-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

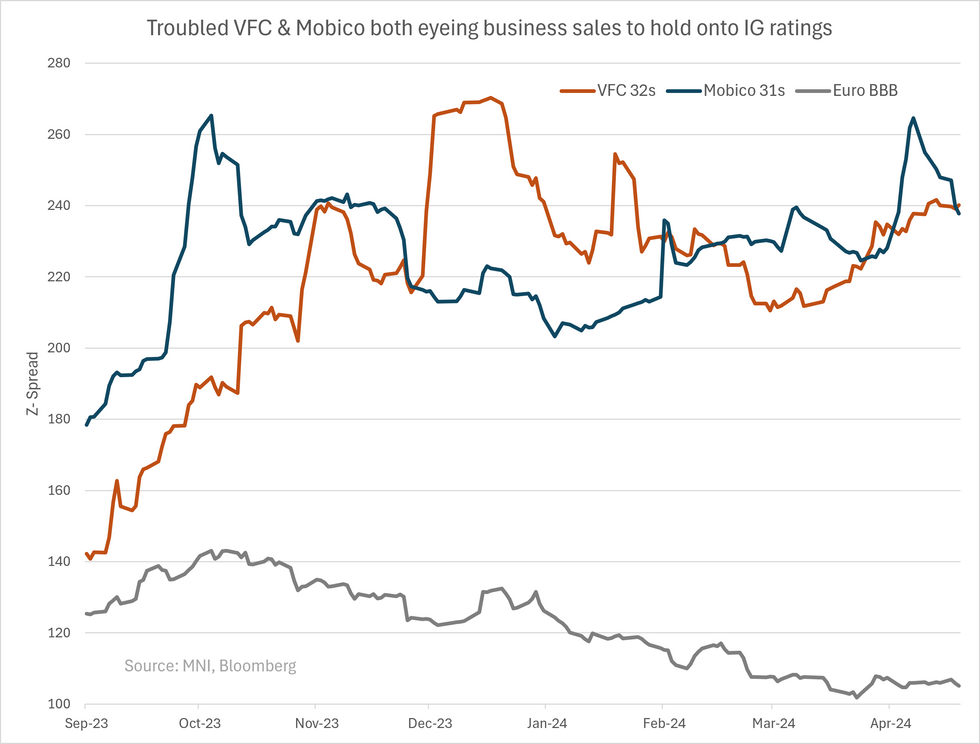

Mobico (Snr; Baa3 & On review for downgrade/NR/BBB S)

Mobico (branded as National Express on long-haul coach services) is facing crossover rating risk after a Moody's downgrade last night (which it based on FY23 results). 1Q results were directionally positive; revenues at £802m up net +3.5% and 6.7% in cc terms but it still left FY24 EBIT guidance unch at £185-205m - latter leaves the downgrade into HY likely. North America school bus business (23% of revenues, lower margin) tabled for sale could put-off a downgrade - timing & use of proceeds remains uncertain & would increase exposure to ALSA business (mostly Spain, already 80% of EBIT).

The €500m 31s trade well wide already at G+273/Z+237/€98, no firm view on the co yet but fallen angel Elo & troubled IG VFC offer equal to higher carry on shorter lines & may see a recovery before Mobico does (we have no view on either till that happens). We don't expect Mobico supply till earliest Nov '25 (first call on £ perp). FY23 results below.

- Revenue at £3.2b, EBITDA £386m (12% margin) & operating cash flows at £252m. Reported EBIT was £169m (5.4% margin) while statutory was -£21m on impairments on contracts from Covid (-£113m), onerous contract provisions in Germain rail (-£100m) & restructuring costs (-£30m).

- On BS covenant gearing was at 3x (from 2.8x previous year, limit in covenants is 3.5x). Net debt was £1.2b, covenant net debt (used on quoted leverage) at £1b. It pushed out reaching target of 1.5x-2x from '24 to '27 on expected poor operating performance/EBITDA. FY24 EBIT guidance is for £185-205m.

- To alleviate pressure on BS it announced in Oct '23 the North America School bus business would be sold - in 1Q results in April it said it was "progressing well".

- Liquidity not a issue with £300m in cash & £600m in undrawn revolver. No near-term risk on the £500m perps (now Ba2 rated) loosing 50% equity treatment - first call is Nov 2025. Near term maturities (next 3yrs) are negligible outside the perp (small bank loans & leases totalling <£100m).

Background on co; most revenues from long-haul, shuttle & charter/private hire bus services in UK, Europe & NA (70%) with remainder from NA school bus services (23%) & German rail (8%). Moody's says ~70% of revenues are contracted & concession based which shields it somewhat from passenger demand fluctuations (but as above exposes it to contract renewal risk).

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.