-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Dollar Up, Bonds Down Pre-CPI

EXECUTIVE SUMMARY:

- U.S. SENATE PASSES DEMOCRATS' $3.5T BUDGET RESOLUTION

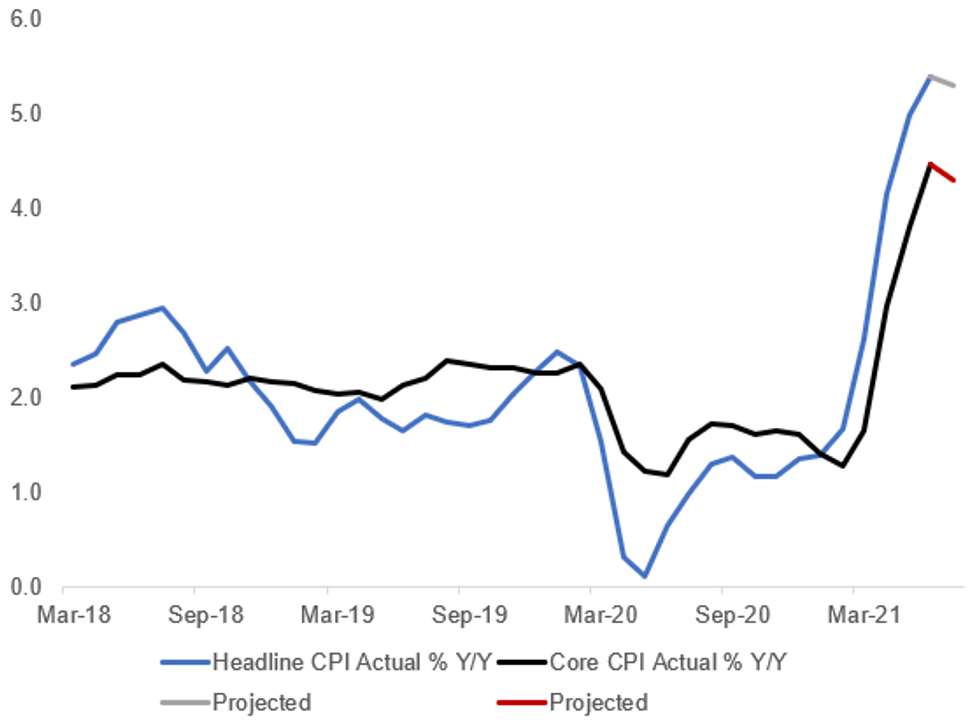

- JULY CPI SEEN FADING TO 5.3% Y/Y (5.4% JUN), CORE 4.3% (4.5% JUN)

- CHINA ALLOWS NON-FINANCIAL DEBT ISSUANCE WITHOUT CREDIT RATINGS

Fig. 1: U.S. CPI Y/Y Including July Expectations

Source: BLS, BBG Survey, MNI

Source: BLS, BBG Survey, MNI

NEWS:

U.S. FISCAL: At around 0400 local time, the US Senate passed a budget resolution that paves the way for a vote on a USD3.5trn infrastructure package to come to the Senate floor in the autumn.

- The vote passed on a party line vote, with 50 Democrats in favour and 49 Republicans against (Republican Senator Lindsey Graham did not vote as he remains in quarantine after contracting COVID-19).

- The approval of the budget resolution came after an all-night 'vote-a-rama'. These sessions are seen as unlikely to affect the nature of the resolution, but the numerous votes held and the results of those votes are often used by parties in election advertisements attacking their opponents (e.g. 'Senator 'X' voted against 'issue Y''), even though the vote was not seen as substantive.

- The budget resolution now passes to the House of Representatives. House majority leader Steny Hoyer (D-MD) sent a letter to Dem colleagues stating that the House is set to be recalled from recess the week of 23 August to take up the resolution.

U.S. CPI: U.S. CPI growth likely slowed in July, with Bloomberg forecasting a 0.5% gain following June's 0.9% increase. From a year earlier, CPI should grow 5.3% after rising 5.4% in June, according to Bloomberg. Excluding food and energy prices, CPI should be up 0.4%, according to Bloomberg, after rising 0.9% in June. From one year ago, core CPI should increase 4.3%, just shy of June's 4.5% y/y gain.

CHINA (BBG): Non-financial companies can issue debt without having a credit rating under a campaign aimed at promoting reform in the ratings sector, the People's Bank of China says in a statement.The change is effective from today

UK (RTRS): British police confirmed that a British national who was arrested by German authorities had been held on suspicion of committing offences relating to being engaged in "intelligence agent activity." Earlier on Wednesday, German prosecutors said police in the country had arrested on Tuesday a British man who worked at the British embassy in Berlin on suspicion of passing documents to the Russian intelligence service in exchange for cash.

DATA:

MNI: ITALY JUL FINAL HICP -1.0% M/M, +1.0% Y/Y; JUN +1.3%Y/Y

ITALY JUN FINAL HICP +0.2% M/M, +1.3% Y/Y; MAY +1.2% Y/Y

FIXED INCOME: EGB/Gilt - Better offered ahead of US Inflation

- EGBs have seen better selling in early trading, so positioning and squaring ahead of the US Inflation data.

- Bund have traded below this weeks low to print a 176.21 low so far, at the time of typing.

- Curves have in turn moved bear steeper.

- German 5s/30s is up, but still short of Monday's high at 72.673, now at 71.949.

- Peripherals are wider versus the German 10yr, and Italy trades 2.5bps wider.

- BTP/Bund spread found a short term base at 100.2027, which was the tightest level since 8th April, now at 102.9bps.

- Gilts are trading in line with Bund, GILT/Bund sits just 0.4bp wider.

- Similar price action in the curve, with UK 5/30s, steeper, but we are still short of yesterday's high.

- Range in the Gilt has been somewhat limited, as the contract sticks to a 19 ticks range (129.30/129.49)

- US treasuries trade in line with their European Bond counterparts. Most of the market flow, has seen better selling interest, as desk positioned ahead of the Inflation release.

- Curve is seeing the 5s/30s steeper, but well within yesterday ranges, while 2s/10s is now steepest since the 14th July, with an eye on the new 10-year note later today.

- Looking ahead, US CPI is where all the attention will be.

- SPEAKERS: Fed Bostic and George

FOREX: Dollar on the Up Pre-CPI

- The greenback is inching higher early Wednesday, gaining against most others in G10 to put the USD Index at the best level since early April. Further gains through 93.437 would put the dollar at it's strongest since November last year.

- AUD and GBP are offered, putting GBP/USD at the lowest levels of the month, but still well clear of nearest key support at the 1.3772 200-dma. USD/JPY is also clearing recent resistance thanks to the bouncing dollar, with the pair touching 110.80 and nearing next resistance at 110.97, the 76.4% Fibonacci retracement of the July - August pullback.

- Commodity-tied currencies are broadly flat, with some of the recent volatility across oil and precious metals markets ebbing lower this morning. This leaves the likes of USD/CAD, USD/NOK well within the week's range so far.

- Focus turns to US CPI data, with analysts expecting M/M CPI to drift to 0.5% from 0.9% previously. Nonetheless, Y/Y CPI is expected to remain above the Fed's target, at 5.3%. Fed speakers are also eyed, with Fed's Bostic, George and Logan on the docket.

EQUITIES: Another Day, Another High For European Stocks

- Asian markets closed higher, with Japan's NIKKEI up 182.36 pts or +0.65% at 28070.51 and the TOPIX up 17.8 pts or +0.92% at 1954.08. China's SHANGHAI closed up 2.69 pts or +0.08% at 3532.621 and the HANG SENG ended 54.54 pts higher or +0.21% at 26660.16.

- European equities are higher (Stoxx600 hit another all-time high), with the German Dax up 9.66 pts or +0.06% at 15770.71, FTSE 100 up 26.75 pts or +0.37% at 7161.04, CAC 40 up 14.77 pts or +0.22% at 6820.21 and Euro Stoxx 50 up 5.78 pts or +0.14% at 4187.82.

- U.S. futures are flat/lower, with the Dow Jones mini unchanged at 35155, S&P 500 mini down 5.75 pts or -0.13% at 4424.25, NASDAQ mini down 39.75 pts or -0.26% at 15004.75.

COMMODITIES: Precious Metals Edge Higher Despite USD's Continued Climb

- WTI Crude down $0.03 or -0.04% at $68.54

- Natural Gas up $0.02 or +0.54% at $4.118

- Gold spot up $3.92 or +0.23% at $1731.92

- Copper down $2.15 or -0.49% at $434.05

- Silver up $0.01 or +0.05% at $23.3785

- Platinum up $7.29 or +0.73% at $1004.16

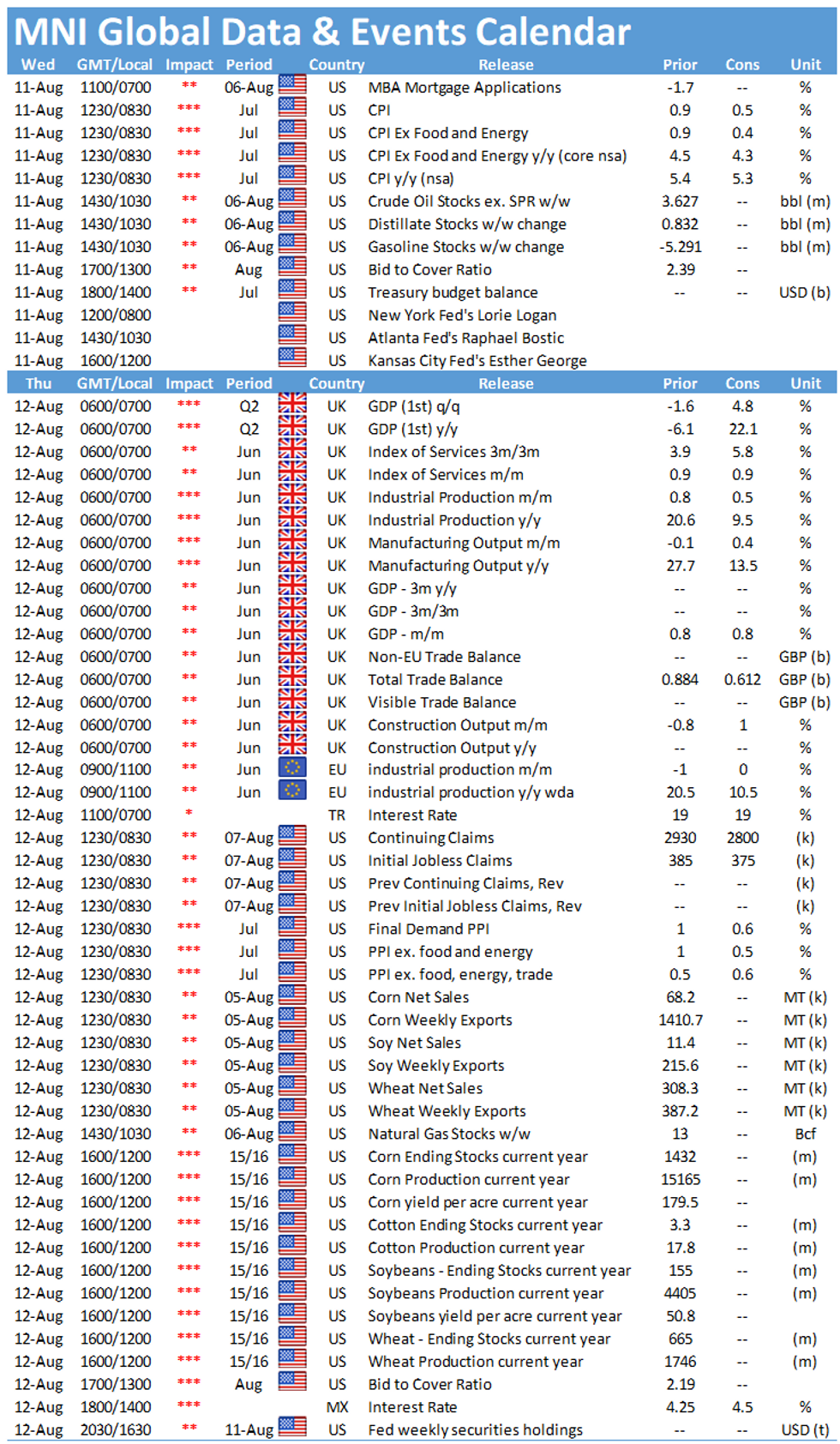

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.