-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Silver Streak Sees Prices Surge 10%

HIGHLIGHTS:

- EUR sinks on soft PMI, German retail sales

- Silver gaps higher, trades with 10% gains as retail takes aim

- Manufacturing ISM in focus, growth pace seen maintained

US TSYS SUMMARY: Range Trade Ahead Of ISM

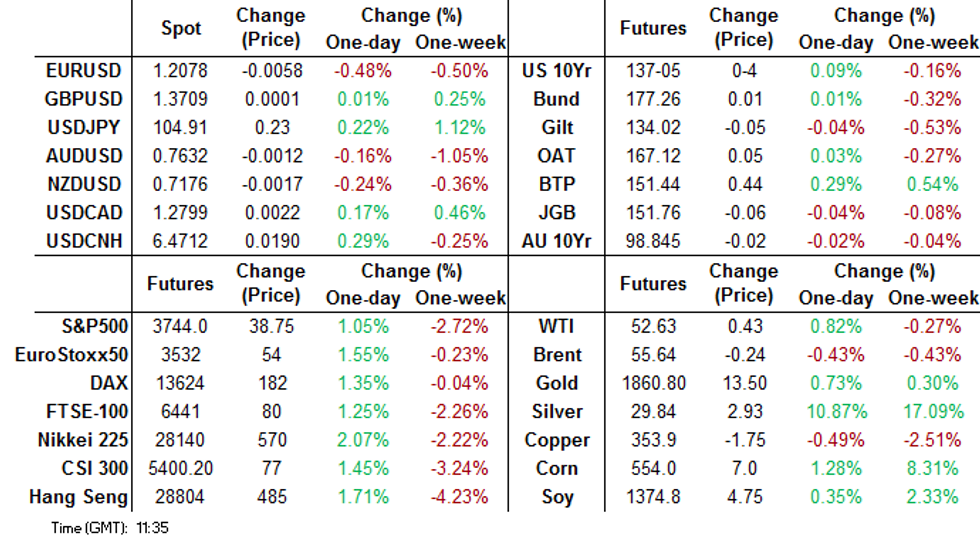

- Mar 10-Yr futures (TY) up 3/32 at 137-04 (L: 137-02 / H: 137-08.5), healthy (~300k) volumes.

- The 2-Yr yield is down 0.2bps at 0.1073%, 5-Yr is up 0.8bps at 0.4272%, 10-Yr is up 1.2bps at 1.0774%, and 30-Yr is up 1.6bps at 1.8453%.

- Dollar's on the front foot, though equities are higher too - the recent retail speculation craze has moved onto Silver which is off highs but still soaring in overnight trade. Again, not much in the way of macro/headlines driving.

- Some attention on Pres Biden meeting w Republican senators at the White House this afternoon to discuss their alternative $600B relief proposal.

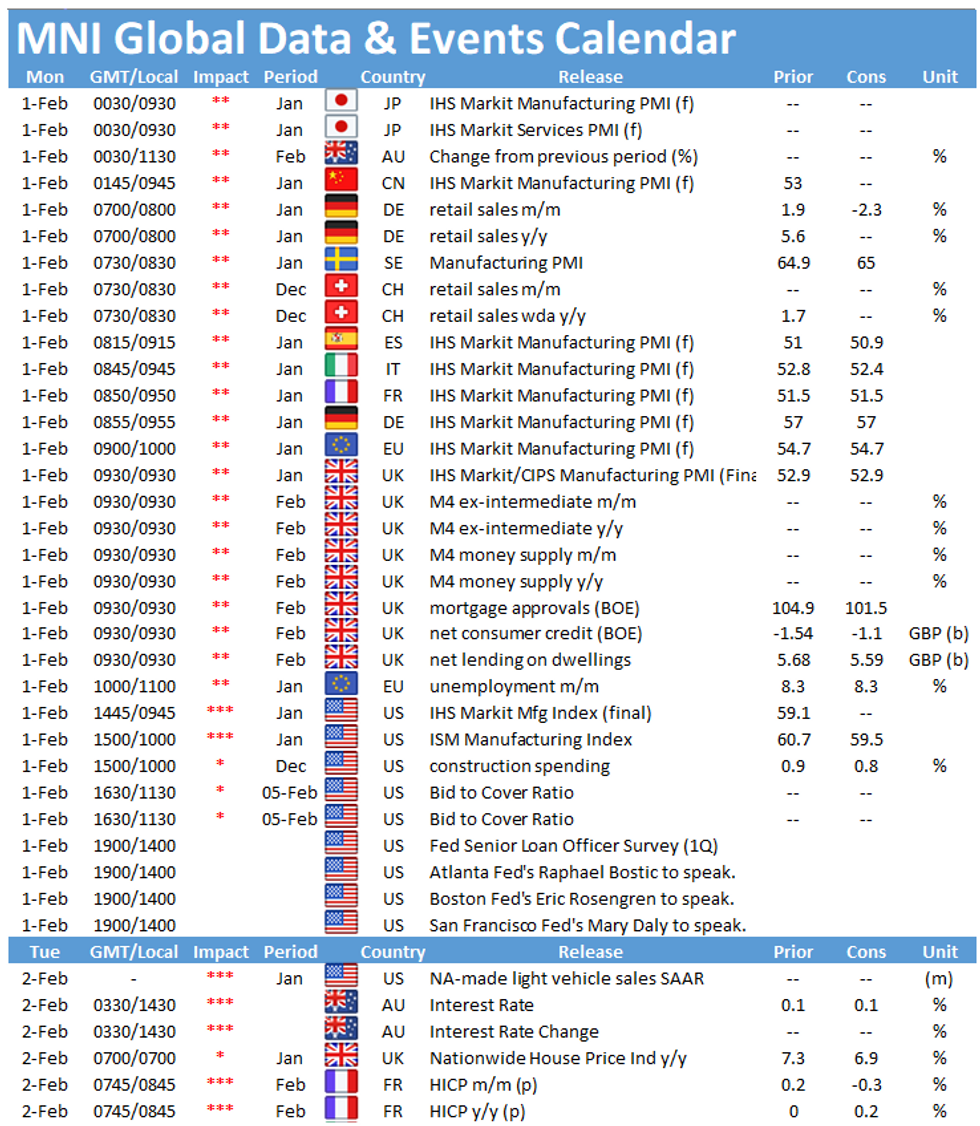

- Final Jan Mfg PMI at 0945ET, with 1000ET bringing Jan ISM and Dec Construction spending.

- Fed speakers today: Minn's Kashkari at 1200ET, Dallas' Kaplan at 1300ET, Atlanta's Bostic and Boston's Rosengren at 1400ET.

- Tsy marketable borrowing estimate released at 1500ET.In bill supply, $105B of 13-/26-week at 1130ET. NY Fed buys ~$1.750B of 20-30Y Tsys.

EGB/GILT SUMMARY: Peripheral EGBs Rallying

Periphery EGBs have rallied this morning while core European sovereign bond markets have started the week on a quiet note.

- Gilts have lacked direction and trade close to unch on the day. Last yields: 2-year -0.1063%, 5-year -0.0254%, 10-year 0.3258%, 30-year 0.8965%.

- Bunds trade a touch weaker with yields within 1bp of Friday's close.

- BTPs have rallied with cash yields 2-3bp lower on the day and the curve 1bp flatter.

- Supply this morning came from Germany (Bubills, EUR5.1175bn allotted) and the Netherlands (DTCs, EUR1.97bn).

- German retail sales data for December missed by a wide margin (-9.6% M/M vs -2.0% survey). The final January manufacturing prints for the UK and Italy were significantly better than expected.

- Having signed up for 60mn doses of Novavax, the UK government has added to its wide and growing stockpile of vaccines following its order of 40mn doses of the Valneva vaccine

EUROZONE ISSUANCE

Cyprus has mandated Barclays, BNP Paribas, J.P. Morgan, Morgan Stanley and SocGen to lead manage a single-tranche EUR 5-Yr benchmark. "The transaction is expected to be launched in the near future subject to market conditions."

Finland has mandated BofA Securities, Credit Agricole CIB,CITI, Danske Bank and Nomura to lead manage its forthcoming EUR3bln (no-grow)30yr benchmark transaction. The transaction will have a 15 April 2052 maturity and is expected to be launched in the near future subject to market conditions.

EFSF's €2bln tap of 0% Oct-27 final terms set. Final terms at MS-11bps (initial guidance was MS-9bps area). Books over E7.8bln.

OPTIONS FLOW SUMMARY

Eurozone:

RXH1 176.00p/178.00c combo, bought put and sold call receiving 3 in 18k (vs 177.16, d 0.50%)

UK:

LH1 100.125 calls bought for 0.5 in 2kLU1 99.75 put bought for 0.5 in 2k

FOREX: EUR Falters on PMIs, German Retail Sales

The EUR is among the poorest performers in G10 early Monday, with the USD gaining after a series of disappointing data releases from the Eurozone. Firstly, German retail sales saw a considerable miss, with December sales falling to -9.6% vs. Exp. -2.0%, which also saw the November release revised lower. This was followed up by a miss of forecast for PMI Numbers from Spain, which saw some further weight go through.

EUR/USD pullback is yet to test the next key support level, which today crosses at the Jan18 low of 1.2054.

Elsewhere, GBP trades well, with EURGBP hitting new 2021 lows this morning of 0.8805. This marks the lowest level for the cross since May 2020.

CHF is the poorest performer in G10, with EUR not far behind. USD and GBP are among the strongest.

Focus turns to ISM data later today, with markets seeing Manufacturing ISM broadly inline with the prior month at 60.0. Speeches are also due from Fed's Kashkari, Kaplan and Bostic.

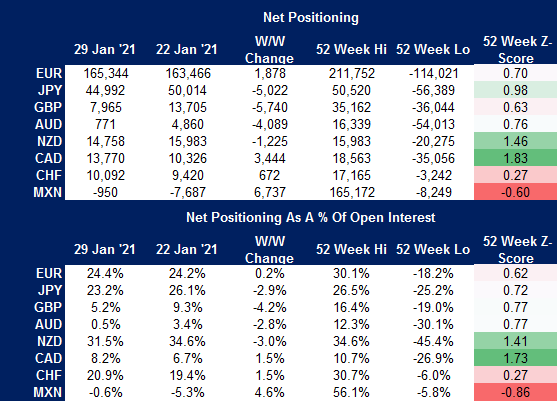

CFTC: Markets Trim GBP, NZD, AUD, JPY Posi, Build MXN

Friday's CFTC release showed markets trimmed the GBP net position by the largest margin among DM, with the net long as a % of open interest dropping to 5.2% from 9.3% previously.

- The largest net long among G10 remains the NZD at 31.5% of OI, but this slipped from the 52week high last week at 34.6%. AUD and JPY also saw their net long positions clipped by close to 3% of OI apiece.

- In EMFX, speculators clipped MXN's net short to close to neutral, with net purchases of +6,737 contracts, lifting MXN net from the 52w low of -5.8% of OI.

- Full update here:

OPTIONS: Expiries for Feb01 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2000(E1.5bln), $1.2220-30(E1.2bln-EUR puts), $1.2300-05(E786mln)

USD/JPY: Y102.30-50($805mln), Y104.45-60($924mln), Y104.75-78($504mln), Y105.50($500mln)

GBP/USD: $1.3550(Gbp547mln)

AUD/JPY: Y77.50(A$600mln), Y79.10(A$605mln), Y83.00(A$614mln)

USD/CNY: Cny6.4835-00($530mln)

USD/MXN: Mxn20.82($580mln), Mxn21.00($720mln)

TECHS: Price Signal Summary - Silver Rally Tests $30.00

- In the FX space, USDJPY remains firm following last week's two important resistance levels:

- The bear channel resistance drawn off the Mar 24 high and

- 104.40, Nov 11 high.

- The break highlights a key reversal and an important shift in sentiment. The focus is on 105.16 High Nov 13.

- EURUSD is softer but remains within the range defined by its key directional triggers. They are: support at 1.2054, Jan 18 low and 1.2190 resistance, Jan 22 high.

- EURGBP is softer with the focus on a break of 0.8800, to open 0.8759, the May 12, 2020 low.

- On the commodity front, Gold directional triggers are resistance at $1875.2, Jan 21 high and support at $1831.5, Jan 27 low. Silver has surged higher today, gapping at the open. $30.00 has been tested, a clear break would open $30.723, 50.0% retracement of the 2011 - 2020 downtrend. Volatility is likely to remain elevated. Support lies at $27.931, Friday's high. Oil contracts remain above support. Brent support is $54.40, Jan 22 low and WTI (H1) support lies at $51.44, Jan 22 low.

- In the FI space:

- Bunds (H1) key support is at 176.85, a trendline drawn off the Jan 12 low.

- Gilts (H1) support lies at 133.79 Jan 21 low.

- In equities, E-mini S&P futures traded lower last week and remain vulnerable despite the bounce so far today off the Asia-Pac low.

- Support to watch is at 3656.50, the overnight low with resistance seen at 3773.61, the 20-day EMA.

EQUITIES: European Indices Uniformly Higher

Continental stock markets are higher across the board early Monday, with the EuroStoxx50 adding 1.3% at the midpoint of the trading day. Spanish, Italian markets are lagging slightly, but still trade higher by 0.6% apiece.

Across Europe, the materials and tech sectors are trading well, with the former receiving a boost from the gap higher in silver prices. Silver trades higher by close to 10% as the wave of retail buying switched from single stock names to silver over the weekend.

In the US, the e-mini S&P is higher by 35 points or so at pixel time, to rise back above the 50-dma after Friday's close below was the first since late October. Friday's high is still a way off at 3777.25.

EQUITIES: Amazon, Alphabet, PayPal Earnings in Focus

Earnings again in focus this week, with consumer discretionary and healthcare in focus.

- Key releases include Amazon, Alphabet and PayPal. Ford Motors' release could also draw some interest. Tuesday is – comfortably – the busiest session for the S&P 500.

Full schedule here: https://roar-assets-auto.rbl.ms/documents/8008/MNI...

COMMODITIES: Silver Streaks Higher as Retail Takes Aim

WTI and Brent crude futures trade higher so far Monday, with the futures contracts notching up 0.6-0.8% gains. This keeps prices above water and support at $54.40, Jan 22 low for Brent and WTI (H1) support at $51.44, Jan 22 low.

On the commodity front, Gold directional triggers remain at resistance at $1875.2, Jan 21 high and support at $1831.5, Jan 27 low.

Silver has surged higher today, gapping at the open as the retail target switched from single name stocks to silver. $30.00 has been tested, a clear break would open $30.723, 50.0% retracement of the 2011 - 2020 downtrend. Volatility is likely to remain elevated. Support lies at $27.931, Friday's high.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.