-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessChicago Business Barometer™ - Eased To 40.2 In November

Chicago Business Barometer™ - Eased To 40.2 In November

MNI POLITICAL RISK - GOP Facing One Seat Majority In House

MNI US MARKETS ANALYSIS - USD/JPY Erases Election Rally

MNI US OPEN: Equities Hold Recent Gains As Oil Jumps

EXECUTIVE SUMMARY:

- KREMLIN: NO BREAKTHROUGH YET IN UKRAINE NEGOTIATIONS

- ECB'S LAGARDE: NOT SEEING ELEMENTS OF STAGFLATION NOW

- BOEING 737 CRASHES WITH 133 ON BOARD IN CHINA

- LME NICKEL DROPS BY 15% EXCHANGE LIMIT AT OPENING

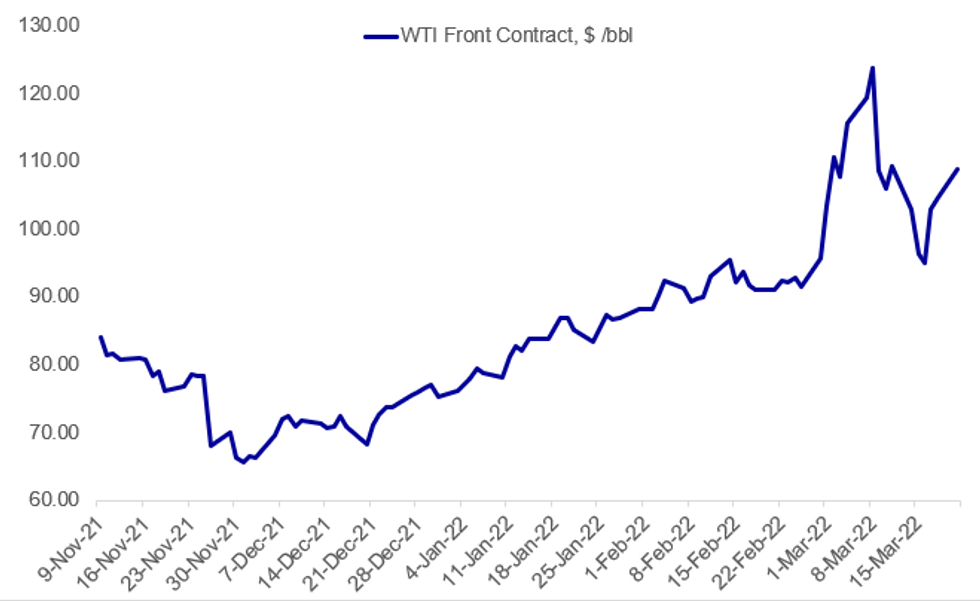

Fig. 1: Oil Bid Resumes

Source: BBG, MNI

Source: BBG, MNI

NEWS:

RUSSIA-UKRAINE (RTRS): The Kremlin said on Monday that peace talks between Moscow and Kyiv had yet to yield any major breakthroughs and called on countries that can exert influence over Ukraine to use their clout to make Kyiv more constructive at the negotiations. Speaking to reporters on a conference call, Kremlin spokesperson Dmitry Peskov said significant progress in the talks still had to be made for there to be a basis for a possible meeting between President Vladimir Putin and his Ukrainian counterpart Volodymyr Zelenskiy.

ECB (BBG): “We are not seeing elements of stagnation now,” European Central Bank President Christine Lagarde says at an ‘Institut Montaigne’ conference in Paris. Lagarde says energy, supply bottlenecks and food are driving short-term inflation. On green transition: “Hawks and doves agree that in the first stage it will be rather inflationary. But in the longer term, forces weighing on prices will be more deflationary”.

BOEING/CHINA/AVIATION (BRISBANE TIMES): A China Eastern Airlines plane with 132 people on board crashed in mountains in south China on Monday while on a flight from the city of Kunming to Guangzhou, China's Civil Aviation Administration of China (CAAC) said.The jet involved in the accident was a Boeing 737 aircraft and the number of casualties was not immediately known, state broadcaster CCTV said. Rescue was on its way, it said.The flight that crashed appeared to be Flight No. MU5735 from Kunming to Guangzhou, according to data from flight-tracking website FlightRadar24. There was no word on the cause of the crash of the plane, a 6-year-old 737-800 aircraft, according to the flight tracking website.

NICKEL / LME (BBG): Nickel fell by the daily limit for a fourth straight session on the London Metal Exchange as prices continue to nosedive after spiking earlier this month in an unprecedented short squeeze.Futures fell by 15% to $31,380 a ton. in the biggest drop since 2015. That’s within reach of prices on the Shanghai Futures Exchange, and close to the $30,000 level that some traders have said would draw in buyers and allow the nickel market to start trading again in earnest.

FED / NABE: The Federal Reserve is seen raising the federal funds rate gradually while likely to remain below 3% through 2023, according to respondents in a National Association of Business Economics survey published on Monday. In the NABE survey with 234 responses showing a record high 77% saying current U.S. monetary policy is too stimulative, over 40% of the panelists anticipated the Fed will raise rates above 2% by year-end 2023 and over half said rates will breach 2% by year-end 2024. Only 9% expect rates to go above 3% by the end of next year and 17% by the end of 2024. A growing number of current and former Fed officials see the fed funds rate moving above neutral, with St. Louis Fed President James Bullard recommending a policy rate above 3% this year.

EUROZONE/ECB: The labour market continues to recover across the euro area, even as pandemic-era 'discouraged workers' return to the workforce, the European Central Bank's latest Economic Bulletin notes, citing the updated Consumer Expectations Survey. Through 2021, the total number of workers in the labour force increased, accompanied by both a decline in discouragement and a decrease in the unemployment rate. Labour supply has, therefore, the ECB says, responded quickly to the strengthening of demand.

ITALY / RUSSIA / ENERGY (BBG): Enel SpA, Italy’s largest utility, will exit from its Russia operations in a matter of months, Chief Executive Officer Francesco Staracesaid on Monday. “We are on the process of selling thermal generation, this is a process we had time ago,” Starace said in a Bloomberg TV interview with Francine Lacqua. “With regret, I think we have to fold.”

DATA:

MNI: GERMANY FEB PPI +1.4% M/M, +25.9% Y/Y, JAN +25.0% Y/Y

German PPI Softer than Forecasts, Capital Goods See 40-Year High

FEB PPI +1.4% M/M, +25.9% Y/Y, JAN +25.0% Y/Y

- German PPI rose again for the 15th consecutive month in February, up 25.9% y/y in the January print.

- This is up 0.9pp from January, albeit a slightly softer acceleration than the consensus expected (+26.2% y/y).

- On the month, factory-gate inflation also rose less than projected, by 1.4% m/m (expected: +1.7% m/m). This is a slowdown from +2.2% m/m recorded in January.

- Energy prices remain the key driving factor, up +68.0% y/y and +2.2% m/m in February, with natural gas up +125.4% y/y, electricity up +66.5% y/y and mineral oils up +34.5% y/y.

- Intermediate goods saw a +21.0% y/y increase in February (+1.4% m/m), whilst capital goods saw an over 40-year high of +5.5% y/y, due to soaring machine and vehicle prices.

- This data does not yet incorporate the effects of the Russian invasion of Ukraine as the survey period ended mid-February.

FIXED INCOME: Oil driving FI lower amid light volumes

Core fixed income has been grinding lower this morning, against a backdrop of higher oil prices and mixed equity markets. There is very little liquidity at present but it does seem as though the moves are being driven by oil markets this morning with STIR futures are lower.

- In the 10-year spce, gilts are the underperformers with yields up around 5bp (following the rally at the back-end of last week) with UST and Bund yields up around 4bp. All three futures contracts remain above Thursday's lows.

- The US has seen the biggest move at the front-end with 2-year yields up 5.0bp against 3.2bp for 2-year gilts and 2.2bp for Schatz.

- This has led to the US curve bear flattening but German and gilt curves bear steepening.

- Today sees a relatively light calendar but speeches from Fed's Powell and Bostic.

- TY1 futures are down -0-13+ today at 124-07 with 10y UST yields up 4.1bp at 2.193% and 2y yields up 5.0bp at 1.989%.

- Bund futures are down -0.58 today at 160.79 with 10y Bund yields up 3.7bp at 0.407% and Schatz yields up 2.2bp at -0.328%.

- Gilt futures are down -0.60 today at 122.03 with 10y yields up 5.0bp at 1.545% and 2y yields up 3.2bp at 1.230%.

FOREX: Markets Pick Up Where They Left Off

- Equities and risk sentiment are mixed early Monday, but have generally picked up where they left off on late on the Friday session, with the e-mini S&P holding just below the 4450 mark and 10y Treasury yields just below 2.2%.

- This has translated to a generally stable European morning for currency markets, with the greenback mixed-to-flat, while commodity-tied currencies edge lower - in contrast with oil prices which are extending their three-day winning streak. As such, AUD and NZD are the poorest performers in G10 - but losses are marginal and markets are awaiting a pick-up in volumes and activity after the Japanese market holiday on Monday.

- The Ukrainian crisis continues to provide the market backdrop, with a Russian ultimatum delivered to the port city of Mariupol firmly rejected by Ukrainian forces - leaving focus on what the next steps of the Russian siege of the city could entail. President Biden is due to hold pre-trip discussions with European leaders in the coming days before his visit to the continent later in the week.

- The data slate is typically light for a Monday, with just the Chicago Fed National Activity Index on the docket. This should keep focus on the speaker slate, with Fed's Bostic and ECB's Nagel both due ahead of an appearance from Chair Powell at the NABE at 1600GMT/1200ET.

EQUITIES: US Futures Soft But Holding Most Of Friday's Gains

- In Asia, Japanese markets were closed for holidays; China / HK stocks closed mixed/lower: China's SHANGHAI closed up 2.613 pts or +0.08% at 3253.686 and the HANG SENG ended 191.06 pts lower or -0.89% at 21221.34

- European equities are fairly flat, with the German Dax up 3.23 pts or +0.02% at 14414.69, FTSE 100 up 34.33 pts or +0.46% at 7437.52, CAC 40 up 0.7 pts or +0.01% at 6617.99 and Euro Stoxx 50 up 3.15 pts or +0.08% at 3905.55.

- U.S. futures are off slightly, with the Dow Jones mini down 78 pts or -0.23% at 34555, S&P 500 mini down 3.75 pts or -0.08% at 4449.75, NASDAQ mini down 46.25 pts or -0.32% at 14367.25.

COMMODITIES: Oil Bounce Continues On Continued Supply Fears

- WTI Crude up $4.18 or +3.99% at $108.88

- Natural Gas up $0.07 or +1.52% at $4.937

- Gold spot up $1.79 or +0.09% at $1923.55

- Copper down $4.85 or -1.02% at $469.15

- Silver up $0.03 or +0.14% at $25.0019

- Platinum up $9.93 or +0.97% at $1037.5

MNI: GERMANY FEB PPI +1.4% M/M, +25.9% Y/Y, JAN +25.0% Y/Y

German PPI Softer than Forecasts, Capital Goods See 40-Year High

FEB PPI +1.4% M/M, +25.9% Y/Y, JAN +25.0% Y/Y

- German PPI rose again for the 15th consecutive month in February, up 25.9% y/y in the January print.

- This is up 0.9pp from January, albeit a slightly softer acceleration than the consensus expected (+26.2% y/y).

- On the month, factory-gate inflation also rose less than projected, by 1.4% m/m (expected: +1.7% m/m). This is a slowdown from +2.2% m/m recorded in January.

- Energy prices remain the key driving factor, up +68.0% y/y and +2.2% m/m in February, with natural gas up +125.4% y/y, electricity up +66.5% y/y and mineral oils up +34.5% y/y.

- Intermediate goods saw a +21.0% y/y increase in February (+1.4% m/m), whilst capital goods saw an over 40-year high of +5.5% y/y, due to soaring machine and vehicle prices.

- This data does not yet incorporate the effects of the Russian invasion of Ukraine as the survey period ended mid-February.

FIXED INCOME: Oil driving FI lower amid light volumes

Core fixed income has been grinding lower this morning, against a backdrop of higher oil prices and mixed equity markets. There is very little liquidity at present but it does seem as though the moves are being driven by oil markets this morning with STIR futures are lower.

- In the 10-year spce, gilts are the underperformers with yields up around 5bp (following the rally at the back-end of last week) with UST and Bund yields up around 4bp. All three futures contracts remain above Thursday's lows.

- The US has seen the biggest move at the front-end with 2-year yields up 5.0bp against 3.2bp for 2-year gilts and 2.2bp for Schatz.

- This has led to the US curve bear flattening but German and gilt curves bear steepening.

- Today sees a relatively light calendar but speeches from Fed's Powell and Bostic.

- TY1 futures are down -0-13+ today at 124-07 with 10y UST yields up 4.1bp at 2.193% and 2y yields up 5.0bp at 1.989%.

- Bund futures are down -0.58 today at 160.79 with 10y Bund yields up 3.7bp at 0.407% and Schatz yields up 2.2bp at -0.328%.

- Gilt futures are down -0.60 today at 122.03 with 10y yields up 5.0bp at 1.545% and 2y yields up 3.2bp at 1.230%.

FOREX: Markets Pick Up Where They Left Off

- Equities and risk sentiment are mixed early Monday, but have generally picked up where they left off on late on the Friday session, with the e-mini S&P holding just below the 4450 mark and 10y Treasury yields just below 2.2%.

- This has translated to a generally stable European morning for currency markets, with the greenback mixed-to-flat, while commodity-tied currencies edge lower - in contrast with oil prices which are extending their three-day winning streak. As such, AUD and NZD are the poorest performers in G10 - but losses are marginal and markets are awaiting a pick-up in volumes and activity after the Japanese market holiday on Monday.

- The Ukrainian crisis continues to provide the market backdrop, with a Russian ultimatum delivered to the port city of Mariupol firmly rejected by Ukrainian forces - leaving focus on what the next steps of the Russian siege of the city could entail. President Biden is due to hold pre-trip discussions with European leaders in the coming days before his visit to the continent later in the week.

- The data slate is typically light for a Monday, with just the Chicago Fed National Activity Index on the docket. This should keep focus on the speaker slate, with Fed's Bostic and ECB's Nagel both due ahead of an appearance from Chair Powell at the NABE at 1600GMT/1200ET.

EQUITIES: US Futures Soft But Holding Most Of Friday's Gains

- In Asia, Japanese markets were closed for holidays; China / HK stocks closed mixed/lower: China's SHANGHAI closed up 2.613 pts or +0.08% at 3253.686 and the HANG SENG ended 191.06 pts lower or -0.89% at 21221.34

- European equities are fairly flat, with the German Dax up 3.23 pts or +0.02% at 14414.69, FTSE 100 up 34.33 pts or +0.46% at 7437.52, CAC 40 up 0.7 pts or +0.01% at 6617.99 and Euro Stoxx 50 up 3.15 pts or +0.08% at 3905.55.

- U.S. futures are off slightly, with the Dow Jones mini down 78 pts or -0.23% at 34555, S&P 500 mini down 3.75 pts or -0.08% at 4449.75, NASDAQ mini down 46.25 pts or -0.32% at 14367.25.

COMMODITIES: Oil Bounce Continues On Continued Supply Fears

- WTI Crude up $4.18 or +3.99% at $108.88

- Natural Gas up $0.07 or +1.52% at $4.937

- Gold spot up $1.79 or +0.09% at $1923.55

- Copper down $4.85 or -1.02% at $469.15

- Silver up $0.03 or +0.14% at $25.0019

- Platinum up $9.93 or +0.97% at $1037.5

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/03/2022 | 1200/0800 |  | US | Atlanta Fed's Raphael Bostic | |

| 21/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 21/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 21/03/2022 | 1600/1200 |  | US | Fed Chair Jerome Powell | |

| 21/03/2022 | 1600/1200 |  | US | Richmond Fed's Tom Barkin | |

| 22/03/2022 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 22/03/2022 | 0730/0830 |  | EU | ECB de Guindos in Panel at Money Review Banking Summit | |

| 22/03/2022 | 0900/1000 | ** |  | EU | EZ Current Acc |

| 22/03/2022 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/03/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 22/03/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/03/2022 | 1300/1400 |  | EU | ECB Panetta Opening CCP Risk Management Conference | |

| 22/03/2022 | 1315/1415 |  | EU | ECB Lagarde Speech at BIS Innovation Summit | |

| 22/03/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 22/03/2022 | 1515/1515 |  | UK | BOE Cunliffe Panels BIS Innovation Summit | |

| 22/03/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 22/03/2022 | 1700/1800 |  | EU | ECB Lane Panels Discussion on Flexible Exchange Rates | |

| 22/03/2022 | 1800/1400 |  | US | San Francisco Fed's Mary Daly | |

| 22/03/2022 | 2100/1700 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.