-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: Volumes Surge As Election Twists Keep Coming

EXECUTIVE SUMMARY:

- BIDEN REGAINS SLIGHT ADVANTAGE IN BETTING ODDS AS VOTES TALLIED IN WISCONSIN AND MICHIGAN

- NEVADA IN FOCUS, WITH TRUMP ONLY NARROWLY BEHIND

- VOLUMES SURGE AS MARKETS VOLATILE AROUND ELECTION RESULTS

- MNI BOE PREVIEW: THE CASE FOR 75 BILLION IN QE

Betdata.io, MNI

Betdata.io, MNI

NEWS:

US: Dump of ballots in Wisconsin puts Joe Biden in the lead in Wisconsin, ahead by 11k votes. Reports from Milwaukee putting Biden ahead. State now at 89% of estimatedprecincts reporting, with Milwaukee at 77% of the total.* Winning Wisconsin would be one step towards Biden taking presidency.

US: With 85% of estimated votes reporting Joe Biden leads Donald Trump by 11k votes in Nevada, a margin of 0.8%.* Clark County, which accounts for 72% of Nevada's population, still has 16% ofits votes to report. Democrats' rule-of-thumb is a 10% lead in the countymakes it comfortable for the party - at present the margin there is 7.5%. * The other main population hub, Washoe County, still has 11% of its estimatedvotes to report. In 2016, Hilary Clinton won the county 46.4% to 45.1%, whileat present Biden leads 50.8% to 46.6%.* Nevada has 6 electoral college votes. Should they go to Donald Trump, Bidenwould be able to gain the White House by winning two of the four toss up states, but it would have to be two of the EC vote-heavy states (Pennsylvania on 20, Michigan and Georgia each have 16). Winning Wisconsin (10 EC votes) and one other state would not be enough for Biden to reach 270 EC votes.

US: 32k Absentee Votes Still To Be Counted In Brown Co. WI, Could Swing State: Reports that 32,000 absentee ballots need to be tabulated in Brown County, Wisconsin. At present county, which backed Trump 52.1% to 41.4% in 2016, is leaning Trump 54,742 votes to 40,473 votes. These absentee ballots are likely to lean heavily towards Joe Biden. Whenthey are released it could put the state beyond Trump's reach (or indeed ifthey do not split in Biden's favour put it back in the likely Trumpcategory).* Release likely in around an hour.

US: Understandably trade in US assets has been pretty frantic throughout Asia, European hours today: E-mini S&P volumes over 3 times higher than average for this time of day; Dec-20 Treasury futures volumes over 4 times higher; WTI crude around 35% above average* USDJPY futures volumes close to double average

MNI BOE Preview - November 2020: The Case for GBP75bln

- The overwhelming majority of analyst BOE previews we have read look for the MPC to extend QE by GBP100bln. Saturday's announcement from Prime Minister Boris Johnson that England would begin a second month-long lockdown beginning on Thursday has been the final straw for some analysts to fall in line with consensus.

- However, the MNI Markets team believes that the decision over the size of the QE extension is far less clear cut than the previews that we have been reading would suggest and a very compelling argument can be made for a smaller GBP75bln extension to QE. We look at the arithmetic of how a GBP75bln package would play out.

- Overall, we think that the decision over whether to increase QE by GBP75bln or GBP100bln is poised on a knife edge. We think that a GBP75bln extension would be more appropriate but concede that the MPC might not want to disappoint and almost unanimous market expectation that QE will be extended by GBP100bln.Fig. 1: Betfair Implied Probability Of Winning Presidency, %

MNI: UK FINAL OCT COMPOSITE PMI 52.1; FLASH 52.9; SEP 56.5

MNI: UK FINAL OCT SERVICES PMI 51.4; FLASH 52.3; SEP 56.1

MNI: EZ FINAL OCT COMPOSITE PMI 50.0; FLASH 49.4; SEP 50.4

MNI: EZ FINAL SEP SERVICES PMI 46.9; FLASH 46.2; SEP 48.0

MNI: GERMANY FINAL OCT COMPOSITE PMI 55.0; FLASH 54.5; SEP 54.7

MNI: GERMANY FINAL OCT SERVICES PMI 49.5; FLASH 48.9; SEP 50.6

MNI: FRANCE FINAL OCT COMPOSITE PMI 47.5; FLASH 47.3; SEP 48.5

MNI: FRANCE FINAL OCT SERVICES PMI 46.5; FLASH 46.5; SEP 47.5

MNI: ITALY FINAL OCT COMPOSITE PMI 49.2; SEP 50.4

MNI: ITALY OCT SERVICES PMI 46.7; SEP 48.8

MNI: SPAIN FINAL OCT COMPOSITE PMI 44.1; SEP 44.3

MNI: SPAIN OCT SERVICES PMI 41.4; SEP 42.4

FIXED INCOME: Still trading the election results

The US election has been the sole focus of the market this morning. After initial polls had shown an increased chance of Biden victory, results have looked more mixed through the night. Now betting odds are close to 50/50 for the presidency but the chance of a Democratic Blue Wave appear to have receded with the Democrats not picking up as many seats in the Senate as they had originally hoped for. Markets judge the lack of a clean sweep makes a quick stimulus package appear less likely and hence would likely see a slower economic recovery. This saw core bond markets move higher globally. Election results are expected to continue to drip in and will remain the focus of markets today.

- TY1 futures are up 0-21+ today at 138-24+ with 10y UST yields down -11.4bp at 0.786% and 2y yields down -1.1bp at 0.158%.

- Bund futures are up 0.42 today at 176.44 with 10y Bund yields down -2.6bp at -0.647% and Schatz yields down -0.5bp at -0.804%.

- Gilt futures are up 0.57 today at 136.06 with 10y yields down -4.7bp at 0.224% and 2y yields down -2.0bp at -0.67%.

FOREX: Dollar in Demand With Polls Too Close to Call

The greenback has rallied against all others, with the USD index bouncing sharply off overnight lows as markets respond to election results that remain too close to call. Vote counting in the key battleground states of Wisconsin, Michigan, Pennsylvania and Georgia remains underway, leaving markets acutely sensitive to headline risk at this point.

Trump's claim to victory in an impromptu speech this morning left little dent, despite the President's proposal to appeal to the Supreme Court in order to stop any more ballots being processed (although his Vice President talked down such action shortly afterwards). This leaves markets at a fractious juncture, with volatility high and price action sensitive.

The USD is stronger against all others in G10, with AUD, NZD and GBP in retreat. Global equity markets are mixed, but the e-mini S&P is holding on to decent gains.

Focus understandably remains on the continued trickle of election results, but ISM services data for October could draw some focus ahead of Friday's payrolls release.

EQUITIES: Volatile Session On US Election Uncertainty

A volatile session for equities so far, with US election intrigue dominating.

- Japan's NIKKEI up 399.75 pts or +1.72% at 23695.23 and the TOPIX up 19.3 pts or +1.2% at 1627.25

- China's SHANGHAI closed up 6.366 pts or +0.19% at 3277.44 and the HANG SENG ended 53.59 pts lower or -0.21% at 24886.14

- with the German Dax down 13.7 pts or -0.11% at 12043.25, FTSE 100 up 2.86 pts or +0.05% at 5789.74, CAC 40 up 6.98 pts or +0.15% at 4810.63 and Euro Stoxx 50 down 8.28 pts or -0.27% at 3082.44.

- Dow Jones mini down 85 pts or -0.31% at 27297, S&P 500 mini up 6.75 pts or +0.2% at 3368.5, NASDAQ mini up 211.75 pts or +1.88% at 11475.75.

COMMODITIES: Gold And Silver Head Lower

Precious metals are underperforming, with the dollar strengthening.

- WTI Crude up $0.67 or +1.78% at $38.32

- Natural Gas down $0.03 or -1.08% at $3.035

- Gold spot down $21.36 or -1.12% at $1888.49

- Copper down $3.15 or -1.02% at $306.1

- Silver down $0.63 or -2.59% at $23.5915

- Platinum down $14.39 or -1.65% at $858.48

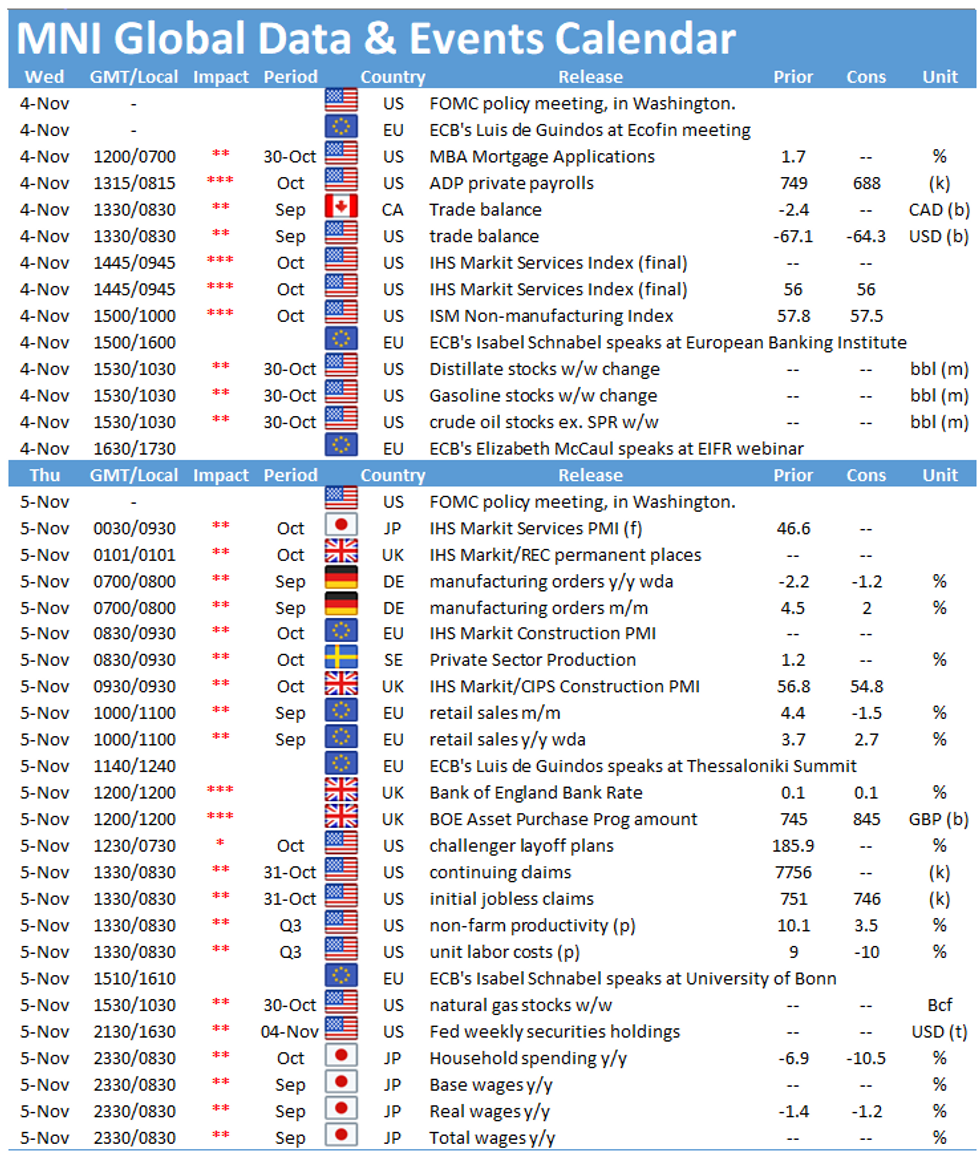

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.