-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI US MARKETS ANALYSIS - US Front End Nears 4%

Highlights:

- SEK weaker as Riksbank undergo a 'dovish' 100bps hike

- US yields continue to climb, 2y nears 4%

- Fed rate hike expectations hit new highs

Key Links: Fed Preview / Norges Bank Preview / Bank Indonesia Preview / China's 5y LPR to Fall As Soon As Oct

US TSYS: 2Y Yield Nears 4%, 20Y Re-Open Later

- Cash Tsys have cheapened further, lagging moves in core EU FI after a large beat for German PPI inflation and with Fed hike expectations drifting above a 4.5% terminal. It pushed new cycle highs for 2YY (highest since Dec’07), 5YY (Jun’08) and 10YY (Apr’11) before a modest retracement.

- 2YY +3.3bps at 3.969% off a high of 3.9877%, 5YY +4.6bps at 3.729%, 10YY +4.1bps at 3.532%, 30YY +3.0bps at 3.545%.

- TYZ2 trades 9 ticks lower at 114-02+ on above average volumes. In hitting session lows at 114-01, it has cleared a key support at 114-06 (Jun 14 low) and opens a test of the round 114-00 after which sits 113-19 (Jun 19, 2009 low, cont.).

- Data: Still housing-focused, with starts/permits for Aug after yesterday’s modest miss for the NAHB index.

- Bond Issuance: US Tsy $12B 20Y Bond auction re-open (912810TK4) – 1300ET

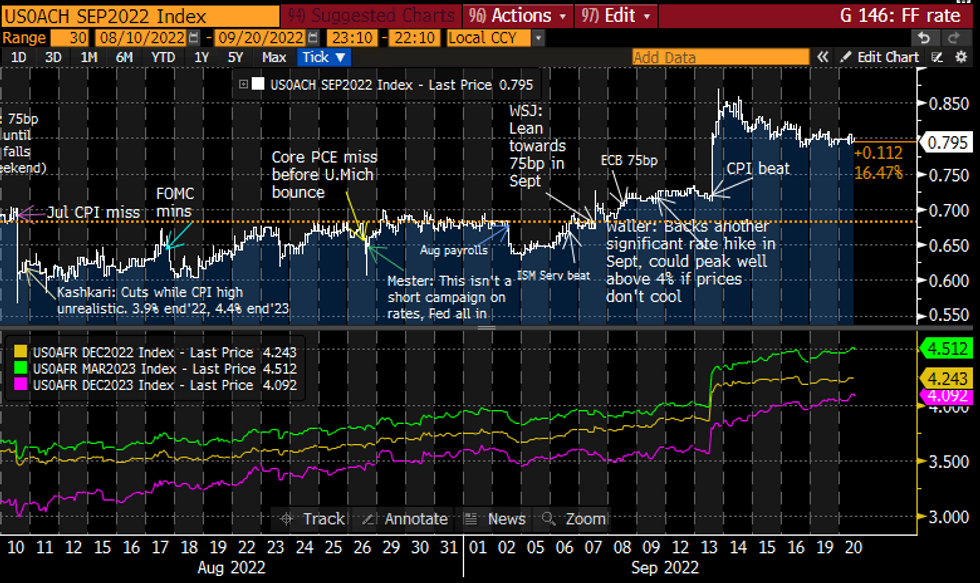

STIR FUTURES: Fed 2023 Rate Expectations Hit New Highs

- Fed Funds implied hikes keep to 79.5-80bps for tomorrow’s meeting whilst the 4.24-25% implied for Dec’22 has drifted higher but just about keeps to Friday’s high.

- New cycle highs further out, with a terminal 4.51% for Mar’23 and 4.09% for Dec’23 as both points have seen a parallel more than 50bp shift higher since just before US CPI.

- Cuts are only seen late in 2023 though, with the first full 25bps from that 4.51% hitting in Nov’23.

UK: PM States No Progress On US FTA, Focus Shifts To UNGA Speech & Fiscal Event

Overnight, Prime Minister Liz Truss stated to journalists that there would not be any more substantive trade talks with the United States in the short or medium term. The announcement has already seen criticism from the opposition and anti-Brexiteers given Truss had repeatedly talked up the prospect of a deal during her time as former PM Boris Johnson's Secretary of State for International Trade.

- Main events for Truss in the remainder of the week will be her address to the UN General Assembly in New York City. She is due to meet with Japanese PM Fumio Kishida, European Commission President Ursula von der Leyen and French President Emmanuel Macron on the UNGA sidelines. Truss due to speak on Wednesday in the afternoon session of the UNGA.

- On Friday, focus turns to the 'fiscal event' in the House of Commons, with Chancellor Kwasi Kwarteng due to announce the Truss gov'ts first action on taxes (reversing planned corporation tax rise, reversing National Insurance rise implemented in April), as well as outlining how the gov't plans to pay for massive energy price guarantee scheme announced two weeks ago. No timing on announcement yet, likely around midday or 1500BST.

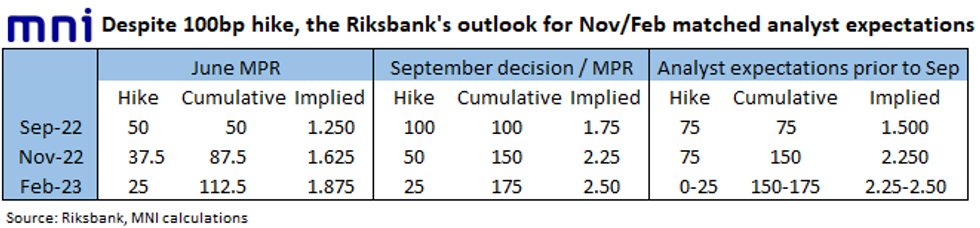

RIKSBANK: A Dovish 100bp Hike

- The first four words of the Riksbank press release say it all: "Inflation is too high." The Riksbank announced a 100bp hike today with their policy rate forecast looking for a further 50bp hike in November and a final 25bp hike in February to 2.50% (with a 10% hike of a further 25bp hike after that).

- Analysts and MNI had been expecting a 75bp hike in September, with the majority also looking for a further 75bp hike in November. Consensus was split between whether there would be further hikes in 2023. So overall, this is more front loaded than expected, but over the next couple of meetings, the policy rate is moving to where analysts had expected. Of course, following today's hike there is now a much higher upside risk to the policy rate decisions in the future.

- The forecasts see CPIF peaking at 10.8% in January/February 2023 before falling back sharply to the target by September 2023 and falling to a trough of 0.37% in February 2024. CPIF ex energy is expected to peak at 7.75% in December 2022 and fall back much more slowly to target - but move back to 3% by October 2023 and to around 2% in late 2024.

- Asset purchases will continue in Q4 as previously announced (most had expected a reduction in Q4) but will likely cease from Q1.

- So overall this is a dovish 100bp hike - and EURSEK is back to its prevailing levels ahead of the decision.

FOREX: SEK Slides as Markets Look to Soft Rate Path

- The greenback sits stronger ahead of NY hours, although the USD Index holds below the 110.00 handle for now. The Monday/Friday highs at 110.175/110.260 provide first resistance on any move higher.

- GBP also trades favourably, turning EUR/GBP back to the 0.8750 level and within range of the 0.8682 support, marking the 23.6% retracement for the Auguust - September upleg.

- Elsewere, SEK trades softer and toward the lower end of the G10 table following the Riksbank decision this morning. The bank raised rates by 100bps, however a dovish lean to the projected rate path worked against the currency, putting EUR/SEK at new multi-month highs to touch 10.8364, the highest level since mid-March.

- The decision sees smaller Riksbank hikes going forward, with a 50bps hike now seen in November - down from a 75bps forecast previously.

- Canadian CPI is on the docket Tuesday, with markets expecting Y/Y prices to slow to 7.3% from 7.6% previously. US housing starts and building permits are also due to cross. ECB's Lagarde is due to speak, speaking in Frankfurt after the European close.

FX OPTIONS: Expiries for Sep20 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9800(E1.5bln), $1.0000(E654mln), $1.0050(E546mln), $1.0100(E632mln)

- GBP/USD: $1.1425(Gbp647mln)

- EUR/JPY: Y138.00(E626mln)

- AUD/USD: $0.6719-25(A$580mln)

Price Signal Summary - Bund Downtrend Resumes Exposing Key Support At 140.67

- In the equity space, S&P E-Minis remain soft despite yesterday’s bounce. The breach of 3900.00 last week, the Sep 7 low, strengthened bearish conditions and signals scope for weakness towards 3819.54 next, 76.4% retracement of the Jun 17 - Aug 16 bull leg. A break would open 3741.75, the Jul 14 low. EUROSTOXX 50 futures started the week on a bearish note, extending last week’s bearish price action before finding support. The recovery is considered corrective and bearish conditions are likely to prevail. The latest reversal lower has opened 3423.00, the Sep 5 low and a key short-term support.

- In FX, the EURUSD outlook remains bearish. The pair continues to trade inside its bear channel, drawn from the Feb 10 high and attention is on the bear trigger at 0.9864, Sep 6 low. The channel top intersects at 1.0096 and marks a key resistance. A channel breakout is required to signal a short-term reversal. GBPUSD trend conditions remain bearish. The recent break of support at 1.1406, Sep 7 low, confirms a resumption of the downtrend and opens 1.1324 next, 1.50 projection of the Jun 16 - Jul 14 - Aug 1 price swing. USDJPY is consolidating and this pause in the uptrend appears to be a bullish pennant formation. This pattern reinforces the broader bullish theme and attention is on the bull trigger at 144.99, Sep 7 high. A break would resume the uptrend and open 145.28 and 146.03, the 2.618 and 2.764 projection of the Aug 2 - 8 - 11 price swing. Initial firm support is at 141.51, Sep 9 low. A strong support also lies at the 20-day EMA, at 141.19.

- On the commodity front, Gold remains in a clear downtrend and last Thursday’s bearish extension reinforces this theme - price has cleared support at $1681.0, the Jul 21 low and this confirms a resumption of the downtrend that started early March. Attention is on $1640.9 next, the Aug 8 2020 low. Initial resistance is at $1688.9, the Sep 1 low. In the Oil space, the WTI futures outlook is bearish despite Monday’s recovery from the day low. The recent break of support at $85.37, Aug 16 low, confirmed a resumption of the downtrend that started Jun 8. This has opened $79.83 next, the Feb 18 low. Firm resistance is at $90.99, the 50-day EMA. A break of this average is required to alter the picture.

- In the FI space, Bund futures remain in a clear downtrend and today’s extension lower has confirmed a resumption of the bear leg that started early August. The 142.00 handle has been cleared and sights are on the next major support at 140.67, the Jun 16 low (cont), ahead of the psychological 140.00 handle. Gilts remain vulnerable and futures have touched a fresh trend low of 104.33 today. Attention is on 103.87, 2.00 projection of the Aug 22 - 24 - 26 price swing.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/09/2022 | 1230/0830 | *** |  | CA | CPI |

| 20/09/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 20/09/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/09/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 20/09/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 20/09/2022 | 1700/1900 |  | EU | ECB Lagarde Lecture in Frankfurt | |

| 20/09/2022 | 1930/1530 |  | CA | BOC Deputy Beaudry speech "Pandemic macroeconomics: What we’ve learned, and what may lie ahead." | |

| 21/09/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 21/09/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 21/09/2022 | 0700/0900 |  | EU | ECB de Guindos Speech at Insurance Summit | |

| 21/09/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 21/09/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 21/09/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 21/09/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 21/09/2022 | 1800/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.