-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: NFP In The Spotlight

MNI US Open: NFP In The Spotlight

EXECUTIVE SUMMARY:

- Japanese PM Yoshihide Suga is stepping down following criticism over the government's Covid response

- Australia has secured additional Covid vaccines from the UK in a swap deal

- The UK government is reported to be considering income tax increases, which would break a pre-election promise

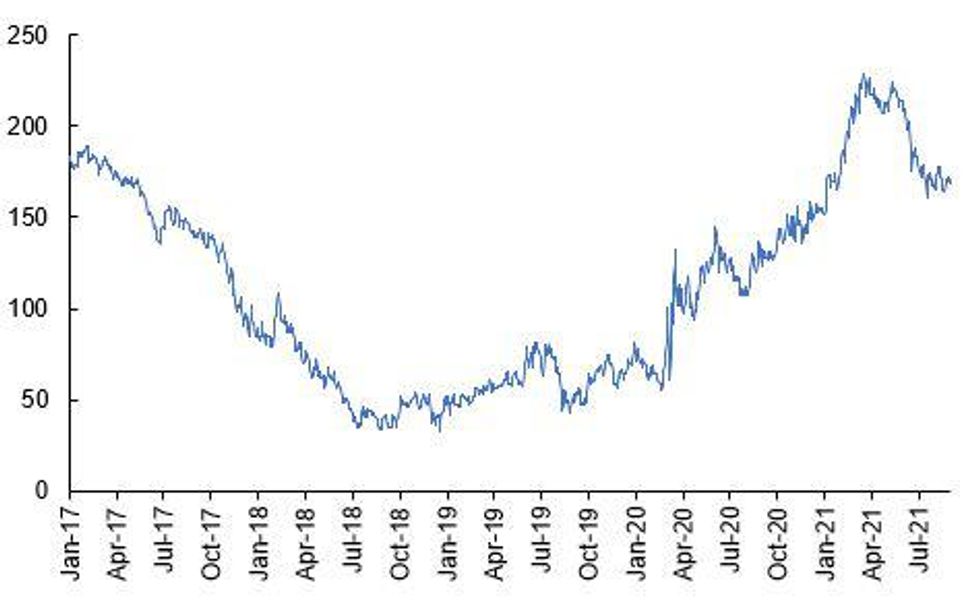

Source: MNI, Bloomberg

NEWS

JAPAN (FT): Yoshihide Suga will step down as prime minister after just a year in office, risking a return to the shortlived premierships that once characterised Japanese politics. Suga, whose popularity plummeted after he failed to rein in the Covid-19 outbreak, announced on Friday he would not seek re-election in this month's leadership race for the ruling Liberal Democratic party. The winner of that contest will lead the party in a general election that must be held by November 30. "I did consider running, but it requires enormous energy to do coronavirus measures as well as an election campaign. I cannot do both. I must focus on Covid-19 measures," Suga said.

EU-COVID (FT): The European Commission has ended an acrimonious court dispute with AstraZeneca, agreeing a revised schedule for the delivery of Covid-19 vaccines with far lower penalties for any failure to meet the targets. AstraZeneca will have until the end of the first quarter of 2022 to finish its deliveries, after missing a deadline to deliver the doses by the end of June. If it fails to meet the targets it will have to pay "rebates" as a percentage of the cost of the vaccine, which is about $3 to $4. These start at 10 per cent for a month delay and rise to 40 per cent for a delay of three months or more. Brussels had demanded a penalty of €10 a dose a day.

AUSTRALIA (REUTERS): Australia has secured 4 million doses of Pfizer COVID-19 vaccines in a swap deal with Britain, Prime Minister Scott Morrison said on Friday, as he looks to convince states and territories to stick to a national COVID-19 reopening plan. The extra doses should reach Australia this month doubling the available Pfizer supply for September, Morrison said, speeding up the country's efforts to come out of economically-damaging coronavirus lockdowns. "The plane is on the tarmac now. It will be leaving tomorrow ... this will enable us to bring forward significantly the opportunity for Australia to open up again," Morrison told reporters in Canberra on Friday, days after announcing a smaller vaccine swap agreement with Singapore.

UK (TELEGRAPH): Boris Johnson is next week expected to announce a manifesto-breaking tax hike to pay for the biggest overhaul in social care in a generation and bring down NHS waiting lists. In a major political gamble, the Prime Minister will reveal a rise in National Insurance that will see around 25 million people pay extra tax. In return, he will promise to cap the amount an individual will ever pay in social care costs – possibly at between £60,000 and £80,000 – and better protect people from having to sell their homes to meet care bills. However, Number 10 and the Treasury remain at loggerheads about how big the tax rise should be as negotiations on the specifics continue despite months of planning.

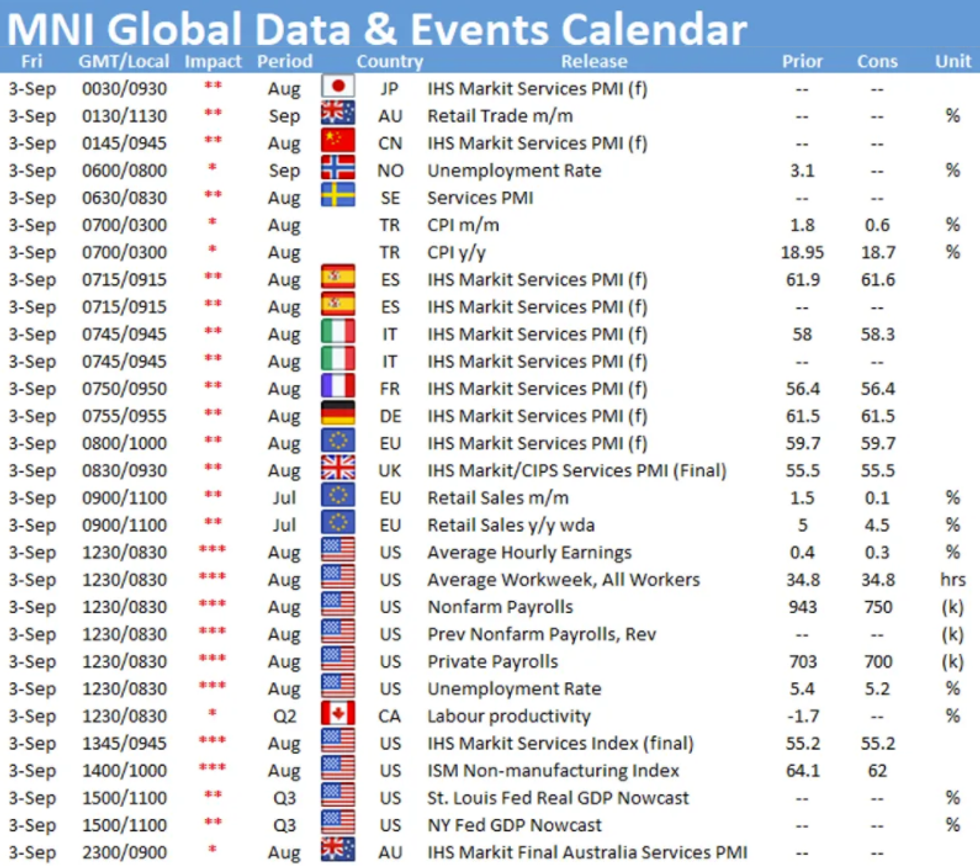

DATA

FIXED INCOME: Focus On NFP and ISM services

- EGBs have traded within ranges this morning, with decent volumes going, but mostly spread related.

- Desks are taking the opportunity ahead of NFP and a long holiday weekend for the US.

- Expiry will be on the 8th for the September contract.

- Italy has underperformed Bund, pushing the 10yr spread 2.7bps wider.

- Greece on the other hand is 0.6bp tighter.

- The morning session was dominated by European services PMIs, but the data had very little impact on markets.

- Gilts saw UK final service PMI being revised lower to 55 vs 55.5 expectation.

- The contract is unaffected, and underperforms Bunds also.

- Gilt/Bund spreads is 1.1bp wider.

- US treasuries are trading within their tight overnight ranges, as the Globe awaits on the US NFP and US.ISM services releases.

- Besides the data, we don't have any scheduled speakers, but the US The President will delivers remarks on the August jobs report at 1000ET/15.00BST. Nothing new here.

FOREX: Final Jobs Report Ahead of Sep FOMC

- Nonfarm payrolls take focus going forward, with markets expecting a decent read of 725,000 jobs added. While this would be below last month's 943,000, the number remains highly elevated above pre-pandemic levels. The dispersion around the median estimate remains considerable, with a range of forecasts between 400k - 1mln, which could suggest a decent market response later today.

- Ahead of the figure, Scandi FX trades weaker, but well within the recent range and AUD continues its recent spell of outperformance. AUD/USD now trades higher on the week by close to 2%, with the pair topping out at a new multi-month high. AUD strength continues to defy broader commodity markets, with Dalian-listed iron ore still nursing losses of over 10% from Monday's high after the China authorities' pledge to pressure prices.

- Outside of the jobs release, the ISM Services Index also crosses. There are no central bank speakers of note.

EQUITIES: US Futures Inch to New Highs Ahead of NFP

- Japan's NIKKEI up 584.6 pts or +2.05% at 29128.11 and the TOPIX up 31.88 pts or +1.61% at 2015.45. China's SHANGHAI COMP closed down 15.308 pts or -0.43% at 3581.734 and the HANG SENG ended 188.44 pts lower or -0.72% at 25901.99.

- The German DAX up 4.66 pts or +0.03% at 15847.38, FTSE 100 up 9.1 pts or +0.13% at 7173.63, CAC 40 down 23.01 pts or -0.34% at 6741.74 and Euro Stoxx 50 down 5.77 pts or -0.14% at 4226.12.

- Dow Jones mini up 41 pts or +0.12% at 35468, S&P 500 mini up 6.75 pts or +0.15% at 4542.25, NASDAQ mini up 12.75 pts or +0.08% at 15614.5.

COMMODITIES: Energy, Metals Products Rangebound Pre-Payrolls

- WTI Crude up $0.02 or +0.03% at $69.98

- Natural Gas down $0.01 or -0.17% at $4.633

- Gold spot up $2.49 or +0.14% at $1812.38

- Copper down $0.45 or -0.1% at $429.85

- Silver up $0.09 or +0.37% at $23.9995

- Platinum up $1.89 or +0.19% at $1004.24

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.