-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Up 0.01% In Week of Nov 29

MNI BRIEF: Japan Q3 Capex Up Q/Q; GDP Revised Lower

MNI US Open: Focus on The Fed

EXECUTIVE SUMMARY

- Focus will be on the FOMC later today; economic forecast revisions closely watched

- UK government under pressure from Washington to end stand-off with EU over Northern Ireland

- EU facing down next coronavirus wave

- Greece planning 30Y issue.

Source: MNI, Bloomberg

NEWS:

US/UK/EU (FT): Boris Johnson is coming under pressure from Washington to end his stand-off with Brussels over Northern Ireland, as Joe Biden prepares to hold St Patrick's day talks with Irish premier Micheál Martin. On the eve of the talks, Washington lawmakers published a resolution warning they would oppose any UK-US trade deal unless the British prime minister upheld the terms of the 1998 Good Friday peace agreement. Meanwhile, Martin has said he hopes the US president, who declared last year "I'm Irish", will use his influence to calm post-Brexit tensions between the UK and the EU and to secure the "right outcomes" in Northern Ireland.

FRANCE (GUARDIAN): French president Emmanuel Macron will hold a meeting with the country's Scientific Council this morning amid growing speculation that Paris, and the wider Île-de-France region is heading for new restrictions, including a weekend lockdown as there is in Nice and the Calais region. The number of new coronavirus infections continues to grow and intensive care units in the Paris region hospitals are under such intense pressure, they are moving patients out to hospitals in less affected areas. The rise in i/c admissions of Covid patients has forced hospitals in Paris and around to cancel non-urgent surgery. "The moment has come to envisage measures for the [Île-de-France] region," the Prime Minister Jean Castex warned on Tuesday evening.

GREECE (BLOOMBERG): Greece is issuing its longest-maturity bonds since 2008, completing the country's full return to debt markets. The nation is selling 30-year bonds via banks, which could be an opportunity for investors to pick up yields that are likely to be the highest in the euro area. Greece is following others in the region in seizing on low borrowing costs to finance its pandemic recovery.

UK (DAILY TELEGRAPH): Nicola Sturgeon's chief of staff meddled in a sexual harassment probe into Alex Salmond almost two months before the First Minister claims she first became aware he was being investigated, it has been claimed. David Davis, the Tory MP, invoked parliamentary privilege in the Commons on Tuesday night to make a series of potentially devastating claims about the Salmond affair, saying a whistleblower had passed him information purporting to show "perjury up to criminal conspiracy".

FIXED INCOME: Awaiting the FOMC

With all eyes on the FOMC later, it has been a tight range session for EGBs

- Bund trades In a 21 ticks range (171.59-171.80), and volumes are as expected way below averages.

- German curve trades flat, leaning steeper on the margin, but well within past ranges.

- Peripherals are wider against the German 10yr, with Greece at 3.4bps

- Gilts have traded somewhat in line with EGB, although on the margin they are underperforming, translating in a bear steeper curve.

- Focus here is on the BoE meeting tomorrow, as well as EMA decision on Astra vaccine, also due on Thursday.

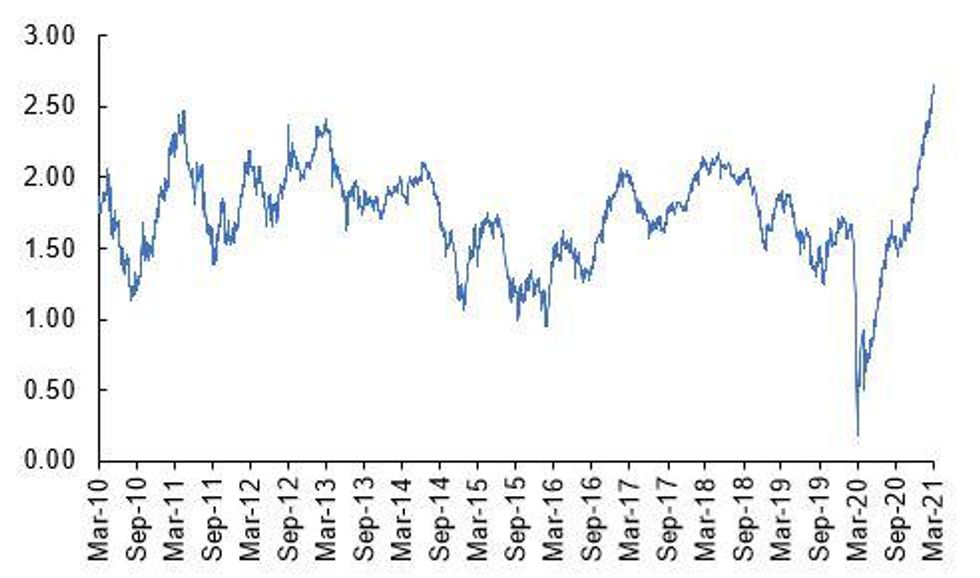

- US Treasuries are just off their lows, after US 10yr tested intraday high and just short of the March high at 1.6405% (printed on 15/03).

- This is also the highest level since 07/02/2020.

- Similar story for the 30yr, just shy of the March peak at 2.4028%, which is also the highest level seen since (02/01/2020).

- Looking ahead, ALL EYES on the Fed, with no tier 1 data scheduled for today.

FOREX: Greenback Closer to Recent Highs Pre-Fed

- The greenback trades in minor positive territory ahead of today's Fed meeting, with the USD Index holding closer to recent highs and is narrowing the gap with 2021's best levels hit on March 9th at 92.503.

- Having traded poorly throughout European hours Tuesday, GBP/USD recovered to close flat. This recovery has extended into the Wednesday morning, with GBP firmer against most others in G10.

- AUD is weaker, but AUD/USD has steered clear of testing the week's lowest levels, with support undercutting at 0.7706/0.7711. A break below here would open 0.7689 initially ahead of the March lows of 0.7621.

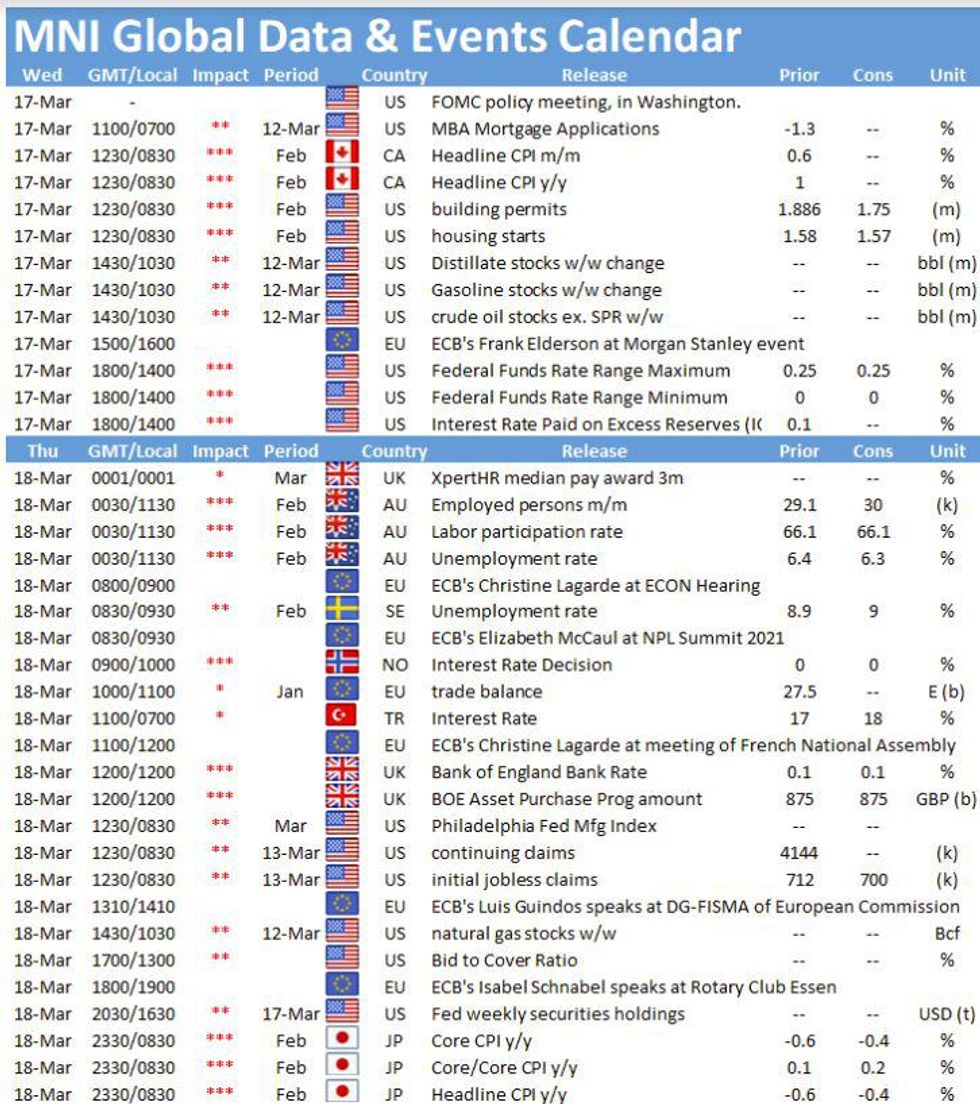

- Focus turns to the upcoming Fed decision, in which markets look for any signs that the FOMC could address the recent volatility in government bond yields. US housing starts/building permits and the Canadian CPI release for February also cross.

EQUITIES: Largely flat on the day ahead of the FOMC

- Japan's NIKKEI down 6.76 pts or -0.02% at 29914.33 and the TOPIX up 2.53 pts or +0.13% at 1984.03

- China's SHANGHAI closed down 1.182 pts or -0.03% at 3445.551 and the HANG SENG ended 6.43 pts higher or +0.02% at 29034.12

- The German Dax is down 13.25 pts or -0.09% at 14545.23, FTSE 100 down 20.11 pts or -0.3% at 6784.24, CAC 40 down 3.71 pts or -0.06% at 6051.88 and Euro Stoxx 50 down 7.72 pts or -0.2% at 3842.84.

- Dow Jones mini down 3 pts or -0.01% at 32835, S&P 500 mini down 3 pts or -0.08% at 3959.5, NASDAQ mini down 24.5 pts or -0.19% at 13127.75.

COMMODITIES: Copper higher but platinum lower

- WTI Crude down $0.08 or -0.12% at $64.69

- Natural Gas down $0.01 or -0.31% at $2.553

- Gold spot up $3.25 or +0.19% at $1734.64

- Copper up $3.3 or +0.81% at $409.95

- Silver up $0.05 or +0.2% at $25.981

- Platinum down $7.09 or -0.58% at $1209.16

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.