-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Credit Weekly: Le Vendredi Noir

MNI: Canada Apr-Sept Budget Deficit Widens On Spending

Policy Support Calls Likely To Continue

On balance, China's Q2 GDP print, and mixed June activity data, are likely to see calls for policy support continue. Notwithstanding the base effect impact on today's outcomes.

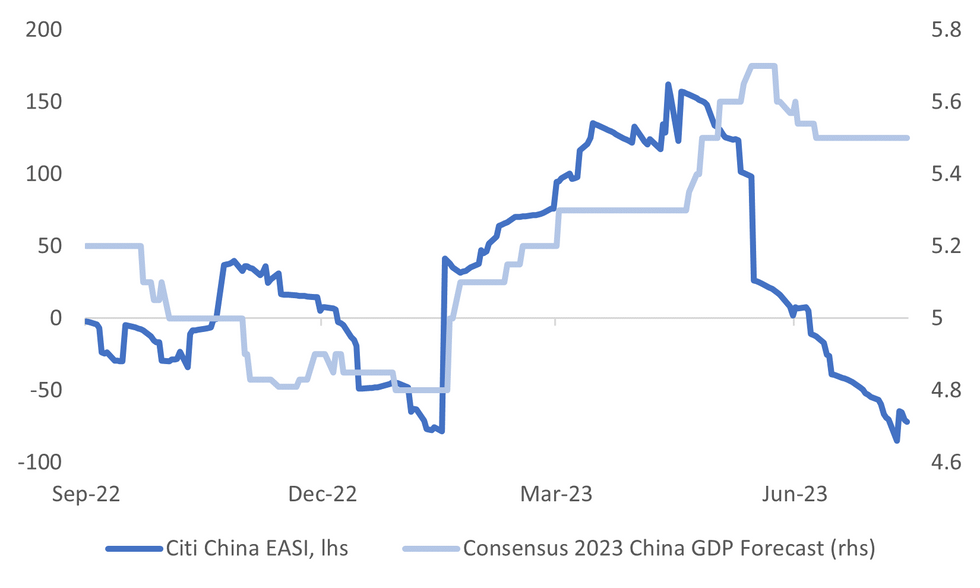

- The data didn't show the same degree of downside surprises we saw in parts of Q2, see the chart below, which overlays the Citi China EASI against 2023 China GDP growth expectations. Still the market may want to see signs of greater policy support to ensure more positive momentum as we progress through H2.

- Q2 GDP was as expected at 0.8% q/q, but the y/y number softer at 6.3%, versus 7.1% expected.

- IP was one of few bright spots, coming in nearly double market expectations in y/y terms. This largely owed to an improved trend in mining related output (back into positive territory +1% from 23.8%.5% y/y, from -1.2%), while agricultural related sectors also improved. Auto manufacturing slowed to 8.8% y/y, from 23.8% y/y.

- Retail sales was slightly weaker than expected, which largely owed to weaker discretionary related spending - restaurants +16.1% y/y from 35.1%, clothing to 6.9% from 17.6%. Household electronics rose 4.5%, from 0.1% prior, but automobiles were weaker at -1.1% (from 24.2%).

- Fixed asset investment showed similar trends to last month. FAI for the private sector easing to -0.2% ytd y/y (from -0.1%), while state owned enterprises were at 8.1%.

- There were little signs of better property related sentiment though at least in ytd y/y terms. Investment to -7.9%, while sales eased to 1.1% from 8.4% on the same basis. Under construction slipped to -6.6%, new construction to -24.3% (from -22.6%) and property sales -5.3% (from -0.9%). The authorities did note trends were stabilizing in the sector in H1.

- The unemployment rate held steady at 5.2% (as expected), although youth unemployment (16-24yrs old) was at 21.3%, a record high.

Fig 1: Citi China EASI Versus 2023 China Growth Expectations

Source: Citi/MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.