-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Credit Supply Pipeline

US Treasury Auction Calendar

MNI US Open: Dollar Takes A Step Back

EXECUTIVE SUMMARY:

- ITALIAN BOND YIELDS FALL TO RECORD LOW AS INVESTORS BACK DRAGHI

- E.U. PUSHES CLEARING TO NEW YORK, NOT EUROZONE (MNI EXCLUSIVE)

- RIKSBANK MEETING FOCUS WILL BE PACE FOR QE IN Q2 (MNI PREVIEW)

- BITCOIN HITS RECORD HIGH; DOLLAR ON BACK FOOT

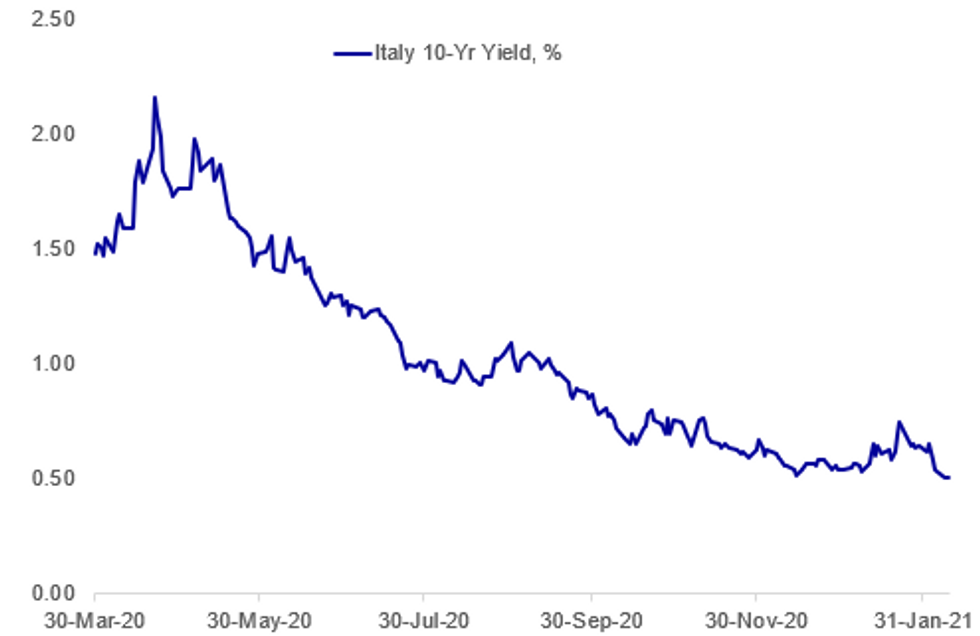

Fig. 1: 10-Yr BTP Yields Dip Below 0.50% For First Time

BBG, MNI

BBG, MNI

NEWS:

ITALY (BBG): Italian bonds rallied to send the country's borrowing costs to a record low, in a sign investors are backing former European Central Bank President Mario Draghi to form a new government. Ten-year yields dropped to 0.5%, dropping below the previous low set last month. Draghi, who helped rein in Italy's debt risk from the euro area crisis nearly a decade ago, has won the initial support of some of the biggest parties following the collapse of the previous coalition.

UK/EU/US (MNI EXCLUSIVE): The European Commission is determined to press ahead with attempts to force London-based clearing houses to relocate operations to the eurozone, despite its frustration with the lack of progress so far and even evidence that some post-Brexit business flow has been out of Europe altogether and to New York, officials and industry representatives said. For full article contact sales@marketnews.com

RIKSBANK (MNI PREVIEW): The focus for the Riksbank meeting will be on the pace of QE for Q2 (we expect SEK80-100bln) and the repo rate path (we expect this to remain flat for the forecast duration.- For our full Riksbank preview including summaries of 13 sell-side analyst notes, please click the link: http://enews.marketnews.com/ct/uz10098501Biz47400181

BITCOIN (BBG): Bitcoin hit a fresh record above $48,000 on Tuesday after Tesla Inc.'s announcement of a $1.5 billion investment in the largest cryptocurrency. The token rose as much as 7.9% to almost $48,216 before paring some of the gains. It was at about $48,000 as of 3:16 p.m. in Hong Kong. Tesla's disclosure Monday sent the price soaring.

CHINA DATA: China's M2 money supply rose 9.4% y/y in January, the slowest rate of growth since February 2020 and decelerating from the 10.1% rise seen in December, data released by the People's Bank of China on Tuesday showed. Analysts had been forecasting a repeat of the 10.1% gain. Among the key metrics, M1 growth picked up 14.7% y/y from the previous 8.6% gain, reflecting robust cash flow. M0 fell 3.9% y/y, reversing Dec's 9.2% gain.

DATA:

Italian Industrial Production Fell Further in Jan

- Dec SA ind. output -0.2% m/m (Nov confirmed -1.4% m/m), WDA -2.0% y/y

- Italy 4Q20 average SA ind. output -3.1% vs Feb 2020 pre-crisis level--ISTAT

- Italy 2020 WDA ind. output -11.4% vs 2019; worst since 2009--ISTAT

- Dec SA m/m intermed. gds, energy rose; consumer, capital gds fell—ISTAT

- Dec WDA y/y consumer, capital gds, energy fell; intermed. gds up --ISTAT

- There were 21 working days in Dec 2020 vs. 20 in Dec 2019.

FIXED INCOME: Big European issuance in focus (again)

Issuance has been the big story of the morning with the UK, Spain and the Netherlands launching new bonds via syndication while Germany launches a new linker for the first time since 2015 via auction. a USD4bln EIB sale has been the highlight in SSA space.

- Outside of issuance, today has been a bit quieter with a mildly risk-off undertone to markets (equities lower, core FI higher, peripheral spreads wider).

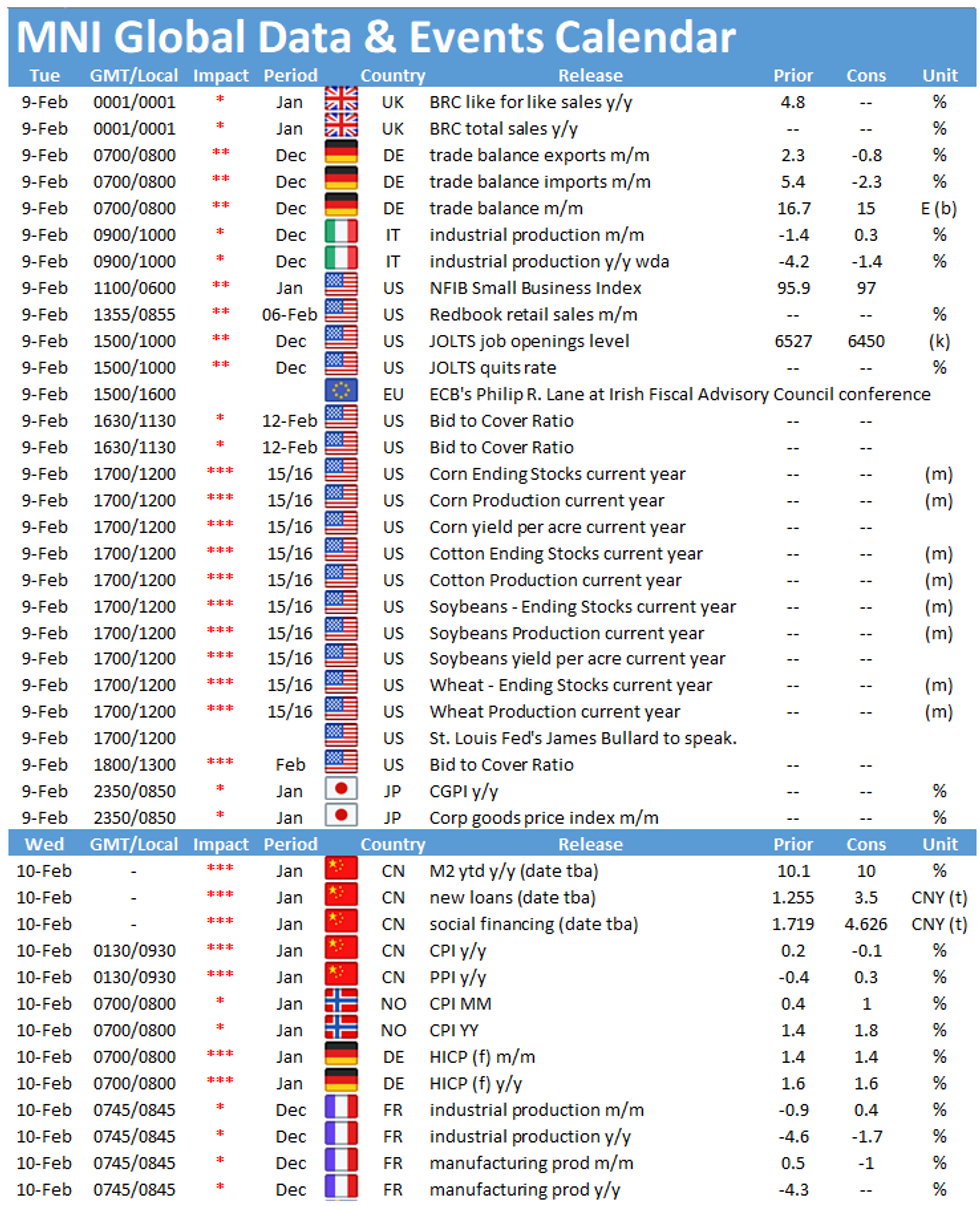

- Looking ahead, we have speeches from the ECB's Visco and Lane and Fed's Bullard while the only notable data release will be JOLTs.

- TY1 futures are up 0-2 today at 136-24 with 10y UST yields down -2.5bp at 1.146% and 2y yields unch at 0.112%.

- Bund futures are up 0.20 today at 176.32 with 10y Bund yields down -0.8bp at -0.455% and Schatz yields unch at -0.716%.

- Gilt futures are up 0.16 today at 132.47 with 10y yields down -0.9bp at 0.465% and 2y yields down -0.3bp at -0.41%.

FOREX: Greenback Offered as Risk Rally Hits Pause

The Greenback is softer, slipping against all others in G10, with haven currencies outperforming as the recent risk rally flatlines. There's been no material drawback in equities, but the e-mini S&P is off by around 4 points or so, while core government bonds are firmer.

The beneficiaries so far Tuesday have been JPY and EUR, the former being supported on the break through the Y105.00 handle in USD/JPY, while EUR garners focus as Italian PM-designate Draghi gains more cross-party support for his technocratic government. EUR/USD sits at the highest since Feb1, with the pair now comfortably above the 1.21 handle.

Despite the softness in stocks this morning, AUD continues to outperform, prompting a new and clean break above the $0.77 mark.

US JOLTs data is the sole material release, but speeches are due from ECB's Visco & Lane and Fed's Bullard.

EQUITIES: Futures Edge Lower

- Asian stocks closed higher, with Japan's NIKKEI up 117.43 pts or +0.4% at 29505.93 and the TOPIX up 1.59 pts or +0.08% at 1925.54. China's SHANGHAI closed up 71.042 pts or +2.01% at 3603.489 and the HANG SENG ended 156.72 pts higher or +0.53% at 29476.19.

- European stocks are off slightly, with the German Dax down 83.78 pts or -0.6% at 14054.51, FTSE 100 down 11.02 pts or -0.17% at 6525.36, CAC 40 down 6.83 pts or -0.12% at 5701.16 and Euro Stoxx 50 down 11.61 pts or -0.32% at 3667.4.

- U.S. futures are a little lower, with the Dow Jones mini down 33 pts or -0.11% at 31235, S&P 500 mini down 3.5 pts or -0.09% at 3904.5, NASDAQ mini down 12.75 pts or -0.09% at 13670.25.

COMMODITIES: Precious Metals Gain Ground As USD Weakens

- WTI Crude up $0.29 or +0.5% at $58.26

- Natural Gas down $0.06 or -2.19% at $2.819

- Gold spot up $16.61 or +0.91% at $1839.24

- Copper up $2.45 or +0.67% at $369

- Silver up $0.39 or +1.42% at $27.6381

- Platinum up $20.29 or +1.75% at $1181.52

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.