-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - UK Gilt Linker Syndication Sees Record Demand

Highlights:

- Biden and Trump secure respective primary majorities, confirming second election face-off

- UK Gilt linker syndication gets see record demand

- Some focus on a possible ECB operational framework release, however details are seen scant

US TSYS: 2Y Yield Through Post-CPI High, 30Y Supply Due Later

- Cash Tsy yields sit 0.5-2bp higher, led by the front end for a bear flattening with 2s10s at -44.5bps. They underperform EGBs, weighed by dovish ECB speak, but outperform Gilts amidst supply.

- TYM4 trades close to session lows of 111-04 (- 01+) on cumulative volumes of 285k, higher than the steady starts to this week’s sessions but low compared to last week. It’s close to yesterday’s low of 111-02+, an initial support level, but the pullback is considered corrective with resistance seen at 112-04+ (Mar 8 high).

- Today sees a particularly quiet session, headlined by 30-year supply. Greater focus is on tomorrow’s retail sales and PPI data, the latter as always watched closely for PCE implications and especially after softer medical care services in yesterday’s CPI report.

- Data: Weekly MBA mortgage data, Mar 8 (0700ET)

- Note/bond issuance: US Tsy $39B 30Y reopen (1300ET)

- Bill issuance: US Tsy 17W bill auction (1130ET)

STIR: Fed Rate Path Extends Post-CPI Push Higher

- Fed Funds implied rates have lifted through European hours, skewed for 2H24 meetings, on limited new macro drivers as it builds on yesterday’s post-CPI reaction.

- Cumulative cuts: 0.5bp Mar (unch from yday close), 3.5bp May (+0.5bp), 19bp Jun (+0.5bp), 31bp Jul (+2bp) and 82bp Dec (+2.5bp) – see table.

- The Dec'24 implied rate sits 11bp higher than before Friday's payrolls, 7bp of which has come since CPI. Its recent high from late Feb implied just above the 75bp of cuts for 2024 penciled by the median FOMC participant in the Dec SEP.

- A quiet session ahead, with macro focus on tomorrow’s PPI and retail sales data.

US TSYS: OI Points To Mix Of Short Setting & Long Cover Post-CPI

Yesterday’s weakness in Tsy futures and preliminary OI data points to a mix of net short setting (TU, FV, US & WN) and net long cover (TY & UXY) in the wake of the CPI data.

- The positioning swings largely offset in net OI DV01 equivalent terms and were generally limited across the curve.

- We previously noted that short positioning had moderated in recent weeks, as yields moved off ’24 highs.

| 12-Mar-24 | 11-Mar-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,639,183 | 3,617,382 | +21,801 | +844,922 |

| FV | 5,855,807 | 5,838,562 | +17,245 | +741,840 |

| TY | 4,255,893 | 4,293,478 | -37,585 | -2,489,714 |

| UXY | 2,035,116 | 2,036,871 | -1,755 | -157,215 |

| US | 1,480,511 | 1,476,248 | +4,263 | +571,513 |

| WN | 1,580,205 | 1,578,502 | +1,703 | +359,699 |

| Total | +5,672 | -128,955 |

SOFR: OI Points To Net Short Setting Through The Greens Post-CPI

Yesterday's move lower in SOFR futures and OI data point to net short setting as the dominant positioning factor through the greens.

- Further out, apparent long cover in SFRZ6 dominated in the blues.

- Shorr positioning had reduced in recent weeks as pricing of Fed '24 rate cuts deepened a little.

- Yesterday's CPI data allowed fresh shorts to be established and pulled the pricing of '24 Fed rate cuts back towards 80bp (familiar 75-100bp range remains intact).

| 23-Mar-24 | 11-Mar-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRZ3 | 1,222,481 | 1,223,054 | -573 | Whites | +51,030 |

| SFRH4 | 1,104,207 | 1,099,631 | +4,576 | Reds | +21,518 |

| SFRM4 | 1,129,148 | 1,094,173 | +34,975 | Greens | +1,592 |

| SFRU4 | 897,933 | 885,881 | +12,052 | Blues | -5,170 |

| SFRZ4 | 1,117,257 | 1,113,694 | +3,563 | ||

| SFRH5 | 681,771 | 674,297 | +7,474 | ||

| SFRM5 | 718,463 | 707,788 | +10,675 | ||

| SFRU5 | 627,566 | 627,760 | -194 | ||

| SFRZ5 | 677,919 | 692,283 | -14,364 | ||

| SFRH6 | 471,871 | 468,516 | +3,355 | ||

| SFRM6 | 493,188 | 490,140 | +3,048 | ||

| SFRU6 | 354,839 | 345,286 | +9,553 | ||

| SFRZ6 | 336,160 | 343,327 | -7,167 | ||

| SFRH7 | 192,386 | 191,692 | +694 | ||

| SFRM7 | 181,549 | 180,876 | +673 | ||

| SFRU7 | 150,815 | 150,185 | +630 |

ECB Non-Monetary Policy Meeting March 2024: An Updated Framework In The Offing

EXECUTIVE SUMMARY

- The ECB is set to reveal the outcome of its operational framework review later today. There are no fixed times for any releases. The meeting begins this morning, we expect announcements in the afternoon.

- Source reports point to a demand-driven floor liquidity system and play down the likelihood of an MRR hike.

- Today may only provide an outline of the updated framework.

- Expect a narrowing of the refinancing/deposit rate gap in the coming months.

- STIR markets show little funding worry, sell-side views are more mixed.

- Our interview with former policymakers warns of risk surrounding the framework review.

- Click below for our full preview of the event.

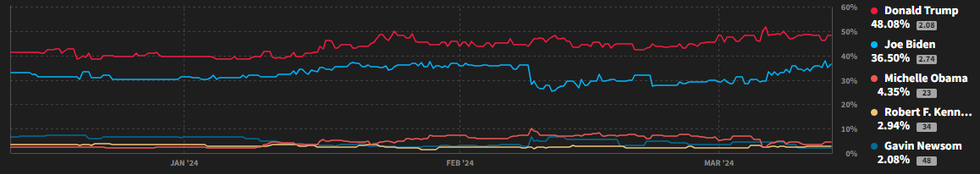

US: Biden And Trump Secure Overall Majority Of Delegates In 12 March Primaries

Both President Joe Biden and former President Donald Trump crossed the 50% thresholds in their primary election races after results from 12 March contests came in. This effectively ensures their positions as Democratic and Republican party candidates respectively ahead of the November presidential election.

- Results from primary elections/caucuses in Georgia (both parties), Mississippi (both parties), Washington (both parties), Hawaii (Republican), Northern Marianas (Democrats), and among Democrats Abroad pushed Biden and Trump over the delegate count required to win the nomination, which will be formally confirmed at the party conventions in the summer.

- Political betting markets have for some time had Trump and Biden as favorites. Data from Smarkets gives Trump a 48.1% implied probability of winning. Biden is on 38.5%, although this is an improvement from a recent nadir of 25.3% on 11 Feb.

- Independent candidate Robert F. Kennedy Jr has a 2.9% implied probability of winning. RFK's campaign has garnered some headlines in the past 24 hours with speculation regarding his vice-presidential pick. The NYT reportedthat Kennedy had sounded out NY Jets QB Aaron Rodgers and former Minnesota governor and professional wrestler Jesse Ventura.

- While Kennedy is a rank long-shot for the presidency, his campaign could have a significant effect on the eventual winner. Given how close the race would appear to be according to polling, the balance of voters from Democratic or Republican ranks, and in which states, are drawn to Kennedy could have a significant impact on the outcome of the election.

Source: Smarkets

Source: Smarkets

EUROPE ISSUANCE UPDATE:

UK Gilt syndication:

- GBP 4.0bln (MNI had expected E3.00-3.75bln) of the new 1.25% Nov-54 I/L gilt. Books closed at above GBP55bln, spread set at 1.25% Nov-55 I/L gilt (GB00B0CNHZ09) +1.5bps

- E3bln of the 2.95% Feb-27 BTP. Avg yield 3.06% (bid-to-cover 1.39x)

- E3bln of the 3.50% Feb-31 BTP. Avg yield 3.31% (bid-to-cover 1.41x)

- E1.25bln of the 3.25% Mar-38 BTP. Avg yield 3.85% (bid-to-cover 1.61x)

- E1.25bln of the 4.00% Oct-31 BTP Green. Avg yield 3.3% (bid-to-cover 1.60x)

- E4.5bln (E3.738bln allotted) of the 2.20% Feb-34 Bund. Avg yield 2.31% (bid-to-offer 1.90x; bid-to-cover 2.29x)

- E485mln of the 0.30% Oct-31 OT. Avg yield 2.645% (bid-to-cover 1.54x)

- E516mln of the 1.15% Apr-42 OT. Avg yield 3.262% (bid-to-cover 1.54x).

FOREX: JPY Shrugs Off ETF Report, EUR/NOK Reverses Off Resistance

- EUR came under modest early pressure on the back of a softer-than-expected German wholesale price index release (-3.0%, Prev. -2.7%) and a dovish lean from ECB's Kazaks, who stated that while uncertainty remains high, there is no need to delay the ECB's rate reduction too much. EUR/USD faded through overnight lows, but remains comfortably off the post-CPI low posted yesterday at 1.0902.

- Across G10, JPY and CHF are the poorest performers. Focus in Japan remains on wage-setting ahead of the final Rengo pay tally on Friday - ahead of which Toyota have agreed union demands for pay rises and bonuses "in full", bolstering the BoJ's plans to consider a rate hike next week. A report that the Bank of Japan are said to be mulling ending their ETF purchase programme with the price goal in sight provided some short-lived support for JPY - but the pair remains in closer proximity to yesterday's highs - crossing at 148.12.

- NOK trades slightly firmer, reversing a small part of the weakness posted since the beginning of the week. EUR/NOK has been capped by resistance at the 200- and 100-dmas of 11.5016 and 11.5204 respectively - levels that could remain a focus on any dovish outturn from the Norges Bank next week.

- The Wednesday schedule is far more muted, with no tier one data from the US or Europe

FX OPTIONS: AUD/NZD Upside Stands Out in Quieter Overnight Session

- Options markets saw support on the back of the US CPI release Tuesday and subsequent USD volatility, with just over $90bln notional crossing and making up for a quieter Monday. Hedging activity unsurprisingly quieter overnight, with markets awaiting the final Rengo pay tally ahead of next week’s stacked central bank schedule – with both the BoJ and the Fed due.

- AUD/NZD and USD/KRW hedging markets were more active overnight, with mid Asia trade seeing sizeable AUD/NZD calls traded – consistent with a 1.0920/1.1140 call spread targeting a late August expiry. The trade would break even on a move above ~1.0950 in spot and would capture an expected first rate cut from the RBNZ on Aug15 – while an RBA rate cut is yet to be fully priced across the contract.

- With Wednesday calendar much quieter than Tuesday - expiries may prove more influential amid quieter markets - particularly those that have seen outsized volatility in either direction this week (namely JPY, SEK, AUD).

- Larger expiries of note for Wednesday include E989mln rolling off at 1.0900-10, E1.5bln at 1.0920-40 and E1.1bln at 1.0945-60 in EUR/USD, while AUD/USD could be biased higher: $0.6600(A$584mln), $0.6640-50(A$1.3bln), $0.6680(A$1.3bln)

EGBS: A Touch Firmer as Dovish ECB Speak Weighed Against Heavy Supply

Core/semi core EGBs have pared early gains but still sit firmer on the day, as markets weigh up heavy supply with this morning's ECB speak.

- Governing Council members Wunsch (after hours Tuesday) and Kazaks (this morning) came across dovish vs their usual leanings, with comments consistent with other recent ECB hawks regarding a potential cut in June.

- Those comments come against a backdrop of heavy morning supply: 3/7/15-year BTPs (and a BTP Green), 10-year Bund, 7/20-year Portuguese OTs, and a Slovenian 10-year syndicated tap.

- Bunds are +17 ticks at 133.30, still almost 100 ticks shy of Friday's post US labour report high. Futures remain in a short-term uptrend and the latest pullback is considered corrective.

- German and French cash yields are 1 to 2bps lower on the day, while 10-year periphery spreads to Bunds are a touch tighter with the exception of Greece. The 10-year BTP/Bund spread sits comfortably below 130bps, currently 1.1bps tighter at 126.8bps.

- The ECB is set to reveal the outcome of its operational framework review later today.

- The regional calendar is otherwise light, with comments from the ECB's Cipollone (1145GMT/1245CET) and Stournaras (1400GMT) scheduled.

CHINA: Property Sub-Indices Lead Benchmarks Lower

The CSI 300 lost 0.7% on Wednesday, while the Hang Seng was 0.1% worse off.

- Country Garden missed a coupon payment on an onshore bond for the first time, subsequently entering a 30-day grace period re: the payment.

- The name led property sub-indices lower, with those metrics seeing larger losses than the broader benchmarks.

- Shipbuilders also struggled as the U.S. looks into Chinese subsidies for the industry.

- There was continued speculation re: the potential for further PBoC easing (RRR and MLF rate cuts) in Q2.

- This had little impact given widely held expectations for such moves after PBoC Governor Pan previously signalled a continued lowering of financing costs and RRR cuts.

- Mainland inflows via the HK-China Stock Connect links continued to moderate (~CNY1.6bn).

- Still, Wednesday saw the fourth consecutive day of net inflows via those links, even with broader benchmarks on the defensive.

- Sentiment surrounding Chinese equities has definitely improved in recent weeks, given firmer policymaker rhetoric and action.

EQUITIES: E-Mini S&P Trading Close to Last Week's Highs

- A bullish theme in Eurostoxx 50 futures remains intact and the contract is trading at its recent highs. Moving average studies are in a bull-mode position - this continues to highlight positive market sentiment. Price is approaching the psychological 5000.00 handle next. Further out, scope is seen for a climb towards a bull channel top at 5042.10. The channel is drawn from the Oct 27 low. Initial firm support lies at 4873.00, the 20-day EMA.

- The trend condition in S&P E-Minis remains bullish and the latest pullback is considered corrective. Last week’s fresh highs reinforce current conditions. Note that price action continues to highlight the fact that corrections remain shallow. This is an important bullish signal highlighting positive market sentiment. Support to watch is 5147.25 the 20-day EMA. A clear break of this average would open 5031.12, the 50-day EMA. Sights are on 5300.00 next.

COMMODITIES: Gold Trend Conditions Bullish Despite Slight Pullback This Week

- The WTI futures trend condition remains bullish and the latest pullback appears to be a correction. The recent breach of key resistance at $79.09, the Jan 29 high, reinforces a bullish theme. The clear break highlights potential for a continuation towards $81.70, a Fibonacci retracement. On the downside, support to watch is $76.61, the 50-day EMA. A break of this average would instead signal a possible top.

- The trend condition in Gold remains bullish and the latest pullback is likely a correction. The yellow metal last week traded above $2135.4, the Dec 4 high, to deliver a fresh all-time cycle high. The break reinforces bullish conditions and signals scope for $2206.6 next, a Fibonacci projection. Short-term conditions are overbought, a deeper retracement would allow this condition to unwind. Firm support is at $2095.2, the 20-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/03/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 13/03/2024 | 1145/1245 |  | EU | ECB's Cipollone at conference in Milan | |

| 13/03/2024 | - | *** |  | CN | Money Supply |

| 13/03/2024 | - | *** |  | CN | New Loans |

| 13/03/2024 | - | *** |  | CN | Social Financing |

| 13/03/2024 | 1230/0830 | * |  | CA | Household debt-to-income |

| 13/03/2024 | 1400/1000 | * |  | US | Services Revenues |

| 13/03/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 13/03/2024 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 14/03/2024 | 0700/0800 | *** |  | SE | Inflation Report |

| 14/03/2024 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/03/2024 | 0930/1030 |  | EU | ECB's Elderson at European Banking Federation meeting | |

| 14/03/2024 | 1100/1200 |  | EU | ECB's Schnabel Speech at MMCG meeting | |

| 14/03/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 14/03/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/03/2024 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/03/2024 | 1230/0830 | *** |  | US | PPI |

| 14/03/2024 | 1230/0830 | *** |  | US | Retail Sales |

| 14/03/2024 | 1400/1000 | * |  | US | Business Inventories |

| 14/03/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 14/03/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 14/03/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 14/03/2024 | 1800/1900 |  | EU | ECB's De Guindos fireside chat at Foros |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.