-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US Open: Stocks Finding A Footing

EXECUTIVE SUMMARY:

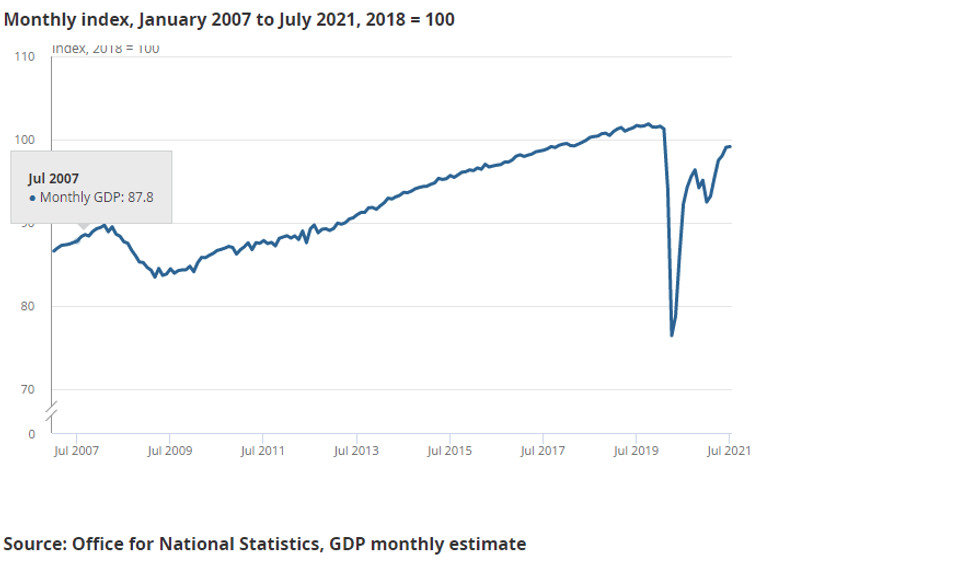

- UK GDP GROWTH SLOWS TO A CRAWL IN JULY

- FED'S KAPLAN, ROSENGREN TO SELL ALL STOCKS AMID ETHICS CONCERNS

- U.S., CHINA LEADERS HOLD CANDID TALKS ON POLICIES

- E.U. DEBT RULES NEED STRENGTHENING: ECB'S KNOT

- TOYOTA CUTS OUTPUT FORECAST DUE TO SHORTAGE OF PARTS

Fig.1:

Source: BBG

Source: BBG

NEWS:

FED (BBG): The presidents of the Federal Reserve banks of Boston and Dallas said they are selling their individual stock holdings by Sept. 30, in moves aimed at quenching ethical concerns over their trading activity last year.Boston Fed chief Eric Rosengren and Dallas Fed's Robert Kaplan released near-identical statements Thursday after their most recent financial disclosure documents showed active trading in a range of investments during a year in which the central bank took sweeping policy actions to protect the U.S. economy from Covid-19.They both said they'd invest the proceeds of their sales in diversified index funds or hold them in cash.

E.U.: Europe's Stability and Growth Pact should be reformed to give it more built-in room for countercyclical fiscal policy, the head of the Dutch central bank said in a speech Friday, with the European Commission set to relaunch its review of the bloc's fiscal rules after Germany's general election on September 26.

U.S.-CHINA: Chinese President Xi Jinping and U.S. counterpart Joe Biden spoke on the phone for a candid, in-depth and extensive strategic communication on Sino-U.S. relations and issues of mutual concern, state media Xinhua News Agency reported on Friday. This is the second call between the two leaders after one in February after Biden took the stage. The two sides can continue to engage in dialogue and promote cooperation on climate change, epidemic control, economic recovery and major international and regional issues, based on respecting each other's core concerns and properly managing differences, Xinhua cited Xi as saying.

TOYOTA / CHIP SHORTAGE (BBG): Toyota Motor Corp. trimmed its production outlook for this year by about 3% because the spread of the coronavirus in Southeast Asia has disrupted access to semiconductors and other key parts. The world's No. 1 automaker, which is adjusting output in September and October, now expects to produce 9 million vehicles in the fiscal year through March, down from 9.3 million previously forecast.

CHINA / TECH STOCKS (BBG): Chinese technology shares rebounded, snapping a two-day loss, after a newspaper report clarified that Beijing was slowing down instead of halting new game approvals. The Hang Seng Tech Index advanced 2.9% on Friday, pushing the index up a third straight week. Tencent Holdings Ltd. and NetEase Inc. were up at least 2.1% after tumbling a day earlier. Hong Kong's Hang Seng Benchmark also gained 1.9%. The return to buying reflected easing investor concerns on the broader tech sector after the South China Morning Post corrected a Thursday report that the government had temporarily halted the approval of new online games. It clarified that there is a slowdown in the process, rather than a complete freeze.

UK POLITICS: Prime Minister Boris Johnson's centre-right Conservative Party is polling behind the main opposition centre-left Labour Party for the first time since January in the latest poll from YouGov.

- YouGov: Lab: 35% (+1), Con: 33% (-5), Lib Dem: 10% (+2), Green: 9% (-1), SNP: 5% (=), Reform UK: 5% (+2). Fieldwork 8-9 Sep, chgs w/ 2-3 Sep

- The sharp decline in support for the Conservatives comes just after the gov't announced a 1.25% hike in individuals' contributions to National Insurance in order to pay for the NHS and adult social care.

AUSTRALIA: Australia is on course to ease lockdowns and open up its economy by mid-November, a prospect which concerns health experts but which plays into the Reserve Bank of Australia's view that the economy will rebound strongly in early 2022. The most populous state of New South Wales is set to ease some restrictions in mid-October and the economy will open up when more than 70% of the population is double vaccinated, according to public health notices.

DATA:

UK DATA: July GDP Growth Slows To A Crawl

UK output rose by a mere 0.1% in July, with retail sales holding back the service sector. Services were unchanged in July, falling short of the 0.6% prediction, and the worst performance since January. Manufacturing was also unchanged between June and July, with output of machinery dampening output.

Construction declined by by 1.6%, the fourth-straight fall. All output categories were affected by the so-called ping-demic in July, which kept workers across a range of industries in isolation over the month. After the weak July performance, output remains 2.1% below the start of the pandemic in February of 2020.

FIXED INCOME: Partially retracing yesterday's rally

Core fixed income has been reversing some of yesterday's gains through the European morning session.

- There have been little in the way of headlines or macro catalysts to trigger the moves. Instead, the moves seem to purely be partial retracements of the moves following the ECB meeting and the 30-year UST auction. 2s10s curves have steepened.

- UK monthly activity data for July disappointed while IP data across the Eurozone has been mixed. The focus later today will be on US PPI while US wholesale inventories are also due.

- - TY1 futures are down -0-6+ today at 133-09+ with 10y UST yields up 2.8bp at 1.327% and 2y yields up 0.7bp at 0.220%.

- Bund futures are down -0.37 today at 171.91 with 10y Bund yields up 2.1bp at -0.341% and Schatz yields unch at -0.718%.

- Gilt futures are down -0.12 today at 127.96 with 10y yields up 1.1bp at 0.747% and 2y yields up 0.5bp at 0.226%.

FOREX: Greenback Following Trend Lower

- In contrast to Thursday's session, early Europe saw JPY selling pressure aided by a strong start for continental equity markets. Trading has possibly be drawn by the sizeable option interest layered between 110.00-25, with $1.7bln notional rolling off at Friday's NY cut.

- Early greenback weakness extended into the NY crossover, with new daily USD lows printed against EUR, GBP, CNH, AUD and others. This put the USD Index through yesterday's lows and within range of support at the 61.8% Fib retracement of the Aug - Sept upmove at 92.2965. Macro newsflow/catalysts for the move lower were few and far between, but the weakness was infitting with the short-term trends in GBP/USD, USD/CNH and AUD/USD.

- This puts JPY, USD at the bottom of the G10 table, while NZD, NOK and AUD outperform.

- US PPI data takes focus going forward, with markets expecting a new series high at 8.2% Y/Y on a final demand basis. The speaker slate is a little busier, with ECB's Lagarde and Elderson due as well as Fed's Mester.

EQUITIES: Solid Start

- Asian markets closed higher, with Japan's NIKKEI up 373.65 pts or +1.25% at 30381.84 and the TOPIX up 26.72 pts or +1.29% at 2091.65. China's SHANGHAI closed up 9.98 pts or +0.27% at 3703.11 and the HANG SENG ended 489.91 pts higher or +1.91% at 26205.91.

- European stocks are rising, with the German Dax up 74.56 pts or +0.48% at 15638, FTSE 100 up 28.26 pts or +0.4% at 7024.21, CAC 40 up 30.83 pts or +0.46% at 6684.72 and Euro Stoxx 50 up 27.62 pts or +0.66% at 4189.83.

- U.S. futures are also in the green, with the Dow Jones mini up 200 pts or +0.57% at 35070, S&P 500 mini up 20.5 pts or +0.46% at 4512.75, NASDAQ mini up 59.75 pts or +0.38% at 15618.5.

COMMODITIES: Crude And Copper Outperforming

- WTI Crude up $1.15 or +1.69% at $68.63

- Natural Gas down $0.01 or -0.14% at $5.005

- Gold spot up $7.71 or +0.43% at $1802.26

- Copper up $7.9 or +1.84% at $433.7

- Silver up $0.21 or +0.88% at $24.2372

- Platinum up $7.81 or +0.8% at $984.36

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.