-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

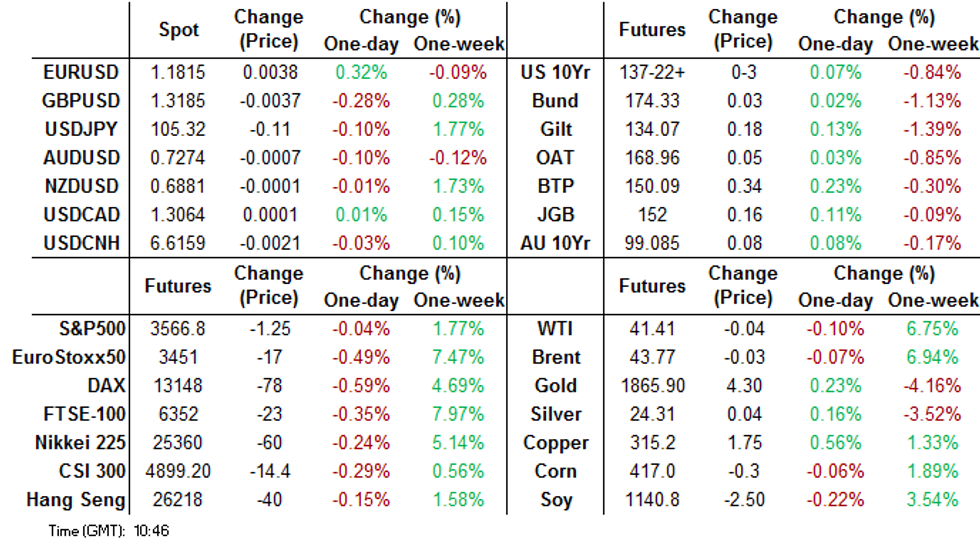

MNI US MARKETS ANALYSIS - Stocks Lower as Vaccine Trade Reverses

HIGHLIGHTS:

- Equities backtrack Monday's vaccine induced rally

- EUR better bid as market continues to price out odds of imminent rate moves from ECB

- Renewed COVID surge in the US leads to curve bull flattening

US TSYS SUMMARY: Curve Bull Flattening With COVID Fears Back In Focus

The bear steepening seen this week in the wake of Monday's Pfizer vaccine optimism has shown some signs of fading Thursday, with bull flattening as cash Tsy markets return from holiday.

- Rising COVID case / hospitalization / death numbers, and Wednesday's announcement of new restrictions in New York (the initial epicentre of the US crisis), have put pandemic risks back into focus - consistent with NASDAQ (ie tech stocks which have previously benefited from pandemic conditions) strength today as Energy and Financials weaken.

- The 2-Yr yield is up 0bps at 0.1808%, 5-Yr is down 2.1bps at 0.4331%, 10-Yr is down 3.5bps at 0.9406%, and 30-Yr is down 3.7bps at 1.7048%.

- Dec 10-Yr futures (TY) up 4/32 at 137-23.5 (L: 137-19.5 / H: 137-27.5)

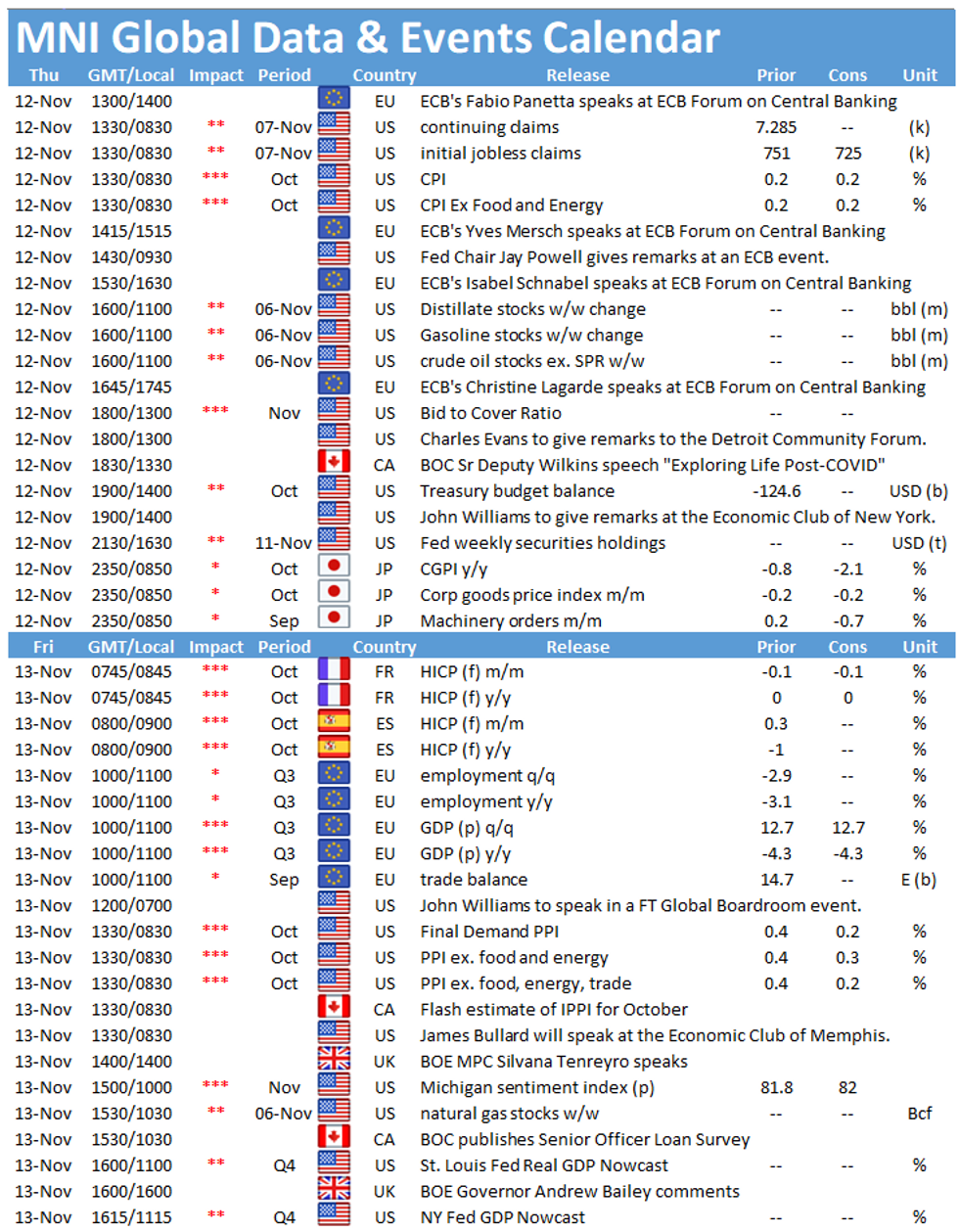

- 0830ET sees weekly jobless claims and October inflation data.

- Fed Chair Powell appears alongside his ECB and BoE counterparts at 1145ET, while Chicago's Evans speaks at 1300ET.

- In supply, we get $65B of 4-/8-week bills at 1000ET, $55B of 105-/154-day bills at 1130ET, though the focus is on $27B 30-Yr Bond auction at 1300ET. NY Fed buys ~$3.625B of 7-20Y Tsys.

EGB/GILT SUMMARY: Vaccine Euphoria Fades, Buoying European Sovereign Bonds

The euphoria over the Pfizer vaccine has died down somewhat. Equities have inched lower while European sovereign bonds have rallied.

- Gilts have traded firmer with yields 1-3bp lower on the day and the curve bull flattening.

- The bund curve has similarly flattened with the 2s30s spread 2bp narrower.

- OATs trade broadly in line with bunds. Last yields: 2-year -0.6845%, 5-year -0.6254%, 10-year -0.2752%, 30-year 0.4075%.

- BTPs have outperformed with cash yields down 2-5bp.

- Supply this morning came from the UK (Gilts, GBP4.25bn), Italy (M/L-T BTPs, EUR6.0bn) and Ireland (bonds, EUR1.25bn).

- UK preliminary Q3 GDP came in close to expectations (15.5% Q/Q vs 158% survey) with both consumer spending and gross fixed capital formation growth exceeding expectations. Elsewhere, Eurozone industrial production for September missed (-6.8% Y/Y vs -5.8% survey).

- There are reports of bitter feuding within Downing Street which has led to the resignation of the Director of Communications Lee Cain.

UK DMO sells GBP3.00bln nominal of new 0.25% Jul-31 gilt

- Avg yld 0.496% (0.244%), bid-to-cover 2.51x (3.00x), tail 0.2bps (0.1bps), price 97.433.

- Brackets refer to previous auction of 0.375% Oct-30 gilt.

- An additional GBP750mln will be available through the PAOF to successful bidders until 13:00GMT.

UK DMO sells GBP1.25bln nominal of 1.625% Oct-54 Gilt

- Avg yld 0.972% (0.816%), bid-to-cover 2.52x (2.23x), tail 0.2bps (0.2bps), price 118.839 (124.086).

- Pre-auction mid-price 118.727.

- An additional GBP312.5mln will be available through the PAOF to successful bidders until 14:30GMT.

Italy Sells E6.0bn of M/L-T BTPs Vs E4.75-6.00bn Target

- E3.00bn of the 0.0% Jan-24 BTP: Average yield -0.19% (-0.14%), bid-to-cover 1.41x (1.40x)

- E1.75bn of the 0.95% Sep-27 BTP: Average yield 0.35% (0.34%), bid-to-cover 1.58x (1.76x)

- E1.25bn of the 1.45% Mar-36 BTP: Average yield 1.05% (1.91%), bid-to-cover 1.53x (1.42x)

Ireland NTMA sells EUR1.25bln of 10y and 30y IGBs

- E850mln of the 0.20% Oct-30 IGB at avg yld -0.202% (-0.19%), bid-to-cover 1.75x (2.74x)

- E400mln of the 1.50% May-50 IGB at avg yield 0.418% (0.52%), bid-to-cover 1.86x (1.9x)

FI OPTIONS SUMMARY

Salient trades include:

US:

0EH1 99.625^ vs 3EH1 99.25 puts, sold the straddle and net received 'credit' 2.5 in 10k

Eurozone:

RXZ0 176/175/174p fly, sold at 35.5 in 1.25k

UK:

0LM1 99.87p/100c^^, bought for 12.25 in 2.5k

2LM1 99.87^ vs LM1 100^, sold the 2yr at 10.75 in 1.5k

FOREX: Single Currency Strong

EUR outperforms early Thursday, with the single currency stronger against most others in G10. EUR/USD is testing the Wednesday high in early trade on little newsflow, although volumes are picking up as the US markets return from partial closes yesterday. Scandi currencies slightly outperform, but upside looks contained for now. First resistance in EUR/GBP rests at 0.8982, the Nov 10 high.

Meanwhile, UK growth data was mixed, leading GBP to be the weakest currency among DMFX. The GDP bounceback in Q3 hit record levels, but stopped short of expectations. Comments from BoE's Bailey raised some interest, with the BoE governor commenting that more Brexit information could make the December MPC more 'live'.

US inflation data and weekly jobless claims are the calendar highlight, with central bank speak also a focus. The ECB's central banking forum continues, with appearances due from Lagarde, BoE's Bailey, Fed's Powell and BoC's Wilkins.

FX OPTIONS: Expiries for Nov12 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1765(E688mln), $1.1795-05(E1.3bln), $1.1825-30(E744mln), $1.1925-30(E640mln)

USD/JPY: Y103.00($1.9bln-USD puts), Y103.50-55($793mln), Y105.40-50($1.55bln), Y106.20($610mln), Y106.55-60($690mln)

EUR/GBP: Gbp0.8900-10(E709mln)

USD/CHF: Chf0.9225($450mln)

EUR/AUD: A$1.6520(E973mln)

AUD/JPY: Y74.00(A$603mln-AUD puts)

USD/CNY: Cny6.64($900mln), Cny6.75($860mln)

USD Index Techs: A Medium-Term Assesment

The USD Index hasn't weakened since the low print of 91.75 on Sep 1. The medium-term chart however continues to highlight a bearish USD theme.

- Moving average analysis highlights a downtrend. Both the 20- and 50-day EMAs remain in a bear mode condition.

- Momentum, looking at the 14-day RSI, is not highlighting any structure that would provide an early warning sign of base building.

- Key resistance levels worth noting are:

- 93.17/44, the area between the 20- day and 50-day EMAs.

- 94.30, Nov 4 high

- 94.74, Sep 25 high and the key reversal trigger. A break would signal a change in the medium-term direction

- Key support levels to watch:

- 92.13, Nov 9 low.

- 91.75, the key bear trigger and Sep 1 low. A break would resume the broader downtrend that started in March and open levels around 90.60.

EQUITIES: Stocks Backtrack Recent Rally

Core European equities trade lower in early European hours, with markets backtracking some of the gains posted since the beginning of the week and the vaccine-induced rally. Most markets trade lower by 0.5-1.0%, with US index futures following suit.

Across Europe, the energy and financials sector is underperforming and leading losses (they were among the main beneficiaries of Monday's rally). Communication services and tech firms are holding more water.

This is echoed in individual performers, with Ubisoft Entertainment and Ocado among the top risers, while Rolls-Royce and Trainline retrace.

COMMODITIES: Precious Metals Bounce As USD Slips

Precious metals have come strongly off early lows with the US dollar coming off overnight highs. Gold's trading between support at $1850.5 and resistance at $1902.3.

- WTI Crude down $0.02 or -0.05% at $41.32

- Natural Gas down $0.01 or -0.07% at $3.019

- Gold spot up $5.16 or +0.28% at $1867.63

- Copper up $1.45 or +0.46% at $314

- Silver up $0.01 or +0.05% at $24.1708

- Platinum up $5.24 or +0.6% at $869.74

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.