-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: Eye On CPI

EXECUTIVE SUMMARY:

- U.S. INFLATION SEEN ACCELERATING IN FEBRUARY

- BANK OF CANADA EXPECTED TO HOLD POLICY STEADY

- P.B.O.C. TO EASE OUTFLOW RULES IN GLOBAL YUAN DRIVE (MNI EXCLUSIVE)

- CHINA CREDIT GROWTH BEATS EXPECTATIONS IN FEB

- E.C.B. TO POINT TO PEPP AS YIELD DEFENCE (MNI STATE OF PLAY)

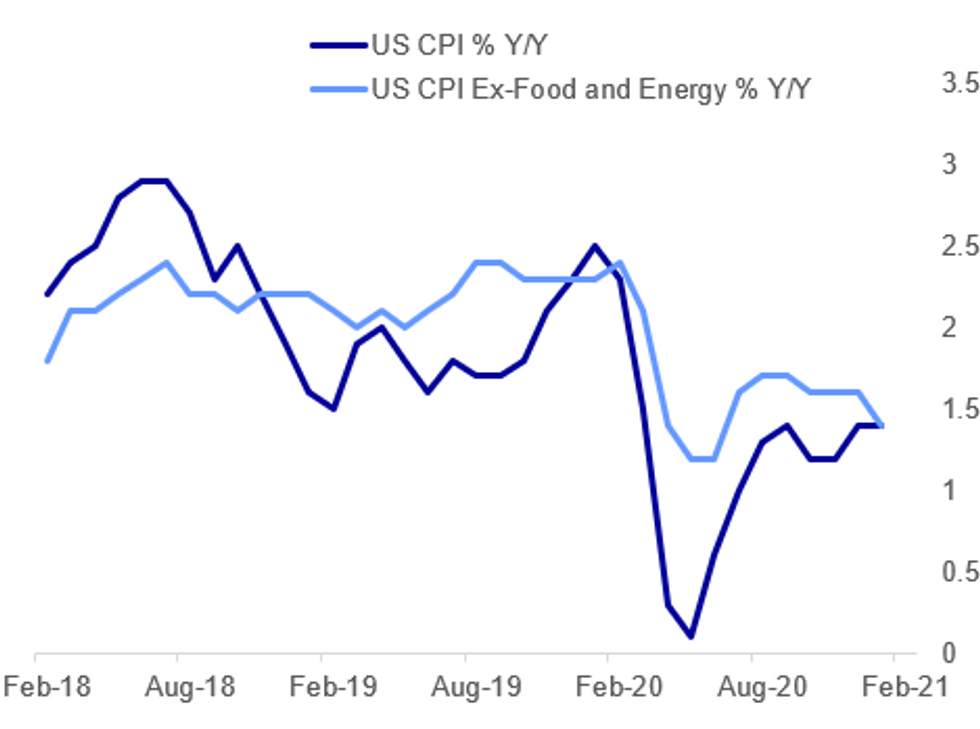

Fig.1: U.S. Inflation Seen Accelerating In February

BLS, BBG, MNI

BLS, BBG, MNI

NEWS:

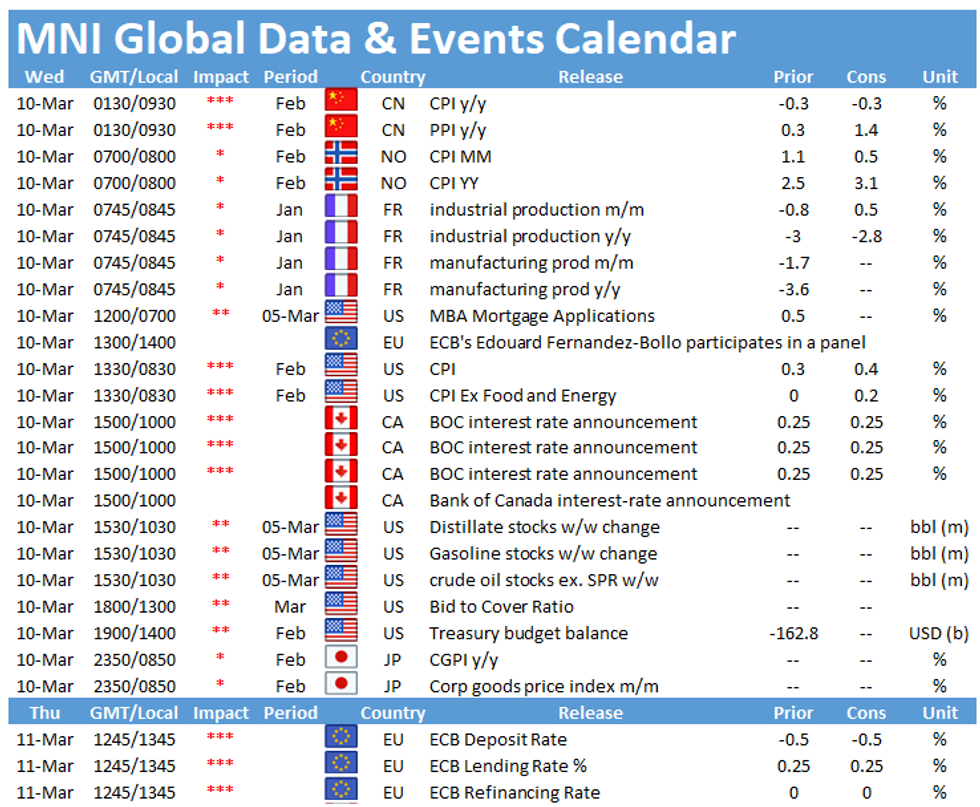

U.S. DATA PREVIEW: U.S. CPI likely advanced 0.4% in February following a 0.3% increase in January, according to Bloomberg, the highest since July. Excluding food and energy, CPI is forecast to increase 0.2% after a flat reading in January. Meanwhile, annual inflation rose by 1.4% in January and markets look for an acceleration to 1.7% in February. Survey evidence is in line with an uptick of inflation. The IHS composite PMI noted an increase in output charges, which was the second steepest on record.

BANK OF CANADA (MNI PREVIEW): The Bank of Canada is widely expected to keep its target rate on hold at 0.25% for the eighth consecutive time Wednesday, while maintaining guidance and asset purchases steady at CAD4B/week. Of the 20 sell-side analyst opinions covered in the MNI Policy Preview, none expect change in the target rate, and half see no change in the next two years. For full preview contact sales@marketnews.com

CHINA (MNI EXCLUSIVE): The People's Bank of China will take further steps to ease restrictions on outbound investments and boost convertibility of the capital account as it reinforces its drive to promote international use of the yuan, central bank officials have told MNI. For full article contact sales@marketnews.com

CHINA: China's M2 money supply rose 10.1% y/y in February, accelerating from the 9.4% rise seen in January, data released by the People's Bank of China on Wednesday showed, outpacing analyst expectations for a 9.4% gain. Among the key metrics, M1 growth slowed to 7.4% y/y from the previous 14.7% gain, while M0 rose 4.2% y/y, reversing Jan's 3.9% decline. Aggregate financing fell sharply to CNY1.71 trillion from Jan's CNY5.17 trillion, although outpacing the median forecast of CNY900 billion. On an annual basis, it accelerated to 13.3% from 13% at end-Jan.

ECB: The European Central Bank could indicate willingness to use its Pandemic Emergency Purchase Programme to contain a global rise in bond yields after its meeting on Thursday, but may stop short of announcing an immediate increase in the pace and volume and purchases. For full article contact sales@marketnews.com

EU-UK: At yesterday's Coreper II meeting of EU ambassadors, the representatives of national gov'ts voted in favour of the European Commission's proposal to launch legal action against the UK for Westminster's decision to unilaterally extend grace periods where checks are not required for certain food trade between GB and Northern Ireland. The legal action could come in the form of an infringement case taken to the European Court of Justice, or according to an EU diplomat talking to Politico "a dispute settlement process in the Withdrawal Agreement". Politico also quotes a diplomat saying that the row over NI grace periods could hit cooperation in other areas, saying "There is some encouragement for the Commission to take into account recent developments around the Northern Ireland protocol when taking a decision on equivalence on financial services"

DATA:

French IP rebounded in Jan

FRANCE JAN IP +3.3% M/M, -0.2% Y/Y; DEC -0.7% M/M

FRANCE JAN Manuf. Output +3.3% M/M, -1.0% Y/Y; DEC -1.4% M/M

- M/M French IP rebounded to 3.3% in Jan, following two consecutive months of decline and coming in markedly stronger than markets expected (BBG: +3.3%).

- Annual IP eased by 0.2% in Jan, showing the highest reading since Nov 2019.

- Mfg output rose by 3.3% as well, showing the highest level since Jul, while annual mfg output fell by 1.0%.

- Compared to Feb 2020, IP was down 1.7% in Jan, while mfg output was still 2.6% lower.

- Jan's rebound was broad-based with production of consumer non-durables showing the largest uptick, rising by 7.6% on a monthly basis after falling by 2.2% in Dec.

- Consumer durables output slowed to 3.8%, while capital and intermediate goods output rebounded to 2.2% and 1.1%, respectively.

- Energy production increased by 2.8% in Jan, up from 1.9% seen in Dec.

- Jan's increase is in line with forward-looking survey evidence such as the manufacturing PMI which signals solid growth in the sector in both Jan and Feb.

- Moreover, Insee's business climate in the mfg sector recovered further since the beginning of the year.

FIXED INCOME: Waiting for tomorrow's ECB decision

Despite some equity indices such as Eurostoxx moving to new highs this morning the European morning fixed income session has had much more of a "wait and see" mood to it ahead of the ECB meeting tomorrow.

- Treasuries hit their highs of the week during the Asian session but futures are only a tick lower than yesterday's close now while Bunds and gilts are little changed, with mixed moves for European peripheral spreads today (Greek spreads are tighter but Italian spreads a little wider).

- As we write in our ECB preview, tomorrow's meeting will be closely watched for indications of how the ECB will respond to the recent rise in nominal yields. Given the divergence of views within the GC on the nature and drivers of the bond sell-off, it may still be too early for the ECB to clarify exactly what it means by 'favourable financing conditions' and how it will preserve them, let alone devise an immediate policy response. Markets remain in wait-and-see mode nonetheless.

- TY1 futures are down -0-1+ today at 132-08 with 10y UST yields up 2.7bp at 1.555% and 2y yields unch at 0.162%.

- Bund futures are unch today at 171.23 with 10y Bund yields down -0.5bp at -0.306% and Schatz yields down -0.2bp at -0.688%.

- Gilt futures are down -0.03 today at 128.71 with 10y yields up 0.1bp at 0.726% and 2y yields down -0.8bp at 0.069%.

FOREX: Markets Stabilise After Tuesday U-Turn

- The greenback has stabilised after Tuesday's decline, although prices remain well within yesterday's range so far. The USD index continues to see resistance at yesterday's high of 92.503 and the 200-dma above at 92.895.

- Data and macro newsflow has been few and far between so far Wednesday, although EUR saw some support on the back of much better-than-expected French industrial and manufacturing production figures. EUR/USD is within range of the Tuesday highs at 1.1916.

- GBP is the best performer so far, with EUR/GBP solidly inside the recent downtrend. 2021 lows at 0.8541 act as first support.

- Focus turns to US CPI data, with prices expected to have risen 0.4% on the month (and +0.2% for the core). The Bank of Canada rate decision is also due, with the Bank seen keeping policy on hold at 0.25%.

EQUITIES: Bounce Continues

- Asian stocks closed mixed, with Japan's NIKKEI up 8.62 pts or +0.03% at 29036.56 and the TOPIX up 2.06 pts or +0.11% at 1919.74. China's SHANGHAI closed down 1.555 pts or -0.05% at 3357.737 and the HANG SENG ended 134.29 pts higher or +0.47% at 28907.52.

- European stocks are mostly higher, with the German Dax up 51.2 pts or +0.35% at 14349.69, FTSE 100 down 10.34 pts or -0.15% at 6712.62, CAC 40 up 34.85 pts or +0.59% at 5895.36 and Euro Stoxx 50 up 14.04 pts or +0.37% at 3763.32.

- U.S. futures are higher, with the Dow Jones mini up 111 pts or +0.35% at 31922, S&P 500 mini up 7 pts or +0.18% at 3880.25, NASDAQ mini up 12.25 pts or +0.1% at 12801.

COMMODITIES: Modest Retreat As Dollar Consolidates

- WTI Crude down $0.11 or -0.17% at $64

- Natural Gas down $0.03 or -1.01% at $2.631

- Gold spot down $1.69 or -0.1% at $1699.22

- Copper up $3.65 or +0.91% at $404.4

- Silver down $0.08 or -0.3% at $25.8595

- Platinum down $1.11 or -0.09% at $1169.14

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.