-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Biggest Earthquake in 25 Years Disrupts Taiwan's Chipmakers

EXECUTIVE SUMMARY:

- BIGGEST EARTHQUAKE IN 25 YEARS DISRUPTS TAIWAN'S LARGEST CHIPMAKERS

- BOJ COULD CONSIDER FURTHER RATE HIKE IN LIGHT OF APRIL SERVICES DATA

- USD/CNY TESTS TOP-END OF TRADING BAND FOR SECOND SESSION

- EUROZONE SERVICES HICP AT 4.0% FOR 5TH CONSECUTIVE MONTH

- POWELL SET TO SPEAK ON ECONOMIC OUTLOOK AT STANFORD

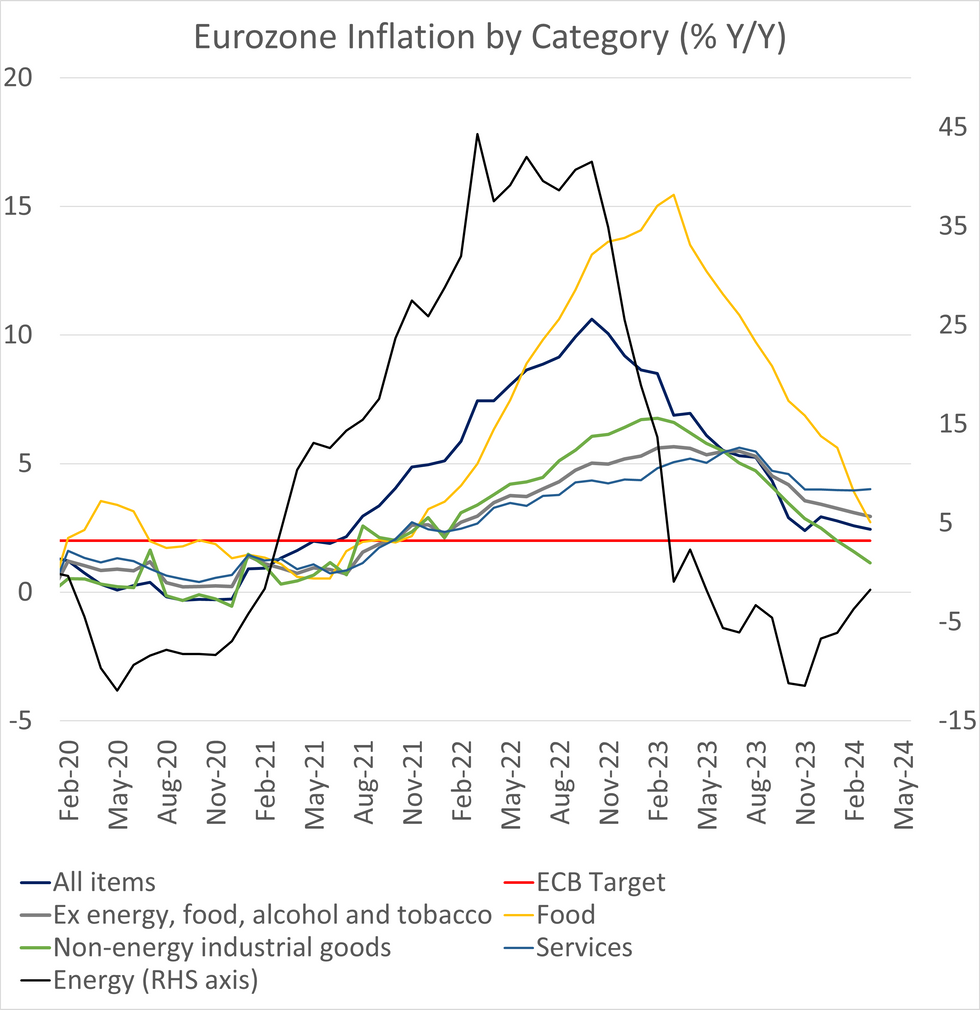

Figure 1: Eurozone services HICP flatlines for 5th month

NEWS

TAIWAN (BBG): Worst Taiwan Quake in 25 Years Kills Four, Disrupts Chips

Taiwan’s strongest earthquake in a quarter century leveled dozens of buildings on the eastern side of the island, killing at least four people and disrupting semiconductor production at some of the world’s leading chipmakers. The quake hit at 7:58 a.m. local time Wednesday and measured 7.4 in magnitude, according to the US Geological Survey, which pinned the epicenter near the eastern city of Hualien. Shocks were felt as far away as Japan and China. At least four people were killed, 711 were injured and 77 have been trapped, according to Taiwan’s Central Emergency Operation Center. More than two dozen buildings collapsed.

US (BBG): Fed Blocks Tough Global Climate-Risk Rules for Wall Street Banks

US regulators, led by the Federal Reserve, have thwarted a push to make climate risk a focus of global financial rules, according to people familiar with the matter. European central bankers have been advocating for the Basel Committee on Banking Supervision to agree on requiring lenders to disclose their strategies for meeting green commitments. In closed-door meetings, US officials have cited their narrow mandate and concerns that the Basel Committee was overstepping its purpose, some of the people said.

ITALY (BBG): EU to Open Deficit Infringement Procedure for Italy: Giorgetti

The European Union is set to open an infringement procedure for excessive deficit against Italy for last year, Finance Minister Giancarlo Giorgetti said Wednesday. “It is obvious” a procedure will be open for Italy and for several other EU countries, Giorgetti told lawmakers

CHINA (BBG): Sinking Yuan Is at a Critical Juncture That Risks PBOC Response

The Chinese yuan is at a watershed moment as its drop toward the fixed trading range against the dollar risks a response from the People’s Bank of China at a time when the greenback’s strength dominates sentiment. The PBOC has a historical track record of intervening forcefully when the yuan approaches this policy boundary. However, recent resilience in the dollar presents an additional challenge, compounded by similar efforts by other Asian central banks to bolster their currencies against multi-decade lows.

US/CHINA (BBG): Trump’s Tariffs Plan Would Likely Spur Inflation, Pressure Fed

The tariff plan that Donald Trump has vowed to impose would likely send inflation above the Federal Reserve’s target and pressure the central bank to raise interest rates, Bloomberg Economics said in a report. The presumptive Republican nominee is promising to slap 60% tariffs on imports from China and 10% duties on those from the rest of the world as he campaigns for a second term.

NATO (MNI): Sec Gen Talks Up Multi-Year Funding Package For Ukraine

Delivering doorstep comments at the NATO Foreign Ministers' Meeting in Brussels, Secretary General Jens Stoltenberg seems to confirm earlier reporting (see 'Foreign Ministers Meet w/USD100bn Ukraine Fund Proposal On The Table', 0901BST) that NATO will seek to put together a significant joint fund to support Ukraine. States that minsiters are to 'discuss a multi-year financial commitment to sustain Ukraine and support NATO'. Adds that 'NATO need to shift the dynamics of Ukraine support to multi-year pledges', rather than the current ad hoc packages passed on a nation-by-nation basis.

BOJ (MNI): April Services Data Key For Further BOJ Rate Move

The Bank of Japan would consider raising its policy rate from zero to 0.1% should services prices data due on April 26 indicate significant upside risks to prices, but a weaker yen is likely to prompt little more than jawboning while underlying inflation remains below 2%, MNI understands. The central bank will update its medium-term outlook, including its first inflation forecast for fiscal 2026, at the April 25-26 meeting, with the services data feeding into considerations for its June 13 meeting.

TURKEY (BBG): Turkey Inflation Nears 70% in March Despite Rate Hikes

Consumer inflation quickened to 68.5% in March, slightly less than expected by analysts but up from 67.1% in February. The median estimate in a Bloomberg poll of economists was 69.1%.Services, education and food were among the key contributors. Core inflation, which strips out volatile items like food and energy, quickened to the highest on record to 75.2%, up from 72.9% in February.

DATA

CHINA CAIXIN COMPOSITE PMI (Mar) M/M 52.7 (Prev. 52.5), SERVICES PMI (Mar) M/M 52.7 vs. Exp. 52.5 (Prev. 52.5)

JAPAN (MNI): Japan Q4 Output Gap Posts Positive Figure - BOJ

The Bank of Japan estimated Japan's output gap at +0.02% in Q4, its first positive print in 15 quarters following -0.37% in Q3, indicating upward pressure on prices is increasing with a time lag, data released Wednesday showed. The BOJ's read of the output gap, based on capital and labour stocks, is smaller than the Cabinet Office's last estimate of -0.6% in Q4 (vs. -0.5% in Q3), which is only based on second preliminary Q4 GDP data showing a 0.1% rise q/q, or an annualised rate of +0.4%.

Services HICP At 4.0% Y/Y For 5th Consecutive Month

Eurozone March flash headline and core inflation both printed below consensus on a rounded basis, in line with MNI’s tracking based on the national data released over the past week.

- The release includes several strong NSA M/M readings across key categories. The ECB’s seasonally adjusted series (released later today) should provide a better indication of actual sequential pressures in March, though previously noted calendar effects may skew the interpretation somewhat.

- Headline HICP was 2.4% Y/Y (vs 2.5/2.6% cons, 2.6% prior) and 0.8% M/M (vs 0.6% prior). On an unrounded basis, headline was 2.44% Y/Y and 0.76% M/M.

- Core HICP was 2.9% Y/Y (vs 3.0% cons, 3.1% prior), below 3% Y/Y for the first time since March 2022. On an unrounded basis, core was 2.946% Y/Y and 1.10% M/M.

- As telegraphed by some of the major Eurozone countries’ data (e.g. Germany, Italy), services inflation remained sticky, printing at a rounded 4.0% Y/Y for the fifth consecutive month. A full analysis of the role that calendar effects related to the Easter weekend timing will have to wait for the final release on April 17.

- Non-energy industrial goods continued to moderate on an annual basis to 1.1% Y/Y, but saw a notably strong 1.9% M/M reading (although again, not seasonally adjusted).

- Food and energy inflation behaved as expected, with the former pulled lower by base effects (unprocessed food inflation was -0.4% Y/Y in March) and the latter seeing negative base effects continue to fade (energy HICP was -1.8% Y/Y vs -3.7% prior).

- At a country level, annual HICP fell in 9 countries, and was the same or higher in the remaining 11.

EGB SUMMARY: Bunds Outperform OATs and BTPs; Eurozone Flash Inflation Below Consensus

Bunds are firmer today, aided in the latest instance by the below consensus Eurozone March flash inflation data.

- Although national level data had largely telegraphed a below consensus HICP print, the 2.4% Y/Y headline and 2.9% Y/Y core readings still surprised some analysts’ updated expectations to the downside.

- Elsewhere, Eurozone February unemployment was 6.5% (vs 6.4% cons, a 0.1pp upwardly revised 6.5% prior).

- Bunds are +27 ticks at 132.41, sitting comfortably within well-defined technical parameters.

- Impending 10-year Bund supply from Germany may weighing, but German cash yields are still flat to 1bps lower today.

- OATs and BTPs underperform Bunds, with OAT futures +5 ticks and BTP futures -30 ticks at typing,

- 10-year periphery spreads to Bunds are wider, with the BTP/Bund spread 3.7bps wider on the day. The spread saw some widening after headlines r.e. the EU opening a deficit infringement procedure for Italy crossed. The higher-than-expected Italian February unemployment rate was not a market mover.

- The ECB’s de Cos is scheduled to speak at 1400BST today, while the US ISM services and ADP employment change data also will garner cross-market interest this afternoon.

GILTS: Either Side Of Unchanged Early Today

Gilts outperform global peers across the curve, although that comes after yesterday’s widening vs. Bunds. Broader core global FI markets have stabilised in recent trade, with ranges remaining relatively contained.

- Futures last +12 at 98.52 (98.26-55 range).

- Cash gilt yields are 0.5-1.5bp lower across the curve, with some light outperformance in 10s.

- SONIA futures mostly reverse early modest losses alongside gilts, to trade little changed on the day.

- BoE-dated OIS moves back towards pricing ~70bp of ’24 cuts, also little changed on the day.

- U.S. data and Fedspeak from Powell provide the scheduled event risks of note through the remainder of the day, with the UK calendar empty.

- Tomorrow’s BoE DMP survey provides the next domestic focal point.

BoE Meeting | SONIA BoE-Dated OIS (%) | Difference Vs. Current Effective SONIA Rate (bp) |

May-24 | 5.156 | -3.9 |

Jun-24 | 5.029 | -16.7 |

Aug-24 | 4.883 | -31.3 |

Sep-24 | 4.767 | -42.9 |

Nov-24 | 4.617 | -57.8 |

Dec-24 | 4.497 | -69.9 |

FOREX: CNY in Focus as Spot Tests Trading Band for Second Session

- JPY is among the poorest performers in G10 headed into the NY crossover. This keeps USD/JPY well within range of the cycle highs and bull trigger at 151.97 - a level flirted with last week and helping draw the ire of Japanese authorities. Trade has so far favoured GBP and the USD, which fare better and keep EUR/GBP underpinned.

- Much of the focus in Asia-Pac has been on the persistent weakening of the CNY, which approaching the upper-end of the 2% trading band for a second consecutive session on Wednesday. The PBOC's statement reiterated their stance that they would "resolutely" correct pro-cyclical behaviour and prevent the risk of the FX rate overshooting. The volatility in spot markets is helping stimulate demand for CNY hedges, resulting in solid CNY options demand across both Asia-Pac and European hours.

- AUD/USD remains within the week's range, however short-term momentum continues pointed lower. Both the 50- and 200-dmas are trending downwards, keeping key support and the bear trigger within view at 0.6481.

- The ISM Services Index and final US March PMI data take focus going forward, with markets expecting headline activity to tick higher, while the prices paid sub-gauge stays stubbornly above 58.0. The central bank speaker slate will be of note, with Fed's Powell speaking on the economic outlook from Stanford, while Bostic, Bowman, Goolsbee, Barr and Kugler are also set to make appearances.

EQUITIES: Bullish Theme Intact Despite Tuesday Pullback

The trend condition in S&P E-Minis is unchanged and remains bullish, however, the move lower yesterday highlights a corrective cycle that suggests potential for a bearish extension. The contract has breached bull channel support - at 5282.02 - drawn from the Jan 17 low. A bullish trend condition in Eurostoxx 50 futures remains intact and the latest pullback appears to be a correction. Yesterday’s fresh cycle highs confirms once again an extension of the uptrend and maintains the price sequence of higher highs and higher lows.

- Japan's NIKKEI closed lower by 387.06 pts or -0.97% at 39451.85 and the TOPIX ended 7.94 pts lower or -0.29% at 2706.51.

- Elsewhere, in China the SHANGHAI COMPOSITE closed lower by 5.662 pts or -0.18% at 3069.296 and the HANG SENG ended 206.42 pts lower or -1.22% at 16725.1.

- Across Europe, Germany's DAX trades higher by 24.98 pts or +0.14% at 18310.69, FTSE 100 lower by 48.47 pts or -0.61% at 7886.32, CAC 40 up 3.17 pts or +0.04% at 8133.91 and Euro Stoxx 50 up 11.97 pts or +0.24% at 5054.48.

- Dow Jones mini down 39 pts or -0.1% at 39468, S&P 500 mini down 6 pts or -0.11% at 5254.25, NASDAQ mini down 29 pts or -0.16% at 18300.25.

COMMODITIES: Gold's Bullish Trend Remains Firm

A bull theme in WTI futures remains intact and this week’s move higher reinforces current conditions and confirms a resumption of the uptrend. The contract has traded through $84.87, the Sep 15 ‘23 high, paving the way for a climb towards the $90.00 handle further out. The trend condition in Gold remains bullish and the yellow metal has traded to fresh all-time highs once again this week. The climb maintains the price sequence of higher highs and higher lows and note that moving average studies are in a bull-mode condition.

- WTI Crude down $0.28 or -0.33% at $84.87

- Natural Gas down $0 or -0.21% at $1.859

- Gold spot down $6.5 or -0.29% at $2275.59

- Copper up $0.9 or +0.22% at $407.75

- Silver up $0.15 or +0.58% at $26.2995

- Platinum down $3.04 or -0.33% at $921

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/04/2024 | 0900/1100 | *** |  | EU | HICP (p) |

| 03/04/2024 | 0900/1100 | ** |  | EU | Unemployment |

| 03/04/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 03/04/2024 | 1215/0815 | *** |  | US | ADP Employment Report |

| 03/04/2024 | 1345/0945 |  | US | Fed Governor Michelle Bowman | |

| 03/04/2024 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/04/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 03/04/2024 | 1600/1200 |  | US | Chicago Fed's Austan Goolsbee | |

| 03/04/2024 | 1610/1210 |  | US | Fed Chair Jerome Powell | |

| 03/04/2024 | 1710/1310 |  | US | Fed Governor Michael Barr | |

| 03/04/2024 | 2030/1630 |  | US | Fed Governor Adriana Kugler | |

| 04/04/2024 | 0030/1130 | * |  | AU | Building Approvals |

| 04/04/2024 | 0630/0830 | *** |  | CH | CPI |

| 04/04/2024 | 0830/0930 |  | UK | BOE's Decision Maker Panel Data | |

| 04/04/2024 | 0900/1100 | ** |  | EU | PPI |

| 04/04/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 04/04/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 04/04/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 04/04/2024 | 1230/0830 | ** |  | US | Trade Balance |

| 04/04/2024 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 04/04/2024 | 1400/1000 |  | US | Philly Fed's Pat Harker | |

| 04/04/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 04/04/2024 | 1615/1215 |  | US | Richmond Fed's Tom Barkin | |

| 04/04/2024 | 1645/1245 |  | US | Chicago Fed's Austan Goolsbee | |

| 04/04/2024 | 1800/1400 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.