-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Looking For Half A Million More Jobs

EXECUTIVE SUMMARY:

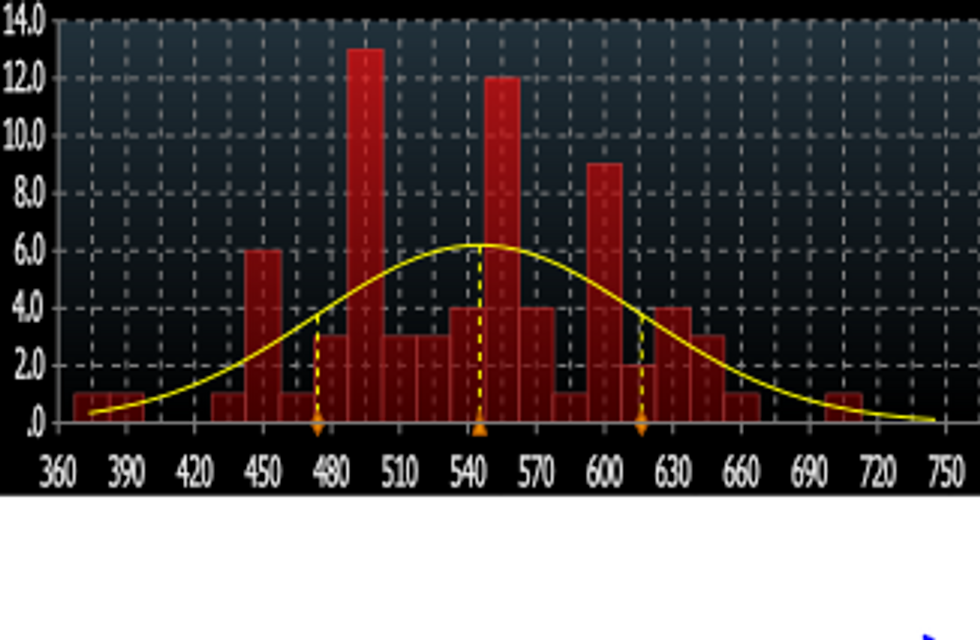

- U.S. NOVEMBER NONFARM PAYROLLS SEEN +550K (MNI DEALER MEDIAN)

- LAGARDE SAYS 2022 ECB HIKE UNLIKELY BUT WILL ACT ON PRICES IF NEEDED

- ECB'S KNOT WON'T RULE OUT RATE INCREASE IN 2023

- TURKEY CENTRAL BANK SAYS IT'S INTERVENED AGAIN IN FX MARKETS

- EX-ECB CHIEF ECONOMIST PETER PRAET JOINS MNI

Fig.1: Distribution Of Analyst Forecasts For November Nonfarm Payrolls Gains

Source: BBG Analyst Survey

Source: BBG Analyst Survey

NEWS:

ECB (BBG): European Central Bank President Christine Lagarde said an increase in interest rates is unlikely next year, but she won’t hesitate to take action to combat elevated inflation as soon as it becomes necessary.“When the conditions of our forward guidance are satisfied, we will not hesitate to act,” Lagarde told Reuters in a webcast interview on Friday.The ECB plans to decide on the future of its stimulus measures on Dec. 16, when the central bank also presents new projections for economic growth and inflation. Its flagship 1.85 trillion-euro ($2.1 trillion) pandemic bond-buying program is due to expire at the end of March.

ECB: Inflation will decline over 2022 as it gets over the current 'hump' European Central Bank President Christine Lagarde said Friday. Speaking at an event hosted by Reuters, Lagarde said prices will decline over the coming year, with price increases now likely at or close to their apex. With many factors set to lessen the upside pressure in 2022, including a likely easing in energy costs, Lagarde said prices will fall towards the ECB's target over the year, although she said the end year level would depend on how soon prices start to ease.

ECB (BBG/FD): ECB Governing Council member Klaas Knot won’t rule out an interest-rate increase in 2023 if inflation is still higher in 2022 than expected in the ECB’s baseline scenario, he said in an interview with Dutch newspaper De Financieele Dagblad.“We still assume that higher inflation is largely a temporary phenomenon,” added Knot, who is president of the Dutch National Bank.

GLOBAL MARKETS (BBG): Berkshire Hathaway Inc.’s Charlie Munger told a conference Friday that markets are wildly overvalued in places and that the current environment is “even crazier” than the dotcom boom of the late 1990s that subsequently led to a bust. “I consider this era an even crazier era than the dotcom era,” Munger, 97, said at the Sohn conference in Sydney, The Australian Financial Review reported. Charlie Munger Munger also said that he wished cryptocurrencies didn’t exist, and praised China for taking action to ban their use, according to the AFR.

UK POLITICS: Prime Minister Boris Johnson's centre-right Conservative Party held onto the outer London seat of Old Bexley and Sidcup in the 2 December parliamentary by-election with a 10.3% swing against the party. However, a much sterner test is set to come in the form of the North Shropshire by-election on 16 December. The Conservatives held the seat with 51.5% of the vote, down from 64.5% inthe 2019 election. The party's majority fell from 18,952 to 4,478, althoughthis is somewhat mitigated for the Conservatives by the very low turnout.Just 33.5% of eligible voters went to the polls, the lowest in aparliamentary by-election since 2018.

TURKEY (MNI/BBG): Central bank has intervened in markets and is selling FX due to “unhealthy price formations,” it says in statement. Intervention follows a similar move Wednesday, its first such intervention since 2014. This is a second intervention at 13.88, just short of the 14.00 handle. As noted before, the CBRT has limited reserve power to continue defending the currency.

MNI: MNI Market News (“MNI”) is delighted to announce that Peter Praet, Executive Board member and Chief Economist of the European Central Bank from 2011 to 2019, is joining the MNI Connect Advisory Board from January 1.

- He joins to help develop the MNI Connect global events programme, where financial market participants are brought together with policymakers and opinion formers from central banks and elsewhere to engage in the critical macroeconomic policy debates of our times. [Click here for more information on MNI Connect and other market-leading MNI services]

- “To have such a prestigious central banker as Peter join our Connect events team at MNI is truly exciting, as we continue our mission of providing the most insightful coverage possible of policy making, not just in the Eurozone, but across global markets,” said Terry Alexander, CEO of MNI.

- Kevin Woodfield, Global Head of Policy / Connect at MNI, added: “In Peter, we have on board at MNI one of the most prominent central bankers of the past decade. Working with a policymaker who was right at the forefront of tackling the last crisis will be invaluable as we evolve our MNI Connect events programme through the current crisis and beyond.”

DATA:

US PREVIEW: Primary Dealer NFP Estimates

| Primary Dealer | Estimate | Primary Dealer | Estimate |

|---|---|---|---|

| Jefferies | 800K | TD Securities | 650k |

| Nomura | 640K | BNP Paribas | 625K |

| Amherst Pierpoint | 615K | Daiwa | 600K |

| Deutsche Bank | 600K | Mizuho | 600K |

| Wells Fargo | 600K | Goldman Sachs | 575K |

| Morgan Stanley | 560K | HSBC | 550K |

| J.P.Morgan | 550K | NatWest | 550K |

| Societe Generale | 515K | Barclays | 500K |

| Credit Suisse | 500K | UBS | 500K |

| RBC | 475K | Bank of America | 450K |

| BMO | 450K | Citi | 450K |

| Scotiabank | 450K | -- | -- |

| Dealer Median | 550K | BBG Whisper | 550K |

MNI: EZ OCT RET SALES +0.2% M/M, +1.4% Y/Y; SEP -0.4%r M/M

European Services PMIs

- SPAIN: Services PMI for November 59.8 (58.6 expected, 56.6 previous)

- ITALY: Services PMI for November 55.9 (54.5 expected, 52.4 previous)

- FRANCE: Services PMI for November at 57.4 vs flash of 58.2

- GERMANY: Services PMI for November at 52.7 vs flash of 53.4

- EUROZONE: Services PMI for November 55.9 (54.5 expected, 52.4 previous)

- UK: Services PMI for November at 58.5 vs flash of 58.6

FIXED INCOME: Waiting for payrolls

Relative to some of the recent moves, this morning has seen a less volatile session as we await the US employment report later this afternoon. There has been a flattening bias in both the UST curve and the German curve this morning, mostly driven by higher yields at the short end.

- Eurozone PMI data was mixed with Italian and Spanish data higher than expected while German and French services data was revised lower.

- A low payrolls print today could put in jeopardy hopes from FOMC members to speed up the pace of tapering in December (as recent communications have suggested).

- TY1 futures are up 0-2+ today at 130-20+ with 10y UST yields down -0.3bp at 1.443% and 2y yields up 0.7bp at 0.623%.

- Bund futures are down -0.14 today at 172.61 with 10y Bund yields up 0.4bp at -0.368% and Schatz yields up 1.2bp at -0.772%.

- Gilt futures are down -0.14 today at 126.45 with 10y yields up 0.2bp at 0.812% and 2y yields unch at 0.530%.

FOREX: AUD/USD Nearing Key Support After Printing Fresh YTD Low

- The single currency trades well early Friday, with similar strength seen across the USD and CHF as equities ebb off the recovery highs posted end-Thursday.

- AUD and NZD are among the worst performers as risk appetite remains clearly fragile, prompting new YTD lows in AUD/USD below 0.7050.This puts prices within range of next key support at the early November 2020 lows at 0.6991.

- Nonfarm payrolls takes focus going forward, with markets expecting the US to have added 550k jobs over the month, pressing the unemployment rate lower to 4.5%. The data will come into particular focus given the proximity to Powell's commitment to discussing an acceleration of the tapering of bond purchases at December's FOMC meeting.

- Fed's Bullard speaks following the NFP release, with BoE's Saunders and ECB's Lane also on the docket.

EQUITIES: Energy Sector Once Again Leads Early Gains

- Asian markets closed mostly higher: Japan's NIKKEI closed up 276.2 pts or +1% at 28029.57 and the TOPIX ended 31.49 pts higher or +1.63% at 1957.86. China's SHANGHAI closed up 33.596 pts or +0.94% at 3607.432 and the HANG SENG ended 22.24 pts lower or -0.09% at 23766.69.

- European bourses are up a little, with the German Dax up 45.93 pts or +0.29% at 15322.83, FTSE 100 up 15.69 pts or +0.22% at 7146.66, CAC 40 up 22.77 pts or +0.34% at 6818.4 and Euro Stoxx 50 up 12.05 pts or +0.29% at 4120.25.

- U.S. futures are mixed, with the Dow Jones mini up 33 pts or +0.1% at 34655, S&P 500 mini down 0.75 pts or -0.02% at 4575, NASDAQ mini down 27.25 pts or -0.17% at 15961.25.

COMMODITIES: Energy Prices Up Sharply

- WTI Crude up $2.08 or +3.13% at $68.45

- Natural Gas up $0.17 or +4.07% at $4.232

- Gold spot down $1.23 or -0.07% at $1769.78

- Copper up $1.15 or +0.27% at $431.7

- Silver down $0.07 or -0.32% at $22.3425

- Platinum up $3.98 or +0.42% at $945.2

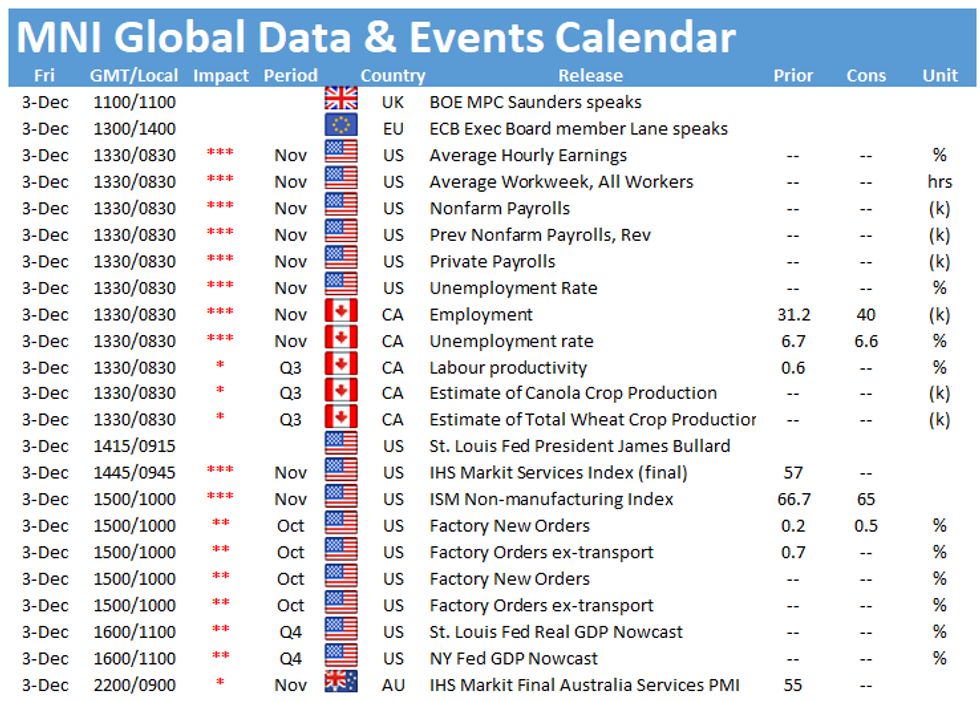

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.