-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

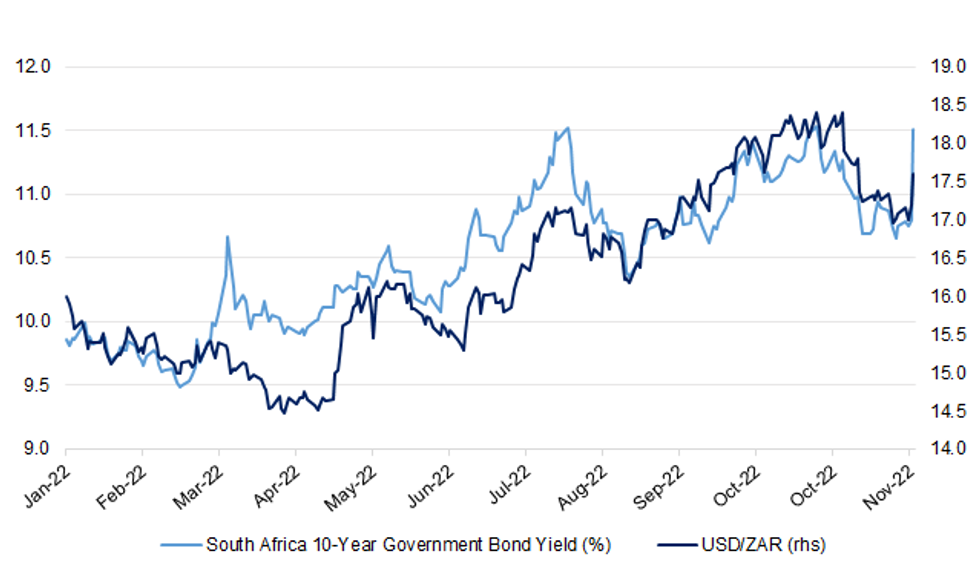

Free AccessRand Stabilises Off Session Lows After Heavy Political Sell-Off In South African Assets

Broad-based greenback sales have seemingly helped USD/ZAR move away from intraday highs, with the BBDXY index last ~0.8% lower on the day and South African headline flow offering little clarity on the fate of embattled President Cyril Ramaphosa.

- The aggregate BBG Commodity Index operates ~1% above neutral levels, with the precious metals index up over 3%. Precious-metals miner stocks are benefitting from the combination of a firmer commodity complex and Rand weakness, helping keep the FTSE/JSE Africa All Share Index in positive territory despite the damage inflicted by domestic political turmoil on South African bank equities, which posted their largest declines since 2020.

- South Africa's local-currency bonds have tumbled. At the time of typing, 10-year yield sits at 11.510% after printing its best levels since the outbreak of the COVID-19 pandemic in the largest single-day rally since December 2015.

- USD/ZAR implied volatilities have surged across the maturity curve. One-week and one-month tenors both reached their highest points since March 2021.

- The market remains on the lookout for the announcement of the time for President Ramaphosa's touted address to the nation amid ongoing talks between ANC officials.

Fig. 1: South Africa 10-Year Government Bond Yield (%) vs. USD/ZAR

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.