-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - WTI, Brent Crude Hit New Cycle Highs

HIGHLIGHTS:

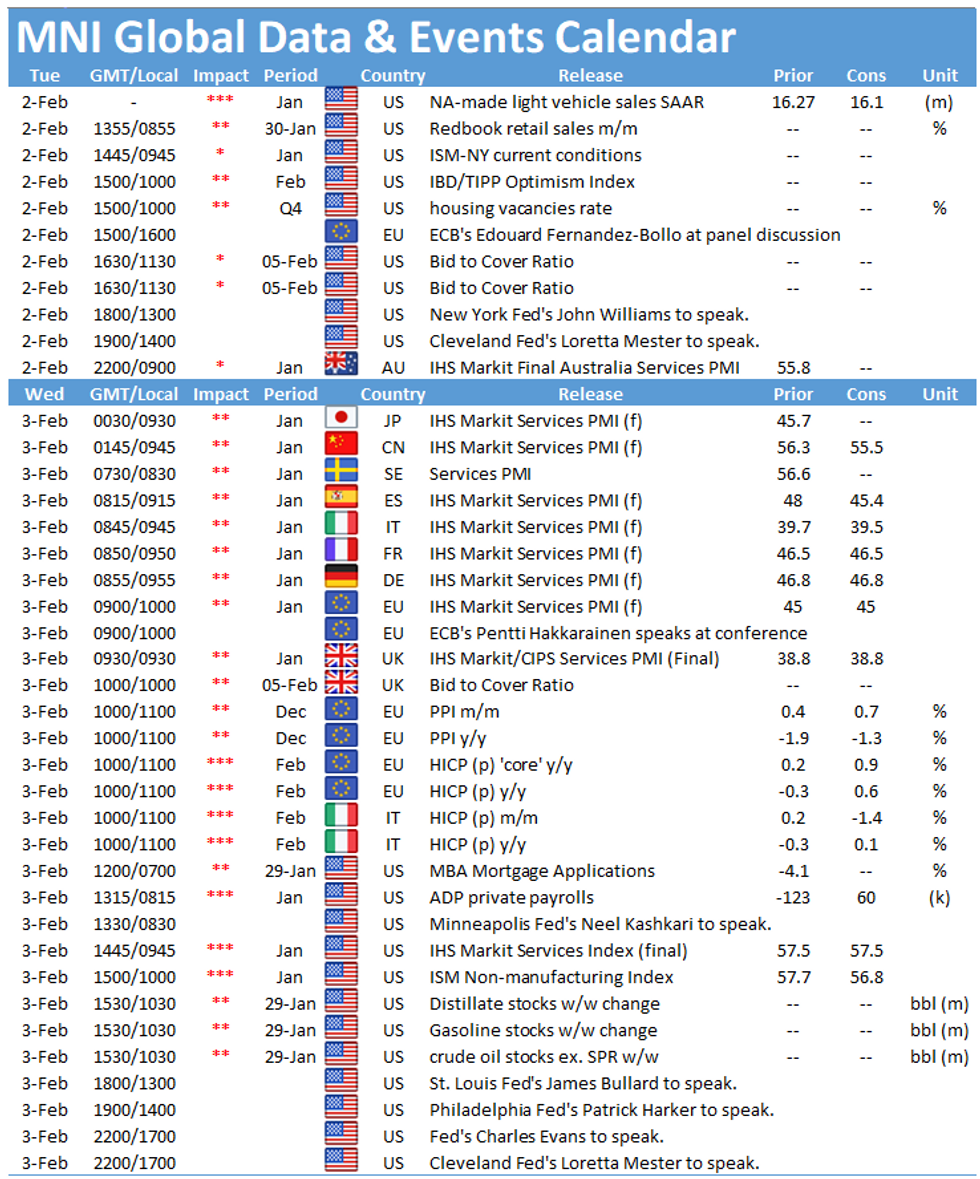

- Earnings front and centre, Alphabet, Amazon due among others

- WTI, Brent rise further, hitting new cycle high

- Calendar void of data, keeps focus on speakers and NFP later in the week

US TSYS SUMMARY: Corporate Earnings Highlight Tuesday's Docket

Treasuries continue to head lower with the curve steepening as equities rally - little on the data/supply calendar but a few Fed speakers and corporate earnings eyed.

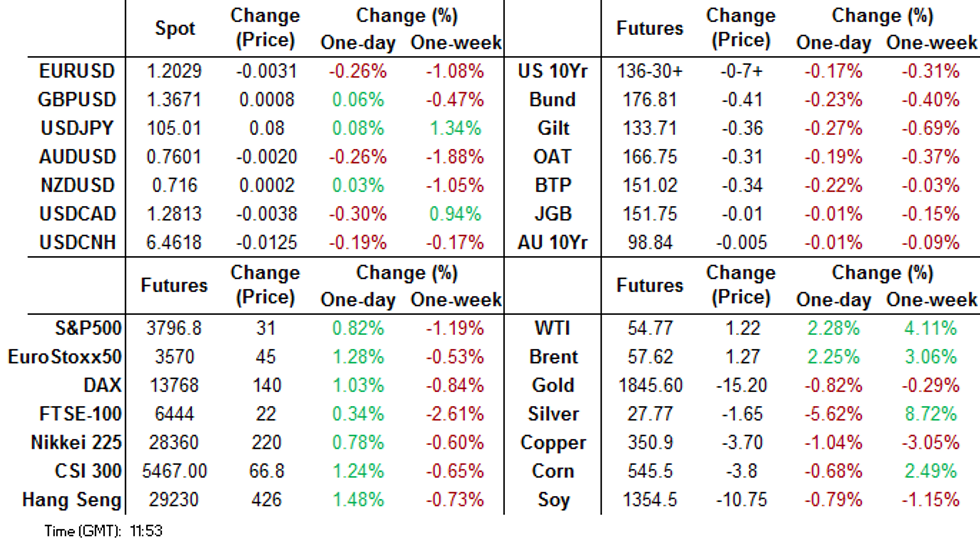

- Mar 10-Yr futures (TY) near session lows, down 7/32 at 136-31 (L: 136-30.5 / H: 137-07)

- The 2-Yr yield is up 0.4bps at 0.1113%, 5-Yr is up 1.4bps at 0.4384%, 10-Yr is up 2.7bps at 1.1065%, and 30-Yr is up 2.6bps at 1.8801%.

- Light newsflow overnight. While some of the recent frenzied trades are subsiding (Gamestop, silver, etc), S&P futs are pushing 3,800 again.

- Probably the most interesting items on the calendar today are key corporate earnings reports (Amazon, Alphabet, ExxonMobil, Pfizer among them; UPS adj. EPS beat expectations).

- Fed speakers: Dallas' Kaplan at 0830ET (on CNBC), and again at 1300ET; NY's Williams moderates a discussion at 1300ET; Cleveland's Mester at 1400ET.

- In supply, $60B of 42-/119-day bills at 1130ET. NY Fed buys ~$1.225B of 7.5-30Y TIPS.

EGB/GILT SUMMARY: Bear Steepening

European sovereign bonds have traded weaker this morning and curve have bear steepened alongside broad equity gains.

- Gilts have sold off with cash yields now 2-4bp higher on the day and the curve 1-2bp steeper.

- Bunds similarly underperform at the longer end. Last yields: 2-year -0.7293%, 5-year -07142%, 10-year -0.4906%, 30-year -0.0487%.

- BTPs have traded weaker with yields 1-2bp higher and the curve marginally steeper.

- Supply this morning came from the UK (Gilts, GBP4bn), Germany (Schatz, EUR4.7315bn allotted), Belgium (TCs, EUR0.81bn) and the ESM (Bills, EUR1.5bn).

- The preliminary Q4 GDP print for Italy came in line with expectations (-2.0% Q/Q), while the Eurozone aggregate was marginally better (-0.7% Q/Q vs -0.9% survey). Elsewhere the flash January CPI print for France beat expectations (0.8% Y/Y vs 0.5% expected).

- The FT reports that Brexit checks on food products at Northern Ireland's largest ports have been suspended following concerns that staff members could be threatened. The move follows the EU's recent and quickly abandoned decision to invoke the Article 16 protocol in a bid to shore up the bloc's vaccine supplies - a move that risked inflaming tensions over the Irish border.

EUROPE OPTIONS FLOW

Eurozone:

RXH1 179c, bought for 7 in 10k

RXH1 179c, bought for 6.5 in 2k now

RXH1 178/179cs 1x2, bought for 7.5 in 1k

RXH1 179c, sold at 7 in 1k

RXM1 174/172ps 1x1.5, bought for 38 in 1k

0EH1 135.00/134.75ps, sold at 6 in 3.5k

SX7E June 82.5c sold at .65 and .70 in 25k

SX7E June 85/95cs, sold at 1.00 in 3k

UK:

0LU1 993.87/99.75/99.625p fly 1x3x2, bought for 1 in 2k

3LU1 99.37/99.00ps, bought for 4.25 in 4k

EUROPEAN ISSUANCE

UK:

DMO sells GBP1bln nominal of 1.625% Oct-71 gilt

- Avg yld 0.741% (0.687%)

- Bid-to-cover 2.32x (2.63x)

- Tail 0.2bp (0.1bp)

- Price 137.295 (140.307)

- Pre-auction mid-price 136.975.

- Avg yld 0.039% (0.072%)

- Bid-to-cover 2.78x (2.06x)

- Tail 0.2bp (0.3bp)

- Price 100.427 (100.272)

Germany:

Germany allots E4.7315bln of the new 0% Mar-23 Schatz

- Average yield -0.73% (-0.73%)

- Buba cover 1.3x (1.52x)

- Bid-to-cover 1.03x (1.22x)

- Price: 101.555

Finland E3bln no-grow Apr-52 RFGB - Spread set at MS+2bps

- Books in excess of E23.5bln (incl. E850mln JLM)

- IPT had been at MS+5bps area, with guidance then revised to MS+3bps area.

- Spread now set at MS+2bps

- Books close at 12:00GMT / 13:00CET

Cyprus E1bln WNG 5yr syndication updated guidance

- Guidance on Cyprus' Feb-26 syndication revised to MS +50/+55 bps area

- Books in excess of E7.5ln

Belgium - New Jun-71 OLO syndication

- Books are in excess of E41bln (incl E4.75bln JLM)

- Spread is set at Jun-66 OLO+7bps

- Books closing at 10:30GMT/11:30 CET

FOREX: EUR/USD Touches New 2021 Lows

The single currency is extending recent losses, with the EUR again among the poorest performers in G10. EURUSD accelerated losses on the break through Monday's low to hit lowest levels of the year and lowest since early December. This has opened support at the Sep 1 low and former breakout level at 1.2011. Below here, the 100-dma undercuts as support at 1.1962.

CAD is the best performer in G10, with NOK not far behind as WTI and Brent crude futures post decent gains. Oil trades with gains of over 2% as USD weakness buoys commodities, helping crude futures chew through near-term resistance.

Data has been few and far between this morning, although Eurozone GDP for Q4 came in ahead of expectations, but still showed sharp contraction of 5.1% over the year.

There are no tier one data releases crossing later today, keeping focus on the speaker slate. This includes ECB's de Cos, Fed's Kaplan and Mester. US earnings could draw some focus, with Pfizer, ExxonMobil, Alphabet and Amazon all due today.

FX OPTIONS: Expiries for Feb02 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1950-65(E653mln), $1.2050(E603mln), $1.2150(E1.4bln-EUR puts), $1.2200(E536mln), $1.2220(E563mln),$1.2290-1.2300(E1.1bln)

USD/JPY: Y106.00($530mln)

AUD/USD: $0.7600(A$1.4bln, A$1.29bln of AUD puts), $0.7650(A$624mln-AUD puts), $0.7685(A$1.1bln-AUD puts), $0.7735(A$592mln-AUD puts), $0.7845-50(A$604mln-AUD puts)

AUD/NZD: N$1.0665-90(A$850mln-AUD puts)

USD/CNY: Cny6.55($1.1bln)

TECHS: Price Signal Summary - EURUSD Cracks Support

- In equities, E-mini S&P futures extend this week's recovery and are pressuring the 3800.00 level. The next resistance and likely near-term objective is 3823.50, Jan 28 high.

- In the FX space, USDJPY is holding onto recent gains and pressuring the 105.00 handle. The recent break of the channel resistance drawn off the Mar 24 high and 104.40, Nov 11 high, paves the way for a climb towards 105.16, Nov 13 high and 105.68, Nov 11 high. The latter level is a key resistance.

- EURUSD is softer and has this morning traded through support at 1.2054, Jan 18 low. The break confirms a resumption of the corrective downtrend and opens 1.2011, Sep 1 high and a former breakout level. The 1.2000 handle is exposed too.

- EURGBP is softer too and is pressuring the 0.8800 handle. Scope is seen for weakness towards 0.8759, the May 12, 2020 low.

- On the commodity front, Gold directional triggers are the resistance at $1875.2, Jan 21 high and the support at $1831.5, Jan 27 low. Silver surged higher yesterday but is under pressure today. Further weakness would open $27.073, the 50% retracement of the Jan 18 - Feb 1 rally. Volatility is likely to remain elevated. Oil contracts are firm. Brent (J1) has cleared resistance at $57.31, Jan 13 high to confirm a resumption of the broader uptrend. This opens $58.59, 76.4% of the Jan - Apr 2020 sell-off (cont). WTI (H1) has also resumed its underlying uptrend and targets $55.00 next, a round number resistance.

- In the FI space:

- Bunds (H1) have probed support at 176.89/88, Jan 29 low and a trendline drawn off the Jan 12 low. This exposes 176.63 next, Jan 22 low.

- Gilts (H1) are softer too and approaching key support at 133.55, Jan 12 low.

EQUITIES: Stocks Solid for Second Session

Global equity markets have built on the Monday bounce, extending gains across the continent to 0.6-1.7%, with French & Spanish stocks outperforming while the UK's FTSE-100 is the laggard.

Across Europe, consumer discretionary and industrials sectors are solid, although all sectors tracked are in the green. Utilities and communication services lag slightly, exhibiting today's underlying risk-on tone.

US equity futures are similarly higher, with the e-mini S&P around 30 points in the green. This narrows the gap with all-time highs to around 60 points, with earnings today the next focus. Key reports due today include Alphabet, Amazon, Pfizer and ExxonMobil.

COMMODITIES: Oil Touches New Cycle High, Silver Goes Into Retreat

Both WTI and Brent crude futures trade higher, with gains of just over 2% apiece, hitting new cycle highs and the best levels since late January last year.

Oil gains come on the back of a weaker greenback this morning and are extending the Monday recovery, running in parallel with global equity markets. Next hurdles for WTI and Brent rest at round number resistance of $55/bbl and the 76.4% retracement of the Jan - Apr 2020 sell-off at $58.59 respectively.

After Silver's winning streak Monday, prices have (more than) levelled off, pulling away from yesterday's highs by as much as 9%. This deflates the bullish argument, with a close below Friday's highs of $27.65 working further against the upside case.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.