-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Treasuries Surge On Bessent And Oil

MNI ASIA OPEN: Israel-Hezbollah Ceasefire Cautiously Reached

MNI US Morning FI Analysis: US Election Goes Down To The Wire

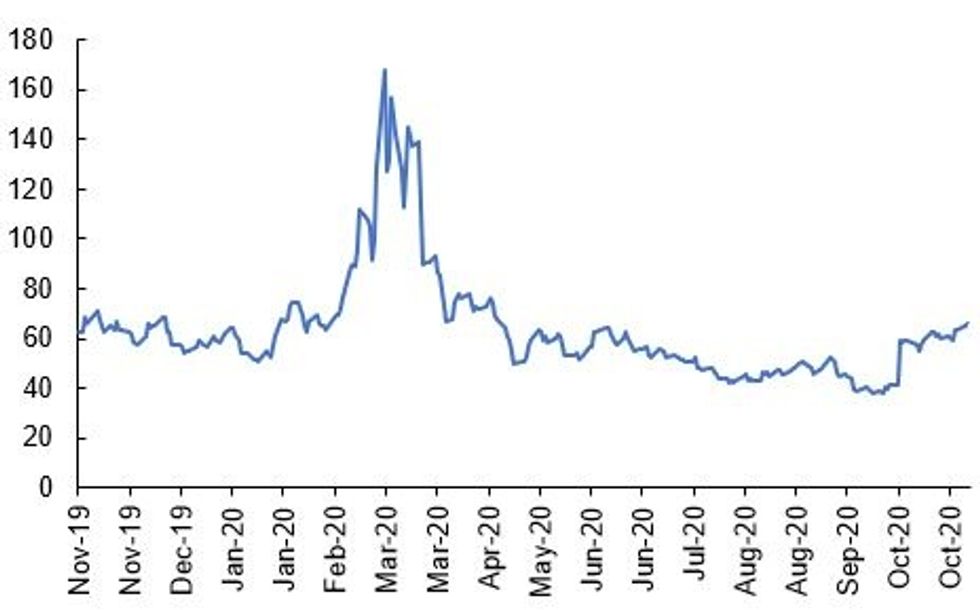

Fig 1. SMOVE Index

Source: MNI, Bloomberg

US TSYS SUMMARY: Treasuries Maintain Gains With Election Disputes Eyed

Those who anticipated a nailbiting, late election night were not disappointed, and Tsys have stabilized after a strong rally on massive volumes (TUZ0s ~1.54mn) overnight.

- Tsys shot higher as it became clear early on that a Blue Wave scenario was off the agenda (the Senate is well out of reach for the Democrats), though the White House remains very much up for grabs.

- The 2-Yr yield is down 0.8bps at 0.1585%, 5-Yr is down 4.4bps at 0.3512%, 10-Yr is down 10.8bps at 0.7914%, and 30-Yr is down 11.7bps at 1.5632%. Dec 10-Yr futures (TY) up 19/32 at 138-22 (L: 137-20.5 / H: 138-30)

- As we write this, Biden has gone to 65% probability to win the presidency (per Betfair odds), vs a low of ~20% just after 1000ET, and is >50% prob to win each of Wisconsin, Michigan, Nevada, and Georgia, though trails in Pennsylvania.

- That being said, recounts and a contested election are possible/likely outcomes in the days and weeks to come, which is helping maintain Tsys bid.

- On more mundane matters, we get some data today: Oct ADP employment (0815ET), Sep trade balance (0830ET), final Oct PMIs (0945ET), and ISM Services (1000ET).

- Of course, the FOMC 2-day meeting kicks off as well.

- $55B in 105-/154-day bills auction at 1130ET.

BOND SUMMARY: EGB/Gilt: US Election Dominating Newsflow

The ongoing US election count continues to dominate this morning's narrative. Equity and commodity markets are broadly risk-on as the balance of probabilities still appears to favour a Biden win, while core sovereign bonds have rallied.

- Gilts have rallied and the curve has bull flattened. The 2s30s spread is 4bp narrower.

- Bunds have slightly lagged the gilt rally. Cash yields are 1-3bp lower on the day.

- OATs are trading broadly in line with bunds. Last yields: 2-year -0.7279%, 5-year -0.7150%, 10-year -0.3649%, 30-year 0.3152%.

- BTPs have similarly traded firmer and the curve is marginally flatter.

- Supply this morning came from Germany (Green Bond, EUR6.62bn), Finland (Bonds, EUR951mn), Greece (Bills, EUR812.5mn).

- This morning's final October PMI prints were broadly in line with the initial estimates with the exception of the Spanish services and composite prints which came in slightly higher, as well as a marginal beat for the German prints.

- Tomorrow's BoE meeting will be a live event with a majority of analysts expecting a GBP100bn QE expansion. The MNI BoE Preview for October has been published online and by email.

DEBT SUPPLY

GERMAN AUCTION RESULTS: Germany Allots E4.621bn of the 0% Oct-25 Green Bond

- Average yield -0.85%, Buba cover 1.3x

FINLAND AUCTION RESULTS: Finland Sold Ebn of the 0% Sep-30 Bond

- Average yield -0.47%, bid-to-cover 1.53x

GREECE AUCTION RESULTS: Greece Sold EUR812.5mn of 3-Month Bills

- Average yield -0.200%, bid-to-cover 2.10x

OPTIONS

EGB OPTIONS: Bund upside

RXZ0 177.50c, bought for 26 in ~1.3k

EGB OPTIONS: Bund put spread

RXZ0 175/174ps, bought for 11 in 1k

EGB OPTIONS: Bund downside

RXZ0 173.00p, bought for 3 in 5k

EGB OPTIONS: Bund downside

RXZ0 176/175.50ps 1x1.5, bought for 1.5 in 1.25k

TECHS

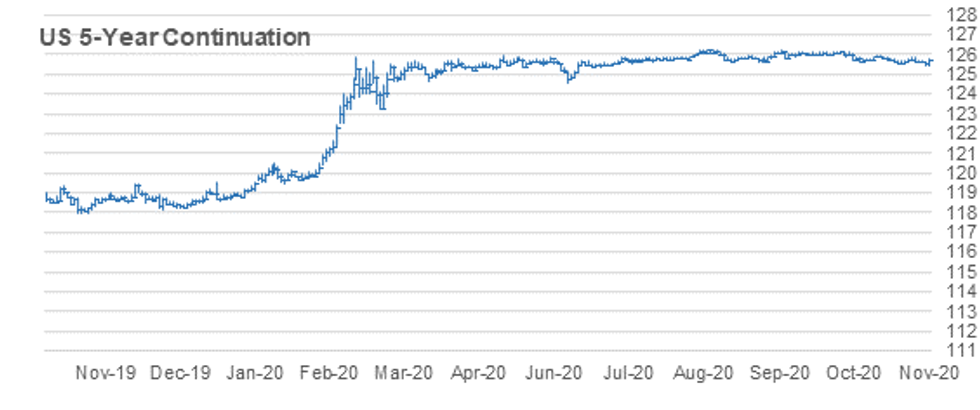

US 5YR FUTURE TECHS: (Z0) Probes Trendline Resistance

- RES 4: 125-31 High Oct 15 and a key near-term resistance

- RES 3: 125-29 61.8% retracement of the Sep 30 - Oct 23 sell-off

- RES 2: 125-272 High Oct 28 and the bull trigger

- RES 1: 125-252 Intraday high

- PRICE: 125-22+ @ 11:21 GMT Nov 4

- SUP 1: 125-122 Intraday low

- SUP 2: 125-112 Low Jun 10 (cont)

- SUP 3: 125-10+ 1.236 proj of Aug 4 - 28 sell-off from Sep 3 high

- SUP 4: 125-07 1.382 proj of Aug 4 - 28 sell-off from Sep 3 high

5yr futures have rallied sharply off today's earlier low of 125-122. Price has also probed trendline resistance at 125-236, drawn off the Sep 30 high. A clear break of the trendline though is still required to signal a reversal. Attention is on resistance at 125-272, Oct 28 high and the near-term bull trigger. A break would confirm a breach of the trendline and strengthen a bullish outlook. Key support has been defined at 125-122.

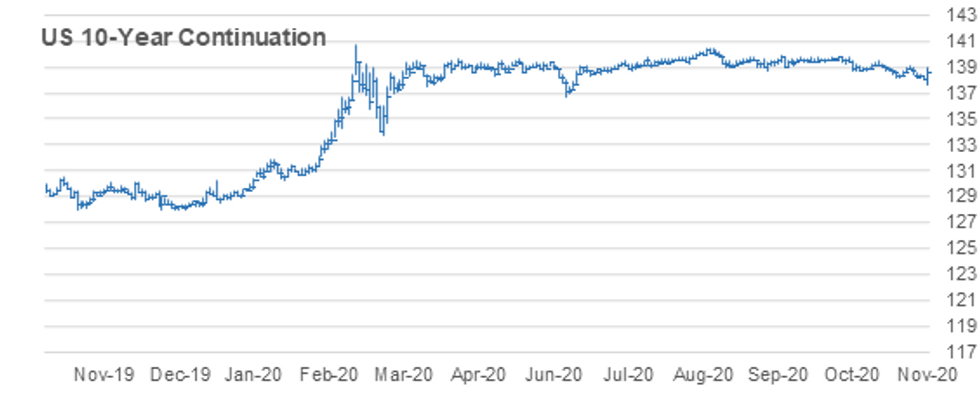

US 10YR FUTURE TECHS: (Z0) Sharp Rally Off The Day Low

- RES 4: 139-07+ High Oct 16

- RES 3: 139-03 High Oct 28 and the bull trigger

- RES 2: 138-31 50-day EMA

- RES 1: 138-30 Intraday high

- PRICE: 138-22 @ 11:33 GMT Nov 4

- SUP 1: 138-09+ 50% retracement of today's range

- SUP 2: 137-20+ Intraday low

- SUP 3: 137-15 1.382 proj of Aug 4 - 28 decline from Sep 3 high

- SUP 4: 137-08 1.500 proj of Aug 4 - 28 decline from Sep 3 high

Treasuries have rallied sharply off today's earlier low of 137-20+. Price has also briefly probed trendline resistance at 138-29, drawn off the Oct 2 high. A clear break of the trendline though is still required to signal a reversal. Attention is on resistance at 139-03, Oct 28 high and the near-term bull trigger. A break would confirm a breach of the trendline and strengthen a bullish outlook. Key support has been defined at 137-20+.

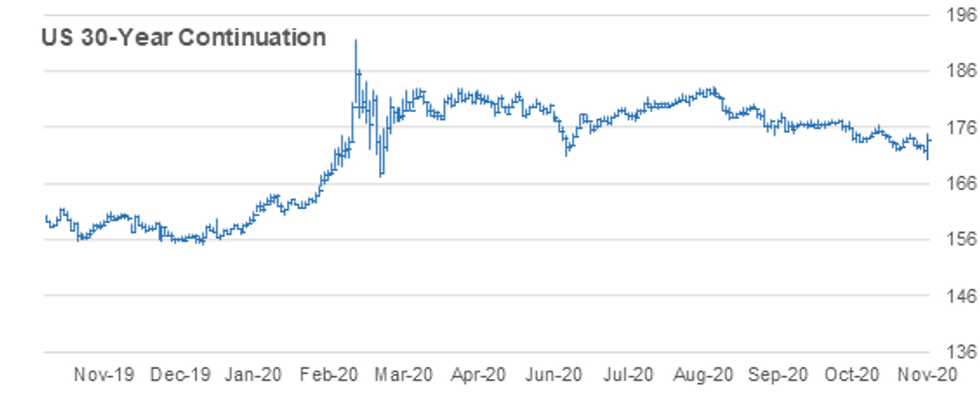

US 30YR FUTURE TECHS: (Z0) Strong Intraday Gains

- RES 4: 177-00 High Oct 2

- RES 3: 176-10 High Oct 15 and a key resistance

- RES 2: 175-00 50-day EMA

- RES 1: 174-28/29 Intraday high / High Oct 28

- PRICE: 174-00 @ 11:45 GMT Nov 4

- SUP 1: 172-18 50.0% retracement of today's rally

- SUP 2: 170-07 Intraday low

- SUP 3: 170-00 Round number support

- SUP 4: 168-19 1.236 proj of Aug 6 - 28 sell-off from Sep 3 high

30yr futures have rallied sharply higher off today's earlier low of 170-07. Price has also probed trendline resistance at 174-15, drawn off the Aug 6 high. A clear break of the trendline though is still required to signal a reversal. Attention is on resistance at 174-29, Oct 28 high and the near-term bull trigger. A break would confirm a breach of the trendline and strengthen a bullish outlook. Key support has been defined at 170-07.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.