-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessPayrolls Report A Necessary But Insufficient Step Toward 75bp In Sept (2/2)

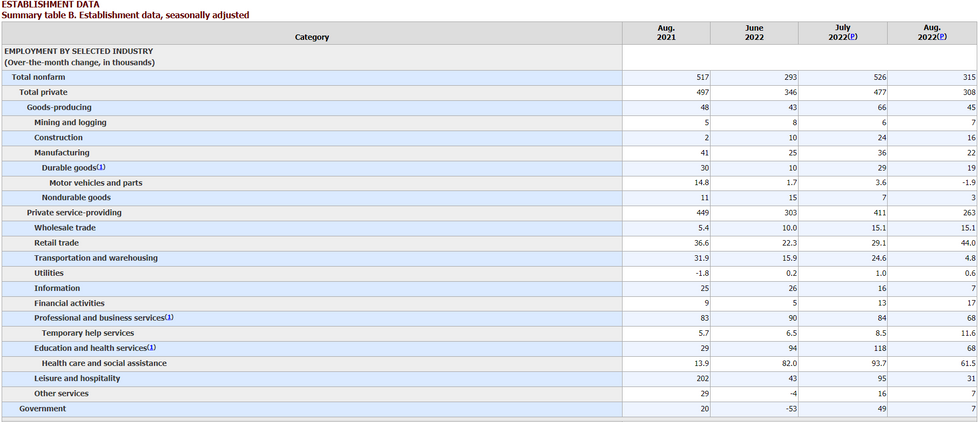

From a broad economic perspective, the payrolls report looked healthy. Job gains were solid across the board in the Establishment Survey, with the major categories of businesses expanding payrolls except one (a 3k drop in durable goods manufacturing of motor vehicles and parts).

- And temporary help services (+11.6k) - historically a leading indicator of labor market health - continued to accelerate, albeit from fairly low levels.

- Higher unemployment / underemployment could be concerning to some on the FOMC, particularly given a sharp rise in unemployment for a variety of demographic categories (Black or African American +0.4%, Hispanic or Latino ethnicity +0.6%, High school graduates, no college +0.6%). And it might point to a labor market with fewer supply-side constraints, meaning less fear over inflation dynamics.

But looking at the bigger picture, this report shouldn't dissuade FOMC policymakers from pursuing the path they had envisaged coming into Friday.

- Incoming economic data still aren't pointing to an ongoing economic / labor market slowdown to the extent that the FOMC will be seriously concerned. NFPs are just one month of data, but might even bolster their belief that a "soft landing" is achievable. Absent a very weak August CPI number, any meaningful dovish "pivot" is likely to have to wait until after the September meeting.

Establishment Survey Payroll Changes By IndustrySource: BLS

Establishment Survey Payroll Changes By IndustrySource: BLS

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.