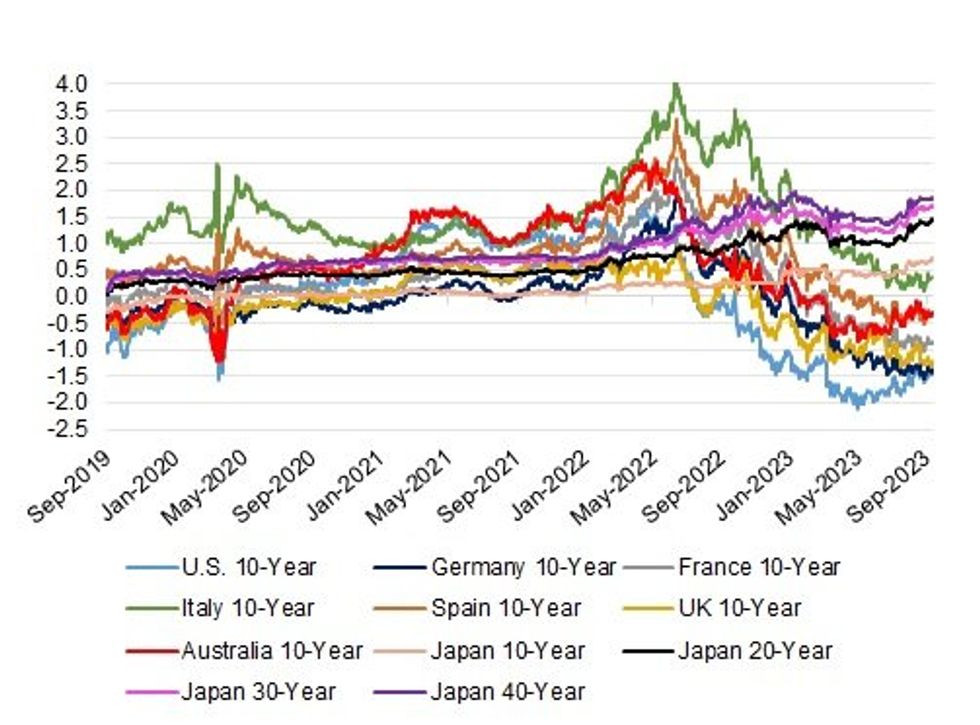

JPY: Largest Round Of Offshore Bond Purchases Since COVID Likely Weighed On JPY Last Week

Some anecdotal evidence re: flow support for XXX/JPY crosses last week.

- The weekly international security flow data from the Japanese MoF revealed the largest round of net weekly purchases of foreign bonds since the initial outbreak of COVID in ’20 (~Y3.6tn).

- The chart below is one we have commented on relatively regularly in recent months.

- It shows that FX-hedged yields from the perspective of a Japanese investor re: the major bond markets disincentivises FX hedging activity when deploying capital in offshore paper.

- That means that the bulk of the flows were likely unhedged from an FX perspective, which would be a JPY negative.

- We won't get a clear idea of the destination of the flows until the monthly current account data for September is released.

- Note that we use a rolling 3-month FX hedge in our calculations.

Source: MNI - Market News

Source: MNI - Market News

CNH: USD/CNH Has Brief Look Above 7.29 On Latest RRR Cut

MNI (London) - The PBoC has delivered the latest 25bp RRR cut.

- The move was perhaps a little ahead of wider expectations timing wise, although not a complete surprise, with some calling for more immediate action.

- There was plenty of speculation re: a RRR cut in Q4 evident, including comments covered by state-run media outlets.

- USD/CNH sees a limited uptick, briefly showing above CNH7.2900, before settling around CNH7.2850.

- A reminder that Asia-Pac hours saw RTRS sources note that PBOC window guidance “has asked some of the country's biggest lenders to refrain from immediately squaring their FX positions for a while in order to alleviate downside pressure on the yuan.”

- Thursday also saw various state-run media outlets reiterate that the PBoC has the means to keep the yuan basically stable. A line that the PBoC once again deployed alongside the RRR cut.

- A low of CNH7.2610 was seen in Asia.

- Technically, trend conditions remain bullish and the move lower in recent sessions appears to be a correction, key short-term support in USD/CNH lies at CNH7.2392, the Sep 1 low.

- For bulls, a break of resistance at CNH7.3682, the Sep 8 high, would resume the uptrend and this would open CNH7.3749, the Oct 25 high - a major resistance and the all-time high.

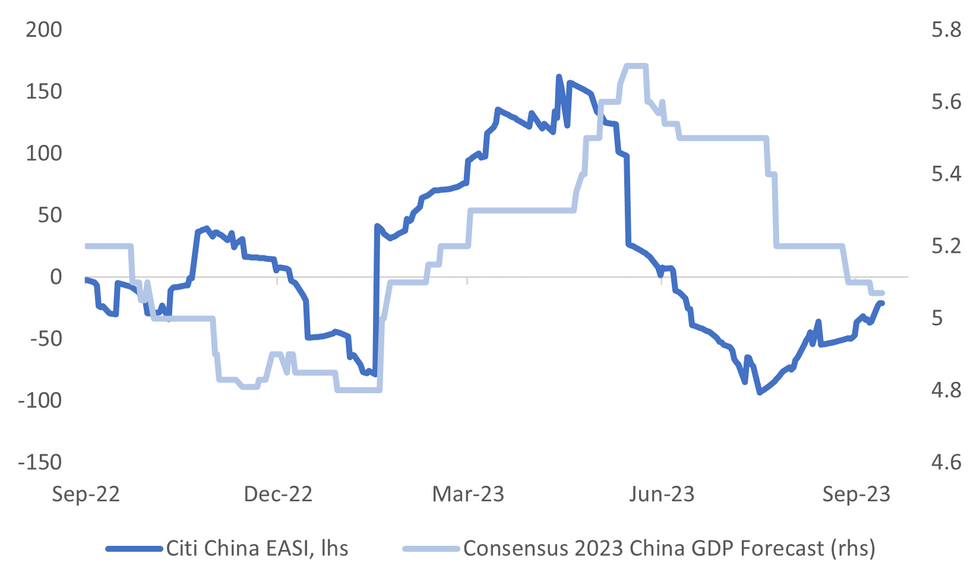

CHINA DATA: August Activity Prints & 1yr MLF On Tap Tomorrow

A reminder that China activity prints for August are due tomorrow, along with the 1yr MLF outcome. China data outcomes have been more mixed in the past month, with manufacturing PMIs more resilient, although services PMIs have continued to moderate. Inflation has improved modestly, while August credit data was better than expected.

- The Citi China EASI is up off recent lows, but remains in negative territory at -21. The chart below plots the EASI against 2023 China GDP growth expectations.

- The 1yr MLF is expected to be held steady at 2.50%, with a forecast range of 2.40-2.50%, although only Bloomberg economics is forecasting a cut. In terms of MLF volumes, the projection is 412.5bn yuan, versus 401bn prior.

- On the activity side, IP for August is projected at 3.9% y/y, prior 3.7% (forecast range 3.4-4.4%).

- Retail sales are forecast at 3.0%, prior 2.5% (forecast range is 1.0%-4.0%).

- Fixed asset Invesment is forecast at 3.3% ytd y/y, prior 3.4% (forecast range is 2.9%-3.6%)

- Property investment is forecast at -8.9% ytd y/y, prior -8.5% (forecast range is -8.4% to -14.2%).

- Residential property sales will also print, no consensus estimate is out, with the prior being 0.7% ytd y/y. New home prices data for August are also due, prior was -0.23% m/m.

- Finally, the jobless rate is projected at 5.3% in August, unchanged from July.

Fig 1: Citi China EASI Versus China 2023 Growth Expectations

Source: Citi/MNI - Market News/Bloomberg

EQUITIES: S&P E-Minis Resistance Remains Intact

- A bear cycle in the E-mini S&P contract remains in play and short-term gains are considered corrective - for now. Key resistance has been defined at 4597.50, the Sep 1 high where a break is required to reinstate the recent bullish theme. For bears, a stronger sell-off would signal scope for a move towards the key support and bear trigger at 4397.75, the Aug 18 low. Clearance of this support would strengthen a bearish case.

- A bear cycle in EUROSTOXX 50 futures remains in play and short-term gains are considered corrective. Price has recently pierced key support at 4187.00, the Aug 18 low and a bear trigger. A clear break of this level would strengthen bearish conditions and open 4177.40 next, 61.8% of the Mar 20 - Jul 31 bull leg. Key resistance has been defined at 4358.00, the Aug 30 high. Initial firm resistance is seen at 4273.90, the 20-day EMA.

COMMODITIES: Oil Bull Cycle Remains In Play

- Gold traded lower again yesterday. Key support to watch lies at $1903.9, the Aug 25 low. A break would be viewed as a bearish development and highlight the fact that the recovery between Aug 21 - Sep 1 has been a correction. This would expose $1884.9, the Aug 21 low. Initial firm resistance is seen at $1928.7, the 50-day EMA. Key resistance is at $1953.0, the Sep 4 high.

- In the oil space, the uptrend in WTI futures remains intact and this week’s gains reinforce this condition. The break higher confirms a resumption of the uptrend and maintains the bullish price sequence of higher highs and higher lows. Note too that moving average studies are in a bull-mode position, highlighting a rising trend. Sights are on the psychological $90.00 handle. On the downside, initial firm support to watch lies at $84.35, the 20-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/09/2023 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 14/09/2023 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 14/09/2023 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 14/09/2023 | 1230/0830 | *** |  | US | Jobless Claims |

| 14/09/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/09/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 14/09/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 14/09/2023 | 1230/0830 | *** |  | US | PPI |

| 14/09/2023 | 1400/1000 | * |  | US | Business Inventories |

| 14/09/2023 | 1415/1615 |  | EU | ECB's Lagarde speaks at Podcast | |

| 14/09/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 14/09/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 14/09/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 15/09/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/09/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/09/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/09/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate M/M |

| 15/09/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 15/09/2023 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 15/09/2023 | 0830/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 15/09/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 15/09/2023 | 0900/1100 |  | EU | Labour Force Survey (Q2) | |

| 15/09/2023 | 0945/1145 |  | EU | ECB's Lagarde & Panetta speak in Spain | |

| 15/09/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 15/09/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/09/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/09/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/09/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/09/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 15/09/2023 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 15/09/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.