-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Stocks Moderate as Focus Turns to Xi-Biden Call

Highlights:

- Stocks moderate, but close to recent highs

- Treasury curve modestly bull flatter

- Markets watch Xi-Biden call, first post-meeting Fedspeak

US TSYS SUMMARY: Modest Bull Flattening With Wide Range Of Fed Speakers Ahead

Treasuries are a little stronger early Friday as equities pause for breath after a big bounce. Though the Tsy curve is bull flattening, the short-end yield move is perhaps most noteworthy, nearly fully retracing the Fed decision sell-off.

- The 2-Yr yield is down 1.9bps at 1.8948%, 5-Yr is down 2.8bps at 2.1158%, 10-Yr is down 2.8bps at 2.1423%, and 30-Yr is down 3.2bps at 2.4369%.

- Fed Gov Waller is due to kick off post-FOMC participant commentary with an appearance on CNBC (0830ET show, appearing around 0845ET).

- While he's decidedly hawkish, we get the biggest FOMC dove, Minn's Kashkari, at 1200ET; somewhere in between on the hawk-dove spectrum are Richmond's Barkin at 1320ET and Gov Bowman at 1400ET.

- Also of note, Biden and China's Xi to hold a call at some point today.

- No supply and a fairly limited data slate, with 1000ET bringing Feb existing home sales at and the Feb Conf Board US Leading Index.

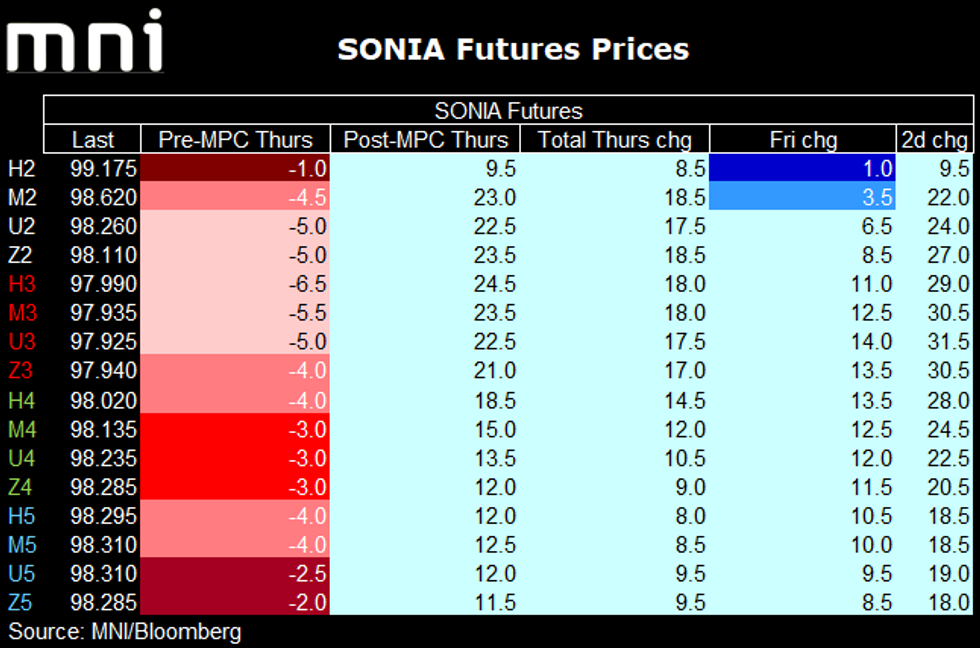

SONIA: Futures continue to move higher

- SONIA futures continue their repricing following yesterday's dovish MPC meeting.

- We have seen Reds move up to 14 ticks higher today, making cumulative moves of over 30 ticks since Wednesday's close.

- We still think that there is more scope for the rally to continue.

- We think the BoE's reaction function is transitioning from being solely concerned with inflation expectations to also taking into account medium-term growth expectations. This is partly a function of rates moving closer to neutral, and partly as the growth/inflation trade-off continues to worsen.

- Markets are still pricing in 32bp for May, 97bp by September and 116bp by year-end.

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXJ2 165.50c, bought for 2.5 in 5.1k

RXM2 164.5/158.5ps 1x2 sold the 1 at 214 in 8k, done vs 1.6k futures at 161.18 (unwind shorts)

RXM2 165.00/156.00ps 1x2.25, sold at 357 in 4k (4k x 9k)

ERU2 99.75/100.00/100.25 1x2x0.5c fly Bought for 1.5 3k

ERZ2 99.875^, bought for 43 in 5k

FOREX: JPY Under Early Pressure

- Markets are extending the risk-on move posted since Wednesday's Fed rate decision, resulting in JPY being the poorest performer in G10 so far Friday. This keeps USD/JPY upside under pressure with the cycle highs of 119.12 in view. A break above here opens levels not seen since early 2016.

- Russia-Ukraine tensions remain front and centre, with Russia's President Putin speaking with the German Chancellor this morning, noting the Ukrainian demands in peace talks as "unrealistic". Putin speaks with Macron later in the day.

- CHF and CAD outperform, while the greenback trades more mixed. The EUR retraces a part of recent impressive gains, but the bias remains for further corrective rallies.

- Focus turns to any outcomes from today's meeting between US President Biden and his Chinese counterpart Xi - who are due to discuss Sino-US relations and, inevitably, the ongoing Ukraine crisis. On the data front, Canadian retail sales and US existing home sales are the focus.

- Fed speakers will also draw attention, with Kashkari, Barkin and Bowman the first FOMC members to comment since Powell's press conference on Wednesday.

FX OPTIONS: Expiries for Mar18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0945-50(E673mln), $1.1000-10($516mln), $1.1100-10(E1.3bln), $1.1200(E618mln)

- USD/JPY: Y116.90-00($1.6bln), Y117.50($520mln), Y119.00($505mln)

- EUR/GBP: Gbp0.8445-50(E850mln), Gbp0.8500(E679mln)

- USD/CNY: Cny6.3290($530mln), Cny6.3500($600mln)

Price Signal Summary - S&P E-Minis Arrive At The 50-DAY EMA

- A firmer week so far in the equity space. S&P E-Minis traded higher again Thursday and has arrived at the 50-day EMA that intersects at 4397.99 - a key resistance area. A clear break of this average would strengthen the current bull cycle and open 4500.00. A strong reversal from current levels would instead be seen as a bearish signal. EUROSTOXX 50 futures traded higher Wednesday and this resulted in a break of the 20-day EMA. The move higher has exposed the 50-day EMA, at 3961.00. The average is a key resistance.

- In FX, EURUSD traded higher yesterday, building on the week’s gains. The pair has probed key resistance at 1.1121, the Jan 28 low. A clear break would signal potential for an extension higher near-term. This would open 1.1187, the 2.0% 10-dma envelope as well as the 50-day EMA of 1.1199. A failure to hold onto gains at the 1.1121 handle would instead highlight a bearish threat. GBPUSD remains in a downtrend and this week’s gains are considered corrective. A resumption of weakness would open; 1.2954, the 1.764 projection of the Jan 13 - 27 - Feb 10 price swing and 1.2933, the Nov 5 2020 low. Resistance is seen at 1.3240, 20-day EMA. USDJPY remains bullish following this week’s breach of resistance at 118.60/66, the Jan 3 ‘17 and Dec 15 ‘16 highs. This has strengthened bullish conditions and opens 119.18 next - the 3.236 projection of the Feb 24 - Mar 3 - 4 price swing. Further out, 120.00 beckons.

- On the commodity front, Gold is off its recent lows. Short-term conditions remain bearish though following the recent pullback from $2070.4, Mar 8 high. The 20-day EMA has been breached exposing $1891.3 next, the 50-day EMA. The broader trend condition is bullish though and the recent pullback is considered corrective. Initial resistance is at $1954.7, the Mar 15 high. Oil markets have recovered from recent lows. WTI is trading above Tuesday's low of $93.53. The recent recovery means the 50-day EMA, at $93.89, remains intact. A continuation higher would open $110.29, the Mar 11 high. A break of this level would signal scope for a stronger short-term rally. On the downside, clearance of the 50-day EMA would instead reinstate the recent bearish theme.

- In the FI space, Bund futures are consolidating but maintain a bearish tone. This week’s price action has resulted in a break of key support at 161.50, the Feb 10 low and a medium-term bear trigger. The break confirms a resumption of this year’s downtrend and opens the 160.00 handle. Gilts Wednesday probed the key support at 121.10, Feb 16 low. A clear break would open 120.00 and confirm a resumption of the broader downtrend. Resistance is seen at 123.52, the Mar 9 high. Gains are considered corrective.

EQUITIES: Modest Retracement

- Asian markets closed mostly higher (though the Hang Seng gave back a modest portion of recent outsized gains): Japan's NIKKEI closed up 174.54 pts or +0.65% at 26827.43 and the TOPIX ended 10.26 pts higher or +0.54% at 1909.27. China's SHANGHAI closed up 36.029 pts or +1.12% at 3251.073 and the HANG SENG ended 88.83 pts lower or -0.41% at 21412.4

- European equities are a little weaker, with the German Dax down 77.88 pts or -0.54% at 14399.02, FTSE 100 down 9.5 pts or -0.13% at 7385.34, CAC 40 down 31.9 pts or -0.48% at 6612.52 and Euro Stoxx 50 down 11.5 pts or -0.3% at 3889.93.

- U.S. futures are pointing lower as well, with the Dow Jones mini down 171 pts or -0.5% at 34290, S&P 500 mini down 26.25 pts or -0.6% at 4384, NASDAQ mini down 91.75 pts or -0.65% at 14020.

RTRS: OPEC+ Compliance w/ Cuts Up To 136% In Feb From 129% In Jan-Sources

Reuters reporting that according to two unnamed OPEC sources, OPEC+ complaince with production cuts was up to 136% in February, from 129% in January.

- Comes as AFP reports that the International Energy Agency (IEA) head says that he hopes oil-producing nations will step in at next OPEC+ meeting to 'relieve the strain' on oil markets.

- Earlier this week, UK PM Boris Johnson travelled to the UAE and Saudi Arabia in an effort to convince both countries to raise output and ease the major price pressures affecting Europe. These efforts were summarily rebuffed.

COMMODITIES: Oil Continues To Gain Ground Above $100

- WTI Crude up $1.58 or +1.53% at $104.37

- Natural Gas down $0.14 or -2.83% at $4.836

- Gold spot down $9.31 or -0.48% at $1932.9

- Copper up $0.2 or +0.04% at $471.75

- Silver down $0.11 or -0.42% at $25.3084

- Platinum up $7.19 or +0.7% at $1029.69

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/03/2022 | 1000/1100 | * |  | EU | Trade Balance |

| 18/03/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 18/03/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 18/03/2022 | 1720/1320 |  | US | Richmond Fed's Tom Barkin | |

| 18/03/2022 | 1800/1400 |  | US | Chicago Fed's Charles Evans | |

| 18/03/2022 | 1800/1400 |  | US | Fed Governor Michelle Bowman | |

| 21/03/2022 | 0300/1100 |  | CN | PBOC LPR decision | |

| 21/03/2022 | 0700/0800 | ** |  | DE | PPI |

| 21/03/2022 | 0730/0830 |  | EU | ECB Lagarde at Institut Montaigne Event | |

| 21/03/2022 | 1000/1100 | ** |  | EU | Construction Production |

| 21/03/2022 | 1200/0800 |  | US | Atlanta Fed's Raphael Bostic | |

| 21/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 21/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 21/03/2022 | 1600/1200 |  | US | Fed Chair Jerome Powell | |

| 21/03/2022 | 1600/1200 |  | US | Richmond Fed's Tom Barkin | |

| 22/03/2022 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 22/03/2022 | 0730/0830 |  | EU | ECB de Guindos in Panel at Money Review Banking Summit | |

| 22/03/2022 | 0900/1000 | ** |  | EU | EZ Current Acc |

| 22/03/2022 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/03/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 22/03/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/03/2022 | 1300/1400 |  | EU | ECB Panetta Opening CCP Risk Management Conference | |

| 22/03/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 22/03/2022 | 1515/1515 |  | UK | BOE Cunliffe Panels BIS Innovation Summit | |

| 22/03/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 22/03/2022 | 1730/1830 |  | EU | ECB Lane Panels Discussion on Flexible Exchange Rates | |

| 22/03/2022 | 1800/1400 |  | US | San Francisco Fed's Mary Daly | |

| 22/03/2022 | 2100/1700 |  | US | Cleveland Fed's Loretta Mester | |

| 23/03/2022 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 23/03/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 23/03/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 23/03/2022 | 1100/0700 |  | US | Fed Chair Jerome Powell | |

| 23/03/2022 | - |  | UK | OBR Economic and Fiscal Forecast | |

| 23/03/2022 | - |  | UK | DMO 2022-23 Financing Remit | |

| 23/03/2022 | 1200/1200 |  | UK | BOE Bailey Panels BIS Innovation Summit | |

| 23/03/2022 | 1230/1230 |  | UK | FY 2022/23 Budget statement | |

| 23/03/2022 | 1315/1415 |  | EU | ECB Lagarde Speech at BIS Innovation Summit | |

| 23/03/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 23/03/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 23/03/2022 | 1435/1035 |  | US | New York Fed's John Williams | |

| 23/03/2022 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/03/2022 | 1530/1530 |  | UK | DMO Quarterly Consultation Meetings Agenda | |

| 23/03/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 23/03/2022 | 1545/1145 |  | US | San Francisco Fed's Mary Daly | |

| 23/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 23/03/2022 | 1900/1500 |  | US | St. Louis Fed's James Bullard | |

| 24/03/2022 | 2200/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 24/03/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 23/03/2022 | 0105/2105 |  | US | St. Louis Fed's James Bullard | |

| 24/03/2022 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 24/03/2022 | 0815/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/03/2022 | 0815/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/03/2022 | 0830/0930 |  | CH | SNB interest rate decision | |

| 24/03/2022 | 0830/0930 | *** |  | CH | SNB policy decision |

| 24/03/2022 | 0830/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/03/2022 | 0830/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/03/2022 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 24/03/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 24/03/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 24/03/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 24/03/2022 | 0930/1030 |  | EU | ECB Elderson at IIEA Webinar | |

| 24/03/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 24/03/2022 | - |  | EU | ECB Lagarde at European Council Meeting | |

| 24/03/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 24/03/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 24/03/2022 | 1230/0830 | * |  | US | Current Account Balance |

| 24/03/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/03/2022 | 1300/1300 |  | UK | BOE Mann Panels Institute of International Finance event | |

| 24/03/2022 | 1300/1400 |  | EU | ECB Elderson in Panel at LSE | |

| 24/03/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/03/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/03/2022 | 1350/0950 |  | US | Chicago Fed's Charles Evans | |

| 24/03/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 24/03/2022 | 1500/1100 |  | US | Atlanta Fed's Raphael Bostic | |

| 24/03/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 24/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 24/03/2022 | 1900/1500 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.