-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessPPI Softens Across Headline and Core

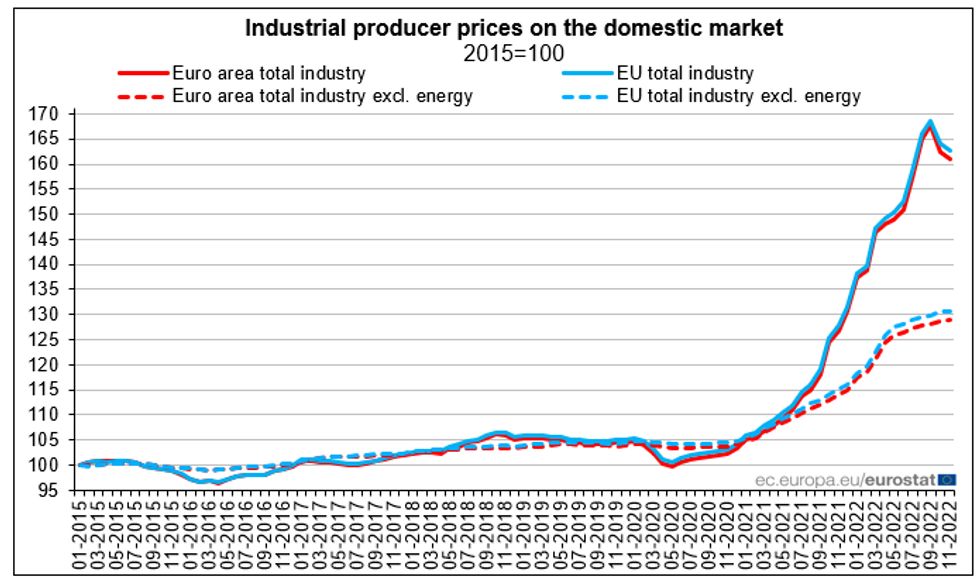

EUROZONE NOV PPI -0.9% M/M (FCST -0.8%); OCT -3.0%r M/M

EUROZONE NOV PPI +27.1% Y/Y (FCST +27.5%); OCT +30.5%r Y/Y

- Eurozone factory-gate inflation eased slightly more than anticipated in November. PPI fell by -0.9% m/m and softened by 3.4pp to +27.1% y/y.

- The fall in month-on-month prices was largely due to the -2.2% m/m decline in energy, followed by intermediate goods (-0.4% m/m). This is in line with signals of easing inflation in PMI data.

- With headline annualised PPI firmly below the August peak of +43.4% y/y, focus for the ECB has shifted towards core inflation data. The PPI uptick in durable consumer goods (+-0.2%), capital goods (+0.3%) and nondurable consumer goods (+0.6%) imply continued pressure on prices over the month, albeit being a softer-than-Oct uptick at +0.1% m/m ex. energy.

- PPI ex. energy declined by 0.9pp to +13.1% compared to Nov 2021, having peaked in May at +16.0% y/y. As such, eurozone inflationary pressures appear set to ease further in the upcoming months.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.