-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: Stock Surge Continues

EXECUTIVE SUMMARY:

- EQUITIES SURGE, WITH MSCI WORLD INDEX HITTING ALL-TIME HIGH

- GREEK 2-YR YIELDS TURN NEGATIVE FOR THE FIRST TIME ON CREDIT RATING UPGRADE

- GERMANY BACKS DELAYING $4BLN U.S. TARIFF STRIKE

Fig.1: Greek Bonds Rally On Ratings Upgrade

BBG, MNI

BBG, MNI

NEWS:

RATINGS: Greece Gets Upgrade At Moody's- Fitch affirmed Germany at AAA; Outlook Stable

- Fitch affirmed Slovakia at A; Outlook changed to Negative from Stable

- Moody's upgraded Greece to Ba3, outlook stable

- Moody's affirmed Italy at Baa3; stable outlook

- DBRS Morningstar confirmed Estonia at AA (low), Stable Trend

- DBRS Morningstar confirmed Finland at AA (high), Stable Trend

US/CHINA: The outcome of the U.S. election will be determined "by U.S. law and procedures," China's Foreign Ministry spokesman Wang Wenbin told a daily briefing on Monday. Noting that that former U.S. Vice President, Joe Biden had claimed victory, Wang said China will "express its reaction" in accordance with international practices.

GERMANY-US (BBG): Germany is seeking to mend transatlantic trade relations and is mulling a more conciliatory approach that would see the European Union delay tariffs set to hit $4 billion of American products as soon as Tuesday, according to a senior official familiar with the government's thinking.

FRANCE (BBG): Bank of France Governor Francois Villeroy de Galhau revises down the central bank's forecast for gross domestic product growth in 2020. Speaking in interview on RTL radio Monday, Villeroy says output will contract between 9% and 10% this year. The central bank previously forecast an 8.7% contraction.

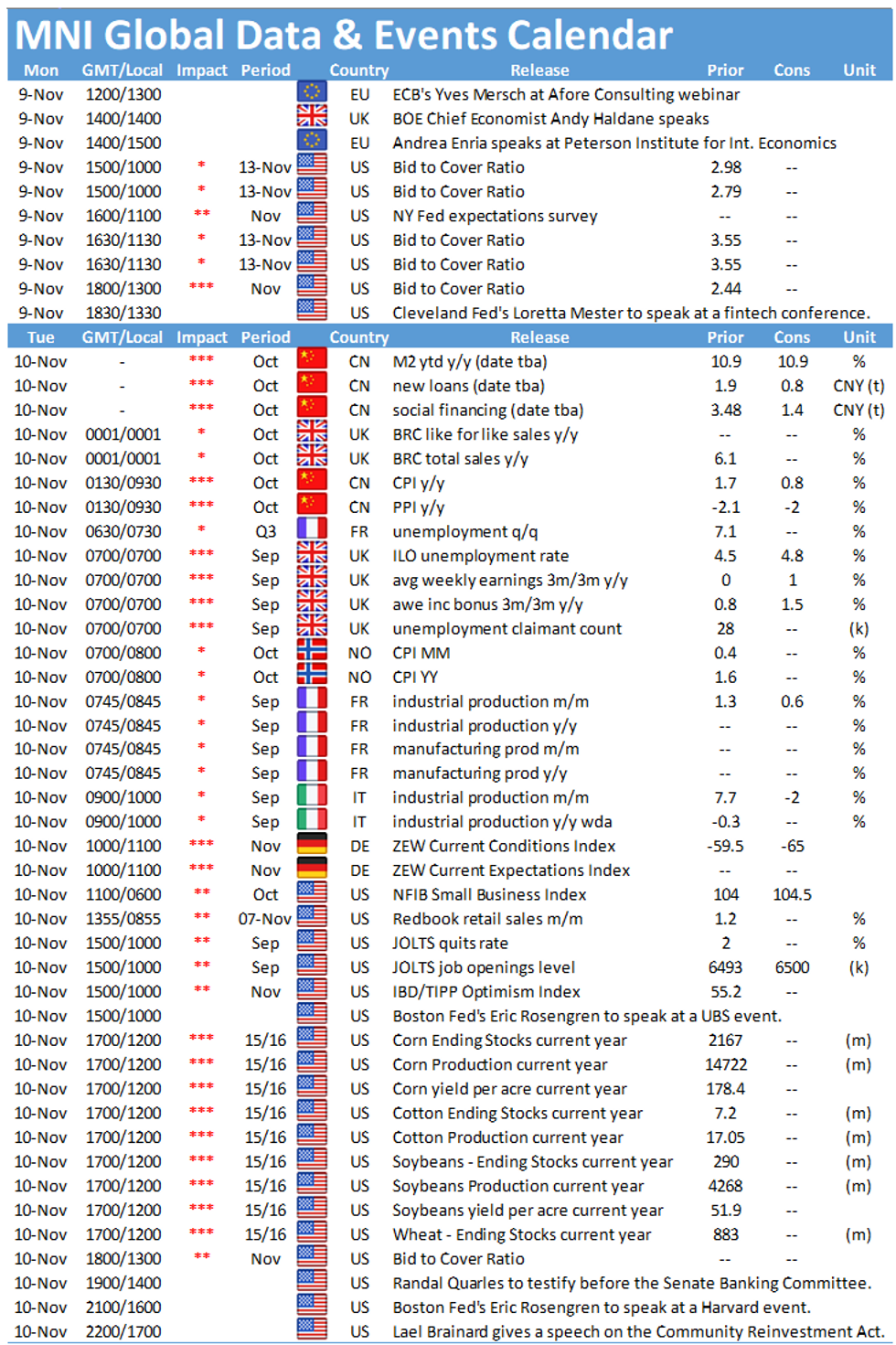

DATA:

FIXED INCOME: Brexit the focus this week

It's another day of equities and fixed income have both started the week on the front foot.

- Core fixed income has seen curves bull flatten this morning.

- The big focus of the week will be Brexit with a soft deadline of the end of this week seen as very helpful in getting legislation passed through all the national parliaments. There has been little in the way of new news over the weekend or this morning about any new breakthroughs in negotiations.

- The calendar for today is rather light with BOE's Haldane and ECB's Mersch the highlights of the central bank speakers today.

- TY1 futures are up 0-6 today at 138-23+ with 10y UST yields down -1.8bp at 0.802% and 2y yields down -0.4bp at 0.150%.

- Bund futures are up 0.37 today at 176.40 with 10y Bund yields down -2.1bp at -0.642% and Schatz yields down -1.0bp at -0.794%.

- Gilt futures are up 0.41 today at 135.90 with 10y yields down -3.4bp at 0.239% and 2y yields down -2.0bp at -0.60%.

FOREX: Equities Make Further Progress, Pressuring JPY

Equities have started the week well, with European indices up just shy of 2% apiece. US equity futures are following suit after the flat close Friday, with the e-mini S&P higher by over 50 points at pixel time.

The counting of Presidential election ballots continues. The market is still paying some attention to Trump's legal proceedings, although traders appear to be continuing to price in a Biden White House from January onwards - with Trump's legal threats seen having little effect.

Equity progress has weighed on havens, with JPY the poorest performer so far today. CHF has also been weighed upon, with AUD, NZD and CAD outperforming.

The calendar's quiet Monday, with no tier one data due. The speakers slate could be a little more interesting, with the first FOMC comments due following last week's presser. BoE's Bailey, Haldane are on the docket as well as Fed's Mester & Kaplan and ECB's Mersch.

EQUITIES: Still Surging

Global equities are continuing to surge following the US election, with the MSCI World hitting an all-time high.

- Asian stocks closed higher, with Japan's NIKKEI up 514.61 pts or +2.12% at 24839.84 and the TOPIX up 23.41 pts or +1.41% at 1681.9. China's SHANGHAI closed up 61.575 pts or +1.86% at 3373.734 and the HANG SENG ended 303.2 pts higher or +1.18% at 26016.17.

- European equities are higher, with the German Dax up 234.38 pts or +1.88% at 12705.25, FTSE 100 up 82.82 pts or +1.4% at 5998.5, CAC 40 up 77.03 pts or +1.55% at 5038.31 and Euro Stoxx 50 up 55.4 pts or +1.73% at 3255.95.

- U.S. futures are ascending too, with the Dow Jones mini up 413 pts or +1.46% at 28617, S&P 500 mini up 53 pts or +1.51% at 3553.75, NASDAQ mini up 219 pts or +1.81% at 12294.

COMMODITIES: Oil Surging Amid Broad Rally

Crude is outperforming to start the week, with commodity prices rising across the board on positive risk appetite (and a mixed USD).

- WTI Crude up $0.76 or +2.05% at $37.91

- Natural Gas down $0.03 or -1.04% at $2.845

- Gold spot up $8.4 or +0.43% at $1958.29

- Copper up $0.65 or +0.21% at $316.25

- Silver up $0.19 or +0.74% at $25.791

- Platinum up $8.9 or +0.99% at $903

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.