-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Japan Oct Real Wages Unchanged Y/Y

MNI ASIA OPEN: Focus on November Jobs Ahead Fed Blackout

MNI ASIA MARKETS ANALYSIS: Consolidation Ahead Nov Jobs Report

MNI US Open: BoE's Negativity In Focus

EXECUTIVE SUMMARY:

- MNI B.O.E. PREVIEW: NEGATIVE RATES FEASIBLE, BUT TFSME MORE LIKELY TO BE TWEAKED

- PERMANENT HIGHER INFLATION IS A RISK: ST LOUIS FED ECONOMIST (MNI INTERVIEW)

- B.O.J. MUST BE ACCOUNTABLE ON JGB RANGE: EX-OFFICIAL (MNI INTERVIEW)

- ITALY'S RENZI SEES DRAGHI'S GOVERNMENT IN PLACE NEXT WEEK

Fig. 1: Dollar Showing Signs Of Life

BBG, MNI

BBG, MNI

NEWS:

MNI BANK OF ENGLAND PREVIEW: For the full BoE preview including summaries of 22 sell-side analyst notes, please click here.There are two key topics in question at this week's MPC meeting. First, negative rates: will they be added to the Bank's toolkit immediately and if so can they be used with mitigation measures that are effective enough for the positives to outweigh the negatives. Second, how the MPC views that the balance of risks has changed and hence whether this is enough of a change for an immediate policy response.

- The MNI Markets team expects negative rates to be deemed feasible but that no explicit lower bound to be given, with the MPC likely to move in 10bps steps if it cuts.

- All in all, strong arguments can be made that downside risks have both increased and decreased. We suspect that different MPC members will take different views as to which arguments are most compelling.

- The MNI Markets team thinks that the QE pace seems appropriate and no pressure to increase the total size of the programme now. TFSME could be tweaked, if not dissents on the rate decision likely while the short-dated QE bucket could be tweaked.

- Timing: The policy decision will be released at 12:00GMT with the press conference live streamed between 13:00-14:00GMT.

FED: Inflation is likely to spike above the Fed's target later in the year and the big question for policymakers is whether "that spike is temporary or persistent," St. Louis Fed economist and senior vice president David Andolfatto told MNI in an exclusive interview published Wednesday. Although not seeing a surge in prices, suggesting a rise to 2.5% at some point in 2021, he warns there is significant chance of a more permanent rise. Amongst the biggest risk he highlights is the potential speed at which stickier inflation can creep in. If long yields and break-evens edge higher, its observable and manageable, Andolfatto says, but if the move is more sudden "as policy makers or central bankers you have to ask what if and what would you do in that case." Until now, many central bankers have played down inflation risks. On Wednesday, Cleveland Fed President Loretta Mester said "structural pressures" will likely weigh on prices.

B.O.J. (MNI 2-PART INTERVIEW) :

- The Bank of Japan can move to a wider trading band for the benchmark 10-year JGB either side of the target rate, but policymakers must be directly accountable for the level, a former BOJ executive director has told MNI.

- Japan needs to ready for the moment the government is no longer backstopping the Covid-hit economy with its support for jobs and smaller companies, a former Bank of Japan executive director has told MNI.

- For full interview contact sales@marketnews.com

GERMANY: Lockdown measures could continue until the middle of September, according to ifo's latest Business Survey, with manufacturers expecting restrictions on public life and businesses to last another 7.4 months, service providers anticipating another 7.5 months, and construction 7.3 months, looking at late Summer or early Autumn before full restrictions are lifted. Manufacturers do not expect their own businesses to return to normal for another 10.2 months, the survey found. The figures for service providers, retail and construction were 10.6 months, 9.3 months, 10.4 months, respectively.

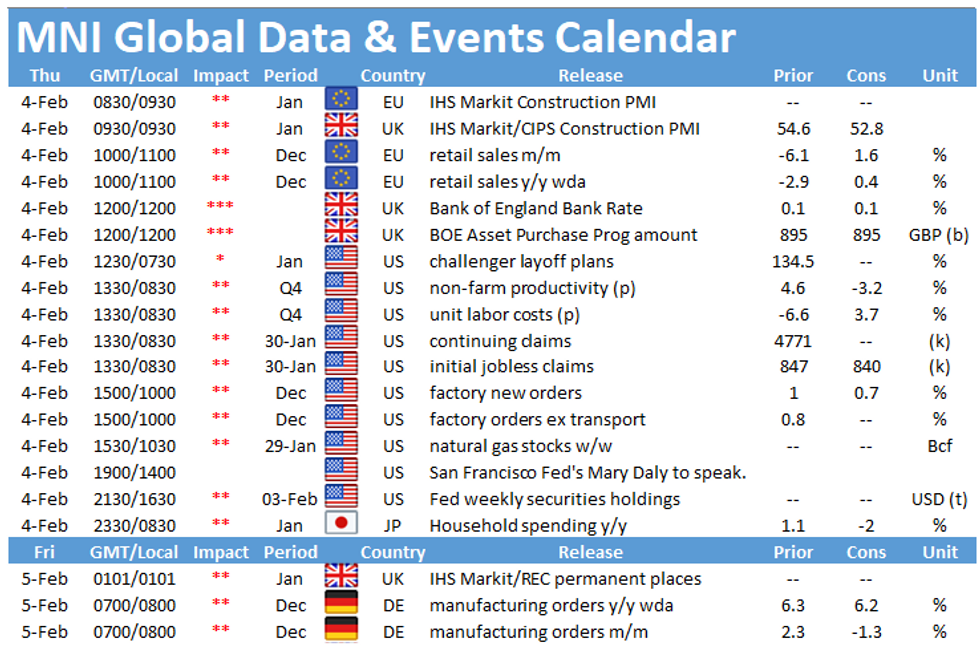

DATA:

EZ Dec Retail Sales Rebound To 4-Month High

EZ DEC RET SALES +2.0% M/M, +0.6% Y/Y; NOV -5.7% M/M

- M/M retail sales rose 2.0% in Dec, coming in slightly stronger than markets expected (BBG: 1.6%), while y/y sales grew 0.6% after falling by 2.2% in the previous month.

- Over the year of 2020, sales were down 1.2% compared to 2019

- Dec's increase was broad-based with every major category recording a monthly gain.

- Food, drinks and tobacco sales ticked up 1.9% in Dec after falling 2.2% in Nov, while sales of non-food products rebounded to 1.5%.

- Within non-food products, sales of clothing and footwear saw the largest increase, rising by 12.4% after Nov's 30.5% drop.

- Automotive fuel sales recovered to 5.1% in Dec, up from -10.2% recorded in the previous month.

- Among the member states, the largest m/m gains were observed in France (+22.3%), Belgium (+15.9%) and Ireland (+11.4%), while Germany (-9.6%), Lithuania (-6.2%) and Latvia (5.7%) posted the largest declines.

MNI: UK JAN CONSTRUCTION PMI 49.2; DEC 54.6

MNI: EZ JAN CONSTRUCTION PMI 44.1; DEC 45.5

FIXED INCOME: Supplies in focus ahead of BoE

A range bound session for EGBs, with Heavy supplies taking center stage.

- OATs were equating some 110k OAT, and too surprising to see the French contract trading more volume than the German Bobl

- Early curve play saw further bear steepening reaching levels last seen since Sep.

- But some reversal, correction is moving the German curve back flatter ahead of the US session.

- Gilts are in a 19 ticks ranger with all eyes on the BoE

- US treasuries have traded in tandem with EGBs, mainly range bound, with attention turning towards the UK central Bank.

- Looking ahead, BoE rate and presser, US IJC, Fed Kaplan, Daly and RBA Lowe

- Bund futures are up 0.01 today at 176.48

- BTP futures are up 0.11 today at 151.88

- OAT futures are up 0.08 today at 166.61

- Gilt futures are unch today at 133.55

- TY1 futures are unch today at 136-25+

FOREX: Antipodeans Trade Well on Aussie Iron Ore Exports

Antipodean currencies trade well, with the AUD, NZD among the best performers in G10 so far Thursday after markets found positivity in Australian trade balance data. The numbers saw iron ore exports reach a record high, boosting the headline surplus to just shy of A$7bln. AUD also saw some support from exporters, with AUD's strength feeding through well into NZD also.

After circling the handle yesterday, EUR/USD cracking through $1.20 support early Thursday, confirming an extension of the recent bearish trend. This narrows the gap with support at the 100-dma, today crossing at $1.1966.

GBP trades poorly ahead of the BoE rate decision later today. While headline policy is expected unchanged, there are some outside bets of rate cuts today and markets will be watching for the results of the Bank's discussions with lenders over the feasibility of negative interest rates.

Weekly US jobless claims and factory orders data also cross. ECB's de Cos, Fed's Kaplan and Daly are due to speak.

EQUITIES: Bouncing From Overnight Lows

- Asian stocks closed lower, with Japan's NIKKEI down 304.55 pts or -1.06% at 28341.95 and the TOPIX down 5.97 pts or -0.32% at 1865.12. China's SHANGHAI closed down 15.449 pts or -0.44% at 3501.859 and the HANG SENG ended 193.96 pts lower or -0.66% at 29113.5.

- European equities are up slightly, having recovered from earlier lows, with the German Dax up 24.94 pts or +0.18% at 14008.47, FTSE 100 up 3.09 pts or +0.05% at 6525.57, CAC 40 up 17.49 pts or +0.31% at 5585.13 and Euro Stoxx 50 up 2.72 pts or +0.08% at 3625.99.

- U.S. futures are very slightly higher, again reversing early losses: Dow Jones mini up 2 pts or +0.01% at 30630, S&P 500 mini up 2.5 pts or +0.07% at 3826, NASDAQ mini up 40.25 pts or +0.3% at 13435.

COMMODITIES: Metals Falter As Dollar Bounce Continues

- WTI Crude up $0.37 or +0.66% at $56.09

- Natural Gas down $0.05 or -1.61% at $2.758

- Gold spot down $20.86 or -1.14% at $1822.97

- Copper up $0.1 or +0.03% at $357.75

- Silver down $0.46 or -1.7% at $26.5547

- Platinum down $24.85 or -2.25% at $1086.69

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.