-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

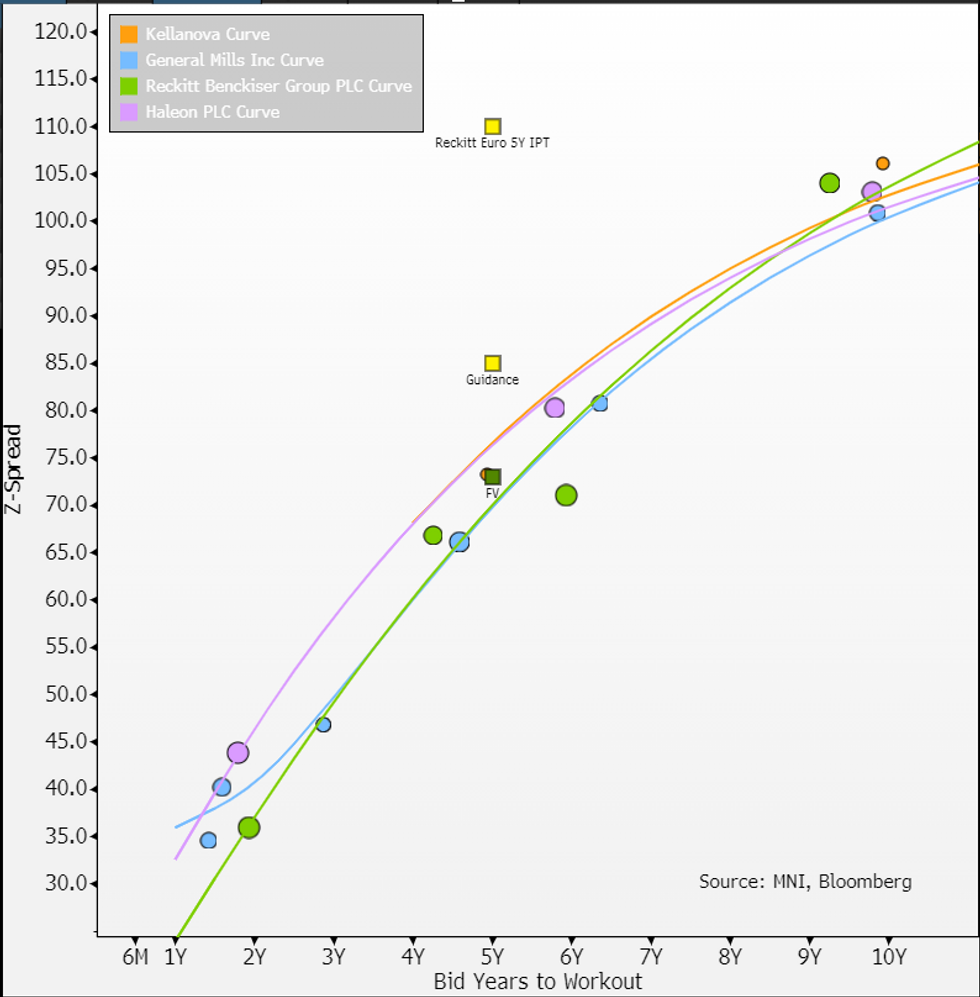

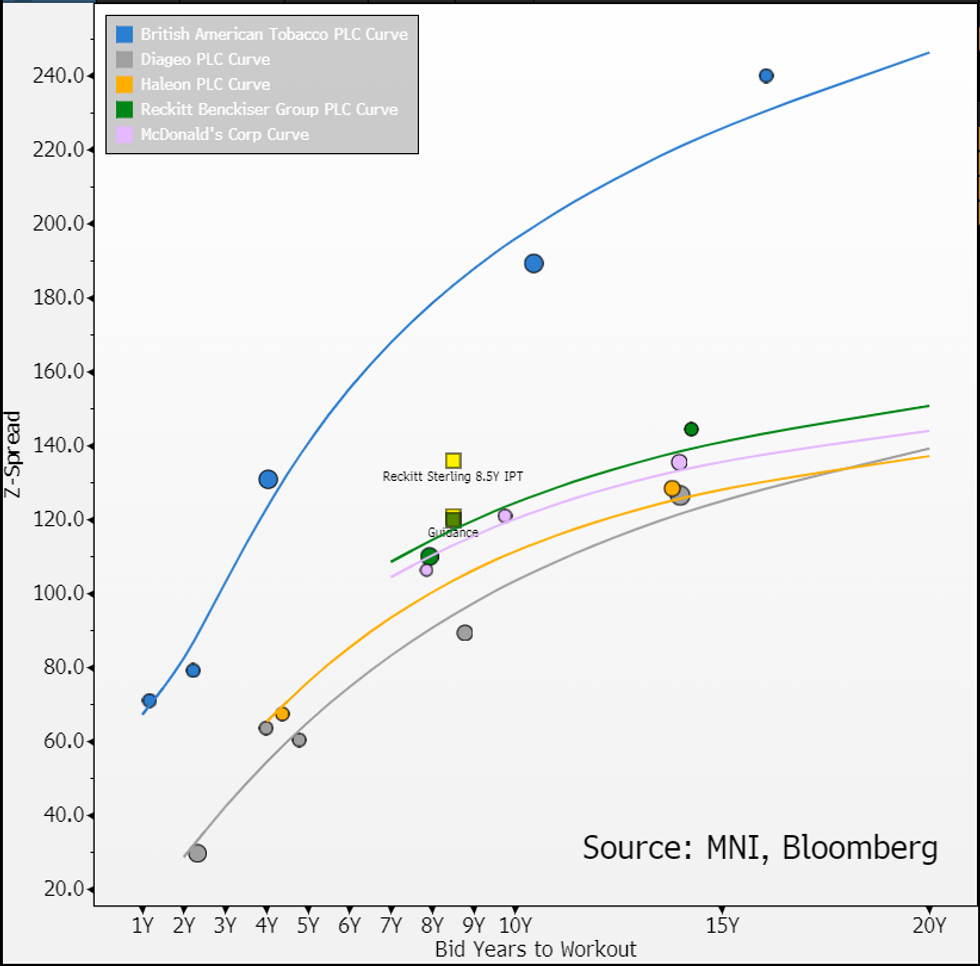

Reckitt (RKTLN; A3 Pos, A-) FV

Guidance:

- €BMARK 5Y MS+85a (-25 from IPT) vs. FV +73, books >€2.5b

- £BMARK 8.5Y UKT+105a (-15 from IPT) vs. FV+104 (or Z+120), books >€645m

- **benchmark we are using is UKT 4.25% June 32s, swap spreads we see at -16 on that

€ lines are +2-9 wider, £ 3-8bps wider (our charts below capture this move). Even with that, we needed a double digit NIC to FV to see value. We don't see much value left in €s and £ looks to be coming flat/without NIC noting shorter May 32s at G+88 but low cash px of £85.

- We have covered the NEC lawsuits in detail, please see previous posts or feel free to ask on any details needed.

- Our main issue is the pay-out/liability from that (could) be large because of the "hundreds" of cases hanging in federal court (could increase as it goes on) and the timing on that is stretched out (we see well into next year).

- Next key catalyst for us is if it is successful on appeal of the first state loss that triggered the sell-off (which management is firm it will win - it hasn't even provisioned for the loss!).

- Equities have not recovered from lows despite management's confidence and clarification it won't change capital allocation (buybacks have continued in size).

- There are broader ESG themes with this name that don't sit well with us - not provisioning, not disclosing details around NEC case leading up to state ruling and accounting issues prior to that.

- Medical experts are supporting Reckitt and that is a positive. We'd also note how staple the two formulas (Reckitt's Enfamil & Abbott's Similac) are. But how those translate to Jury outcomes is not clear (first state loss already had medical experts testify).

Latest earnings call, special call on NECand useful medical takes shared by JP analysts

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.