-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Europe Sentiment Slumps, But US Gas Deal Agreed

EXECUTIVE SUMMARY:

- U.S., EU REACH ENERGY SUPPLY DEAL TO CUT DEPENDENCE ON RUSSIA

- GERMANY PLANS TO BE ALMOST INDEPENDENT FROM RUSSIAN GAS MID-'24

- UK FEB RETAIL SALES SLUMP, BELOW ANALYST FORECASTS

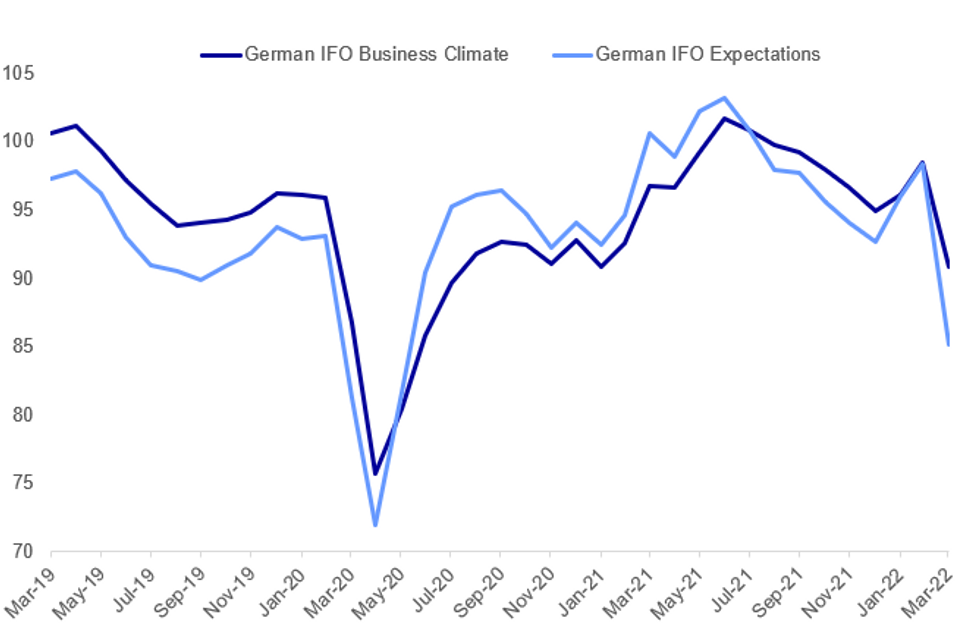

- GERMAN BUSINESS CONFIDENCE PLUNGES ON UKRAINE WAR REPERCUSSIONS

Fig. 1: German Business Confidence Drops Sharply In March

Source: IFO, MNI

Source: IFO, MNI

NEWS:

US / EU / ENERGY / RUSSIA (BBG): A political deal between President Joe Biden and the European Union will pave the way for additional imports of liquefied natural gas from the U.S. to help the bloc replace Russian imports of the fuel, a senior EU official said. Biden, who joined EU leaders at a summit in a bid to showcase a common resolve against the Russian invasion of Ukraine, will announce the agreement together with European Commission President Ursula von der Leyen on Friday morning, according to the official. LNG imports from Russia, the EU’s biggest energy supplier, stood at around 14 billion to 18 billion cubic meters annually in the past years. “We are taking further, concrete steps in our energy cooperation to ensure the security of supply and to reduce dependence on Russian fossil fuels,” Biden and von der Leyen said in a joint statement late on Thursday in Brussels.

GERMANY / ENERGY (BBG): Germany is aiming to almost completely halt imports of Russian gas by the middle of 2024 after broadly ending purchases of the nation’s oil and coal already this year. “In recent weeks, we have made intensive efforts together with all relevant players to import fewer fossil fuels from Russia and to put supply on a broader footing,” Economy Minister Robert Habeck said Friday in an emailed statement. “The first important milestones have been reached in order to free ourselves from the grip of Russian imports,” he added.

GERMAN IFO (BBG): German business confidence plunged to the lowest level since the early months of the pandemic after Russia’s invasion of Ukraine clouded the outlook and caused energy prices to soar. A business-expectations gauge compiled by the Munich-based Ifo Institute fell to 85.1 in March -- more than all but one of 27 economists predicted in a Bloomberg survey and the worst reading since May 2020.Separate data this week from the European Commission showed a similar slump in consumer sentiment across the 19-member euro zone. “Sentiment in the German economy has collapsed,” Ifo President Clemens Fuest said Friday in a statement. “Companies in Germany are expecting tough times.”

ITALY CONFIDENCE (BBG): Confidence among Italian businesses and consumers fell sharply on concerns about the economic consequences of Russia’s invasion of Ukraine. The economic sentiment index fell to 105.4 in March from a revised 107.9 in February, statistics office Istat said Friday. Measures of consumer and manufacturing confidence both declined, with the former reaching its lowest level since January 2021.Finance Minister Daniele Franco said this week that Italy’s economic growth is set for a potentially significant downgrade because of the war, which is adding to energy-price inflation and supply disruptions. The European Commission currently forecasts expansion this year of 4.1%.

U.S.-E.U./TECH (DJ): The U.S. and the European Union reached a preliminary deal on controlling how digital data moves between their two markets, European Commission President Ursula von der Leyen said Friday. The deal, if concluded, could resolve one of the thorniest outstanding issues between the two economic giants and assuage concerns of companies with operations on both sides of the Atlantic. An earlier deal regulating trans-Atlantic data flows was deemed illegal by the EU's top court in 2020.Officials and observers on both sides of the Atlantic expect any new deal to be challenged in court again.

JAPAN: Japan's government upgraded its assessment on corporate profits for the first time since August 2021, but left its main economic assessment mostly unchanged from the previous month, though it voiced concern on the impact of pandemic curbs, the Cabinet Office said on Friday.

DATA:

MNI: UK FEB RETAIL SALES -0.3% M/M, +7% Y/Y

MNI BRIEF: UK Feb Retail Sales Slump, Below Analysts Forecasts

UK retail sales slumped by 0.3% in February, falling well short of the 0.6% gain predicted by City analysts, with food sales remaining weak, the Office for National Statistics said Friday.

Supermarket sales declined by 0.2% last month, extending a 1.6% plunge in January, the fourth straight decline. That takes food sales 0.1% below pre-pandemic levels. The ONS noted falls in alcohol and tobacco sales, suggesting more people are now eating and drinking outside the home.

Non-food sales rose by 0.6%, lifted by a 13.2% surge in clothing sales, as consumers return to offices and grow more comfortable socialising. Department store sales increased by 1.3%. However, household goods sales declined by 2.5%, while other store sales fell by 7.0%. Petrol sales rose by 3.6%, taking transactions 0.9% above pre-pandemic levels for the first time since February of 2020. The survey period ran through Feb 26, the ONS said.

MNI: SPAIN FEB PPI +1.9% M/M, +40.7% Y/Y, JAN +35.7% Y/Y

Spanish PPI Jumps to New High

SPAIN FEB PPI +1.9% M/M, +40.7% Y/Y, JAN +35.7% Y/Y

- Spanish factory-gate inflation jumped five points to +40.7% y/y in February's PPI print.

- This is the highest seen in the series which began in 1976.

- The key upwards driver remains energy, as core PPI rose a more modest 0.1pp to 12.2% y/y in February.

- Energy prices more than doubled to +114.4% y/y in February, an increase of over 23pp on January, as prices for production, transportation and distribution of energy soared.

- Consumer goods were up +6.9% y/y followed by capital goods by +4.6% y/y due to increased automotive costs

Source: INE

SPAIN Q4 FINAL GDP +2.2r% Q/Q SA, +5.5r% Y/Y

ITALY ISTAT MAR CONSUMER CONFIDENCE INDEX 100.8 VS FEB 112.4

- ITALY ISTAT: MAR CONSUMER FUTURE OUTLOOK 93.5 VS FEB 116.6

- ITALY MAR SA BUSINESS SENTIMENT INDICATOR 105.4 VS FEB 107.9

- ITALY MAR SA MANUFACTURING MORALE 110.3 VS FEB 112.9

FIXED INCOME: Moving mildly higher

Core fixed income is drifting higher this morning with gilts the outperformers. Indeed, Treasuries and Bunds remain within yesterday's ranges at the time of writing but gilts have broken above to the highest levels since Monday.

- There's not a huge amount of headline drivers for the price action. UK retail sales were a bit weaker than expected while Spanish PPI was at its higher level since the series began in 1976.

- The main headline of the day has been the announcement that the EU and US have agreed a deal to import 15BCM of LNG in 2022 to reduce the EU's reliance on German imports. However, this still leaves the EU hugely reliant upon Russian imports, so hurts Russia a little but doesn't really change the narrative.

- Looking ahead we are due to hear from Fed's Williams, Barkin and Waller as well as Bank of Canada's Kozicki.

- TY1 futures are down -0-1 today at 122-28+ with 10y UST yields down -3.3bp at 2.341% and 2y yields down -0.4bp at 2.137%.

- Bund futures are up 0.21 today at 159.47 with 10y Bund yields down -2.6bp at 0.503% and Schatz yields down -1.3bp at -0.221%.

- Gilt futures are up 0.35 today at 121.43 with 10y yields down -4.6bp at 1.599% and 2y yields down -3.3bp at 1.305%.

FOREX: JPY Reverses Course as BoJ Steer Clear of Intervention

- After several sessions of distinct underperformance and weakness, the JPY is solidly higher early Friday. The moves follow the BoJ failing to act as 10-year JGB yields hit 0.23%. A break above that level triggered BoJ fixed rate operations back in Feb as the central bank sought to defend the upper end of permitted 10-Year yield trading range (-/+0.25%). There was speculation that the level could again act as a trigger for BoJ intervention but the central bank chose to stay on the sidelines today.

- Elsewhere, GBP trades poorly after a particularly weak set of retail sales figures, with sales unexpectedly dropping in the month of February. The weight on sales was led by a sharp drop in online activity, with spending instead favouring in-person consumption and clothing and footwear as COVID restrictions were relaxed. After starting the overnight session strong, GBP/USD has faded, putting Thursday's lows under pressure at 1.3157. A break below here opens firmer support seen into 1.3120.

- The greenback is more mixed, with the USD Index holding inside the recent range as markets watch for any further signs of tentative progress in a resolution for the Ukraine Crisis. Reports continue to suggest an element of progression between Russian and Ukrainian negotiators, with traders now watching for anything more concrete on a potential ceasefire agreement.

- The data slate is relatively light, with just the final revision to March's UMich Sentiment data and pending home sales on the docket. Fedspeak remains thick and fast, with the highlight today being Williams, who speaks at 1400GMT/1000ET directly on monetary policy. Barkin, Waller and the BoC deputy governor Kozicki also make appearances.

EQUITIES: Energy Lags As Europe Trades Mixed

- Asian markets closed mostly weaker: Japan's NIKKEI closed up 39.45 pts or +0.14% at 28149.84 and the TOPIX ended 0.09 pts lower or 0% at 1981.47. China's SHANGHAI closed down 38.024 pts or -1.17% at 3212.24 and the HANG SENG ended 541.07 pts lower or -2.47% at 21404.88.

- European equities are mixed, with energy names lagging; the German Dax up 7.94 pts or +0.06% at 14281.36, FTSE 100 down 9.53 pts or -0.13% at 7457.75, CAC 40 up 13.46 pts or +0.21% at 6568.17 and Euro Stoxx 50 down 0.79 pts or -0.02% at 3862.66.

- U.S. futures are a little weaker, with the Dow Jones mini down 45 pts or -0.13% at 34559, S&P 500 mini down 9 pts or -0.2% at 4503.5, NASDAQ mini down 46 pts or -0.31% at 14717.75.

COMMODITIES: Oil Drops As US-EU Agree LNG Deal

- WTI Crude down $2.89 or -2.57% at $109.37

- Natural Gas down $0.03 or -0.59% at $5.37

- Gold spot down $2.18 or -0.11% at $1955.57

- Copper down $0.55 or -0.12% at $473.9

- Silver up $0.05 or +0.21% at $25.5837

- Platinum up $1.37 or +0.13% at $1025.25

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/03/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 25/03/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 25/03/2022 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 25/03/2022 | 1400/1000 |  | US | New York Fed's John Williams | |

| 25/03/2022 | 1500/1100 |  | US | San Francisco Fed's Mary Daly | |

| 25/03/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 25/03/2022 | 1530/1130 |  | US | Richmond Fed's Tom Barkin | |

| 25/03/2022 | 1600/1200 |  | US | Fed Governor Christopher Waller | |

| 25/03/2022 | 1645/1245 |  | CA | BOC Deputy Kozicki speaks at SF Fed conference on "A world of difference: households, the pandemic and monetary policy" |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.