-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Eurozone Inflation Preview - November 2024

MNI POLITICAL RISK - Trump Initiates Tariff Negotiations

MNI US OPEN: July Nonfarm Payrolls Seen Rising 1.5M ****TEST 2****

US: EXECUTIVE SUMMARY:

- JUL NONFARM PAYROLLS SEEN +1.5M, BUT WITH WIDE RANGE OF ESTIMATES

- TIKTOK "WILL PURSUE ALL REMEDIES AVAILABLE" AGAINST TRUMP EXEC ORDER

- EUROZONE ECONOMIES SEE SHARP INDUSTRIAL REBOUND IN JUNE

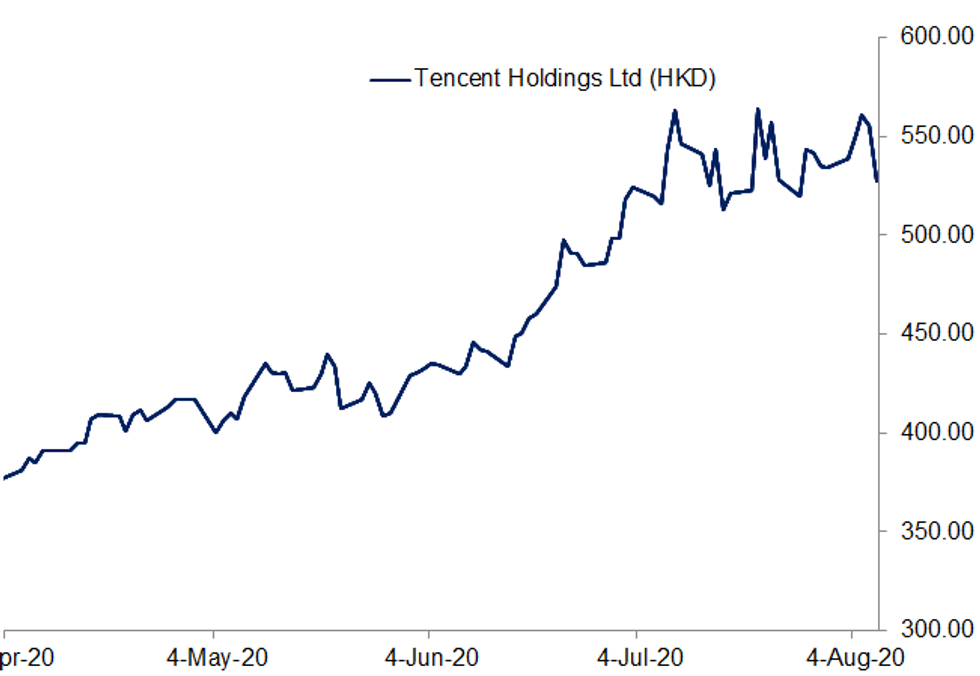

Source: Bloomberg, MNI

NEWS

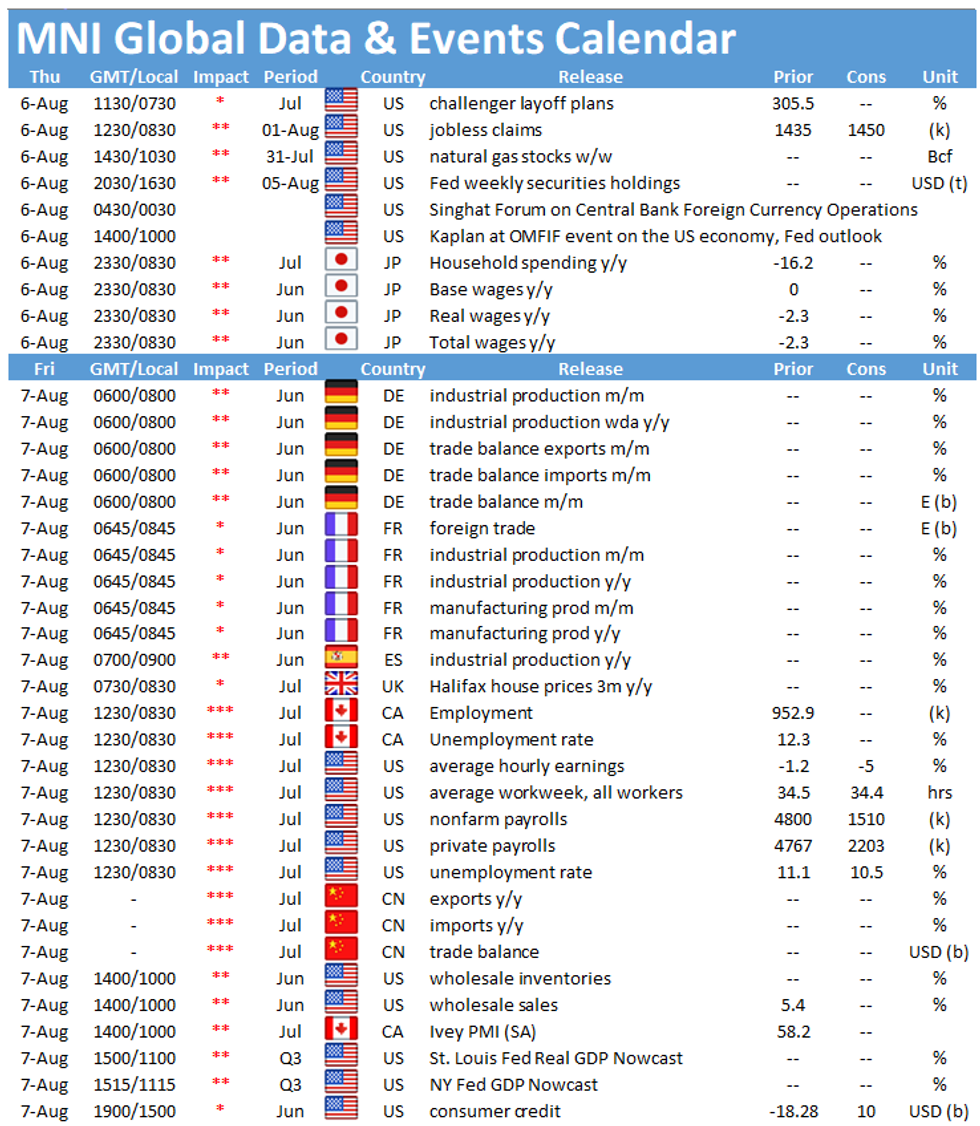

US DATA: Primary Dealer Jul Nonfarm Payroll Change Estimates:

- Citi 3.0m

- SocGen 2.66m

- RBC 2.25m

- BMO, C. Suisse, MS, Scotia 2.0m

- Daiwa 1.8m

- JPM, UBS 1.75m

- Wells Fargo 1.7m

- MNI DEALER MEDIAN - 1.475m

- Mizuho 1.25m

- BAML, Deutsche, Goldmans 1.0m

- BNP 800K

- Nomura 550K

- HSBC, TD Sec 500K

- NatWest 200K

- Barclays, Jefferies 0

- Whisper: 1.1m

In a corporate blog post, TikTok responds to Pres Trump's Executive Order issued

last night, which would effectively ban the company (and WeChat) from US markets

in 45 days' time:

- "We are shocked by the recent Executive Order, which was issued without any

due process. For nearly a year, we have sought to engage with the US

government in good faith to provide a constructive solution to the concerns

that have been expressed. What we encountered instead was that the

Administration paid no attention to facts, dictated terms of an agreement

without going through standard legal processes, and tried to insert itself

into negotiations between private businesses." - "We will pursue all remedies available to us in order to ensure that the ruleof law

is not discarded and that our company and our users are treated fairly - if not by

the Administration, then by the US courts."

the Treasury Department to alter its opposition to losses on the signature Main Street

lending program, even as such restrictions have limited its use to USD95 million. "I would

like that, but I don't know that I would expect to see that," Crapo told MNI Thursday on

Capitol Hill.

FRANCE DATA: JUN Mfg Output +14.4% M/M, -12.5% Y/Y; MAY +22.2% M/M

* After sharp rebound in May, French IP ticked up again in Jun, rising 12.7%

and came in stronger than markets expected (BBG: 8.7% m/m).

* Annual output declined again, down 11.7%, the slowest pace of deceleration

since Feb

* Monthly Mfg production increased as well in Jun, the second uptick in a row,

while y/y output fell further.

* Insee noted that production is still 11% below Feb's level, while mfg output

is 12.4% lower.

* All sectors saw m/m increases with consumer durable goods showing the largest

uptick, up +36.3% after jumping 188.8% in the previous month.

* Capital goods grew 24.0%, followed by Intermediate goods gaining 10.3%, while

consumer non-durable goods ticked up 7.8%.

* Energy output saw the smallest increase, rising 4.4% in Jun.

JAPAN: Japan Holiday On Monday

A reminder that Japanese markets are closed on Monday as the country observes a national holiday.

DATA:

- SPAIN JUN IND PRD +14.0% M/M, -14.0% Y/Y; MAY +14.3% M/M

- FRANCE JUN IP +12.7% M/M, -11.7% Y/Y; MAY +19.9% M/M

- GERMANY JUN IND PROD +8.9% M/M,-11.7% Y/Y; MAY +7.4% M/M

- HALIFAX UK JUL HPI +1.6% (-0.2%) MM; +3.8% 3MYY (+2.6%)

- FRANCE JUN SA TRADE BALANCE -EUR8.0 BN; MAY -EUR7.5 BN

- FRANCE JUN EXPORTS E32.4 BILLION

- FRANCE JUN IMPORTS E40.4 BILLION

- GERMANY JUN SA TRADE BALANCE +EUR14.5BN

- GERMANY JUN EXPORTS +14.9% M/M, -9.4% Y/Y

- GERMANY JUN IMPORTS +7.0% M/M, -10.0% Y/Y

FIXED INCOME:

TRADE TENSIONS INTENSIFYGovernment bonds are trading mixed this morning and little changed on the day.

- The UST curve has bull flattened slightly with the 2s20s and 2s30s spreads 2bp narrower.

- Gilts trade around yesterday's closing levels. Last yields: 2-year -0.044%, 5-year -0.0898%, 10-year 0.1067%, 30-year 0.6307%.

- Price action in bunds is relatively contained with the curve ~1bp flatter.

- BTPS are a toucher weaker and the curve marginally steeper.

- Reflecting what is likely to be a core pillar of his campaign strategy ahead of this year's election, US President Donald Trump

and intensified the crackdown on Chinese trade by giving US companies 45 days to stop engaging in business activities with

ByteDance, the owner of WeChat and Tiktok.. -Alongside continued concerns about a possible second wave in Europe, India has

reported a record number of daily coronavirus cases.

FOREX:

Awaiting PayrollsThe estimates for today's Nonfarm Payrolls release are disparate at best, with economists forecasting a headline number

of anywhere between 0 and +2.65mln. The volatile and unpredictable nature of the headline could keep some focus on the

rolling averages and multi-month net revisions.

- The greenback is the firmest currency in G10 so far today, with markets trading with a modest risk-off feel. equities are lower

across Europe, with Spanish and Italian stock markets underperforming. US futures are following suit, with all three major indices

seen opening lower for the final session of the week. The strongest currencies so far this week have pulled off their recent highs,

with EUR and NZD a touch lower this morning. - US President Trump's decision to bar US corporates and individuals from doing business with China's WeChat and TikTok

services is largely responsible for the mild risk-off theme today, with Chinese representatives swiftly criticizing the decision. - Outside of the US jobs report, the Canadian jobs data is also due as well as US wholesale inventories/sales. Fed's Rosengren

- is also speaking on the Main Street lending program.

STOCKS:

Recovery From Session LowsUS Pres Trump's executive order against Tiktok/WeChat roiled Asian equity markets overnight and that has spilled

over into European/US sentiment, but we are off session's worst levels.

* Asian equities closed weaker, with Japan's NIKKEI down 88.21 pts or -0.39% at

22329.94 and the TOPIX down 3.14 pts or -0.2% at 1546.74. China's SHANGHAI

closed down 32.428 pts or -0.96% at 3354.035 and the HANG SENG ended 398.96

pts lower or -1.6% at 24531.62.

* European stocks are down, with the German Dax down 63.06 pts or -0.5% at

12532.65, FTSE 100 down 5.01 pts or -0.08% at 6022.25, CAC 40 down 22.7 pts

or -0.46% at 4862.42 and Euro Stoxx 50 down 18.08 pts or -0.56% at 3223.4. * U.S. futures have retreated slightly, with

the Dow Jones mini down 168 pts or

-0.62% at 27125, S&P 500 mini down 18.75 pts or -0.56% at 3326, NASDAQ mini down 65.75 pts or -0.58% at 11197.75.

COMMODITIES:

Risk-Off RetreatCommodity prices are lower pretty much across the board; Silver / Platinum underperforming.

* WTI Crude down $0.39 or -0.93% at $41.57

* Natural Gas up $0 or +0.05% at $2.167

* Gold spot down $2.7 or -0.13% at $2060.94

* Copper down $3.55 or -1.22% at $287.65

* Silver down $0.56 or -1.92% at $28.371

* Platinum down $21.47 or -2.15% at $975.7

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.