-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Payrolls Seen Pushing The Million Mark

EXECUTIVE SUMMARY:

- MNI DEALER MEDIAN FOR U.S. NONFARM PAYROLLS: +900K

- SALVINI TIPS BERLUSCONI FOR ITALIAN PRESIDENCY, SUPPORTS DRAGHI FOR NOW

- HONG KONG OPPOSES U.S. MEASURE TO GIVE RESIDENTS TEMPORARY SAFE HAVEN

- DIDI IS SAID TO WEIGH GIVING UP DATA CONTROL TO APPEASE BEIJING

- EVERGRANDE BOND SELLOFF DEEPENS ON COURT CONCERN, DOWNGRADES

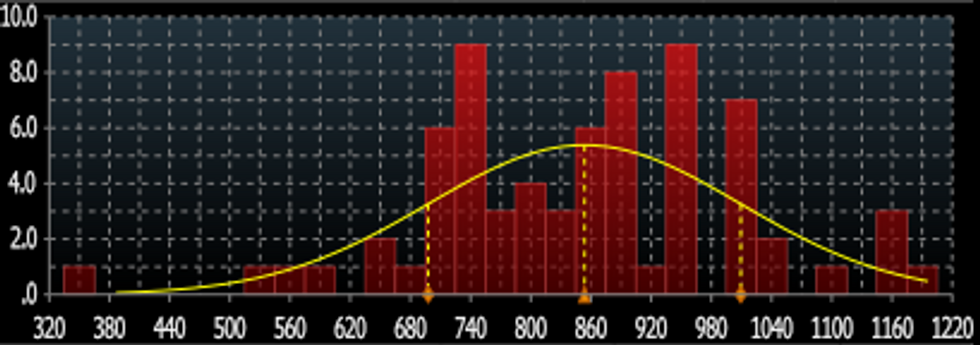

Fig.1: Bloomberg Survey For July Nonfarm Payroll Change ('000s) Distribution

Source: BBG

Source: BBG

NEWS:

US NONFARM PAYROLLS: The Bloomberg survey median estimate for July nonfarm payrolls change is +858k, with average 853k. The range of estimates is 350k to 1.2mn, with a 155k standard deviation. The BBG "Whisper" number is +884k.

ITALY POLITICS: In an interview with Corriere Della Sera, head of the right-wing populist League, Matteo Salvini, states that former PM and head of centre-right Forza Italia, Silvio Berlusconi, saying that "On paper, we already have the candidate for the Quirinale [Italy's presidential palace]. I heard Silvio Berlusconi this morning and I felt [he was] in great shape." Incumbent President Sergio Mattarella's seven-year term expires in February 2022 and has already stated his intention to retire, leaving a potential path open to the controversial media tycoon and politician to make a run for the position.

HONG KONG / US (GOV'T PRESS RELEASE): The Hong Kong Special Administrative Region (HKSAR) Government today (August 6) expressed strong opposition to the latest actions by the United States Government against the HKSAR under the so-called "Memorandum on the Deferred Enforced Departure for Certain Hong Kong Residents" (the Memorandum). A Government spokesman said, "We strongly object to the baseless and purely politically oriented comments in the Memorandum smearing the Law of the People's Republic of China on Safeguarding National Security in the Hong Kong Special Administrative Region (Hong Kong National Security Law). National security is a matter within the purview of the Central Authorities. It is the legitimate right and duty of every country to safeguard its national security.

DIDI / CHINA (BBG): Didi Global Inc. is weighing giving up control of its most valuable data as part of efforts to resolve a regulatory probe into the aftermath of its controversial U.S. initial public offering, people familiar with the matter said.The ride-hailing giant has put forth a number of proposals to appease the powerful internet industry overseer, including ceding management of its data to a private third party, the people said, asking not to be identified talking about internal deliberations. Regulators have signaled a preference for that third party to be state-controlled, one of the people said. It's uncertain how such an arrangement would impact Didi's access to the data, which is crucial to helping the firm orchestrate 25 million rides a day between some 400 million riders and drivers.

MEITUAN / CHINA (BBG): China plans to levy a $1 billion fine on Meituan for abusing its market position, the Wall Street Journal reported, citing people with knowledge of the matter.The penalty could be announced in coming weeks and the food-delivery giant will be required to revamp its operations and end its exclusivity arrangements with merchants, the newspaper reported. Meituan and the State Administration for Market Regulation didn't immediately respond to the WSJ's requests for comment Friday.The antitrust watchdog had announced an investigation into Meituan in April, weeks after slapping a record $2.8 billion fine on fellow internet giant Alibaba Group Holding Ltd. for abusing its market dominance

EVERGRANDE / CHINA (BBG): China Evergrande Group bonds dropped to record lows after reports that creditor lawsuits against the world's most indebted developer will be consolidated, a step that has preceded several high-profile defaults by Chinese borrowers.Cases related to Evergrande and its affiliates will be centralized in a Guangzhou court, Caixin reported, citing two unnamed lawyers. Speculation about the move triggered a slump in the developer's bonds late Thursday, with losses deepening after the city of Beijing tightened property curbs and S&P Global Ratings cut its assessment of Evergrande for the second time in as many weeks.

UK DATA: UK house price slowed on an annual basis to the lowest level since March, the Halifax said Friday, although the average price of a house across the UK remains only just shy of the all-time high seen in May this year. "Recent months have been characterised by historically high volumes of buyer activity, with June the busiest month for mortgage completions since 2008. This has been fueled both by the 'race for space' and the time-limited stamp duty break," Halifax managing director Russell Galley said. The average cost of a house increased 0.4% m/m, clawing back some of the 0.6% decline seen in June, the Halifax said. Annual house price growth slowed to a still healthy 7.6%.

DATA:

PREVIEW: Primary Dealer Nonfarm Payroll Estimates

| Dealer | Estimate | Dealer | Estimate |

|---|---|---|---|

| Jefferies | +1.20mn | Citi | +1.15mn |

| Goldman Sachs | +1.15mn | Credit Suisse | +1.10mn |

| Nomura | +1.05mn | Morgan Stanley | +1.025mn |

| Amherst Pierpoint | +1.015mn | BNP Paribas | +1.00mn |

| Deutsche Bank | +1.00mn | TD Securities | +1.00mn |

| UBS | +953K | HSBC | +900K |

| J.P.Morgan | +900K | RBC | +880K |

| Wells Fargo | +865K | Societe Generale | +825K |

| Scotiabank | +800K | Mizuho | +775K |

| Barclays | +750K | Bank of America | +750K |

| Daiwa | +750K | NatWest | +700K |

| BMO | +675K | ||

| Dealer Median | +900K | BBG Whisper | +895K |

Italian IP Back Above Pre-Covid Levels In June

Jun SA ind. output +1.0% m/m (May revised dn -1.6% m/m), WDA +%13.9 y/y

- Jun SA ind. output 0.3% above Feb 2020 pre-Covid level--Istat says

- 21 working days in Jun 2021 as in Jun 2020

- Jun SA m/m consumer goods, intermed., capital gds, energy rose—Istat says

- Jun WDA y/y consumer, intermed., capital gds., energy rose--Istat says

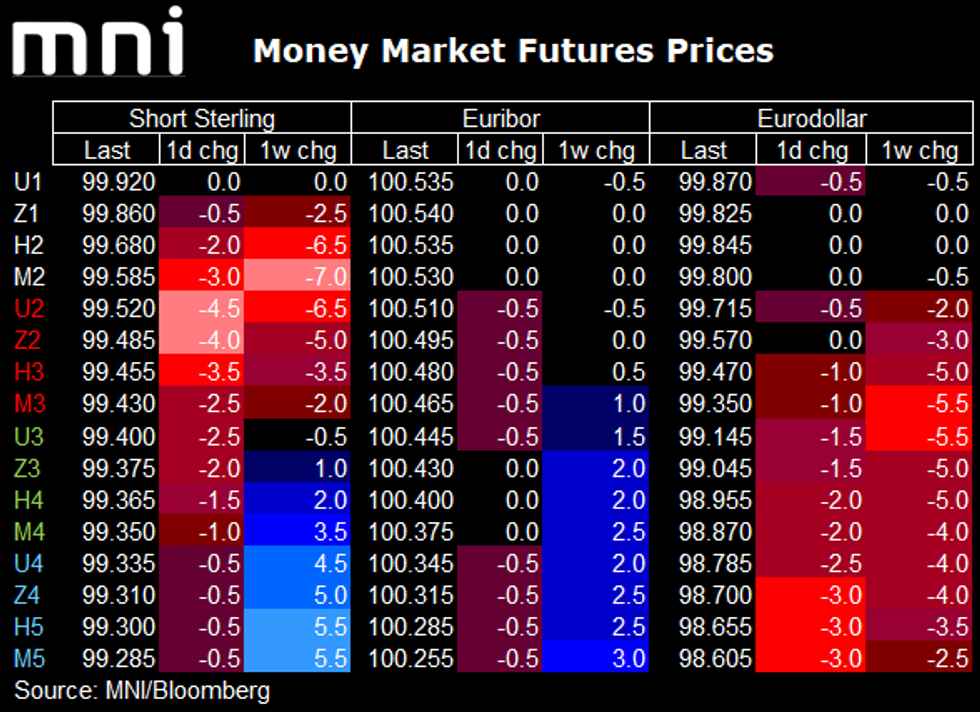

FIXED INCOME: Short sterling curve steepens to 0.50% hike, then flattens. Payrolls ahead

- Short sterling has seen the most interesting moves in core fixed income this morning. Markets continue to push forward the first hike and the hike to 0.50%. A 15bp hike is now priced around the end of the first quarter and a 25bp hike by the end of 2022. The biggest moves have been around the Sep22/Dec22 contracts, with the curve steepening up to that point and then flattening after. This continues the trend seen yesterday of markets pricing in fast hikes up to the 0.50% threshold when QE reinvestments will cease, with slower rate hikes after. Short sterling Blues for example are only 0.5bp lower on the day. In gilts, 2-year yields are 3.2bp higher on the day while 10-year yields 1.8bp higher as the curve bear flattens.

- Outside of continued reaction to yesterday's BoE, the US employment report will be the highlight later today. The UST curve has bear steepened. 10-year UST yields are up 1.5bp (not a million miles from the move in 10-year gilts) but 2-year UST yields are only up 0.6bp on the day.

- Bund futures extended the streak of higher highs Thursday, printing up at 177.61 and the highest level since late January. Intraday rallies, however, remain short-lived, with markets keenly watching for any extension of the pullback.

- BTPs further cemented the uptrend, extending the gains to hit fresh alltime highs. A positive outlook follows the recent resumption of the uptrend that started May 19 - gains on Jul 6 and 7 resulted in a breach of a former key resistance at 152.47, Jun 14 high and established a bullish price sequence of higher highs and higher lows.

- TY1 futures are down -0-5+ today at 134-10+ with 10y UST yields up 1.5bp at 1.239% and 2y yields up 0.6bp at 0.206%.

- Bund futures are down -0.14 today at 177.15 with 10y Bund yields up 0.6bp at -0.494% and Schatz yields up 0.5bp at -0.775%.

- Gilt futures are down -0.16 today at 130.07 with 10y yields up 1.7bp at 0.540% and 2y yields up 3.1bp at 0.119%.

FOREX: EUR/USD Leaning Lower Pre-Payrolls

- EUR trades weaker early Friday, with EUR/USD pressing to new weekly lows of 1.1807. A break below the handle would mark a resumption of the downtrend after the corrective bounce at the tail-end of July. Below 1.18, markets may find some support at 1.1789 ahead of the key level at 1.1752 - the Jul 21 low and bear trigger. Decent option interest could draw focus into the NY cut, with over $1bln notional rolling off at 1.18 today.

- The greenback is mildly stronger, helping the USD Index climb to the best levels since Jul28. This is working against the likes of gold and silver, which both sit lower ahead of NY hours, but a further stabilisation and bounce in oil prices is supporting CAD. EUR/CAD sits on 50-dma support at 1.4769.

- Payrolls for July take focus going forward, with analysts expecting job gains of around 850k, in line with the June report. The whisper number is a touch above consensus at 884k, which may suggest a positive lean headed into the figure.

- The Canadian jobs data also crosses, with markets expecting a further decline in the unemployment rate, seen hitting 7.4% from 7.8% previously. There are no central bank speakers of note.

EQUITIES: Mixed Start Pre-US Payrolls

- Asian markets closed mixed, with Japan's NIKKEI up 91.92 pts or +0.33% at 27820.04 and the TOPIX up 0.36 pts or +0.02% at 1929.34. China's SHANGHAI closed down 8.321 pts or -0.24% at 3458.228 and the HANG SENG ended 25.29 pts lower or -0.1% at 26179.4

- European equities are likewise flat/mixed, with the German Dax up 15.97 pts or +0.1% at 15744.67, FTSE 100 down 2.41 pts or -0.03% at 7120.43, CAC 40 down 3.07 pts or -0.05% at 6781.19 and Euro Stoxx 50 up 2.6 pts or +0.06% at 4161.08.

- So too are US stocks: Dow Jones mini up 12 pts or +0.03% at 34955, S&P 500 mini up 1 pts or +0.02% at 4422.5, NASDAQ mini down 15.25 pts or -0.1% at 15152.5.

COMMODITIES: Copper Outperforms As Inventories Dwindle

- WTI Crude up $0.35 or +0.51% at $69.4

- Natural Gas down $0 or -0.05% at $4.126

- Gold spot down $4.8 or -0.27% at $1800.99

- Copper up $4.7 or +1.08% at $439.8

- Silver down $0.04 or -0.17% at $25.1755

- Platinum down $4.15 or -0.41% at $1007.46

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.