-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: Rates Rise Ahead Of Payrolls

EXECUTIVE SUMMARY:

- U.S. SEPTEMBER NONFARM PAYROLLS SEEN RISING 500K

- U.S. SHOULD PULL TROOPS FROM TAIWAN: CHINA FOREIGN MINISTRY SPOKESMAN

- LAVROV: RUSSIA READY TO HELP EUROPE OVERCOME ENERGY CRISIS: IFX

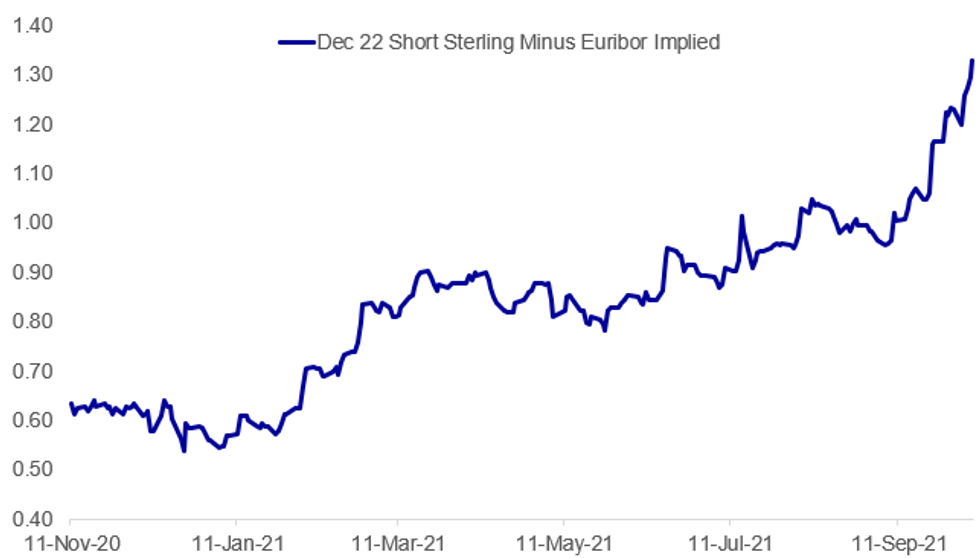

Fig. 1: UK Rate Differential Over Eurozone Widening

Source: BBG, MNI

Source: BBG, MNI

NEWS:

CHINA/U.S.: Wires and social media reporting comments attributed to Chinese foreign ministry spokesman Zhao Lijan stating that the US should withdraw its troops from Taiwan. Comes after revelations emerged that US marines and special forces has been training Taiwanese troops on the island.

- Cross-strait tensions have risen notably over the past week, with China increasing its military aircraft incursions into Taiwanese air space to record levels for four days in a row.

- Taiwan's gov't has stated that it will 'defend freedom at all cost' as fears grow of a potential Chinese invasion of the island. Some of the more hawkish estimates have judged Beijing capable of an assault on Taiwan anywhere from 3 years to a decade.

RUSSIA / ENERGY (BBG): Russia was, is and will be a responsible country and is ready to respond to the growing energy needs of its European partners, Kremlin spokesman Dmitry Peskov tells reporters on conference call.

- Russia "categorically disagrees" with U.S. accusations it's using energy crisis as a geopolitical weapon; U.S. is the one that constantly threatens sanctions against commercial projects that can help stabilize Europe's energy markets, Peskov says

- Russia is ready to discuss new long-term supply contracts

- Kremlin congratulates journalist Dmitry Muratov on winning the Nobel Peace prize, Peskov says

PBOC (BBG): China drained the most short-term liquidity from the banking system in a year on a net basis as it reduced support after a week-long holiday. Government bond futures slid by the most since August.The People's Bank of China offered 10 billion yuan ($1.6 billion) of short-term funds to lenders, resulting in a net liquidity withdrawal of 330 billion yuan taking into account maturities. The operation broke a pattern where the central bank had added 100 billion yuan on a gross basis each day in the past five sessions.

UK / FRANCE / ENERGY /EU (BBG): France has no plans to cut power to the island of Jersey but could use other measures if the U.K. doesn't respect the Brexit deal on fishing, French European Affairs Minister Clement Beaune said on Friday."The idea is not to tell Jersey people that they won't have power this winter," Beaune said in an interview with RMC radio and BFM TV. "To cut power to each Jersey inhabitant who needs heat this winter, this won't happen."

BOJ (MNI POLICY): A likely upward revision to IMF global growth forecast for next year is expected to feed into an upbeat view on economic recovery next year in the Bank of Japan's end October release of its medium-term Outlook report, MNI understands. For full article contact sales@marketnews.com

BOK (MNI STATE OF PLAY): Benchmark interest rates will likely be kept steady at 0.75% by the Bank of Korea next week as it shows caution amid an economic slowdown in neighbouring China, though the stance is seen as more of a pause, MNI understands. For full article contact sales@marketnews.com

BOK (MNI INTERVIEW): The Bank of Korea wants to swiftly curb high house prices spurred by low borrowing costs and will move to raise rates for the second straight meeting, said Kota Hirayama, senior economist in charge of emerging economies at SMBC Nikko Securities. For full article contact sales@marketnews.com

JAPAN: Japan's sentiment index posted the first rise in two months as major components improved from the previous month and the outlook index for two to three months ahead rebounded sharply, the Economy Watchers report released by the Cabinet Office Friday showed. The Economy Watchers sentiment index rose a seasonally adjusted 7.4 points to 42.1 in September from 34.7 in August.

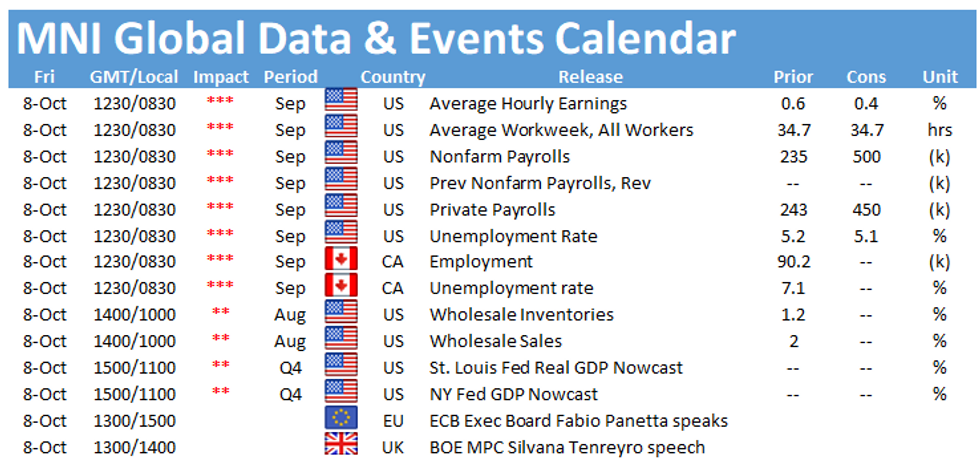

DATA:

No key data released in the European morning session.

US DATA PREVIEW: NFP Headline Expected at +500k, Whisper Number at +525k

Sell-side analyst breakdown:

| Morgan Stanley | 700k |

| UBS | 635k |

| Goldman Sachs | 600k |

| UniCredit | 600k |

| JP Morgan | 575k |

| Citigroup | 560k |

| Deutsche Bank | 550k |

| Wells Fargo | 535k |

| HSBC | 525k |

| TD Securities | 525k |

| Standard Chartered | 500k |

| Wrightson ICAP | 500k |

| Barclays | 475k |

| ING | 470k |

| SocGen | 470k |

| Mizuho | 450k |

| Daiwa | 400k |

| Natwest Markets | 400k |

| Bank of America | 325k |

| Jefferies | 300k |

| Scotiabank | 250k |

FIXED INCOME: A busy morning session for Bonds

- A very busy morning for Govies, not your typical pre NFP early morning trading session.

- Bund dipped lower, as US Yield rose overnight, after the US extended the Debt ceiling until December.

- German 10yr tested the initial yield target we noted at -0.146%, printed a -0.149% high

- Peripherals are trading inline with Bund and close to flat on the day.

- Gilt/Bund spread is once again widening this morning, now by another 2.2bps, and widest since May 2016.

- US Treasuries have dragged EGBs lower, helped by the Debt ceiling extension.

- Tnotes has traded through next yield resistance that was noted at 1.59%

- US 10yr is at 1.594% at the time of typing.

- Looking ahead, ALL EYES will be on NFP, but looking at this morning's price action, it looks like the market is possibly already looking past this release, given the volumes and the sell off.

- We also get US Wholesale inventories, but final reading for the latter.

- SPEAKERS: ECB Lagarde, Panetta, and US Yellen.

FOREX: USD Falters After Initial Yield-Inspired Strength

- The greenback initially traded well in early European hours, with the USD index rising to touch 94.336 alongside a general extension in the move higher across the US yield curve. This move is fading ahead of the NY crossover, with pre-positioning and squaring likely responsible ahead of the US jobs data.

- Haven currencies are offered for a second session after the debt ceiling can was kicked on Thursday, helping pressure both the JPY and CHF to the bottom of the G10 pile. The single currency fares more favourably, with the EUR higher against most others.

- Nonfarm payrolls takes focus going forward, with markets expecting a +500k print across September - a total that would likely keep the Fed on track to taper asset purchases by the end of the year. Canadian jobs data also crosses, with 60k net jobs expected to be added over the month.

EQUITIES: Futures Weaker Ahead Of US Payrolls

- Asian equities closed higher, with Japan's NIKKEI up 370.73 pts or +1.34% at 28048.94 and the TOPIX up 22.23 pts or +1.15% at 1961.85. China's SHANGHAI closed up 24 pts or +0.67% at 3592.167 and the HANG SENG ended 136.12 pts higher or +0.55% at 24837.85.

- European equities are mostly lower, with the German Dax down 57.26 pts or -0.38% at 15211.47, FTSE 100 up 5.04 pts or +0.07% at 7085.62, CAC 40 down 29.34 pts or -0.44% at 6585.6 and Euro Stoxx 50 down 21.37 pts or -0.52% at 4086.08.

- U.S. futures are a little weaker, with the Dow Jones mini down 43 pts or -0.12% at 34595, S&P 500 mini down 7.25 pts or -0.17% at 4382.75, NASDAQ mini down 37.25 pts or -0.25% at 14844.

COMMODITIES: WTI Eyeing $80/bbl Again

- WTI Crude up $1.2 or +1.53% at $79.35

- Natural Gas up $0.04 or +0.78% at $5.777

- Gold spot up $1.82 or +0.1% at $1756.41

- Copper up $2.45 or +0.58% at $426.55

- Silver down $0.1 or -0.43% at $22.5088

- Platinum up $13.11 or +1.33% at $993.84

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.