-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - Crude Back Below $100/bbl

Highlights:

- Chinese equity rout continues, Shanghai Comp sheds another 5%

- Polish, Czech, Slovenian leaders head to Kyiv

- GBP/USD circling new multi-year lows

US TSYS SUMMARY: Treasuries Unwinding Monday's Steepening

- Cash Tsys have firmed almost since the open as they unwind some of yesterday’s large sell-off.

- With gains led by the front-end after the 2YY yesterday touched highs of 1.89% (highest since July 2019), the curve steepens slightly with 2s10s up 1.5bps to 28bps.

- 2YY -4.5bps at 1.816%, 5YY -3.3bps at 2.057%, 10YY -2.8bps at 2.106%, 30YY -2.4bps at 2.447%.

- TYM2 is 9 ticks higher at 125-03 on slightly above average volumes. It sits above an early intraday low of 124-18, which should form initial support after which it could open support at 124-15 (May 23, 2019 low cont). Resistance is eyed at 126-13+, Friday’s high.

- Data: PPI inflation for Feb (0830ET), Empire mfg for Mar (0830ET).

- No Tsy issuance

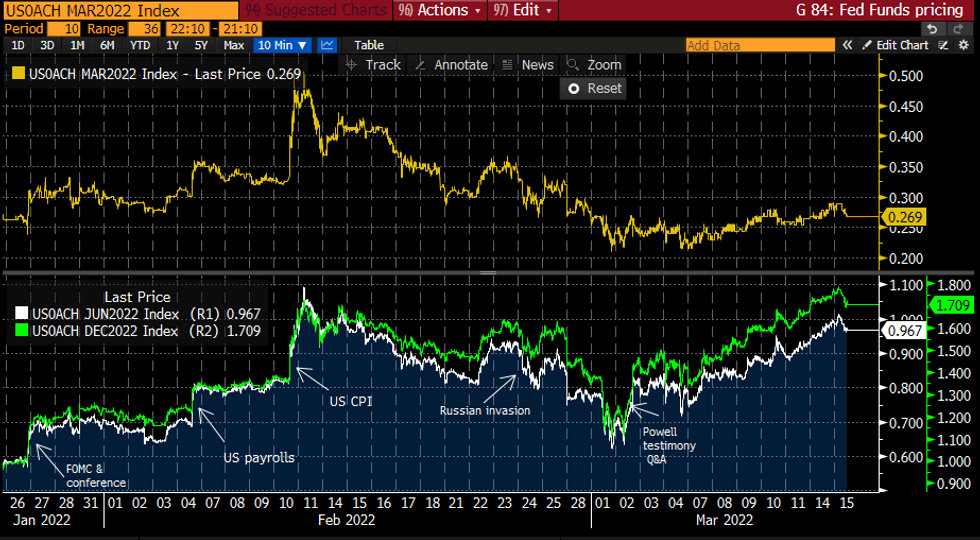

STIR FUTURES: Just Shy Of 7 Fed Hikes In 2022

- Hikes implied by Fed Funds futures have been trimmed modestly after yesterday’s steepening.

- After fully pricing 7 hikes in 2022 late yesterday for the first time, Dec’22 pricing dips to 171bps.

- The path remains somewhat front-loaded with a cumulative 97bps priced over the next three meetings, starting with 25bp liftoff tomorrow being seen as very likely (27bps).

- Data: PPI inflation for Feb (0830ET) will help finalise core PCE estimates for Mar 31 and Empire mfg for Mar (0830ET) offers the first look at US business sentiment following the beginning of the war in Ukraine after Germany’s ZEW investor survey has just tanked.

FOMC-dated Fed Funds futures cumulative hikes for specific meetingsSource: Bloomberg

FOMC-dated Fed Funds futures cumulative hikes for specific meetingsSource: Bloomberg

EUROPE ISSUANCE UPDATE:

- UK sells GBP1.20bln 0.125% Aug-31 linker, Avg yield 2.829% (Prev. -3.242%), Bid-to-cover 2.30x (Prev. 2.25x)

- Germany allots E4.403bln 0% Mar-24 Schatz, Avg yield -0.36% (Prev. -0.50%), Bid-to-cover 0.87x (Prev. 0.97x), Buba cover 1.08x (Prev. 1.20x)

FOREX: GBP/USD Circling New Multiyear Low

- The single currency trades well early Tuesday, rising against all others in G10 as EUR/USD extends the recovery off last week's lows. EUR/USD is now either side of the 1.10 handle, but will need to make progress through 1.1121 to secure any progress toward the 1.1257 50-dma.

- Market focus remains on the Ukraine crisis, with markets watching for the re-convening of regular negotiations between Russian and Ukrainian representatives after the technical break in talks yesterday. Separately, the Polish, Slovenian, Czech leaders are headed to Kyiv to meet with the Ukrainian President - a move that could lessen the military incursion on the city from the Russian side, in order to avoid directly endangering the leaders of NATO nations.

- Elsewhere, UK jobs data fared better than expected, with average weekly earnings growing ahead of forecast, alongside a lower-than-forecast ILO Unemployment Rate. GBP initially saw some support, tilting GBP/USD up to 1.3051 before the support faded through the European morning. This keeps the pair well within range of the overnight cycle lows, printed at 1.3000 - GBP/USD last traded below that mark in late 2020.

- Focus turns to the upcoming US PPI release, with markets expecting a Y/Y rise of 10% for producer prices - another series high. Germany's ZEW survey also crosses, as well as Canada's existing home sales/manufacturing sales data. ECB's Lagarde speaks, appearing at the WELT Economic Summit.

FX OPTIONS: Expiries for Mar15 NY Cut 1000ET (Source DTCC)

- EUR/USD: $1.1090-00(E1.1bln), $1.0933-43(E781mln), $1.1000-20(E616mln),$1.1100(E1.2bln)

- USD/JPY: Y115.50-70($850mln), Y116.00($1.6bln), Y117.25($545mln)

- AUD/USD: $0.7050(A$1.2bln)

- USD/CAD: C$1.2755-75($790mln)

- USD/CNY: Cny6.3000($740mln), Cny6.3200($525mln)

Price Signal Summary - Gold Extends Its Retracement

- In the equity space, the trend in the S&P E-Minis remains bearish. The contract continues to trade below the 20-day EMA that intersects at 4299.75. A clear break of this average is required to suggest scope for a stronger short-term recovery. On the downside, the bear trigger is unchanged at 4094.25, the Feb 24 low. EUROSTOXX 50 futures remain vulnerable and continue to trade below Friday’s high of 3827.00 and below the 20-day EMA, at 3810.30. The recent move higher has allowed an oversold condition to unwind. A break above the 20-day EMA is required to suggest potential for a stronger retracement. A reversal lower would refocus attention on key support and the bear trigger at 3380.00, the Mar 7 low.

- In FX, EURUSD is slightly firmer but remains below its key short-term resistance of 1.1121, the Jan 28 low, a recent breakout level plus last week’s high. The trend remains down and a resumption of weakness would open 1.0767 next, the May 7 2020 low. Clearance of 1.1121 is needed to suggest scope for a stronger short-term correction. GBPUSD has traded lower again today and touched 1.3000. A bearish theme remains intact and sights are on; 1.2954, the 1.764 projection of the Jan 13 - 27 - Feb 10 price swing and 1.2933, the Nov 5 2020 low. Last week’s key technical development in USDJPY was the break of resistance at 116.34/35, the Feb 10 / Jan 4 highs and a bull trigger. The break higher confirms a resumption of the broader uptrend and the rally has accelerated. The next objective is 118.60/66, the Jan 3 ‘17 and Dec 15 ‘16 highs. This zone also represents a key resistance.

- On the commodity front, the all-time high print in Gold of $2075.5 on Aug 7 2020, remains intact. The current bear cycle is allowing a recent overbought condition to unwind. The 20-day EMA has been breached and this opens $1901.5 next, the Mar 1 low. On the upside, an initial firm short-term resistance is seen at $2009.2, the Mar 10 high. Oil markets continue to correct lower. The move down in WTI is allowing the recent overbought trend condition to unwind. The 20-day EMA has been breached and this exposes the 50-day EMA, currently at $93.34. This EMA highlights a key area of support. Initial resistance is at $110.29, the Mar 11 high.

- In the FI space, Bund futures traded lower Monday and breached key support at 161.50, the Feb 10 low and a medium-term bear trigger. The break confirms a resumption of this year’s downtrend and opens the 160.00 handle. Gilts remain weak and attention is on the key support at 121.10, Feb 16 low. A break would open 120.00.

EQUITIES: Stocks Sink as Chinese Equities Extend Plunge

- Equity markets across Europe are uniformly lower, with the EuroStoxx50 off by close to 2% as sentiment remains shaky following late weakness on Wall Street Monday. Compounding concerns is the accelerated sell-off in Chinese markets, which prompted the Shanghai Composite to shed another 5% overnight, pushing the index to its lowest levels since mid-2020.

- Focus remains on the ongoing Ukraine conflict, with Russian representatives this morning cautioning against optimism in bilateral peace talks, stating that they while it is positive that talks are continuing, it is too early to discuss what the talks may lead to.

- As was the case for US stocks, cyclical stocks including consumer discretionary, energy and materials names are leading declines across Europe, with food and staples retailing the only subsector to trade higher so far.

- E-Mini S&P futures remain vulnerable. Key support lies at 4094.25, the Feb 24 low. A break of this level would confirm a resumption of the downtrend and expose the 4000.00 handle. The 20-day EMA, at 4299.75, still represents an important near-term resistance.

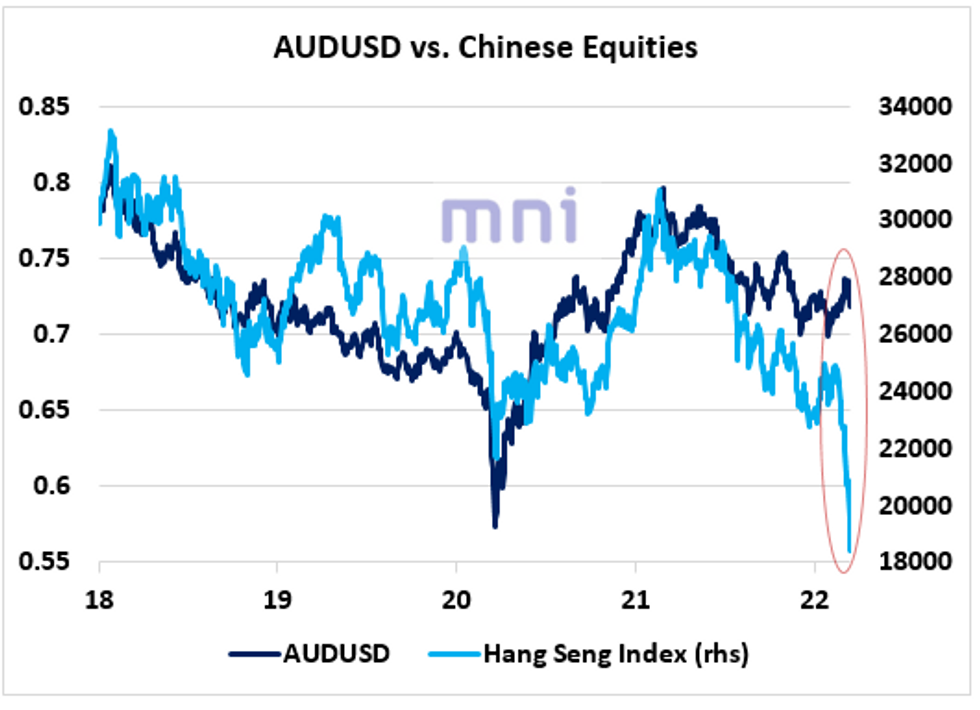

Aussie Remains ‘Strong’ Despite China Equities Free Fall

- One interesting development in recent weeks has been the significant divergence between Chinese equities, which keep constantly testing new lows amid Covid uncertainty and renewed crackdown fears, and ‘risk-pair’ AUDUSD, which has remained ‘strong’ despite surging price volatility.

- As China has been historically been one of the engines of Australia’s GDP growth and investment, the two times series have shown strong relationship in recent years (until recently).

- The H2 2021 AUD weakness has also been partly driven by the delay in policy normalization by the BA due to the renewed lockdown policies imposed by the government to stop the Delta variant crisis.

- The RBA left it policy unchanged at its March meeting (at 0.1%), in line with expectations; a hike this year remains ‘plausible’ according to Governor Lowe but the uncertainty remains elevated.

- However, this year’s Aussie strength has been partly attributed to the firm trend in commodity prices (AUD is also known as a commodity currency).

- Hence, investors have been questioning if the divergence can persist in the medium term as Chinese growth expectations keep being revised to the downside.

Source: Bloomberg/MNI

COMMODITIES: WTI Overbought Condition Now Fully Unwound

- Oil markets extend their move lower, putting the active WTI crude future back below the $100/bbl mark on the more positive noises emanating from Ukraine/Russia peace talks as well as the protracted drop in Chinese equity markets, with the Shanghai Composite shedding another 5% overnight.

- Oil options markets have suitably slipped, with the Brent market showing less upside price risk with lower liquidity. The Brent call-put skew has flattened over the last week suggesting the market is currently putting less upside price risk than last week. Implied Vol for 25D calls for May22 have fallen from 104 points back to around 74 points.

- The drop in prices has allowed the technically overbought condition evident in WTI to completely unwind - putting the RSI back below the 50 level:

WTI Crude Active Future vs. rolling RSI:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/03/2022 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 15/03/2022 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 15/03/2022 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 15/03/2022 | 1000/1100 | ** |  | EU | industrial production |

| 15/03/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 15/03/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 15/03/2022 | 1230/0830 | *** |  | US | PPI |

| 15/03/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/03/2022 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/03/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 15/03/2022 | 1300/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 15/03/2022 | 1515/1615 |  | EU | ECB Lagarde Speaks at WELT Economic Summit | |

| 15/03/2022 | 2000/1600 | ** |  | US | TICS |

| 16/03/2022 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 16/03/2022 | 0900/1000 |  | EU | ECB Panetta at Italian Banking Association Meeting | |

| 16/03/2022 | 0930/1030 |  | EU | ECB Elderson Panels Asia High-level Meeting | |

| 16/03/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 16/03/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 16/03/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 16/03/2022 | 1230/0830 | *** |  | CA | CPI |

| 16/03/2022 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 16/03/2022 | 1400/1000 | * |  | US | Business Inventories |

| 16/03/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 16/03/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 16/03/2022 | 1800/1400 | *** |  | US | FOMC Statement |

| 17/03/2022 | 2145/1045 | *** |  | NZ | GDP |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.