-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: ECB Hawks And Doves Speak Out

EXECUTIVE SUMMARY:

- ECB GOV COUNCIL MEMBERS ELABORATE ON THURSDAY'S DECISION

- BANK OF GREECE DEPUTY ALSO CITES EURO FX FOR ECB APP SHIFT (MNI)

- PUTIN TO BRING IN FIGHTERS FROM MIDDLE EAST

- UK JAN GDP BEATS EXPECTATIONS; ABOVE PRE-COVID LEVEL

- CHINA SHUTS SCHOOLS IN SHANGHAI AS COVID CASES CROSS 1,000

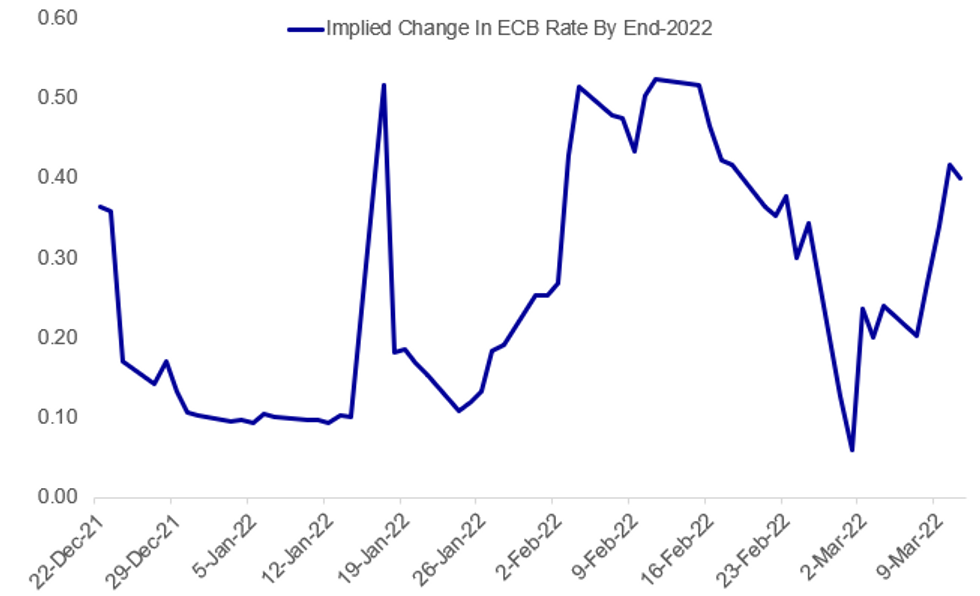

Fig. 1: ECB Rate Hike Expectations Remain Volatile

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB (MNI): The recent decline in the euro's value against the dollar was certainly a factor behind the European Central Bank's shift to a quicker removal of net asset purchases going forward, according to Theodore Pelagidis, a Deputy Governor at the Bank of Greece. For full article contact sales@marketnews.com

ECB (BBG): The European Central Bank has broken the automatic link between winding down stimulus and raising interest rates -- meaning it can now take as long as officials deem necessary before lifting borrowing costs from record lows, according to Governing Council member Francois Villeroy de Galhau. The Bank of France chief -- seen as a moderate on the 25-strong panel -- said markets didn’t sufficiently acknowledge the change, announced on Thursday, with investors more focused on the plan to accelerate the conclusion of net asset purchases. “We’ll likely end asset purchases under certain conditions, but we’re saying the question of interest-rate hikes will come some time after,” Villeroy told BFM Business television on Friday. “That means it’s completely open, there’s no automatism, it could be a long time and we’ll take all the necessary time.”

ECB (BBG): “To my mind, there’s no change as regards earlier or later,” ECB Governing Council member Olli Rehn says in response to question on whether ECB’s new interest-rate guidance make a hike this year less likely. “Yesterday’s decision to my mind means we have more freedom of maneuver in monetary-policy decisions and I think this is the right course of action,” tells reporters in Helsinki. “It’s better to be safe than sorry”. “This wording ‘some time after’ could mean one week or several months -- it’s all encompassing and depends on the incoming data and development of the security and economic landscape in Europe”. Thursday’s ECB decision “was a compromise and we all supported the decision unanimously”.

ECB (FT): The FT has released a sources story overnight following yesterday's ECB meeting. "Several ECB governing council members argued at Thursday's meeting that it should wait before speeding up the withdrawal of its bond-buying stimulus due to uncertainty over the economic fallout from Russia's invasion of Ukraine. But they were outnumbered by more hawkish voices." On source reportedly told the FT "the more hawkish voices calling for more immediate action on inflation outnumbered those advocating patience by 15 to10." This adds to the Reuters story yesterday afternoon which stated that "only a handful had called for keeping the previous guidance for purchases to run at least until October" and that "all 25 policymakers also agreed that the 1.9% rate of inflation now expected for 2024 was compatible with the bank's inflation target."

ECB (BBG): “Fast inflation for at least the rest of this year seems inevitable,” ECB Governing Council member Madis Muller says in blog post. It’s probable that euro-zone average will remain higher than 5% this year, before slowing next year.

UKRAINE-RUSSIA (BBG): Russia will send thousands of fighters from the Middle East, along with weapons, to join its forces in Ukraine, President Vladimir Putin said Friday. “We need to help them get to the war zone,” Putin told members of his Security Council on a video call during which Defense Minister Sergei Shoigu said. Russia had received more than 16,000 applications to fight in the separatist regions in eastern Ukraine. Putin also endorsed a proposal to send more weapons, including anti-aircraft systems, to the separatist forces there.

EU-UKRAINE-RUSSIA (BBG): The EU plans to double to 1 billion euros ($1.1 billion) the size of the European Peace Facility, which provides lethal and non-lethal weapons to Ukraine, according to the bloc’s foreign policy chief, Josep Borrell. He made the proposal to EU leaders Thursday during a summit in Versailles, France. The EU will “increase by another 500 million euros our contribution to the military support to Ukraine,” Borrell said to reporters ahead of summit’s second day of talks. “I’m sure the leaders will approve it this morning and it’s going to be immediate -- now it flows quickly.”

CHINA / COVID (BBG): China is suspending in-person classes for schools in Shanghai and locked down a city in the country’s northeast, as the highly infectious omicron variant drives Covid-19 cases to a level only seen at the peak of the outbreak in Wuhan.All students up to middle school will need to learn from home again starting Saturday, according authorities in the financial center. China reported 1,100 domestic infections on Friday, a tally that has ballooned from just over 300 cases a day in less than a week. The surge presents a significant challenge to the country’s ongoing, zero-tolerance approach to the virus.

DATA:

MNI: UK JAN GDP +0.8% M/M, +1.1% 3MM, +7.8% 3M Y/Y

MNI: UK JAN SERVICES INDEX +0.8% M/M, +1% 3MM

UK JAN MANUFACTURING OUTPUT +0.8% M/M; +3.7% Y/Y

MNI BRIEF:UK Jan GDP Beats Expectations; Above Pre-Virus Level

The UK economy rebounded smartly in January, rising by 0.8%, the Office for National Statistics said Friday, far exceeding analysts’ forecasts of a 0.1% gain. That takes output 0.8% above its pre-pandemic level in February 2020.

Service sector output jumped by 0.8%, topping expectations of a 0.2.% gain, accounting for 0.6 percentage points of the total rise. Consumer-facing services were particularly buoyant, with the food and beverage sector rising by 6.8% over December, when large numbers of people were isolating due to the Omicron Covid variant. Manufacturing output jumped by 0.8%, boosted by gains across the board, while total industrial production rose by 0.7%. Production remains 2.0% below pre-pandemic levels.

Construction rose by 1.1%, extending the 2.0% gain recorded in December. Construction output is now 1.4% above the level of February 2020.

MNI BRIEF: UK Jan Trade Gap Balloons On Data Collection Change

The UK trade deficit ballooned in January, although export data were distorted by a change in reporting standards, the Office for National Statistics said Friday. The gap hit GBP16.159 billion in the opening month of the year, the biggest shortfall since records began in 1997, following a GBP2.337 billion deficit in December.

Exports declined by 8.3%, or by GBP4.6 billion after an adjustment in the assumed departure date in shipments to the European Union from five to 15 days. That accounted for between GBP2-3 billion of the plunge in exports, according to ONS officials. Collection of import data also changed in January, with the ONS using figures provided by HMRC, rather than the Intra-Stat Survey, but officials do not believe the adaption caused any great distortion. Imports rose by 16.0%, boosted by incoming shipments of non-monetary gold, according to officials.

The EU goods trade gap expanded to GBP12.849 billion from GBP4.478 billion, while the non-EU gap rose to GBP13.650 billion.

UK DATA: BOE/Kantar inflation expetations survey highlights

- Latest BOE/Kantar inflation expetations survey highlights:

- Current rate of inflation: 5.0% in Feb (from 3.7% in Nov)

- Median inflation over coming year: 4.3% in Feb (from 3.2% in Nov)

- Inflation in 12-months after: 3.2% in Feb (from 2.4% in Nov)

- Longer-term inflation (e.g in 5-years time): 3.3% in Feb (from 3.1% in Nov)

- Note that there were two quota samples completed between 4-7 February and 18-21 February. So all of this was pre-Ukraine war and the ensuing large increases in commodity prices.

- Little market reaction on the release. Gilts and SONIA futures had already been moving modestly lower through the morning.

CHINA END-FEB M2 +9.2% Y/Y VS MEDIAN +9.6% Y/Y

CHINA: Aggregate Financing Rises 1.19tr CNY in February

- *CHINA FEB. AGGREGATE FINANCING 1,190.0B YUAN; EST. 2,200.0B

- *CHINA FEB. NEW YUAN LOANS 1,230.0B YUAN; EST. 1,450.0B

- *CHINA FEB. M2 MONEY SUPPLY RISES 9.2% Y/Y; EST. 9.6% (BBG)

MNI BRIEF: China Feb M2 Ease, Aggregate Finance At 7-Month Low

China's M2 money supply growth eased to 9.2% y/y in February, decelerating from January's near one-year high of 9.8%, underperforming the 9.6% forecast by market analysts, data by the People's Bank of China released on Friday showed. Among the key metrics, M1 growth reversed the previous fall to rise 4.7% y/y.

New loans rose by CNY1.23 trillion, more than halving from January's record high of CNY3.98 trillion and short of the CNY1.45 trillion forecast. Aggregate financing, half the expected level, decelerated sharply to CNY1.19 trillion when compared to the previous CNY6.17 trillion, hitting the lowest since August 2021. On an annual basis, outstanding total social finance grew 10.2%, compared with 10.5% last month.

Shadow banking transactions fell by CNY505.3 billion, compared to an increase of CNY447.9 billion in January.

FIXED INCOME: Lower this morning

USTs, Bunds and gilts are all lower in the European sesion this morning, although Treasuries are still above where they closed yesterday after moving higher in the Asian timezone.

- There has been little in the way of headline drivers this morning and the market is now looking ahead to Canadian labour market data, Michigan confidence (particularly the inflation expectations component) as well as digesting more from sporadic ECB speakers' appearances. Focus will then begin to turn to any position squaring ahead of the end of the week and next week's FOMC and BOE meetings.

- TY1 futures are up 0-4 today at 126-04+ with 10y UST yields down -0.3bp at 1.987% and 2y yields up 1.4bp at 1.712%.

- Bund futures are down -0.06 today at 162.72 with 10y Bund yields down -0.4bp at 0.266% and Schatz yields down -0.7bp at -0.405%.

- Gilt futures are up 0.01 today at 122.25 with 10y yields up 0.2bp at 1.524% and 2y yields up 1.1bp at 1.350%.

FOREX: Markets More Stable After Volatile Thursday

- Markets are more stable early Friday after a volatile Thursday session that saw Wall Street stocks finish with losses of 0.4-0.9%. European indices have inched off the lows ahead of the NY crossover, with most markets higher by 1% apiece. Currency markets are following suit, putting haven FX at the bottom of the pile. JPY underperforms all others, with the USD/JPY rate hitting a new multi-year cycle high overnight of 117.06.

- This puts the pair through the bull trigger at the break of 116.34/35, the Feb 10 / Jan 4 highs. The break higher confirms a resumption of the broader uptrend that started early Jan 2021. Attention turns to highs dating back to Jan 2017 - 117.53, the next objective, is the Jan 9 2017 high.

- AUD trades weaker, with the currency still under pressure after the bearish shooting star candle pattern posted on Monday. Recent weakness still suggests scope for a deeper correction and has exposed 0.7258/20, the 20- and 50-day EMA values and a key support zone.

- Regional currencies in close proximity to Ukraine are faring better, with NOK and SEK looking stable. The greenback

- The Canadian jobs report takes focus Friday, with markets expecting the unemployment rate to shed another 0.3ppts to reach 6.2%. Prelim Uni of Michigan data also crosses, with attention as ever on the inflation expectations component.

EQUITIES: DAX Leading European Stocks Higher

- Asian markets closed mostly weaker: Japan's NIKKEI closed down 527.62 pts or -2.05% at 25162.78 and the TOPIX ended 30.49 pts lower or -1.67% at 1799.54China's SHANGHAI closed up 13.655 pts or +0.41% at 3309.747 and the HANG SENG ended 336.47 pts lower or -1.61% at 20553.79.

- European stocks are rising, led by German equities: German Dax up 179.73 pts or +1.34% at 13619.12, FTSE 100 up 76.7 pts or +1.08% at 7175.51, CAC 40 up 46.13 pts or +0.74% at 6247.51 and Euro Stoxx 50 up 31.84 pts or +0.87% at 3682.8.

- U.S. futures are higher, with tech leading: Dow Jones mini up 119 pts or +0.36% at 33271, S&P 500 mini up 19.5 pts or +0.46% at 4277, NASDAQ mini up 66.5 pts or +0.49% at 13652.5.

COMMODITIES: Oil Reverses Overnight Losses

- WTI Crude up $1.89 or +1.78% at $107.81

- Natural Gas up $0.05 or +1.04% at $4.679

- Gold spot down $5.32 or -0.27% at $1990.87

- Copper up $1.05 or +0.23% at $466.45

- Silver down $0.1 or -0.4% at $25.8024

- Platinum up $0.34 or +0.03% at $1071.93

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/03/2022 | 1330/0830 | ** |  | CA | Capacity Utilization |

| 11/03/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 11/03/2022 | 1330/0830 | * |  | CA | Household debt-to-disposable income |

| 11/03/2022 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 11/03/2022 | 1500/1000 | * |  | US | Services Revenues |

| 14/03/2022 | 0700/0800 | *** |  | SE | Inflation report |

| 14/03/2022 | 0745/0845 | * |  | FR | Foreign Trade |

| 14/03/2022 | 0745/0845 | * |  | FR | Current Account |

| 14/03/2022 | 1000/1100 | ** |  | EU | industrial production |

| 14/03/2022 | 1100/1200 |  | EU | ECB Elderson Speech at European Banking Institute | |

| 14/03/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 14/03/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.