-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI US Open: German Investor Confidence Drops...But Stocks Rise

EXECUTIVE SUMMARY:

- U.S. SENATE TO VOTE ON INFRA AT 11ET, THEN MOVE TO $3.5T SPENDING BILL

- GERMAN ZEW: CURRENT CONDITIONS UP, EXPECTATIONS DOWN

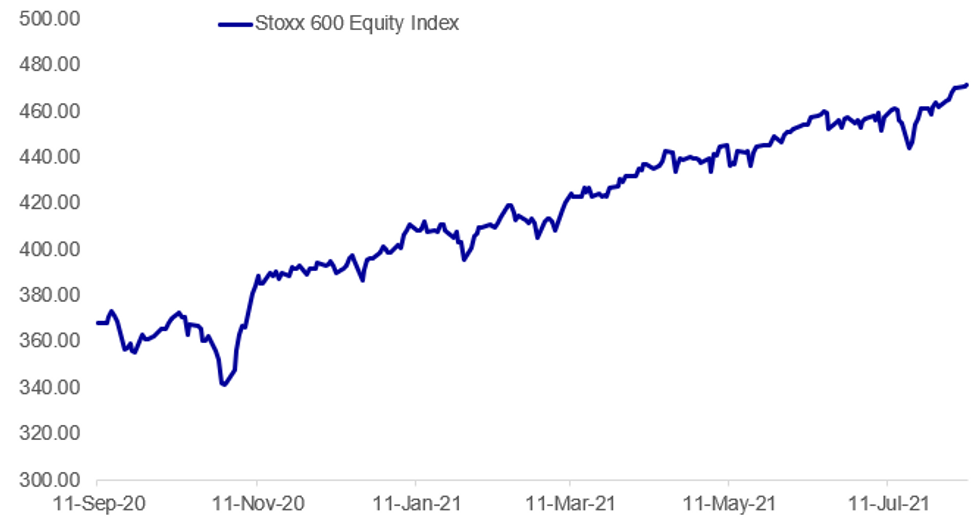

- EUROSTOXX 600 HITS ALL-TIME HIGHS

Fig. 1: European Stocks Hitting All-Time Highs

NEWS:

U.S. CONGRESS / FISCAL: Fox's Chad Pergram on Twitter explains today's proceedings in the Senate: "Senate to vote today at 11 am et on bipartisan infrastructure bill. Needs simple majority. Senate expected to turn immediately after vote on infrastructure bill to budget framework for Dems $3.5 trillion spending plan to avoid a filibuster. Will likely prompt vote-a-rama where senators vote for hours on amendment after amendment."

GERMANY (MNI INTERVIEW): Recent catastrophic floods in Germany, along with wildfires in Mediterranean countries and Monday's stark report from the UN's Intergovernmental Panel on Climate Change, are boosting the Greens' prospects by pushing climate change to the top of the German Sept. 26 general election agenda, party spokesman Sven Giegold told MNI. On MNI Policy MainWire now, for more details please contact sales@marketnews.com

CHINA (BBG): China recalled its ambassador to Lithuania and demanded that the Baltic nation remove its top diplomat in Beijing, over a dispute on setting up a Taiwan representative office.The decision was made because the Lithuanian government allowed "Taiwan authorities to open a 'representative office' under the name of 'Taiwan,'" which "severely undermines China's sovereignty and territorial integrity," the Foreign Ministry said in a statement Tuesday.

DATA:

GERMANY DATA: ZEW Current Conditions Up, Expectations Down

GERMANY AUG ZEW ECONOMIC SENTIMENT +40.4; JUL +63.3

GERMANY AUG CURRENT CONDITIONS +29.3; JUL 21.9

- ZEW Expectations dropped 22.9pt to 40.3 in Aug, coming in weaker than expected (Median55.0: 75.0), although remaining at a fairly high historical level.

- The ZEW Current Conditions jumped 7.4pt to 29.3 in Jul, just below market forecasts +31.7) and only the second positive reading in two years.

- "This points to increasing risks for the German economy, such as from a possible fourth COVID-19 wave starting in autumn or a slowdown in growth in China.", said s ZEW President Professor Achim Wambach.

FIXED INCOME: Gilts/German 5s30s the focus

Bund and gilt futures have been trading within yesterday's ranges while Treasury futures touched their lowest level since July 16 but have since also moved back into yesterday's range.

- The highlight of the morning session has been the German ZEW survey which saw the expectations component disappoint by about 10 points to come in close to November's levels. Core fixed income moved marginally higher on the release.

- Focus has more been on 5s30s curve in Europe, with gilt 5s30s at its lowest level since July 2020. German 5s30s are above last week's low of 70.2bp (currently at 70.9bp) but are flirting with the 61.8% Fibonacci retracement of the December 2020 to May 2021 move which comes in at 70.6bp.

- Looking ahead, a speech from Fed's Mester is the only noteworthy scheduled event for the rest of the day. The market will continue to await tomorrow's US CPI print and Thursday's UK activity data.

- TY1 futures are down -0-2 today at 133-23 with 10y UST yields down -0.2bp at 1.323% and 2y yields up 0.4bp at 0.225%.

- Bund futures are up 0.12 today at 176.64 with 10y Bund yields down -0.1bp at -0.462% and Schatz yields down -0.2bp at -0.755%.

- Gilt futures are up 0.10 today at 129.67 with 10y yields down -0.5bp at 0.578% and 2y yields down -0.3bp at 0.126%.

FOREX: Single Currency Weakness Puts EUR/GBP at 18 Month Low

- Trading has been generally thin on the ground, with most currency markets respecting recent ranges amid a lack of macro catalysts. Germany's ZEW survey came in well below forecast, at 40.4 vs. Exp. 55.0 for the expectations component. This put the single currency under minor pressure, with the EUR/USD rate edging further through yesterday's lows.

- JPY is the weakest currency in G10, helping USD/JPY rise closer to 110.50, although this hasn't filtered into stock markets which remain in a range.

- GBP is the firmest DM currency so far, with the strength most evident in EUR/GBP which crosses at the lowest level since late February last year.

- Once again, the data schedule is light, with US Nonfarm Productivity data and Unit Labor Costs the sole releases. Fed's Mester is scheduled to speak on inflation risks.

EQUITIES: Asia Closes Stronger; Eurozone Stocks On Front Foot

- Asian equities closed higher, with Japan returning from a holiday: Japan's NIKKEI up 68.11 pts or +0.24% at 27888.15 and the TOPIX up 6.94 pts or +0.36% at 1936.28. China's SHANGHAI closed up 35.296 pts or +1.01% at 3529.931 and the HANG SENG ended 322.22 pts higher or +1.23% at 26605.62

- European stocks are mixed (though Stoxx600 hit an all-time high), with the German Dax up 5.1 pts or +0.03% at 15745.41, FTSE 100 down 9.76 pts or -0.14% at 7132.3, CAC 40 up 2.07 pts or +0.03% at 6813.18 and Euro Stoxx 50 up 6.65 pts or +0.16% at 4177.15.

- U.S. futures are flat, with the Dow Jones mini down 16 pts or -0.05% at 34982, S&P 500 mini down 1.5 pts or -0.03% at 4424.25, NASDAQ mini up 5.5 pts or +0.04% at 15131.

COMMODITIES: Oil Up 4.3% From Monday's Lows

- WTI Crude up $1.35 or +2.03% at $67.83

- Natural Gas down $0.01 or -0.3% at $4.048

- Gold spot up $1.01 or +0.06% at $1737

- Copper up $2.75 or +0.64% at $431.7

- Silver up $0.05 or +0.2% at $23.4957

- Platinum up $7.69 or +0.78% at $989.67

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.