-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Equity + Energy Rally Continues

EXECUTIVE SUMMARY:

- EU TRAVEL RESTRICTIONS ON OMICRON UNLIKELY: GERMANY'S SPAHN

- GERMAN INVESTOR CONFIDENCE DETERIORATES ON NEW VIRUS WAVE

- EUROPEAN GAS JUMPS AS TALK OF FRESH RUSSIAN SANCTIONS SWIRLS

- EVERGRANDE BONDHOLDERS YET TO BE PAID AS GRACE PERIOD ENDS

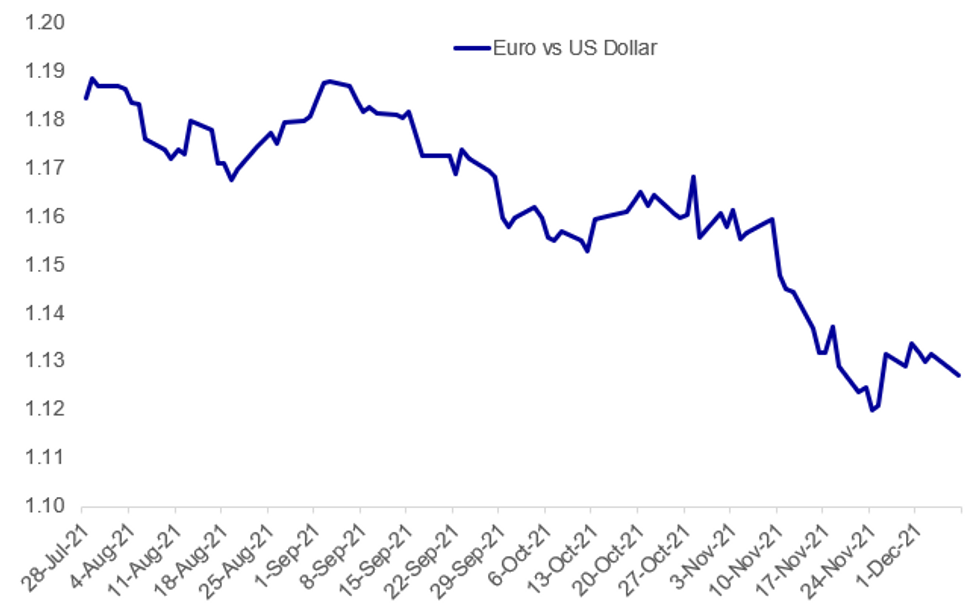

Fig. 1: USD Regaining Ground vs EUR

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB: An FT sources story published this morning (see link here) has suggested that there is a debate on the ECB about how much longer inflation would remain above target. This was in line with comments made by the Central Bank of Malta Governor Scicluna to MNI last week, as he said that there are upside risks to inflation and that further supply chain disruption due to the pandemic would leave Eurozone inflation above target "longer than previously anticipated."

- The FT story also says there is some support on the Governing Council for a delay to commit to a long-dated post-PEPP programme at the December meeting (as had originally been expected by markets). This was also cited in a Reuters story last week.

- There has been little immediate reaction to the release of the FT story, but it will add to the tone in markets that the ECB is unlikely to act hawkishly any time soon and the markets' view that the ECB will take the Omicron variant more into account than the FOMC at next week's policy meetings.

GERMANY / EU / COVID: Wires and social media reporting comments from outgoing German Health Minister Jens Spahn. He states that he believes the introduction of travel restrictions within the EU due to the spread of the Omicron variant is 'unlikely'.

- Also states that the EU should treat vaccinated and unvaccinated individuals differently.

- Once Olaf Scholz and his Cabinet are sworn into office tomorrow, Social Democrat Bundestag member and professor of health economics and epidemiology at the University of Cologne Karl Lauterbach will become the new German health minister.

- Lauterbach is seen as an outspoken advocate for tough measures to combat the coronavirus, and therefore Spahn's more relaxed comments regarding restrictions may not carry through to the next gov't.

DATA:

MNI: GERMANY OCT IND PROD +2.8% M/M, -0.6% Y/Y; SEP -0.5r% M/M

MNI: GERMANY DEC ECONOMIC SENTIMENT INDEX 29.9

GERMANY DEC ZEW CURRENT CONDITIONS -7.4

FIXED INCOME: German curve outperforming

Core fixed income is all under some pressure this morning with US and German curves flattening (while the gilt curve has seen another parallel shift.

- Schatz and Bunds have seen larger moves than corresponding Treasuries, in contrast to moves in recent days. This is despite the Eurodollar strip moving more than the Euribor strip today, but suggests the German curve is playing catch up with moves in the Treasury curve seen over recent days.

- TY1 futures are down -0-2+ today at 130-18+ with 10y UST yields up 0.9bp at 1.445% and 2y yields up 2.6bp at 0.659%.

- Bund futures are down -0.32 today at 174.41 with 10y Bund yields up 1.8bp at -0.373% and Schatz yields up 3.3bp at -0.730%.

- Gilt futures are down -0.19 today at 126.94 with 10y yields up 2.3bp at 0.754% and 2y yields up 2.3bp at 0.477%.

FOREX: Equity Bounce Extends, Pressuring JPY to Weekly Low

- Equity markets across Asia rallied well, feeding through into a uniformly positive session so far for European stocks. The evident risk appetite has also filtered into currency markets, with the JPY among the session's poorest performers and printing fresh weekly lows. USD/JPY's rally has put the pair through yesterday's 113.55, opening 113.96 as the near-term target. Monday's close above the 50-dma has lent further support.

- At the other end of the table, AUD is stronger, putting AUD/USD briefly back above the $0.71 handle following the RBA rate decision, in which the bank appeared confident that the new omicron variant would fall short of impacting the economy in the same manner as prior strains.

- EUR/USD has been sold off the overnight highs of 1.1298 as the pair re-initiates an inverse correlation with continental equity markets. The puts the pair in close proximity to first support of 1.1236 - the Nov30 low.

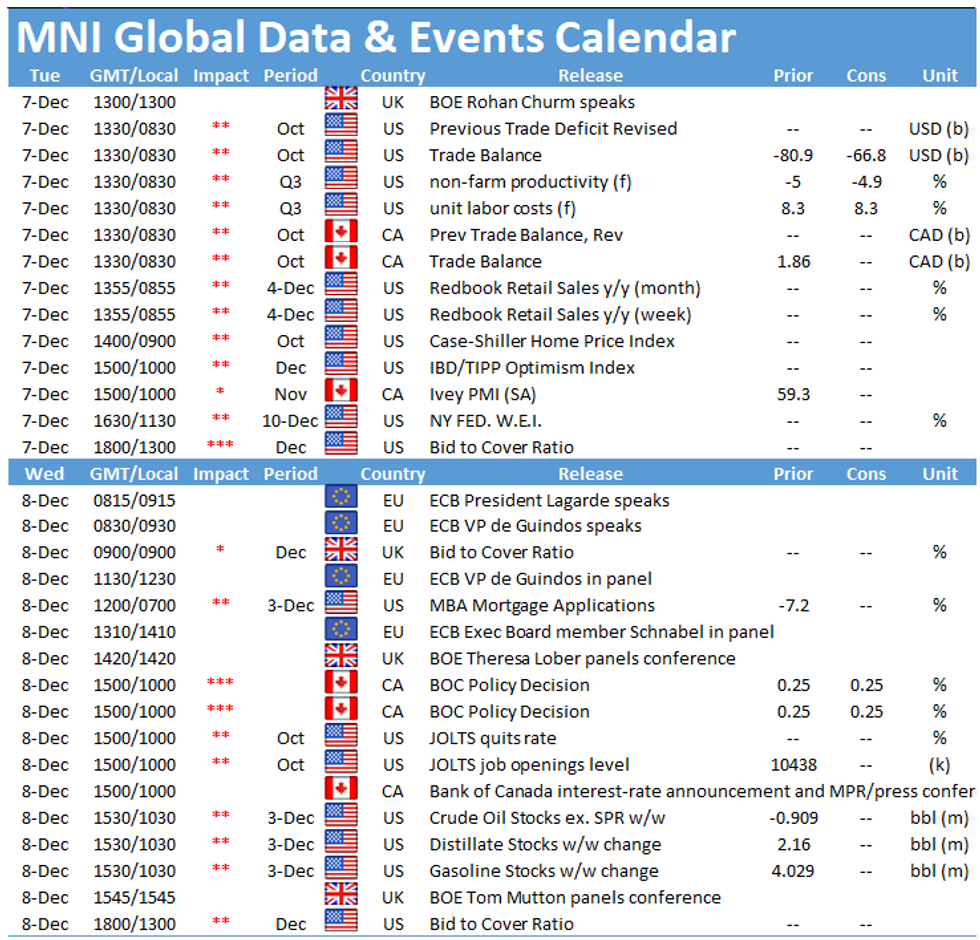

- Data releases are few and far between Tuesday, with US/Canadian trade balance numbers the sole highlight. Similarly, the speakers slate is quieter with the Fed having entered their media blackout period at the end of last week.

EQUITIES: Tech Stocks Up Sharply

- Asian markets closed sharply higher: Japan's NIKKEI closed up 528.23 pts or +1.89% at 28455.6 and the TOPIX ended 42.31 pts higher or +2.17% at 1989.85. China's SHANGHAI closed up 5.782 pts or +0.16% at 3595.088 and the HANG SENG ended 634.28 pts higher or +2.72% at 23983.66.

- European markets are gaining strongly, with the German Dax up 304.74 pts or +1.98% at 15275.67, FTSE 100 up 80.04 pts or +1.11% at 7170.34, CAC 40 up 136.02 pts or +1.98% at 6796.45 and Euro Stoxx 50 up 98.18 pts or +2.37% at 4097.55.

- U.S. futures are higher, led by tech, with the Dow Jones mini up 303 pts or +0.86% at 35515, S&P 500 mini up 53 pts or +1.15% at 4643, NASDAQ mini up 265 pts or +1.67% at 16107.75.

COMMODITIES: Energy Prices Regaining Lost Ground

- WTI Crude up $1.73 or +2.49% at $68.21

- Natural Gas up $0.12 or +3.39% at $3.682

- Gold spot up $2.69 or +0.15% at $1781.39

- Copper up $2.3 or +0.53% at $431.1

- Silver up $0.03 or +0.14% at $22.341

- Platinum up $15.31 or +1.63% at $943.34

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.