-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

November's MTBPS Moves Onto the Radar Amid SAGB Sell-Off

- With SAGBs still notably under pressure in the global risk-off environment, one thing to start to look towards is the November Medium Term budget (4 Nov) - which is broadly expected to reflect a decidedly rosier fiscal picture as a result of the recent GDP rebasing and higher than expected tax windfall.

- Higher oil prices, inflation and upside pressure on UST yields on inflation/growth concerns have seen investors head for the hills in high-beta risk assets, and SAGBs have been no exception.

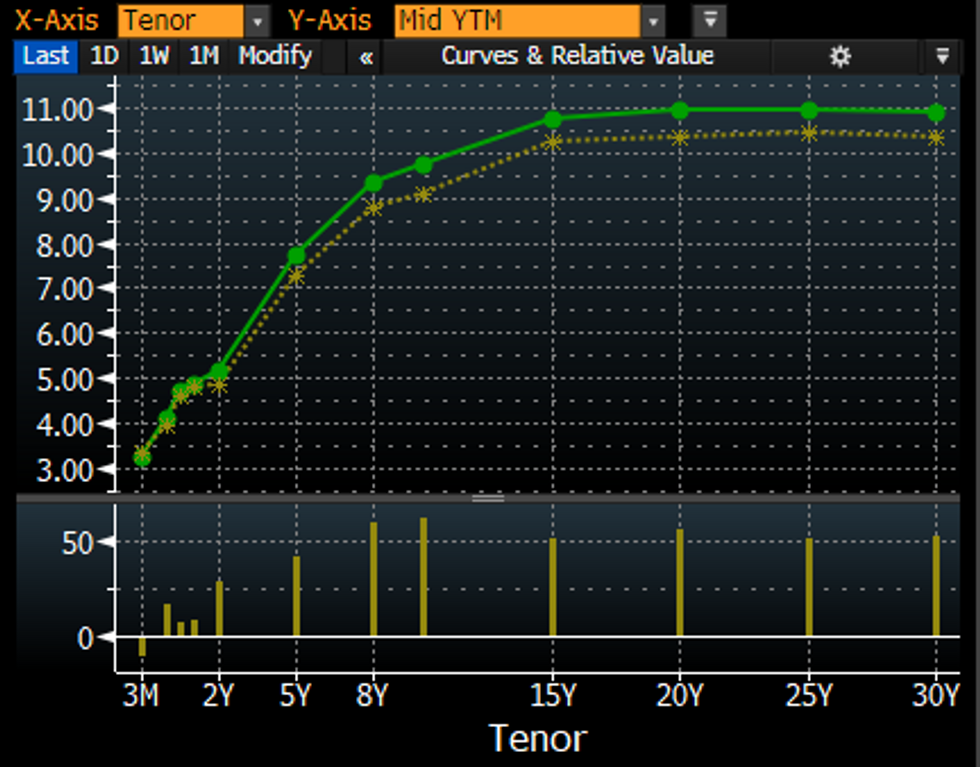

- Since the start of September the local curve stands +51-63bp bear steeper in

the 8-30Y section of the curve. 2Y yields are positioned +28.3bp higher with the

2s10 spread +34bp wider with the 10Y feeling the brunt of this bout of global

risk aversion (+63bp).

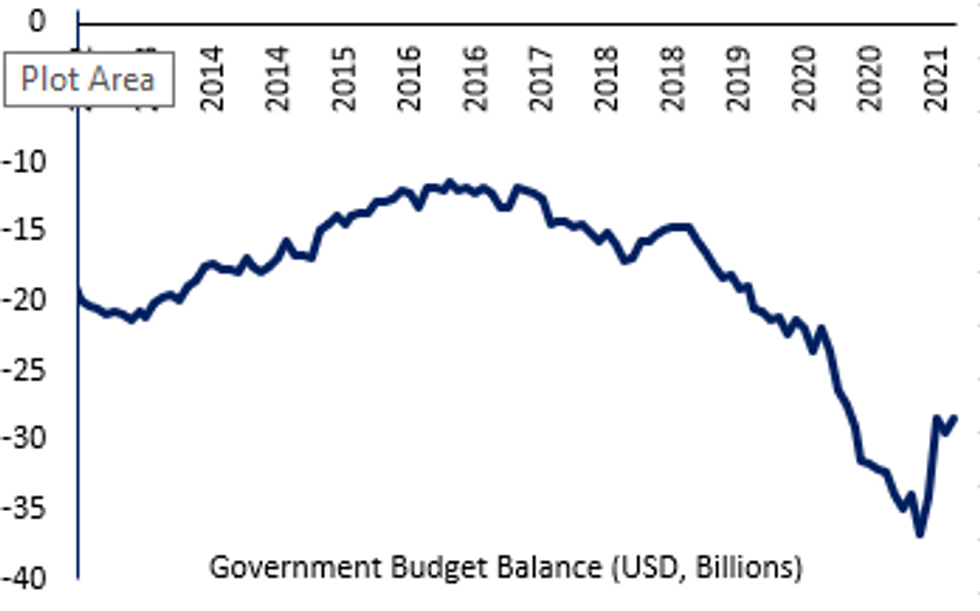

- As noted above, the fiscal picture is looking much healthier. The budget deficit narrowed further in August to 7.4% of GDP from 7.8% in the prior two months owing to higher revenue collection and curbed expenditure (one of Govt's key goals). This is broadly in line with the target set by the Treasury for March 2023 – 18 months ahead of its fiscal consolidation plans. FY21 Debt to GDP metrics were also revised lower from 82.5% to 79.3% as a result of the recent GDP rebasing that boosted the size of the economy by 11%, but remains well above the BB sovereign median at 59% of GDP.

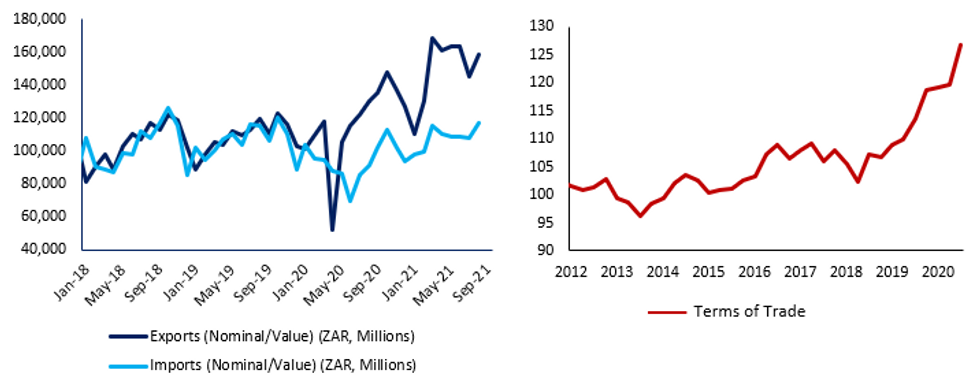

- Substantial mining profits aligned with the commodity super cycle and attractive terms of trade have been the primary driver of the tax windfall, offsetting the narrowing of the tax base due to the covid-19 pandemic. Revenue overrun estimates stand in the R80-R120bn zone, which when you deduct roughly R60bn in covid and unrest costs – still leaves scope for a notable surplus.

- Here, FinMin Godongwana has promised not to let this super cycle go to waste – promising to deliver growth inducing policies – while staying committed to the fiscal consolidation path and avoiding grant dependency. Key discussion points will likely be the introduction of a universal income grant, energy security/transition measures, SOE management and growth-inducing reforms to address SA's chronic unemployment crisis that will be enacted in Feb 2022.

- Overall, however, things are looking broadly positive for this MTBPS – which may see SA's untethered long-term bond yields find some support as the meeting draws nearer. Markets will be looking for more of the same in terms of revenue collection, and concrete fiscal consolidation promises with wage disputes still a contentious issue, but undoubtedly a greater degree of policy direction and credibility in terms of delivering reforms.

SAGB Curve Change vs 01 Sept

SAGB Curve Change vs 01 Sept

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.