-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - US 10y Yield Testing Tuesday Low

HIGHLIGHTS:

- Treasury curve remains flatter post-CPI

- Oil strength persists, WTI challenging bear channel top

- USD softer, EUR/USD challenging Tuesday high

US TSYS SUMMARY: Curve Retains Post-CPI Flattening Bias

The curve continued to flatten overnight Wednesday following the weaker-than-expected August CPI reading.

- 5s30s at the lowest level since August 2020 (105.6bp), down ~4bp vs pre-CPI.

- The 2-Yr yield is up 0.2bps at 0.2091%, 5-Yr is down 0.3bps at 0.7822%, 10-Yr is down 1bps at 1.2735%, and 30-Yr is down 2.1bps at 1.8385%.

- Dec 10-Yr futures (TY) are steady at at 133-19.5 and well within Tuesday's ranges (L: 133-15 / H: 133-20).

- Not much reaction overnight to weaker-than-expected China economic data, nor higher-than-expected UK CPI.

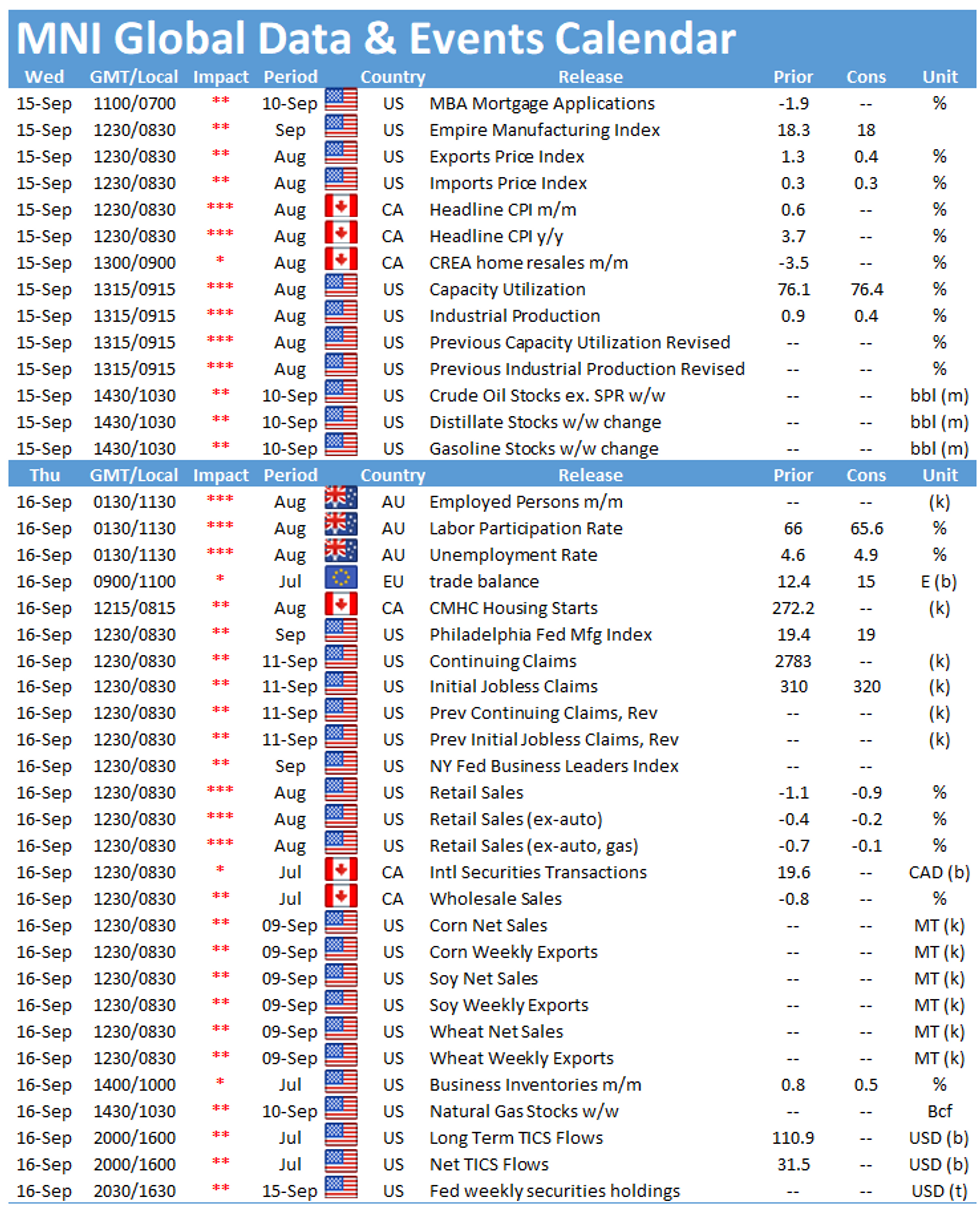

- Data today includes MBA mortgage apps (0700ET), Empire State Manufacturing (0830ET), Import Prices (also 0830ET), and industrial production (0915ET).

- Industrial Production is the highlight of the schedule, but probably less attention on this than retail sales / jobless claims which come Thursday.

- Supply consists of $30B 119-day bill auction at 1130ET. NY Fed buys ~$12.425B of 0-2.25Y Tsys.

EGB/GILT SUMMARY: UK CPI Surprises Higher

European sovereign bonds have traded mixed this morning and are broadly weaker on the day. Equities have inched lower, while the dollar is on the back foot against global FX,

- UK inflation for August came in above expectations (3.2% Y/Y vs 2.9% survey). Elsewhere, Eurozone industrial production growth accelerated to 7.7% Y/Y vs 6.0% expected.

- Gilts opened lower, but gradually recovered losses to trade within sight of yesterday's close.

- Bunds have lacked direction and trade close to flat on the day.

- OATs initially traded weaker, but similarly returned towards yesterday's close.

- BTPs have sold off with cash yields broadly 2bp higher.

- The ECB's Isabel Schnabel and Philip Lane are due to speak later today.

- Supply this morning came from the UK (Gilts, GBP2.50bn) and the EU (Bills, EUR4.996bn).

EUROPE ISSUANCE UPDATE

UK DMO allots GBP2.5bln 0.25% Jul-31 Gilt, Avg yield 0.740% (Prev. 0.664%), Bid-to-cover 2.52x (Prev. 2.72x), Tail 0.2bp (Prev. 0.1bps)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXV1 172/173/174c fly, bought for 22.5 in 2k

DUX1 112.20/112.30 Risk Reversal, bought the call for flat and half in 7k total

DUX1 112.30/112.40cs 1x2, bought for 1 in 1k

UK:

0LZ1 99.37/99.25ps 1x2, bought for 1 in 4k

3LZ1 99.25/99.375cs 1x2, bought for 0.75 in 8k

SFIH2 99.80^, bought for 11 in 5k (ref 99.785)

SFIH2 99.80/99.85/99.90/99.95 call condor, bought for 1 in 7k

FOREX: USD Off Overnight Highs

- The USD is ebbing off the overnight highs, with the USD Index back below the 50-dma. Greenback weakness has helped EUR/USD recover off the overnight lows of 1.1799, with the Tuesday high at 1.1846 now within range. Markets need to close above here to confirm a reversal, after which focus will turn to key resistance at the 1.1909 level.

- Persistent oil strength continues to work in favour of the NOK, which outperforms all others in G10. This puts USD/NOK on track to take the Tuesday low at 8.5739 ahead of the 200-dma at 8.5550.

- Canadian CPI due Wednesday is expected to creep higher, mimicking the US release yesterday with median core CPI seen inching up to 2.7% Y/Y - matching levels last seen in 2008. USD/CAD remains in a short-term uptrend, with 50-dma support at 1.2590 providing some support.

- US Empire manufacturing, import/export price indices and industrial production data also cross. ECB's Schnabel and Lane are both due to speak.

FX OPTIONS: Expiries for Sep15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E647mln), $1.1820-30(E1.0bln), $1.2000(E1.1bln)

- USD/JPY: Y109.60-80($1.5bln), Y110.00($686mln)

- USD/CAD: C$1.2750($660mln), C$1.2795-00($988mln)

Price Signal Summary - WTI Challenges Bear Channel Top

- In the equity space, S&P E-minis traded lower again yesterday. Attention is on the key 50-day EMA at 4407.80. Key resistance is unchanged at 4539.50, Sep 3 high. EUROSTOXX 50 futures continue to consolidate. The contract remains above 4132.50, Sep 9 low. A clear break of this level would expose 4078.00, Aug 19 low. The bull trigger is unchanged at 4252.00, Sep 6 high.

- In FX, EURUSD failed to hold onto yesterday's high. Recent weakness highlights a short-term bearish theme and a resumption of weakness would open 1.1758 next, 61.8% of the Aug 20 - Sep 3 rally. Initial resistance is at 1.1851, Sep10 high. The key resistance remains 1.1909, Jul 30 and Sep 3 high. Recent activity in GBPUSD has defined short-term directional parameters at; 1.3913 as resistance, Sep 14 high and support at 1.3727, Sep 8 low. Yesterday's gains did result in a breach of 1.3892, Sep 3 high. however Cable failed to hold above it and reversed lower.

- On the commodity front, Gold, while slightly firmer, remains in a range and is trading above recent lows. The near-term outlook remains bullish but a break of $1834.1, Jul 15 high is required to confirm a resumption of gains. Support to watch is unchanged at $1774.5, Aug 19 low. A break would threaten a bull theme and signal scope for a deeper reversal. WTI futures maintain a bullish outlook and are firmer today. The focus is on $71.30, the bear channel top drawn from the Jul 6 high. This marks a key resistance and an important hurdle for bulls. A clear break would open $73.52, Jul 30 high. Note the channel top has been probed.

- In FI, Bund futures remain vulnerable and the contract traded to a low of 171.33 yesterday. The focus is on 171.30, 2.382 projection of the Aug 5 - 11 - 17 price swing. Resistance to watch is 172.48, Sep 9 high. Gilt futures remain in a bear mode following last week's breach of support at 128.03, the Jul 6 low (cont). The contract traded lower yesterday as it extends the bear that started Aug 4. 127.65 has been probed, 61.8% of the Jun 3 - Aug rally (cont). An extension would open 127.39, J1.50 projection of the Aug 20 - 26 - 31 price swing.

EQUITIES: Fragile Bounce in US Futures Overnight

- Equity markets across Europe are modestly lower in cash terms, with Spain's IBEX-35 underperforming to trade lower by 0.6%. The UK's FTSE-100 is the sole index in the green, with firmer oil & gas stocks (notably BP and Royal Dutch Shell) tilting prices higher.

- In US futures space, the outlook is more positive, with the e-mini S&P higher by around 10 points ahead of the NY crossover.

- S&P E-minis traded lower again yesterday, extending the corrective pullback from 4539.50. The contract has recently breached its 20-day EMA and this signals potential for a pullback towards and test of the key 50-day EMA at 4407.80. The 50-day EMA still represents a key trend support parameter for bulls.

COMMODITIES: Oil Strength Persists, Tops Downtrendline

- Strength across oil markets persists early Wednesday, with inclement weather and production shutdowns threatened by weather system Nicholas across the Gulf of Mexico.

- As a result, WTI crude futures continue to trend higher, edging through the downtrendline drawn off the Jun high to strengthen the outlook further.

- Despite the weaker USD helping boost commodities prices across energy products, precious metals have seen little reprieve - with gold and silver both in minor negative territory ahead of the Wednesday open.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.