-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Central Bankers Weigh Stimulus Pullback

EXECUTIVE SUMMARY:

- E.C.B. HIKES MAY BE CLOSER THAN THOUGHT (MNI INTERVIEW)

- MNI ECB PREVIEW: TWEAKING THE PACE, POSTPONING DURATION

- BOE SAUNDERS: RATE COULD RISE IN "NEXT YEAR OR SO"

- U.K. P.M. JOHNSON SET TO ANNOUNCE TAX INCREASE TODAY

- LOCKDOWNS FORCE RBA TO EXTEND QE (MNI STATE OF PLAY)

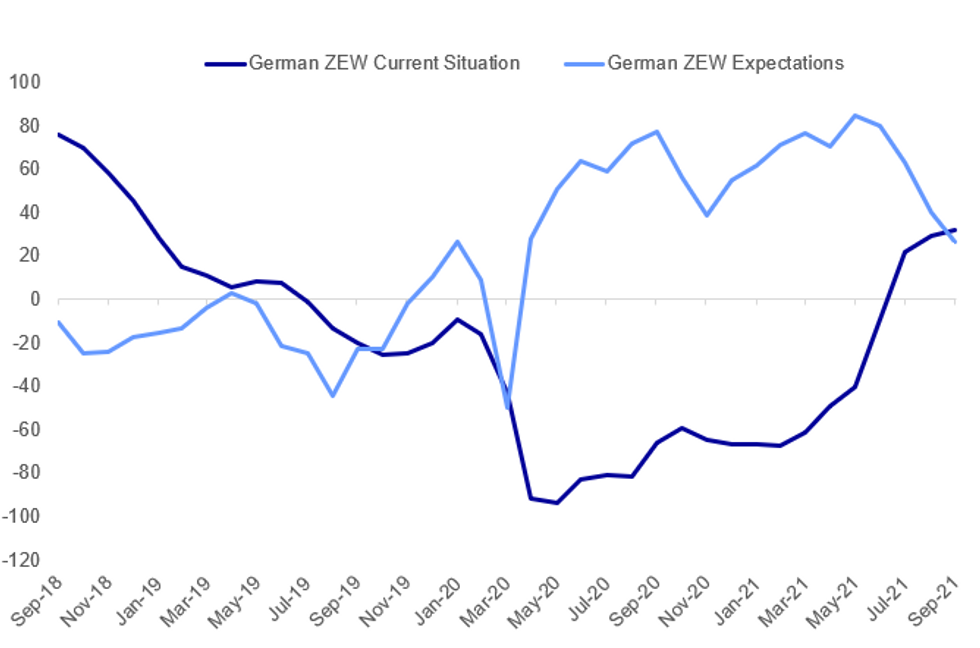

Fig. 1: German ZEW Disappoints In September

Source: ZEW, BBG, MNI

Source: ZEW, BBG, MNI

NEWS:

ECB (MNI INTERVIEW): The ECB may have to hike more quickly than it thinks in order to safeguard the financial system, Ignazio Angeloni, its former head of financial stability tells MNI. For full article contact sales@marketnews.com

ECB (MNI PREVIEW): Easing financial conditions since the July GC meeting, coupled with an improvement in economic conditions and an acceleration in inflation, suggest that the ECB is likely to announce a reduction in the PEPP purchase rate this week. A more fundamental decision on the future of PEPP is likely to be postponed until December. See full preview on our website.

BOE: Dependant on economic conditions, the first UK rate hike could come in the next 12 months or so, Bank of England Monetary Policy Committee member Michael Saunders said Tuesday. Saunders, who voted to end asset purchases at the last meeting, said in an Intuit video session he made clear that he is now contemplating rate hikes in the near future. "If the economy continues to recover and inflation shows signs of being more persistent then in might be right to think of interest rates going up in the next year or so," he said. He stressed that the policy rate, currently at 0.1%, would not have to rise far as the neutral, or non-expansionary or contractionary, level is exceptionally low. "Any rise in interest rates in the next year or so should be relatively limited given that a neutral level of interest rates is much lower than it used to be and it is not clear that you would even need to get back to neutral," Saunders said.

U.K.: Having met with the Cabinet earlier this morning, Prime Minister Boris Johnson is set to make a statement to the House of Commons at around 1230BST (0730ET, 1330CET) confirming a widely-anticipated 1.25% increase in the rate of National Insurance contributions. In doing so, Johnson will break one of the key manifesto pledges of the Conservatives ahead of the 2019 general election, where the party promised no increases to income tax, NI, or VAT. The hike is billed as crucial for assisting the NHS to rid a huge backlog of operations and treatments disrupted due to the pandemic, as well as funding elderly social care.

RBA (MNI STATE OF PLAY): The Reserve Bank of Australia is recognizing the damage the extended pandemic lockdowns are doing to the economic recovery, prompting an extension of its bond buying programme "until a least mid-February" next year as it left rates on hold at a record low 0.10%. The RBA had previously said, albeit narrowly in August, that the lockdowns in place in the two largest cities of Sydney and Melbourne had not changed its base case scenario for the economy. But the decision on Tuesday showed a strong change in that view. For full article contact sales@marketnews.com

E.U. ISSUANCE: The EU Commission has confirmed its funding plan for NGEU this year at EUR80 billion of long-term bonds, supplemented by tens of billions of short-term bills to be sold at regular auctions. The Commission made the announcement at the same time as releasing details of Green Bond Framework, planning total Green Bond issuance of EUR250 billion over the lifetime of the NGEU programme, 30% of the total.

EUROZONE DATA: Q2 GDP Revised Higher

Eurozone gross domestic product expanded by 2.2% in the second quarter, exceeding the previous estimate of 2.0% growth, according Eurostat date released on Tuesday.- That outpaces growth in both the U.S. and China, although both those economies have already regained pre-pandemic levels. European Central Bank officials believe the eurozone will not regain pre-Covid output until year end. GDP remained 2.5% below the level of Q4 2019.

- On an annual basis, output surged by 14.3%, well above there previously-reported 13.6% gain. GDP declined by 0.3% in the opening quarter of 2021, unrevised from earlier estimates.

- Employment rose by 0.7% in the second quarter, above the 0.5% rise reported last month.

- Amongst the largest eurozone members, German output grew by 1.6% in the second quarter, while France rose by 1.1%, Italy by 2.7% and Spain by 2.8%.

GERMANY SEP ZEW ECONOMIC SENTIMENT +26.5 AUG +40.4

* GERMANY SEP CURRENT CONDITIONS +31.9; AUG +29.3

FIXED INCOME: Core Europe Softer as US Markets Play Catch-Up

- Core European government bond markets trade lower, with the Dec-21 Bund future off over 60 ticks as markets anticipate heavy supply, follow US Treasuries and pre-position for Thursday's ECB rate decision. Bunds took out support at the Sep 3 and 6 lows of 172.01 on the way lower, narrowing the gap with the next projection level at 171.49.

- Further weakness went through in core Europe on the release of a better-than-expected final revision to Eurozone Q2 GDP, with both the quarterly and yearly figures revised higher to 2.2% and 14.3% respectively.

- Peripheral spreads have widened (albeit slightly) with Greek, Slovenian and Austrian bonds modestly underperforming. Austrian 10yr yields are around 0.6bps wider against Germany following E1.4bln in 10/15yr RAGB supply, with markets also set to digest 2 Gilt auctions as well as German Linkers.

- Datapoints are few and far between Tuesday, with no central bank speakers of note.

FOREX: AUD Lower as RBA Opt for Slower, But Longer Asset Purchases

- After a spell of USD weakness coinciding with the European open, markets are reversing course slightly into the NY crossover, with a steeper US curve and more buoyant 10y year yields underpinning the greenback.

- AUD has certainly been the most volatile among G10 overnight, with the RBA's decision to stick to a cautious taper initially boosting AUD, only for progress to be countered by an extension of the QE programme into mid-February next year. AUD/USD hi/lo sits at 0.7468/0.7404. This keeps resistance intact at 0.7478 and progress through here would open the 100-dma at 0.7541. Option interest at 0.7410-15 could keep prices anchored alongside a larger expiry for tomorrow's cut at 0.7425.

- EUR benefited from an upward revision in final Q2 Eurozone GDP, which saw the figure revised up to 2.2% (from 2.0%) for the quarter, and up to 14.3% from 13.6%.

- Datapoints are few and far between Tuesday, with no central bank speakers of note for the rest of the session.

EQUITIES: US Futures Continue To Retreat From Highs

- Asian stocks closed higher, with Japan's NIKKEI up 256.25 pts or +0.86% at 29916.14 and the TOPIX up 22.16 pts or +1.09% at 2063.38. China's SHANGHAI closed up 54.728 pts or +1.51% at 3676.587 and the HANG SENG ended 190 pts higher or +0.73% at 26353.63.

- European equities are a little weaker, with the German Dax down 33.72 pts or -0.21% at 15932.12, FTSE 100 down 14.9 pts or -0.21% at 7187.18, CAC 40 down 7.96 pts or -0.12% at 6743.5 and Euro Stoxx 50 down 10.35 pts or -0.24% at 4246.13.

- U.S. futures are flat/higher, with the Dow Jones mini up 8 pts or +0.02% at 35361, S&P 500 mini up 2.75 pts or +0.06% at 4537.25, NASDAQ mini up 15.25 pts or +0.1% at 15666.75.

COMMODITIES: Metals Dip

- WTI Crude down $0.21 or -0.3% at $69.1

- Natural Gas down $0.04 or -0.91% at $4.669

- Gold spot down $8.75 or -0.48% at $1817.28

- Copper down $4.95 or -1.14% at $428.45

- Silver down $0.26 or -1.05% at $24.4233

- Platinum down $11.16 or -1.09% at $1012.54

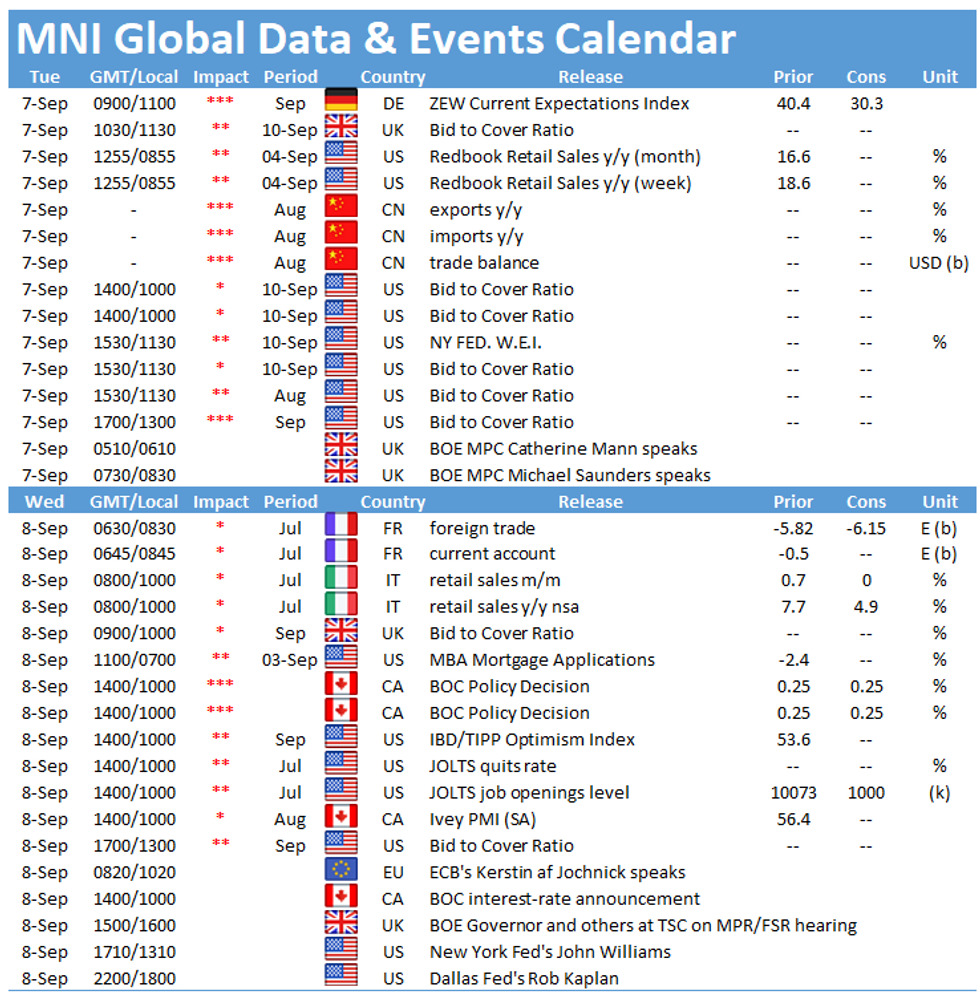

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.